Introduction to MQL5 (Part 10): A Beginner's Guide to Working with Built-in Indicators in MQL5

This article introduces working with built-in indicators in MQL5, focusing on creating an RSI-based Expert Advisor (EA) using a project-based approach. You'll learn to retrieve and utilize RSI values, handle liquidity sweeps, and enhance trade visualization using chart objects. Additionally, the article emphasizes effective risk management, including setting percentage-based risk, implementing risk-reward ratios, and applying risk modifications to secure profits.

Automating Trading Strategies in MQL5 (Part 21): Enhancing Neural Network Trading with Adaptive Learning Rates

In this article, we enhance a neural network trading strategy in MQL5 with an adaptive learning rate to boost accuracy. We design and implement this mechanism, then test its performance. The article concludes with optimization insights for algorithmic trading.

Graphics in DoEasy library (Part 91): Standard graphical object events. Object name change history

In this article, I will refine the basic functionality for providing control over graphical object events from a library-based program. I will start from implementing the functionality for storing the graphical object change history using the "Object name" property as an example.

Developing a trading Expert Advisor from scratch (Part 15): Accessing data on the web (I)

How to access online data via MetaTrader 5? There are a lot of websites and places on the web, featuring a huge amount information. What you need to know is where to look and how best to use this information.

Automating Trading Strategies in MQL5 (Part 21): Enhancing Neural Network Trading with Adaptive Learning Rates

In this article, we enhance a neural network trading strategy in MQL5 with an adaptive learning rate to boost accuracy. We design and implement this mechanism, then test its performance. The article concludes with optimization insights for algorithmic trading.

MQL5 Cookbook: Reducing the Effect of Overfitting and Handling the Lack of Quotes

Whatever trading strategy you use, there will always be a question of what parameters to choose to ensure future profits. This article gives an example of an Expert Advisor with a possibility to optimize multiple symbol parameters at the same time. This method is intended to reduce the effect of overfitting parameters and handle situations where data from a single symbol are not enough for the study.

Creating an EA that works automatically (Part 08): OnTradeTransaction

In this article, we will see how to use the event handling system to quickly and efficiently process issues related to the order system. With this system the EA will work faster, so that it will not have to constantly search for the required data.

Timeseries in DoEasy library (part 49): Multi-period multi-symbol multi-buffer standard indicators

In the current article, I will improve the library classes to implement the ability to develop multi-symbol multi-period standard indicators requiring several indicator buffers to display their data.

From Novice to Expert: Demystifying Hidden Fibonacci Retracement Levels

In this article, we explore a data-driven approach to discovering and validating non-standard Fibonacci retracement levels that markets may respect. We present a complete workflow tailored for implementation in MQL5, beginning with data collection and bar or swing detection, and extending through clustering, statistical hypothesis testing, backtesting, and integration into an MetaTrader 5 Fibonacci tool. The goal is to create a reproducible pipeline that transforms anecdotal observations into statistically defensible trading signals.

Creating an EA that works automatically (Part 09): Automation (I)

Although the creation of an automated EA is not a very difficult task, however, many mistakes can be made without the necessary knowledge. In this article, we will look at how to build the first level of automation, which consists in creating a trigger to activate breakeven and a trailing stop level.

Canvas based indicators: Filling channels with transparency

In this article I'll introduce a method for creating custom indicators whose drawings are made using the class CCanvas from standard library and see charts properties for coordinates conversion. I'll approach specially indicators which need to fill the area between two lines using transparency.

Exploring Advanced Machine Learning Techniques on the Darvas Box Breakout Strategy

The Darvas Box Breakout Strategy, created by Nicolas Darvas, is a technical trading approach that spots potential buy signals when a stock’s price rises above a set "box" range, suggesting strong upward momentum. In this article, we will apply this strategy concept as an example to explore three advanced machine learning techniques. These include using a machine learning model to generate signals rather than to filter trades, employing continuous signals rather than discrete ones, and using models trained on different timeframes to confirm trades.

Graphics in DoEasy library (Part 96): Graphics in form objects and handling mouse events

In this article, I will start creating the functionality for handling mouse events in form objects, as well as add new properties and their tracking to a symbol object. Besides, I will improve the symbol object class since the chart symbols now have new properties to be considered and tracked.

DoEasy. Controls (Part 15): TabControl WinForms object — several rows of tab headers, tab handling methods

In this article, I will continue working on the TabControl WinForm object — I will create a tab field object class, make it possible to arrange tab headers in several rows and add methods for handling object tabs.

Studying PrintFormat() and applying ready-made examples

The article will be useful for both beginners and experienced developers. We will look at the PrintFormat() function, analyze examples of string formatting and write templates for displaying various information in the terminal log.

Non-linear indicators

In this article, I will make an attempt to consider some ways of building non-linear indicators and their use in trading. There are quite a few indicators in the MetaTrader trading platform that use non-linear approaches.

Connection of Expert Advisor with ICQ in MQL5

This article describes the method of information exchange between the Expert Advisor and ICQ users, several examples are presented. The provided material will be interesting for those, who wish to receive trading information remotely from a client terminal, through an ICQ client in their mobile phone or PDA.

Automating Trading Strategies in MQL5 (Part 2): The Kumo Breakout System with Ichimoku and Awesome Oscillator

In this article, we create an Expert Advisor (EA) that automates the Kumo Breakout strategy using the Ichimoku Kinko Hyo indicator and the Awesome Oscillator. We walk through the process of initializing indicator handles, detecting breakout conditions, and coding automated trade entries and exits. Additionally, we implement trailing stops and position management logic to enhance the EA's performance and adaptability to market conditions.

Other classes in DoEasy library (Part 68): Chart window object class and indicator object classes in the chart window

In this article, I will continue the development of the chart object class. I will add the list of chart window objects featuring the lists of available indicators.

Mountain or Iceberg charts

How do you like the idea of adding a new chart type to the MetaTrader 5 platform? Some people say it lacks a few things that other platforms offer. But the truth is, MetaTrader 5 is a very practical platform as it allows you to do things that can't be done (or at least can't be done easily) in many other platforms.

Developing a robot in Python and MQL5 (Part 1): Data preprocessing

Developing a trading robot based on machine learning: A detailed guide. The first article in the series deals with collecting and preparing data and features. The project is implemented using the Python programming language and libraries, as well as the MetaTrader 5 platform.

Build Self Optimizing Expert Advisors in MQL5 (Part 6): Self Adapting Trading Rules (II)

This article explores optimizing RSI levels and periods for better trading signals. We introduce methods to estimate optimal RSI values and automate period selection using grid search and statistical models. Finally, we implement the solution in MQL5 while leveraging Python for analysis. Our approach aims to be pragmatic and straightforward to help you solve potentially complicated problems, with simplicity.

How to Create an Interactive MQL5 Dashboard/Panel Using the Controls Class (Part 2): Adding Button Responsiveness

In this article, we focus on transforming our static MQL5 dashboard panel into an interactive tool by enabling button responsiveness. We explore how to automate the functionality of the GUI components, ensuring they react appropriately to user clicks. By the end of the article, we establish a dynamic interface that enhances user engagement and trading experience.

Automating Trading Strategies in MQL5 (Part 31): Creating a Price Action 3 Drives Harmonic Pattern System

In this article, we develop a 3 Drives Pattern system in MQL5 that identifies bullish and bearish 3 Drives harmonic patterns using pivot points and Fibonacci ratios, executing trades with customizable entry, stop loss, and take-profit levels based on user-selected options. We enhance trader insight with visual feedback through chart objects.

Arranging a mailing campaign by means of Google services

A trader may want to arrange a mailing campaign to maintain business relationships with other traders, subscribers, clients or friends. Besides, there may be a necessity to send screenshotas, logs or reports. These may not be the most frequently arising tasks but having such a feature is clearly an advantage. The article deals with using several Google services simultaneously, developing an appropriate assembly on C# and integrating it with MQL tools.

The price movement model and its main provisions. (Part 3): Calculating optimal parameters of stock exchange speculations

Within the framework of the engineering approach developed by the author based on the probability theory, the conditions for opening a profitable position are found and the optimal (profit-maximizing) take profit and stop loss values are calculated.

Graphics in DoEasy library (Part 82): Library objects refactoring and collection of graphical objects

In this article, I will improve all library objects by assigning a unique type to each object and continue the development of the library graphical objects collection class.

MQL5 Wizard techniques you should know (Part 02): Kohonen Maps

These series of articles will proposition that the MQL5 Wizard should be a mainstay for traders. Why? Because not only does the trader save time by assembling his new ideas with the MQL5 Wizard, and greatly reduce mistakes from duplicate coding; he is ultimately set-up to channel his energy on the few critical areas of his trading philosophy.

Forecasting with ARIMA models in MQL5

In this article we continue the development of the CArima class for building ARIMA models by adding intuitive methods that enable forecasting.

How to connect MetaTrader 5 to PostgreSQL

This article describes four methods for connecting MQL5 code to a Postgres database and provides a step-by-step tutorial for setting up a development environment for one of them, a REST API, using the Windows Subsystem For Linux (WSL). A demo app for the API is provided along with the corresponding MQL5 code to insert data and query the respective tables, as well as a demo Expert Advisor to consume this data.

Other classes in DoEasy library (Part 71): Chart object collection events

In this article, I will create the functionality for tracking some chart object events — adding/removing symbol charts and chart subwindows, as well as adding/removing/changing indicators in chart windows.

Working with GSM Modem from an MQL5 Expert Advisor

There is currently a fair number of means for a comfortable remote monitoring of a trading account: mobile terminals, push notifications, working with ICQ. But it all requires Internet connection. This article describes the process of creating an Expert Advisor that will allow you to stay in touch with your trading terminal even when mobile Internet is not available, through calls and text messaging.

Automated grid trading using limit orders on Moscow Exchange (MOEX)

The article considers the development of an MQL5 Expert Advisor (EA) for MetaTrader 5 aimed at working on MOEX. The EA is to follow a grid strategy while trading on MOEX using MetaTrader 5 terminal. The EA involves closing positions by stop loss and take profit, as well as removing pending orders in case of certain market conditions.

Tales of Trading Robots: Is Less More?

Two years ago in "The Last Crusade" we reviewed quite an interesting yet currently not widely used method for displaying market information - point and figure charts. Now I suggest you try to write a trading robot based on the patterns detected on the point and figure chart.

Creating an EA that works automatically (Part 13): Automation (V)

Do you know what a flowchart is? Can you use it? Do you think flowcharts are for beginners? I suggest that we proceed to this new article and learn how to work with flowcharts.

Implementing the Deus EA: Automated Trading with RSI and Moving Averages in MQL5

This article outlines the steps to implement the Deus EA based on the RSI and Moving Average indicators for guiding automated trading.

Reimagining Classic Strategies (Part 18): Searching For Candlestick Patterns

This article helps new community members search for and discover their own candlestick patterns. Describing these patterns can be daunting, as it requires manually searching and creatively identifying improvements. Here, we introduce the engulfing candlestick pattern and show how it can be enhanced for more profitable trading applications.

Multiple indicators on one chart (Part 02): First experiments

In the previous article "Multiple indicators on one chart" I presented the concept and the basics of how to use multiple indicators on one chart. In this article, I will provide the source code and will explain it in detail.

Developing a trading Expert Advisor from scratch (Part 29): The talking platform

In this article, we will learn how to make the MetaTrader 5 platform talk. What if we make the EA more fun? Financial market trading is often too boring and monotonous, but we can make this job less tiring. Please note that this project can be dangerous for those who experience problems such as addiction. However, in a general case, it just makes things less boring.

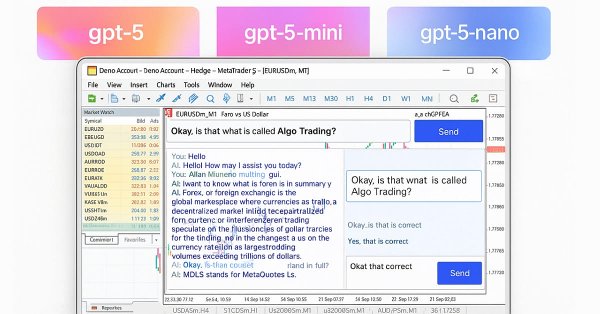

Building AI-Powered Trading Systems in MQL5 (Part 2): Developing a ChatGPT-Integrated Program with User Interface

In this article, we develop a ChatGPT-integrated program in MQL5 with a user interface, leveraging the JSON parsing framework from Part 1 to send prompts to OpenAI’s API and display responses on a MetaTrader 5 chart. We implement a dashboard with an input field, submit button, and response display, handling API communication and text wrapping for user interaction.