Connexus Helper (Part 5): HTTP Methods and Status Codes

In this article, we will understand HTTP methods and status codes, two very important pieces of communication between client and server on the web. Understanding what each method does gives you the control to make requests more precisely, informing the server what action you want to perform and making it more efficient.

Trading with the MQL5 Economic Calendar (Part 3): Adding Currency, Importance, and Time Filters

In this article, we implement filters in the MQL5 Economic Calendar dashboard to refine news event displays by currency, importance, and time. We first establish filter criteria for each category and then integrate these into the dashboard to display only relevant events. Finally, we ensure each filter dynamically updates to provide traders with focused, real-time economic insights.

Neural networks made easy (Part 79): Feature Aggregated Queries (FAQ) in the context of state

In the previous article, we got acquainted with one of the methods for detecting objects in an image. However, processing a static image is somewhat different from working with dynamic time series, such as the dynamics of the prices we analyze. In this article, we will consider the method of detecting objects in video, which is somewhat closer to the problem we are solving.

Neural Networks in Trading: Contrastive Pattern Transformer (Final Part)

In the previous last article within this series, we looked at the Atom-Motif Contrastive Transformer (AMCT) framework, which uses contrastive learning to discover key patterns at all levels, from basic elements to complex structures. In this article, we continue implementing AMCT approaches using MQL5.

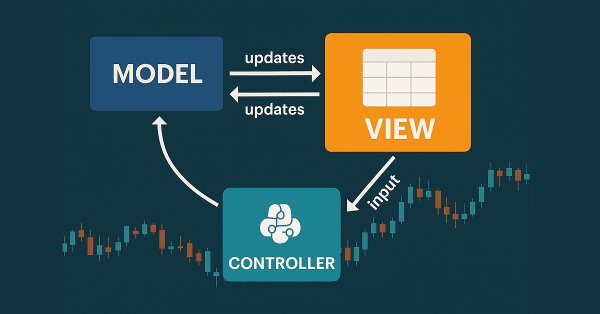

The View and Controller components for tables in the MQL5 MVC paradigm: Resizable elements

In the article, we will add the functionality of resizing controls by dragging edges and corners of the element with the mouse.

Tables in the MVC Paradigm in MQL5: Integrating the Model Component into the View Component

In the article, we will create the first version of the TableControl (TableView) control. This will be a simple static table being created based on the input data defined by two arrays — a data array and an array of column headers.

Developing a Replay System — Market simulation (Part 18): Ticks and more ticks (II)

Obviously the current metrics are very far from the ideal time for creating a 1-minute bar. That's the first thing we are going to fix. Fixing the synchronization problem is not difficult. This may seem hard, but it's actually quite simple. We did not make the required correction in the previous article since its purpose was to explain how to transfer the tick data that was used to create the 1-minute bars on the chart into the Market Watch window.

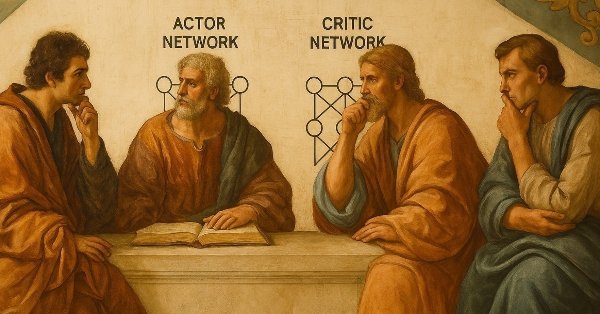

MQL5 Wizard Techniques you should know (Part 58): Reinforcement Learning (DDPG) with Moving Average and Stochastic Oscillator Patterns

Moving Average and Stochastic Oscillator are very common indicators whose collective patterns we explored in the prior article, via a supervised learning network, to see which “patterns-would-stick”. We take our analyses from that article, a step further by considering the effects' reinforcement learning, when used with this trained network, would have on performance. Readers should note our testing is over a very limited time window. Nonetheless, we continue to harness the minimal coding requirements afforded by the MQL5 wizard in showcasing this.

Developing an MQTT client for Metatrader 5: a TDD approach — Part 4

This article is the fourth part of a series describing our development steps of a native MQL5 client for the MQTT protocol. In this part, we describe what MQTT v5.0 Properties are, their semantics, how we are reading some of them, and provide a brief example of how Properties can be used to extend the protocol.

Reimagining Classic Strategies (Part IX): Multiple Time Frame Analysis (II)

In today's discussion, we examine the strategy of multiple time-frame analysis to learn on which time frame our AI model performs best. Our analysis leads us to conclude that the Monthly and Hourly time-frames produce models with relatively low error rates on the EURUSD pair. We used this to our advantage and created a trading algorithm that makes AI predictions on the Monthly time frame, and executes its trades on the Hourly time frame.

The base class of population algorithms as the backbone of efficient optimization

The article represents a unique research attempt to combine a variety of population algorithms into a single class to simplify the application of optimization methods. This approach not only opens up opportunities for the development of new algorithms, including hybrid variants, but also creates a universal basic test stand. This stand becomes a key tool for choosing the optimal algorithm depending on a specific task.

Big Bang - Big Crunch (BBBC) algorithm

The article presents the Big Bang - Big Crunch method, which has two key phases: cyclic generation of random points and their compression to the optimal solution. This approach combines exploration and refinement, allowing us to gradually find better solutions and open up new optimization opportunities.

MQL5 Wizard Techniques you should know (Part 21): Testing with Economic Calendar Data

Economic Calendar Data is not available for testing with Expert Advisors within Strategy Tester, by default. We look at how Databases could help in providing a work around this limitation. So, for this article we explore how SQLite databases can be used to archive Economic Calendar news such that wizard assembled Expert Advisors can use this to generate trade signals.

Gain an Edge Over Any Market (Part III): Visa Spending Index

In the world of big data, there are millions of alternative datasets that hold the potential to enhance our trading strategies. In this series of articles, we will help you identify the most informative public datasets.

Data Science and ML (Part 35): NumPy in MQL5 – The Art of Making Complex Algorithms with Less Code

NumPy library is powering almost all the machine learning algorithms to the core in Python programming language, In this article we are going to implement a similar module which has a collection of all the complex code to aid us in building sophisticated models and algorithms of any kind.

Building a Trading System (Part 5): Managing Gains Through Structured Trade Exits

For many traders, it's a familiar pain point: watching a trade come within a whisker of your profit target, only to reverse and hit your stop-loss. Or worse, seeing a trailing stop close you out at breakeven before the market surges toward your original target. This article focuses on using multiple entries at different Reward-to-Risk Ratios to systematically secure gains and reduce overall risk exposure.

Developing a multi-currency Expert Advisor (Part 9): Collecting optimization results for single trading strategy instances

Let's outline the main stages of the EA development. One of the first things to be done will be to optimize a single instance of the developed trading strategy. Let's try to collect all the necessary information about the tester passes during the optimization in one place.

Price Action Analysis Toolkit Development (Part 18): Introducing Quarters Theory (III) — Quarters Board

In this article, we enhance the original Quarters Script by introducing the Quarters Board, a tool that lets you toggle quarter levels directly on the chart without needing to revisit the code. You can easily activate or deactivate specific levels, and the EA also provides trend direction commentary to help you better understand market movements.

Neural Networks Made Easy (Part 81): Context-Guided Motion Analysis (CCMR)

In previous works, we always assessed the current state of the environment. At the same time, the dynamics of changes in indicators always remained "behind the scenes". In this article I want to introduce you to an algorithm that allows you to evaluate the direct change in data between 2 successive environmental states.

Developing a Replay System (Part 31): Expert Advisor project — C_Mouse class (V)

We need a timer that can show how much time is left till the end of the replay/simulation run. This may seem at first glance to be a simple and quick solution. Many simply try to adapt and use the same system that the trading server uses. But there's one thing that many people don't consider when thinking about this solution: with replay, and even m ore with simulation, the clock works differently. All this complicates the creation of such a system.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (V): AnalyticsPanel Class

In this discussion, we explore how to retrieve real-time market data and trading account information, perform various calculations, and display the results on a custom panel. To achieve this, we will dive deeper into developing an AnalyticsPanel class that encapsulates all these features, including panel creation. This effort is part of our ongoing expansion of the New Admin Panel EA, introducing advanced functionalities using modular design principles and best practices for code organization.

Data Science and ML (Part 39): News + Artificial Intelligence, Would You Bet on it?

News drives the financial markets, especially major releases like Non-Farm Payrolls (NFPs). We've all witnessed how a single headline can trigger sharp price movements. In this article, we dive into the powerful intersection of news data and Artificial Intelligence.

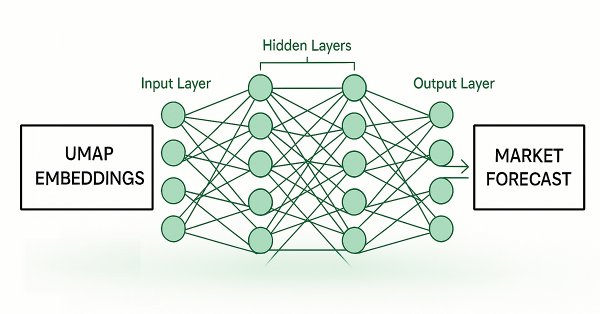

Feature Engineering With Python And MQL5 (Part IV): Candlestick Pattern Recognition With UMAP Regression

Dimension reduction techniques are widely used to improve the performance of machine learning models. Let us discuss a relatively new technique known as Uniform Manifold Approximation and Projection (UMAP). This new technique has been developed to explicitly overcome the limitations of legacy methods that create artifacts and distortions in the data. UMAP is a powerful dimension reduction technique, and it helps us group similar candle sticks in a novel and effective way that reduces our error rates on out of sample data and improves our trading performance.

From Novice to Expert: Animated News Headline Using MQL5 (I)

News accessibility is a critical factor when trading on the MetaTrader 5 terminal. While numerous news APIs are available, many traders face challenges in accessing and integrating them effectively into their trading environment. In this discussion, we aim to develop a streamlined solution that brings news directly onto the chart—where it’s most needed. We'll accomplish this by building a News Headline Expert Advisor that monitors and displays real-time news updates from API sources.

Developing a Replay System (Part 44): Chart Trade Project (III)

In the previous article I explained how you can manipulate template data for use in OBJ_CHART. In that article, I only outlined the topic without going into details, since in that version the work was done in a very simplified way. This was done to make it easier to explain the content, because despite the apparent simplicity of many things, some of them were not so obvious, and without understanding the simplest and most basic part, you would not be able to truly understand the entire picture.

Mastering Log Records (Part 7): How to Show Logs on Chart

Learn how to display logs directly on the MetaTrader chart in an organized way, with frames, titles and automatic scrolling. In this article, we show you how to create a visual log system using MQL5, ideal for monitoring what your robot is doing in real time.

Feature Engineering With Python And MQL5 (Part II): Angle Of Price

There are many posts in the MQL5 Forum asking for help calculating the slope of price changes. This article will demonstrate one possible way of calculating the angle formed by the changes in price in any market you wish to trade. Additionally, we will answer if engineering this new feature is worth the extra effort and time invested. We will explore if the slope of the price can improve any of our AI model's accuracy when forecasting the USDZAR pair on the M1.

Chemical reaction optimization (CRO) algorithm (Part II): Assembling and results

In the second part, we will collect chemical operators into a single algorithm and present a detailed analysis of its results. Let's find out how the Chemical reaction optimization (CRO) method copes with solving complex problems on test functions.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (I)

This discussion delves into the challenges encountered when working with large codebases. We will explore the best practices for code organization in MQL5 and implement a practical approach to enhance the readability and scalability of our Trading Administrator Panel source code. Additionally, we aim to develop reusable code components that can potentially benefit other developers in their algorithm development. Read on and join the conversation.

MQL5 Wizard Techniques you should know (Part 79): Using Gator Oscillator and Accumulation/Distribution Oscillator with Supervised Learning

In the last piece, we concluded our look at the pairing of the gator oscillator and the accumulation/distribution oscillator when used in their typical setting of the raw signals they generate. These two indicators are complimentary as trend and volume indicators, respectively. We now follow up that piece, by examining the effect that supervised learning can have on enhancing some of the feature patterns we had reviewed. Our supervised learning approach is a CNN that engages with kernel regression and dot product similarity to size its kernels and channels. As always, we do this in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

Price Action Analysis Toolkit Development (Part 9): External Flow

This article explores a new dimension of analysis using external libraries specifically designed for advanced analytics. These libraries, like pandas, provide powerful tools for processing and interpreting complex data, enabling traders to gain more profound insights into market dynamics. By integrating such technologies, we can bridge the gap between raw data and actionable strategies. Join us as we lay the foundation for this innovative approach and unlock the potential of combining technology with trading expertise.

Category Theory in MQL5 (Part 6): Monomorphic Pull-Backs and Epimorphic Push-Outs

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

Developing a Replay System (Part 66): Playing the service (VII)

In this article, we will implement the first solution that will allow us to determine when a new bar may appear on the chart. This solution is applicable in a wide variety of situations. Understanding its development will help you grasp several important aspects. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Developing a multi-currency Expert Advisor (Part 24): Adding a new strategy (I)

In this article, we will look at how to connect a new strategy to the auto optimization system we have created. Let's see what kind of EAs we need to create and whether it will be possible to do without changing the EA library files or minimize the necessary changes.

Balancing risk when trading multiple instruments simultaneously

This article will allow a beginner to write an implementation of a script from scratch for balancing risks when trading multiple instruments simultaneously. Besides, it may give experienced users new ideas for implementing their solutions in relation to the options proposed in this article.

Combinatorially Symmetric Cross Validation In MQL5

In this article we present the implementation of Combinatorially Symmetric Cross Validation in pure MQL5, to measure the degree to which a overfitting may occure after optimizing a strategy using the slow complete algorithm of the Strategy Tester.

Risk-Based Trade Placement EA with On-Chart UI (Part 1): Designing the User Interface

Learn how to build a clean and professional on-chart control panel in MQL5 for a Risk-Based Trade Placement Expert Advisor. This step-by-step guide explains how to design a functional GUI that allows traders to input trade parameters, calculate lot size, and prepare for automated order placement.

Reimagining Classic Strategies (Part 17): Modelling Technical Indicators

In this discussion, we focus on how we can break the glass ceiling imposed by classical machine learning techniques in finance. It appears that the greatest limitation to the value we can extract from statistical models does not lie in the models themselves — neither in the data nor in the complexity of the algorithms — but rather in the methodology we use to apply them. In other words, the true bottleneck may be how we employ the model, not the model’s intrinsic capability.

Developing a Replay System (Part 49): Things Get Complicated (I)

In this article, we'll complicate things a little. Using what was shown in the previous articles, we will start to open up the template file so that the user can use their own template. However, I will be making changes gradually, as I will also be refining the indicator to reduce the load on MetaTrader 5.

Artificial Cooperative Search (ACS) algorithm

Artificial Cooperative Search (ACS) is an innovative method using a binary matrix and multiple dynamic populations based on mutualistic relationships and cooperation to find optimal solutions quickly and accurately. ACS unique approach to predators and prey enables it to achieve excellent results in numerical optimization problems.