Graphical Interfaces IX: The Color Picker Control (Chapter 1)

With this article we begin chapter nine of series of articles dedicated to creating graphical interfaces in MetaTrader trading terminals. It consists of two chapters where new elements of controls and interface, such as color picker, color button, progress bar and line chart are presented.

Promote Your Development Projects Using EX5 Libraries

Hiding of the implementation details of classes/functions in an .ex5 file will enable you to share your know-how algorithms with other developers, set up common projects and promote them in the Web. And while the MetaQuotes team spares no effort to bring about the possibility of direct inheritance of ex5 library classes, we are going to implement it right now.

Timeseries in DoEasy library (part 36): Object of timeseries for all used symbol periods

In this article, we will consider combining the lists of bar objects for each used symbol period into a single symbol timeseries object. Thus, each symbol will have an object storing the lists of all used symbol timeseries periods.

Automating Trading Strategies in MQL5 (Part 16): Midnight Range Breakout with Break of Structure (BoS) Price Action

In this article, we automate the Midnight Range Breakout with Break of Structure strategy in MQL5, detailing code for breakout detection and trade execution. We define precise risk parameters for entries, stops, and profits. Backtesting and optimization are included for practical trading.

The Liquidity Grab Trading Strategy

The liquidity grab trading strategy is a key component of Smart Money Concepts (SMC), which seeks to identify and exploit the actions of institutional players in the market. It involves targeting areas of high liquidity, such as support or resistance zones, where large orders can trigger price movements before the market resumes its trend. This article explains the concept of liquidity grab in detail and outlines the development process of the liquidity grab trading strategy Expert Advisor in MQL5.

Decreasing Memory Consumption by Auxiliary Indicators

If an indicator uses values of many other indicators for its calculations, it consumes a lot of memory. The article describes several methods of decreasing the memory consumption when using auxiliary indicators. Saved memory allows increasing the number of simultaneously used currency pairs, indicators and strategies in the client terminal. It increases the reliability of trade portfolio. Such a simple care about technical resources of your computer can turn into money resources at your deposit.

Build Self Optimizing Expert Advisors in MQL5 (Part 4): Dynamic Position Sizing

Successfully employing algorithmic trading requires continuous, interdisciplinary learning. However, the infinite range of possibilities can consume years of effort without yielding tangible results. To address this, we propose a framework that gradually introduces complexity, allowing traders to refine their strategies iteratively rather than committing indefinite time to uncertain outcomes.

Graphical Interfaces X: Sorting, rebuilding the table and controls in the cells (build 11)

We continue to add new features to the rendered table: data sorting, managing the number of columns and rows, setting the table cell types to place controls into them.

MQL5 Cookbook: Analyzing Position Properties in the MetaTrader 5 Strategy Tester

We will present a modified version of the Expert Advisor from the previous article "MQL5 Cookbook: Position Properties on the Custom Info Panel". Some of the issues we will address include getting data from bars, checking for new bar events on the current symbol, including a trade class of the Standard Library to a file, creating a function to search for trading signals and a function for executing trading operations, as well as determining trade events in the OnTrade() function.

Price Action Analysis Toolkit Development (Part 27): Liquidity Sweep With MA Filter Tool

Understanding the subtle dynamics behind price movements can give you a critical edge. One such phenomenon is the liquidity sweep, a deliberate strategy that large traders, especially institutions, use to push prices through key support or resistance levels. These levels often coincide with clusters of retail stop-loss orders, creating pockets of liquidity that big players can exploit to enter or exit sizeable positions with minimal slippage.

Mastering ONNX: The Game-Changer for MQL5 Traders

Dive into the world of ONNX, the powerful open-standard format for exchanging machine learning models. Discover how leveraging ONNX can revolutionize algorithmic trading in MQL5, allowing traders to seamlessly integrate cutting-edge AI models and elevate their strategies to new heights. Uncover the secrets to cross-platform compatibility and learn how to unlock the full potential of ONNX in your MQL5 trading endeavors. Elevate your trading game with this comprehensive guide to Mastering ONNX

Implementing an ARIMA training algorithm in MQL5

In this article we will implement an algorithm that applies the Box and Jenkins Autoregressive Integrated Moving Average model by using Powells method of function minimization. Box and Jenkins stated that most time series could be modeled by one or both of two frameworks.

Graphical Interfaces XI: Integrating the Standard Graphics Library (build 16)

A new version of the graphics library for creating scientific charts (the CGraphic class) has been presented recently. This update of the developed library for creating graphical interfaces will introduce a version with a new control for creating charts. Now it is even easier to visualize data of different types.

Graphics in DoEasy library (Part 83): Class of the abstract standard graphical object

In this article, I will create the class of the abstract graphical object. This object is to serve as a basis for creating the class of standard graphical objects. Graphical objects feature multiple properties. Therefore, I will need to do a lot of preparatory work before actually creating the abstract graphical object class. This work includes setting the properties in the library enumerations.

A scientific approach to the development of trading algorithms

The article considers the methodology for developing trading algorithms, in which a consistent scientific approach is used to analyze possible price patterns and to build trading algorithms based on these patterns. Development ideals are demonstrated using examples.

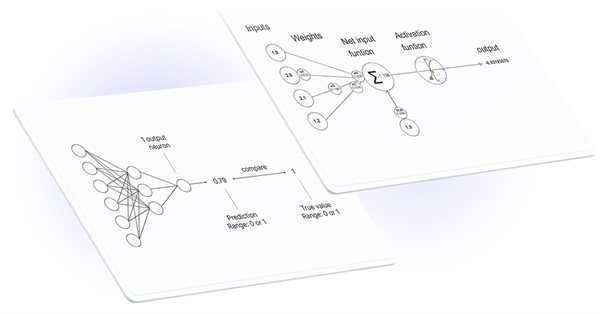

Neural networks made easy (Part 26): Reinforcement Learning

We continue to study machine learning methods. With this article, we begin another big topic, Reinforcement Learning. This approach allows the models to set up certain strategies for solving the problems. We can expect that this property of reinforcement learning will open up new horizons for building trading strategies.

Graphics in DoEasy library (Part 86): Graphical object collection - managing property modification

In this article, I will consider tracking property value modification, as well as removing and renaming graphical objects in the library.

Matrix and Vector operations in MQL5

Matrices and vectors have been introduced in MQL5 for efficient operations with mathematical solutions. The new types offer built-in methods for creating concise and understandable code that is close to mathematical notation. Arrays provide extensive capabilities, but there are many cases in which matrices are much more efficient.

Automating Trading Strategies in MQL5 (Part 3): The Zone Recovery RSI System for Dynamic Trade Management

In this article, we create a Zone Recovery RSI EA System in MQL5, using RSI signals to trigger trades and a recovery strategy to manage losses. We implement a "ZoneRecovery" class to automate trade entries, recovery logic, and position management. The article concludes with backtesting insights to optimize performance and enhance the EA’s effectiveness.

Designing and implementing new GUI widgets based on CChartObject class

After I wrote a previous article on semi-automatic Expert Advisor with GUI interface it turned out that it would be desirable to enhance interface with some new functionalities for more complex indicators and Expert Advisors. After getting acquainted with MQL5 standard library classes I implemented new widgets. This article describes a process of designing and implementing new MQL5 GUI widgets that can be used in indicators and Expert Advisors. The widgets presented in the article are CChartObjectSpinner, CChartObjectProgressBar and CChartObjectEditTable.

Graphical Interfaces V: The List View Element (Chapter 2)

In the previous chapter, we wrote classes for creating vertical and horizontal scrollbars. In this chapter, we will implement them. We will write a class for creating the list view element, a compound part of which will be a vertical scrollbar.

Automating Trading Strategies in MQL5 (Part 13): Building a Head and Shoulders Trading Algorithm

In this article, we automate the Head and Shoulders pattern in MQL5. We analyze its architecture, implement an EA to detect and trade it, and backtest the results. The process reveals a practical trading algorithm with room for refinement.

Movement continuation model - searching on the chart and execution statistics

This article provides programmatic definition of one of the movement continuation models. The main idea is defining two waves — the main and the correction one. For extreme points, I apply fractals as well as "potential" fractals - extreme points that have not yet formed as fractals.

Prices in DoEasy library (Part 64): Depth of Market, classes of DOM snapshot and snapshot series objects

In this article, I will create two classes (the class of DOM snapshot object and the class of DOM snapshot series object) and test creation of the DOM data series.

Graphical Interfaces XI: Text edit boxes and Combo boxes in table cells (build 15)

In this update of the library, the Table control (the CTable class) will be supplemented with new options. The lineup of controls in the table cells is expanded, this time adding text edit boxes and combo boxes. As an addition, this update also introduces the ability to resize the window of an MQL application during its runtime.

The Principles of Economic Calculation of Indicators

Calls to user and technical indicators takes up very little space in the program code of automated trading systems. Often it’s simply a few code lines. But it often happens that it is these few lines of code which use up the largest portion of time, which needs to be spent on testing the Expert Advisor. Therefore, everything that is related to data calculations within an indicator, needs to be considered much more thoroughly than would seem at first glance. This article will talk precisely about this.

Neural networks made easy (Part 29): Advantage Actor-Critic algorithm

In the previous articles of this series, we have seen two reinforced learning algorithms. Each of them has its own advantages and disadvantages. As often happens in such cases, next comes the idea to combine both methods into an algorithm, using the best of the two. This would compensate for the shortcomings of each of them. One of such methods will be discussed in this article.

Combinatorics and probability for trading (Part V): Curve analysis

In this article, I decided to conduct a study related to the possibility of reducing multiple states to double-state systems. The main purpose of the article is to analyze and to come to useful conclusions that may help in the further development of scalable trading algorithms based on the probability theory. Of course, this topic involves mathematics. However, given the experience of previous articles, I see that generalized information is more useful than details.

Deep Neural Networks (Part III). Sample selection and dimensionality reduction

This article is a continuation of the series of articles about deep neural networks. Here we will consider selecting samples (removing noise), reducing the dimensionality of input data and dividing the data set into the train/val/test sets during data preparation for training the neural network.

DoEasy. Controls (Part 1): First steps

This article starts an extensive topic of creating controls in Windows Forms style using MQL5. My first object of interest is creating the panel class. It is already becoming difficult to manage things without controls. Therefore, I will create all possible controls in Windows Forms style.

Everything you need to learn about the MQL5 program structure

Any Program in any programming language has a specific structure. In this article, you will learn essential parts of the MQL5 program structure by understanding the programming basics of every part of the MQL5 program structure that can be very helpful when creating our MQL5 trading system or trading tool that can be executable in the MetaTrader 5.

Brute force approach to pattern search (Part III): New horizons

This article provides a continuation to the brute force topic, and it introduces new opportunities for market analysis into the program algorithm, thereby accelerating the speed of analysis and improving the quality of results. New additions enable the highest-quality view of global patterns within this approach.

Neural networks made easy (Part 5): Multithreaded calculations in OpenCL

We have earlier discussed some types of neural network implementations. In the considered networks, the same operations are repeated for each neuron. A logical further step is to utilize multithreaded computing capabilities provided by modern technology in an effort to speed up the neural network learning process. One of the possible implementations is described in this article.

Advantages of MQL5 Signals

Trading Signals service recently introduced in MetaTrader 5 allows traders to copy trading operations of any signals provider. Users can select any signal, subscribe to it and all deals will be copied at their accounts. Signals providers can set their subscription prices and receive a fixed monthly fee from their subscribers.

Using Layouts and Containers for GUI Controls: The CGrid Class

This article presents an alternative method of GUI creation based on layouts and containers, using one layout manager — the CGrid class. The CGrid class is an auxiliary control that acts as a container for other containers and controls using a grid layout.

Introduction to MQL5 (Part 12): A Beginner's Guide to Building Custom Indicators

Learn how to build a custom indicator in MQL5. With a project-based approach. This beginner-friendly guide covers indicator buffers, properties, and trend visualization, allowing you to learn step-by-step.

Multiple indicators on one chart (Part 04): Advancing to an Expert Advisor

In my previous articles, I have explained how to create an indicator with multiple subwindows, which becomes interesting when using custom indicators. This time we will see how to add multiple windows to an Expert Advisor.

Neural Networks Made Easy (Part 96): Multi-Scale Feature Extraction (MSFformer)

Efficient extraction and integration of long-term dependencies and short-term features remain an important task in time series analysis. Their proper understanding and integration are necessary to create accurate and reliable predictive models.

Calculating mathematical expressions (Part 1). Recursive descent parsers

The article considers the basic principles of mathematical expression parsing and calculation. We will implement recursive descent parsers operating in the interpreter and fast calculation modes, based on a pre-built syntax tree.

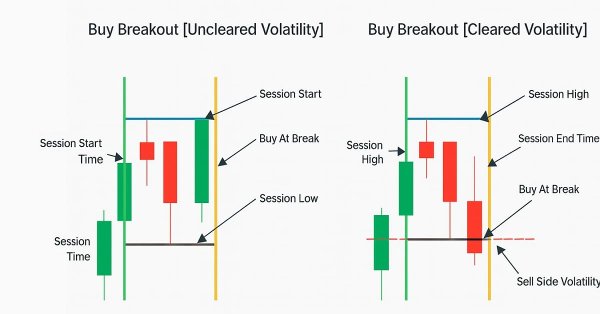

Developing a Volatility Based Breakout System

Volatility based breakout system identifies market ranges, then trades when price breaks above or below those levels, filtered by volatility measures such as ATR. This approach helps capture strong directional moves.