Mathematics in trading: Sharpe and Sortino ratios

Return on investments is the most obvious indicator which investors and novice traders use for the analysis of trading efficiency. Professional traders use more reliable tools to analyze strategies, such as Sharpe and Sortino ratios, among others.

A DLL for MQL5 in 10 Minutes (Part II): Creating with Visual Studio 2017

The original basic article has not lost its relevance and thus if you are interested in this topic, be sure to read the first article. However much time has passed since then, so the current Visual Studio 2017 features an updated interface. The MetaTrader 5 platform has also acquired new features. The article provides a description of dll project development stages, as well as DLL setup and interaction with MetaTrader 5 tools.

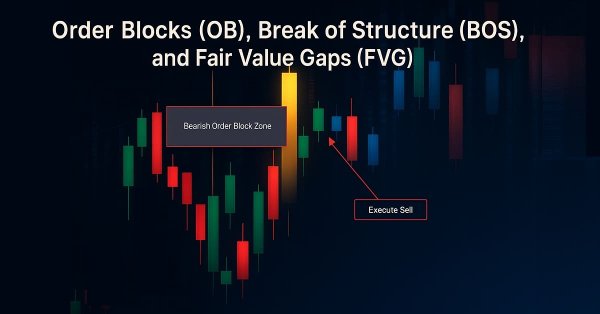

Elevate Your Trading With Smart Money Concepts (SMC): OB, BOS, and FVG

Elevate your trading with Smart Money Concepts (SMC) by combining Order Blocks (OB), Break of Structure (BOS), and Fair Value Gaps (FVG) into one powerful EA. Choose automatic strategy execution or focus on any individual SMC concept for flexible and precise trading.

Dealing with Time (Part 1): The Basics

Functions and code snippets that simplify and clarify the handling of time, broker offset, and the changes to summer or winter time. Accurate timing may be a crucial element in trading. At the current hour, is the stock exchange in London or New York already open or not yet open, when does the trading time for Forex trading start and end? For a trader who trades manually and live, this is not a big problem.

How to Export Quotes from МetaTrader 5 to .NET Applications Using WCF Services

Want to organize export of quotes from MetaTrader 5 to your own application? The MQL5-DLL junction allows to create such solutions! This article will show you one of the ways to export quotes from MetaTrader 5 to applications written in .NET. For me it was more interesting, rational and easy to implement export of quotes using this very platform. Unfortunately, version 5 still does not support .NET, so like in old days we will use win32 dll with .NET support as an interlayer.

Studying candlestick analysis techniques (part I): Checking existing patterns

In this article, we will consider popular candlestick patterns and will try to find out if they are still relevant and effective in today's markets. Candlestick analysis appeared more than 20 years ago and has since become quite popular. Many traders consider Japanese candlesticks the most convenient and easily understandable asset price visualization form.

MQL5 Cookbook: Sound Notifications for MetaTrader 5 Trade Events

In this article, we will consider such issues as including sound files in the file of the Expert Advisor, and thus adding sound notifications to trade events. The fact that the files will be included means that the sound files will be located inside the Expert Advisor. So when giving the compiled version of the Expert Advisor (*.ex5) to another user, you will not have to also provide the sound files and explain where they need to be saved.

The Implementation of a Multi-currency Mode in MetaTrader 5

For a long time multi-currency analysis and multi-currency trading has been of interest to people. The opportunity to implement a full fledged multi-currency regime became possible only with the public release of MetaTrader 5 and the MQL5 programming language. In this article we propose a way to analyze and process all incoming ticks for several symbols. As an illustration, let's consider a multi-currency RSI indicator of the USDx dollar index.

A Virtual Order Manager to track orders within the position-centric MetaTrader 5 environment

This class library can be added to an MetaTrader 5 Expert Advisor to enable it to be written with an order-centric approach broadly similar to MetaTrader 4, in comparison to the position-based approach of MetaTrader 5. It does this by keeping track of virtual orders at the MetaTrader 5 client terminal, while maintaining a protective broker stop for each position for disaster protection.

Library for easy and quick development of MetaTrader programs (part XXI): Trading classes - Base cross-platform trading object

In this article, we will start the development of the new library section - trading classes. Besides, we will consider the development of a unified base trading object for MetaTrader 5 and MetaTrader 4 platforms. When sending a request to the server, such a trading object implies that verified and correct trading request parameters are passed to it.

Combinatorics and probability theory for trading (Part I): The basics

In this series of article, we will try to find a practical application of probability theory to describe trading and pricing processes. In the first article, we will look into the basics of combinatorics and probability, and will analyze the first example of how to apply fractals in the framework of the probability theory.

Finding Errors and Logging

MetaEditor 5 has the debugging feature. But when you write your MQL5 programs, you often want to display not the individual values, but all messages that appear during testing and online work. When the log file contents have large size, it is obvious to automate quick and easy retrieval of required message. In this article we will consider ways of finding errors in MQL5 programs and methods of logging. Also we will simplify logging into files and will get to know a simple program LogMon for comfortable viewing of logs.

Processing of trade events in Expert Advisor using the OnTrade() function

MQL5 gave a mass of innovations, including work with events of various types (timer events, trade events, custom events, etc.). Ability to handle events allows you to create completely new type of programs for automatic and semi-automatic trading. In this article we will consider trade events and write some code for the OnTrade() function, that will process the Trade event.

Extract profit down to the last pip

The article describes an attempt to combine theory with practice in the algorithmic trading field. Most of discussions concerning the creation of Trading Systems is connected with the use of historic bars and various indicators applied thereon. This is the most well covered field and thus we will not consider it. Bars represent a very artificial entity; therefore we will work with something closer to proto-data, namely the price ticks.

The Drawing Styles in MQL5

There are 6 drawing styles in MQL4 and 18 drawing styles in MQL5. Therefore, it may be worth writing an article to introduce MQL5's drawing styles. In this article, we will consider the details of drawing styles in MQL5. In addition, we will create an indicator to demonstrate how to use these drawing styles, and refine the plotting.

EA remote control methods

The main advantage of trading robots lies in the ability to work 24 hours a day on a remote VPS server. But sometimes it is necessary to intervene in their work, while there may be no direct access to the server. Is it possible to manage EAs remotely? The article proposes one of the options for controlling EAs via external commands.

Library for easy and quick development of MetaTrader programs (part XXXI): Pending trading requests - opening positions under certain conditions

Starting with this article, we are going to develop a functionality allowing users to trade using pending requests under certain conditions, for example, when reaching a certain time limit, exceeding a specified profit or closing a position by stop loss.

Learn how to trade the Fair Value Gap (FVG)/Imbalances step-by-step: A Smart Money concept approach

A step-by-step guide to creating and implementing an automated trading algorithm in MQL5 based on the Fair Value Gap (FVG) trading strategy. A detailed tutorial on creating an expert advisor that can be useful for both beginners and experienced traders.

Parallel Calculations in MetaTrader 5

Time has been a great value throughout the history of mankind, and we strive not to waste it unnecessarily. This article will tell you how to accelerate the work of your Expert Advisor if your computer has a multi-core processor. Moreover, the implementation of the proposed method does not require the knowledge of any other languages besides MQL5.

Automating Trading Strategies in MQL5 (Part 47): Nick Rypock Trailing Reverse (NRTR) with Hedging Features

In this article, we develop a Nick Rypock Trailing Reverse (NRTR) trading system in MQL5 that uses channel indicators for reversal signals, enabling trend-following entries with hedging support for buys and sells. We incorporate risk management features like auto lot sizing based on equity or balance, fixed or dynamic stop-loss and take-profit levels using ATR multipliers, and position limits.

Native Twitter Client: Part 2

A Twitter client implemented as MQL class to allow you to send tweets with photos. All you need is to include a single self contained include file and off you go to tweet all your wonderful charts and signals.

Comparing speeds of self-caching indicators

The article compares the classic MQL5 access to indicators with alternative MQL4-style methods. Several varieties of MQL4-style access to indicators are considered: with and without the indicator handles caching. Considering the indicator handles inside the MQL5 core is analyzed as well.

Practical application of neural networks in trading. Python (Part I)

In this article, we will analyze the step-by-step implementation of a trading system based on the programming of deep neural networks in Python. This will be performed using the TensorFlow machine learning library developed by Google. We will also use the Keras library for describing neural networks.

Patterns available when trading currency baskets

Following up our previous article on the currency baskets trading principles, here we are going to analyze the patterns traders can detect. We will also consider the advantages and the drawbacks of each pattern and provide some recommendations on their use. The indicators based on Williams' oscillator will be used as analysis tools.

Developing a cross-platform Expert Advisor to set StopLoss and TakeProfit based on risk settings

In this article, we will create an Expert Advisor for automated entry lot calculation based on risk values. Also the Expert Advisor will be able to automatically place Take Profit with the select ratio to Stop Loss. That is, it can calculate Take Profit based on any selected ratio, such as 3 to 1, 4 to 1 or any other selected value.

Library for easy and quick development of MetaTrader programs (part XIII): Account object events

The article considers working with account events for tracking important changes in account properties affecting the automated trading. We have already implemented some functionality for tracking account events in the previous article when developing the account object collection.

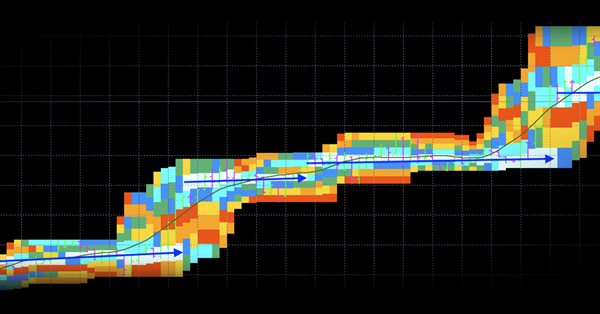

Econometric approach to finding market patterns: Autocorrelation, Heat Maps and Scatter Plots

The article presents an extended study of seasonal characteristics: autocorrelation heat maps and scatter plots. The purpose of the article is to show that "market memory" is of seasonal nature, which is expressed through maximized correlation of increments of arbitrary order.

MQL5 Cookbook – Economic Calendar

The article highlights the programming features of the Economic Calendar and considers creating a class for a simplified access to the calendar properties and receiving event values. Developing an indicator using CFTC non-commercial net positions serves as a practical example.

Graphical Interfaces X: The Multiline Text box control (build 8)

The Multiline Text box control is discussed. Unlike the graphical objects of the OBJ_EDIT type, the presented version will not have restrictions on the number of input characters. It also adds the mode for turning the text box into a simple text editor, where the cursor can be moved using the mouse or keys.

Money-Making Algorithms Employing Trailing Stop

This article's objective is to study profitability of algorithms with different entries into trades and exits using trailing stop. Entry types to be used are random entry and reverse entry. Stop orders to be used are trailing stop and trailing take. The article demonstrates money-making algorithms with a profitability of about 30% per annum.

Advanced EA constructor for MetaTrader - botbrains.app

In this article, we demonstrate features of botbrains.app - a no-code platform for trading robots development. To create a trading robot you don't need to write any code - just drag and drop the necessary blocks onto the scheme, set their parameters, and establish connections between them.

Forecasting Time Series (Part 2): Least-Square Support-Vector Machine (LS-SVM)

This article deals with the theory and practical application of the algorithm for forecasting time series, based on support-vector method. It also proposes its implementation in MQL and provides test indicators and Expert Advisors. This technology has not been implemented in MQL yet. But first, we have to get to know math for it.

Using the Object Pointers in MQL5

By default, all objects in MQL5 are passed by reference, but there is a possibility to use the object pointers. However it's necessary to perform the pointer checking, because the object may be not initialized. In this case, the MQL5 program will be terminated with critical error and unloaded. The objects, created automatically, doesn't cause such an error, so in this sence, they are quite safe. In this article, we will try to understand the difference between the object reference and object pointer, and consider how to write secure code, that uses the pointers.

Learn how to design a trading system by ADX

In this article, we will continue our series about designing a trading system using the most popular indicators and we will talk about the average directional index (ADX) indicator. We will learn this indicator in detail to understand it well and we will learn how we to use it through a simple strategy. By learning something deeply we can get more insights and we can use it better.

The price movement model and its main provisions (Part 1): The simplest model version and its applications

The article provides the foundations of a mathematically rigorous price movement and market functioning theory. Up to the present, we have not had any mathematically rigorous price movement theory. Instead, we have had to deal with experience-based assumptions stating that the price moves in a certain way after a certain pattern. Of course, these assumptions have been supported neither by statistics, nor by theory.

WebSockets for MetaTrader 5 — Using the Windows API

In this article, we will use the WinHttp.dll to create a WebSocket client for MetaTrader 5 programs. The client will ultimately be implemented as a class and also tested against the Deriv.com WebSocket API.

Statistical distributions in the form of histograms without indicator buffers and arrays

The article discusses the possibility of plotting statistical distribution histograms of market conditions with the help of the graphical memory meaning no indicator buffers and arrays are applied. Sample histograms are described in details and the "hidden" functionality of MQL5 graphical objects is shown.

Universal Expert Advisor: Trading Modes of Strategies (Part 1)

Any Expert Advisor developer, regardless of programming skills, is daily confronted with the same trading tasks and algorithmic problems, which should be solved to organize a reliable trading process. The article describes the possibilities of the CStrategy trading engine that can undertake the solution of these tasks and provide a user with convenient mechanism for describing a custom trading idea.

Error Handling and Logging in MQL5

This article focuses on general issues linked to handling software errors. Furthermore, the logging term is brought up and the examples of logging implementation with MQL5 tools are shown.

Developing Pivot Mean Oscillator: a novel Indicator for the Cumulative Moving Average

This article presents Pivot Mean Oscillator (PMO), an implementation of the cumulative moving average (CMA) as a trading indicator for the MetaTrader platforms. In particular, we first introduce Pivot Mean (PM) as a normalization index for timeseries that computes the fraction between any data point and the CMA. We then build PMO as the difference between the moving averages applied to two PM signals. Some preliminary experiments carried out on the EURUSD symbol to test the efficacy of the proposed indicator are also reported, leaving ample space for further considerations and improvements.