Neural networks made easy (Part 14): Data clustering

It has been more than a year since I published my last article. This is quite a lot time to revise ideas and to develop new approaches. In the new article, I would like to divert from the previously used supervised learning method. This time we will dip into unsupervised learning algorithms. In particular, we will consider one of the clustering algorithms—k-means.

Introduction to MQL5 (Part 26): Building an EA Using Support and Resistance Zones

This article teaches you how to build an MQL5 Expert Advisor that automatically detects support and resistance zones and executes trades based on them. You’ll learn how to program your EA to identify these key market levels, monitor price reactions, and make trading decisions without manual intervention.

Analytical Volume Profile Trading (AVPT): Liquidity Architecture, Market Memory, and Algorithmic Execution

Analytical Volume Profile Trading (AVPT) explores how liquidity architecture and market memory shape price behavior, enabling more profound insight into institutional positioning and volume-driven structure. By mapping POC, HVNs, LVNs, and Value Areas, traders can identify acceptance, rejection, and imbalance zones with precision.

MetaTrader 5 Machine Learning Blueprint (Part 2): Labeling Financial Data for Machine Learning

In this second installment of the MetaTrader 5 Machine Learning Blueprint series, you’ll discover why simple labels can lead your models astray—and how to apply advanced techniques like the Triple-Barrier and Trend-Scanning methods to define robust, risk-aware targets. Packed with practical Python examples that optimize these computationally intensive techniques, this hands-on guide shows you how to transform noisy market data into reliable labels that mirror real-world trading conditions.

Introduction to MQL5 (Part 17): Building Expert Advisors for Trend Reversals

This article teaches beginners how to build an Expert Advisor (EA) in MQL5 that trades based on chart pattern recognition using trend line breakouts and reversals. By learning how to retrieve trend line values dynamically and compare them with price action, readers will be able to develop EAs capable of identifying and trading chart patterns such as ascending and descending trend lines, channels, wedges, triangles, and more.

Automating Trading Strategies with Parabolic SAR Trend Strategy in MQL5: Crafting an Effective Expert Advisor

In this article, we will automate the trading strategies with Parabolic SAR Strategy in MQL5: Crafting an Effective Expert Advisor. The EA will make trades based on trends identified by the Parabolic SAR indicator.

How to choose an Expert Advisor: Twenty strong criteria to reject a trading bot

This article tries to answer the question: how can we choose the right expert advisors? Which are the best for our portfolio, and how can we filter the large trading bots list available on the market? This article will present twenty clear and strong criteria to reject an expert advisor. Each criterion will be presented and well explained to help you make a more sustained decision and build a more profitable expert advisor collection for your profits.

Tips for Purchasing a Product on the Market. Step-By-Step Guide

This step-by-step guide provides tips and tricks for better understanding and searching for a required product. The article makes an attempt to puzzle out different methods of searching for an appropriate product, sorting out unwanted products, determining product efficiency and essentiality for you.

Price Action Analysis Toolkit Development (Part 47): Tracking Forex Sessions and Breakouts in MetaTrader 5

Global market sessions shape the rhythm of the trading day, and understanding their overlap is vital to timing entries and exits. In this article, we’ll build an interactive trading sessions EA that brings those global hours to life directly on your chart. The EA automatically plots color‑coded rectangles for the Asia, Tokyo, London, and New York sessions, updating in real time as each market opens or closes. It features on‑chart toggle buttons, a dynamic information panel, and a scrolling ticker headline that streams live status and breakout messages. Tested on different brokers, this EA combines precision with style—helping traders see volatility transitions, identify cross‑session breakouts, and stay visually connected to the global market’s pulse.

Automating Trading Strategies in MQL5 (Part 26): Building a Pin Bar Averaging System for Multi-Position Trading

In this article, we develop a Pin Bar Averaging system in MQL5 that detects pin bar patterns to initiate trades and employs an averaging strategy for multi-position management, enhanced by trailing stops and breakeven adjustments. We incorporate customizable parameters with a dashboard for real-time monitoring of positions and profits.

From Novice to Expert: Developing a Liquidity Strategy

Liquidity zones are commonly traded by waiting for the price to return and retest the zone of interest, often through the placement of pending orders within these areas. In this article, we leverage MQL5 to bring this concept to life, demonstrating how such zones can be identified programmatically and how risk management can be systematically applied. Join the discussion as we explore both the logic behind liquidity-based trading and its practical implementation.

Graphical interfaces X: New features for the Rendered table (build 9)

Until today, the CTable was the most advanced type of tables among all presented in the library. This table is assembled from edit boxes of the OBJ_EDIT type, and its further development becomes problematic. Therefore, in terms of maximum capabilities, it is better to develop rendered tables of the CCanvasTable type even at the current development stage of the library. Its current version is completely lifeless, but starting from this article, we will try to fix the situation.

Graphics in DoEasy library (Part 87): Graphical object collection - managing object property modification on all open charts

In this article, I will continue my work on tracking standard graphical object events and create the functionality allowing users to control changes in the properties of graphical objects placed on any charts opened in the terminal.

The Most Active MQL5.community Members Have Been Awarded iPhones!

After we decided to reward the most outstanding MQL5.com participants, we have selected the key criteria to determine each participant's contribution to the Community development. As a result, we have the following champions who published the greatest amount of articles on the website - investeo (11 articles) and victorg (10 articles), and who submitted their programs to Code Base – GODZILLA (340 programs), Integer (61 programs) and abolk (21 programs).

Prices in DoEasy library (part 60): Series list of symbol tick data

In this article, I will create the list for storing tick data of a single symbol and check its creation and retrieval of required data in an EA. Tick data lists that are individual for each used symbol will further constitute a collection of tick data.

Jeremy Scott - Successful MQL5 Market Seller

Jeremy Scott who is better known under Johnnypasado nickname at MQL5.community became famous offering products in our MQL5 Market service. Jeremy has already made several thousands of dollars in the Market and that is not the limit. We decided to take a closer look at the future millionaire and receive some pieces of advice for MQL5 Market sellers.

Calculation of Integral Characteristics of Indicator Emissions

Indicator emissions are a little-studied area of market research. Primarily, this is due to the difficulty of analysis that is caused by the processing of very large arrays of time-varying data. Existing graphical analysis is too resource intensive and has therefore triggered the development of a parsimonious algorithm that uses time series of emissions. This article demonstrates how visual (intuitive image) analysis can be replaced with the study of integral characteristics of emissions. It can be of interest to both traders and developers of automated trading systems.

DoEasy. Controls (Part 2): Working on the CPanel class

In the current article, I will get rid of some errors related to handling graphical elements and continue the development of the CPanel control. In particular, I will implement the methods for setting the parameters of the font used by default for all panel text objects.

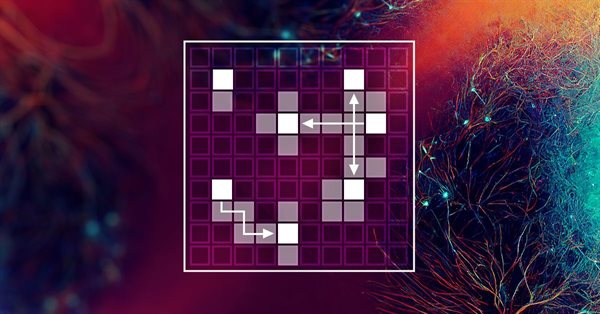

Neural networks made easy (Part 36): Relational Reinforcement Learning

In the reinforcement learning models we discussed in previous article, we used various variants of convolutional networks that are able to identify various objects in the original data. The main advantage of convolutional networks is the ability to identify objects regardless of their location. At the same time, convolutional networks do not always perform well when there are various deformations of objects and noise. These are the issues which the relational model can solve.

Working with ONNX models in float16 and float8 formats

Data formats used to represent machine learning models play a crucial role in their effectiveness. In recent years, several new types of data have emerged, specifically designed for working with deep learning models. In this article, we will focus on two new data formats that have become widely adopted in modern models.

Gain An Edge Over Any Market

Learn how you can get ahead of any market you wish to trade, regardless of your current level of skill.

Prices in DoEasy library (part 62): Updating tick series in real time, preparation for working with Depth of Market

In this article, I will implement updating tick data in real time and prepare the symbol object class for working with Depth of Market (DOM itself is to be implemented in the next article).

Monte Carlo Permutation Tests in MetaTrader 5

In this article we take a look at how we can conduct permutation tests based on shuffled tick data on any expert advisor using only Metatrader 5.

Timeseries in DoEasy library (part 58): Timeseries of indicator buffer data

In conclusion of the topic of working with timeseries organise storage, search and sort of data stored in indicator buffers which will allow to further perform the analysis based on values of the indicators to be created on the library basis in programs. The general concept of all collection classes of the library allows to easily find necessary data in the corresponding collection. Respectively, the same will be possible in the class created today.

Graphics in DoEasy library (Part 79): "Animation frame" object class and its descendant objects

In this article, I will develop the class of a single animation frame and its descendants. The class is to allow drawing shapes while maintaining and then restoring the background under them.

Creating an EA that works automatically (Part 15): Automation (VII)

To complete this series of articles on automation, we will continue discussing the topic of the previous article. We will see how everything will fit together, making the EA run like clockwork.

Creating volatility forecast indicator using Python

In this article, we will forecast future extreme volatility using binary classification. Besides, we will develop an extreme volatility forecast indicator using machine learning.

Developing a Replay System — Market simulation (Part 03): Adjusting the settings (I)

Let's start by clarifying the current situation, because we didn't start in the best way. If we don't do it now, we'll be in trouble soon.

How to create and test custom MOEX symbols in MetaTrader 5

The article describes the creation of a custom exchange symbol using the MQL5 language. In particular, it considers the use of exchange quotes from the popular Finam website. Another option considered in this article is the possibility to work with an arbitrary format of text files used in the creation of the custom symbol. This allows working with any financial symbols and data sources. After creating a custom symbol, we can use all the capabilities of the MetaTrader 5 Strategy Tester to test trading algorithms for exchange instruments.

Rebuy algorithm: Math model for increasing efficiency

In this article, we will use the rebuy algorithm for a deeper understanding of the efficiency of trading systems and start working on the general principles of improving trading efficiency using mathematics and logic, as well as apply the most non-standard methods of increasing efficiency in terms of using absolutely any trading system.

Creating a Daily Drawdown Limiter EA in MQL5

The article discusses, from a detailed perspective, how to implement the creation of an Expert Advisor (EA) based on the trading algorithm. This helps to automate the system in the MQL5 and take control of the Daily Drawdown.

Cycle analysis using the Goertzel algorithm

In this article we present code utilities that implement the goertzel algorithm in Mql5 and explore two ways in which the technique can be used in the analysis of price quotes for possible strategy development.

Other classes in DoEasy library (Part 67): Chart object class

In this article, I will create the chart object class (of a single trading instrument chart) and improve the collection class of MQL5 signal objects so that each signal object stored in the collection updates all its parameters when updating the list.

The Role of Statistical Distributions in Trader's Work

This article is a logical continuation of my article Statistical Probability Distributions in MQL5 which set forth the classes for working with some theoretical statistical distributions. Now that we have a theoretical base, I suggest that we should directly proceed to real data sets and try to make some informational use of this base.

Integrating AI model into already existing MQL5 trading strategy

This topic focuses on incorporating a trained AI model (such as a reinforcement learning model like LSTM or a machine learning-based predictive model) into an existing MQL5 trading strategy.

Developing a trading Expert Advisor from scratch (Part 12): Times and Trade (I)

Today we will create Times & Trade with fast interpretation to read the order flow. It is the first part in which we will build the system. In the next article, we will complete the system with the missing information. To implement this new functionality, we will need to add several new things to the code of our Expert Advisor.

Automated Parameter Optimization for Trading Strategies Using Python and MQL5

There are several types of algorithms for self-optimization of trading strategies and parameters. These algorithms are used to automatically improve trading strategies based on historical and current market data. In this article we will look at one of them with python and MQL5 examples.

Data Science and Machine Learning (Part 05): Decision Trees

Decision trees imitate the way humans think to classify data. Let's see how to build trees and use them to classify and predict some data. The main goal of the decision trees algorithm is to separate the data with impurity and into pure or close to nodes.

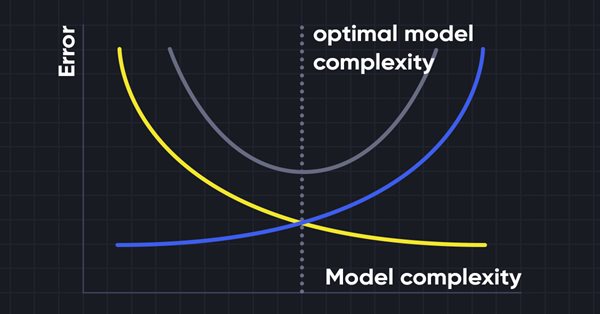

Data Science and Machine Learning (Part 10): Ridge Regression

Ridge regression is a simple technique to reduce model complexity and prevent over-fitting which may result from simple linear regression

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 5): Bollinger Bands On Keltner Channel — Indicators Signal

The Multi-Currency Expert Advisor in this article is an Expert Advisor or Trading Robot that can trade (open orders, close orders and manage orders for example: Trailing Stop Loss and Trailing Profit) for more than one symbol pair from only one symbol chart. In this article we will use signals from two indicators, in this case Bollinger Bands® on Keltner Channel.