Neural networks made easy (Part 16): Practical use of clustering

In the previous article, we have created a class for data clustering. In this article, I want to share variants of the possible application of obtained results in solving practical trading tasks.

Neural networks made easy (Part 32): Distributed Q-Learning

We got acquainted with the Q-learning method in one of the earlier articles within this series. This method averages rewards for each action. Two works were presented in 2017, which show greater success when studying the reward distribution function. Let's consider the possibility of using such technology to solve our problems.

Data Science and Machine Learning (Part 24): Forex Time series Forecasting Using Regular AI Models

In the forex markets It is very challenging to predict the future trend without having an idea of the past. Very few machine learning models are capable of making the future predictions by considering past values. In this article, we are going to discuss how we can use classical(Non-time series) Artificial Intelligence models to beat the market

Experiments with neural networks (Part 2): Smart neural network optimization

In this article, I will use experimentation and non-standard approaches to develop a profitable trading system and check whether neural networks can be of any help for traders. MetaTrader 5 as a self-sufficient tool for using neural networks in trading.

Reimagining Classic Strategies (Part 15): Daily Breakout Trading Strategy

Human traders had long participated in financial markets before the rise of computers, developing rules of thumb that guided their decisions. In this article, we revisit a well-known breakout strategy to test whether such market logic, learned through experience, can hold its own against systematic methods. Our findings show that while the original strategy produced high accuracy, it suffered from instability and poor risk control. By refining the approach, we demonstrate how discretionary insights can be adapted into more robust, algorithmic trading strategies.

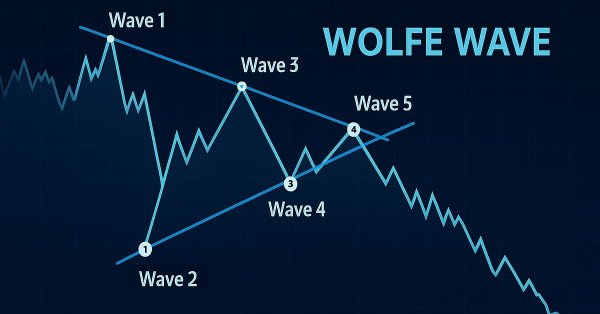

Introduction to MQL5 (Part 19): Automating Wolfe Wave Detection

This article shows how to programmatically identify bullish and bearish Wolfe Wave patterns and trade them using MQL5. We’ll explore how to identify Wolfe Wave structures programmatically and execute trades based on them using MQL5. This includes detecting key swing points, validating pattern rules, and preparing the EA to act on the signals it finds.

Neural networks made easy (Part 21): Variational autoencoders (VAE)

In the last article, we got acquainted with the Autoencoder algorithm. Like any other algorithm, it has its advantages and disadvantages. In its original implementation, the autoenctoder is used to separate the objects from the training sample as much as possible. This time we will talk about how to deal with some of its disadvantages.

Neural Networks in Trading: A Multi-Agent System with Conceptual Reinforcement (FinCon)

We invite you to explore the FinCon framework, which is a a Large Language Model (LLM)-based multi-agent system. The framework uses conceptual verbal reinforcement to improve decision making and risk management, enabling effective performance on a variety of financial tasks.

Data label for time series mining(Part 1):Make a dataset with trend markers through the EA operation chart

This series of articles introduces several time series labeling methods, which can create data that meets most artificial intelligence models, and targeted data labeling according to needs can make the trained artificial intelligence model more in line with the expected design, improve the accuracy of our model, and even help the model make a qualitative leap!

Prices in DoEasy library (part 59): Object to store data of one tick

From this article on, start creating library functionality to work with price data. Today, create an object class which will store all price data which arrived with yet another tick.

USD and EUR index charts — example of a MetaTrader 5 service

We will consider the creation and updating of USD index (USDX) and EUR index (EURX) charts using a MetaTrader 5 service as an example. When launching the service, we will check for the presence of the required synthetic instrument, create it if necessary, and place it in the Market Watch window. The minute and tick history of the synthetic instrument is to be created afterwards followed by the chart of the created instrument.

Moral expectation in trading

This article is about moral expectation. We will look at several examples of its use in trading, as well as the results that can be achieved with its help.

Advanced resampling and selection of CatBoost models by brute-force method

This article describes one of the possible approaches to data transformation aimed at improving the generalizability of the model, and also discusses sampling and selection of CatBoost models.

Ready-made templates for including indicators to Expert Advisors (Part 2): Volume and Bill Williams indicators

In this article, we will look at standard indicators of the Volume and Bill Williams' indicators category. We will create ready-to-use templates for indicator use in EAs - declaring and setting parameters, indicator initialization and deinitialization, as well as receiving data and signals from indicator buffers in EAs.

Neural networks made easy (Part 15): Data clustering using MQL5

We continue to consider the clustering method. In this article, we will create a new CKmeans class to implement one of the most common k-means clustering methods. During tests, the model managed to identify about 500 patterns.

Developing a trading Expert Advisor from scratch (Part 28): Towards the future (III)

There is still one task which our order system is not up to, but we will FINALLY figure it out. The MetaTrader 5 provides a system of tickets which allows creating and correcting order values. The idea is to have an Expert Advisor that would make the same ticket system faster and more efficient.

Developing an Expert Advisor from scratch (Part 30): CHART TRADE as an indicator?

Today we are going to use Chart Trade again, but this time it will be an on-chart indicator which may or may not be present on the chart.

Formulating Dynamic Multi-Pair EA (Part 4): Volatility and Risk Adjustment

This phase fine-tunes your multi-pair EA to adapt trade size and risk in real time using volatility metrics like ATR boosting consistency, protection, and performance across diverse market conditions.

Custom Indicator Workshop (Part 1): Building the Supertrend Indicator in MQL5

Build a non‑repainting Supertrend in MQL5 for MetaTrader 5 from first principles. We use an iATR handle and CopyBuffer for volatility, bind buffers with SetIndexBuffer, and configure plots (DRAWCOLORCANDLES plus two line bands) via PlotIndexSetInteger. The logic updates only on closed bars with EMPTY_VALUE to suppress inactive bands, exposing atrPeriod and atrMultiplier inputs. You get a clean, EA‑ready overlay with documented buffers for strategies and signals.

Creating Time Series Predictions using LSTM Neural Networks: Normalizing Price and Tokenizing Time

This article outlines a simple strategy for normalizing the market data using the daily range and training a neural network to enhance market predictions. The developed models may be used in conjunction with an existing technical analysis frameworks or on a standalone basis to assist in predicting the overall market direction. The framework outlined in this article may be further refined by any technical analyst to develop models suitable for both manual and automated trading strategies.

DoEasy. Controls (Part 3): Creating bound controls

In this article, I will create subordinate controls bound to the base element. The development will be performed using the base control functionality. In addition, I will tinker with the graphical element shadow object a bit since it still suffers from some logic errors when applied to any of the objects capable of having a shadow.

Creating a ticker tape panel: Basic version

Here I will show how to create screens with price tickers which are usually used to display quotes on the exchange. I will do it by only using MQL5, without using complex external programming.

Population optimization algorithms: Grey Wolf Optimizer (GWO)

Let's consider one of the newest modern optimization algorithms - Grey Wolf Optimization. The original behavior on test functions makes this algorithm one of the most interesting among the ones considered earlier. This is one of the top algorithms for use in training neural networks, smooth functions with many variables.

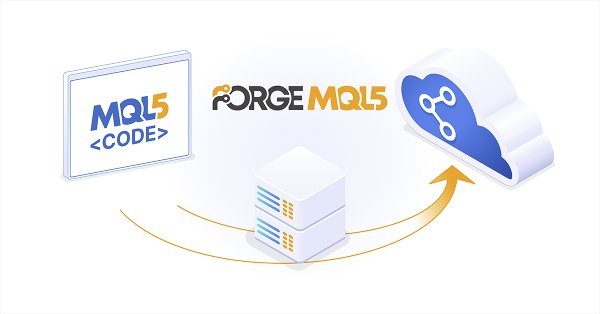

Getting Started with MQL5 Algo Forge

We are introducing MQL5 Algo Forge — a dedicated portal for algorithmic trading developers. It combines the power of Git with an intuitive interface for managing and organizing projects within the MQL5 ecosystem. Here, you can follow interesting authors, form teams, and collaborate on algorithmic trading projects.

New Opportunities with MetaTrader 5

MetaTrader 4 gained its popularity with traders from all over the world, and it seemed like nothing more could be wished for. With its high processing speed, stability, wide array of possibilities for writing indicators, Expert Advisors, and informatory-trading systems, and the ability to chose from over a hundred different brokers, - the terminal greatly distinguished itself from the rest. But time doesn’t stand still, and we find ourselves facing a choice of MetaTrade 4 or MetaTrade 5. In this article, we will describe the main differences of the 5th generation terminal from our current favor.

Price Action Analysis Toolkit Development (Part 46): Designing an Interactive Fibonacci Retracement EA with Smart Visualization in MQL5

Fibonacci tools are among the most popular instruments used by technical analysts. In this article, we’ll build an Interactive Fibonacci EA that draws retracement and extension levels that react dynamically to price movement, delivering real‑time alerts, stylish lines, and a scrolling news‑style headline. Another key advantage of this EA is flexibility; you can manually type the high (A) and low (B) swing values directly on the chart, giving you exact control over the market range you want to analyze.

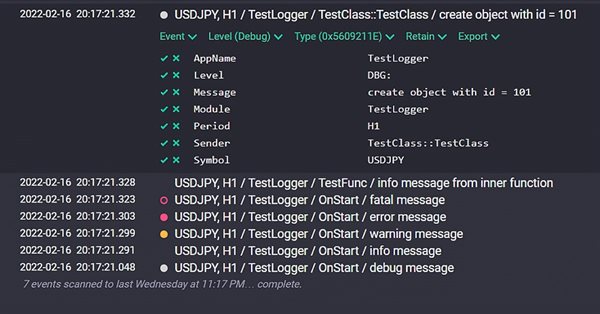

Tips from a professional programmer (Part III): Logging. Connecting to the Seq log collection and analysis system

Implementation of the Logger class for unifying and structuring messages which are printed to the Experts log. Connection to the Seq log collection and analysis system. Monitoring log messages online.

Technical Analysis: What Do We Analyze?

This article tries to analyze several peculiarities of representation of quotes available in the MetaTrader client terminal. The article is general, it doesn't concern programming.

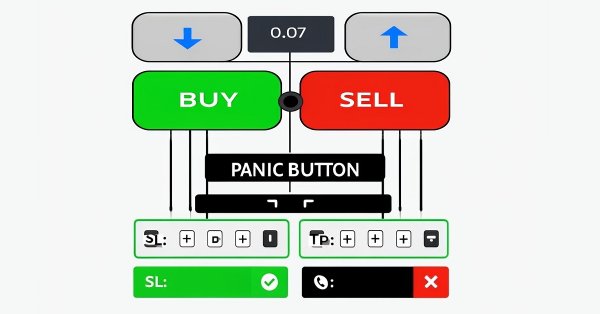

Manual Backtesting Made Easy: Building a Custom Toolkit for Strategy Tester in MQL5

In this article, we design a custom MQL5 toolkit for easy manual backtesting in the Strategy Tester. We explain its design and implementation, focusing on interactive trade controls. We then show how to use it to test strategies effectively

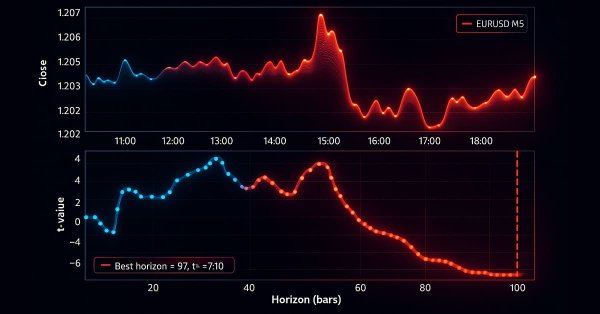

MetaTrader 5 Machine Learning Blueprint (Part 3): Trend-Scanning Labeling Method

We have built a robust feature engineering pipeline using proper tick-based bars to eliminate data leakage and solved the critical problem of labeling with meta-labeled triple-barrier signals. This installment covers the advanced labeling technique, trend-scanning, for adaptive horizons. After covering the theory, an example shows how trend-scanning labels can be used with meta-labeling to improve on the classic moving average crossover strategy.

Graphics in DoEasy library (Part 93): Preparing functionality for creating composite graphical objects

In this article, I will start developing the functionality for creating composite graphical objects. The library will support creating composite graphical objects allowing those objects have any hierarchy of connections. I will prepare all the necessary classes for subsequent implementation of such objects.

Timeseries in DoEasy library (part 54): Descendant classes of abstract base indicator

The article considers creation of classes of descendant objects of base abstract indicator. Such objects will provide access to features of creating indicator EAs, collecting and getting data value statistics of various indicators and prices. Also, create indicator object collection from which getting access to properties and data of each indicator created in the program will be possible.

How we developed the MetaTrader Signals service and Social Trading

We continue to enhance the Signals service, improve the mechanisms, add new functions and fix flaws. The MetaTrader Signals Service of 2012 and the current MetaTrader Signals Service are like two completely different services. Currently, we are implementing A Virtual Hosting Cloud service which consists of a network of servers to support specific versions of the MetaTrader client terminal.

High frequency arbitrage trading system in Python using MetaTrader 5

In this article, we will create an arbitration system that remains legal in the eyes of brokers, creates thousands of synthetic prices on the Forex market, analyzes them, and successfully trades for profit.

Category Theory in MQL5 (Part 14): Functors with Linear-Orders

This article which is part of a broader series on Category Theory implementation in MQL5, delves into Functors. We examine how a Linear Order can be mapped to a set, thanks to Functors; by considering two sets of data that one would typically dismiss as having any connection.

Formulating Dynamic Multi-Pair EA (Part 3): Mean Reversion and Momentum Strategies

In this article, we will explore the third part of our journey in formulating a Dynamic Multi-Pair Expert Advisor (EA), focusing specifically on integrating Mean Reversion and Momentum trading strategies. We will break down how to detect and act on price deviations from the mean (Z-score), and how to measure momentum across multiple forex pairs to determine trade direction.

Neural networks made easy (Part 25): Practicing Transfer Learning

In the last two articles, we developed a tool for creating and editing neural network models. Now it is time to evaluate the potential use of Transfer Learning technology using practical examples.

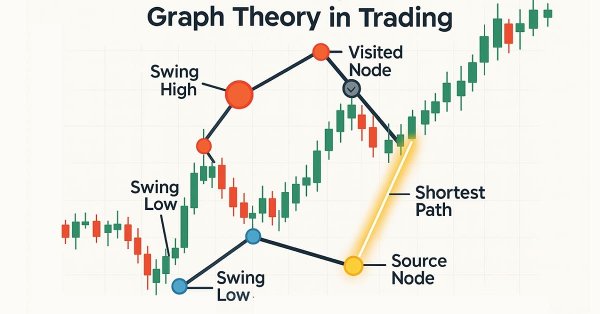

Graph Theory: Dijkstra's Algorithm Applied in Trading

Dijkstra's algorithm, a classic shortest-path solution in graph theory, can optimize trading strategies by modeling market networks. Traders can use it to find the most efficient routes in the candlestick chart data.

News Trading Made Easy (Part 1): Creating a Database

News trading can be complicated and overwhelming, in this article we will go through steps to obtain news data. Additionally we will learn about the MQL5 Economic Calendar and what it has to offer.

Population optimization algorithms: Harmony Search (HS)

In the current article, I will study and test the most powerful optimization algorithm - harmonic search (HS) inspired by the process of finding the perfect sound harmony. So what algorithm is now the leader in our rating?