Making charts more interesting: Adding a background

Many workstations contain some representative image which shows something about the user. These images make the working environment more beautiful and exciting. Let's see how to make the charts more interesting by adding a background.

Graphical Interfaces X: Text selection in the Multiline Text box (build 13)

This article will implement the ability to select text using various key combinations and deletion of the selected text, similar to the way it is done in any other text editor. In addition, we will continue to optimize the code and prepare the classes to move on to the final process of the second stage of the library's evolution, where all controls will be rendered as separate images (canvases).

Using MetaTrader 5 as a Signal Provider for MetaTrader 4

Analyse and examples of techniques how trading analysis can be performed on MetaTrader 5 platform, but executed by MetaTrader 4. Article will show you how to create simple signal provider in your MetaTrader 5, and connect to it with multiple clients, even running MetaTrader 4. Also you will find out how you can follow participants of Automated Trading Championship in your real MetaTrader 4 account.

Analyzing charts using DeMark Sequential and Murray-Gann levels

Thomas DeMark Sequential is good at showing balance changes in the price movement. This is especially evident if we combine its signals with a level indicator, for example, Murray levels. The article is intended mostly for beginners and those who still cannot find their "Grail". I will also display some features of building levels that I have not seen on other forums. So, the article will probably be useful for advanced traders as well... Suggestions and reasonable criticism are welcome...

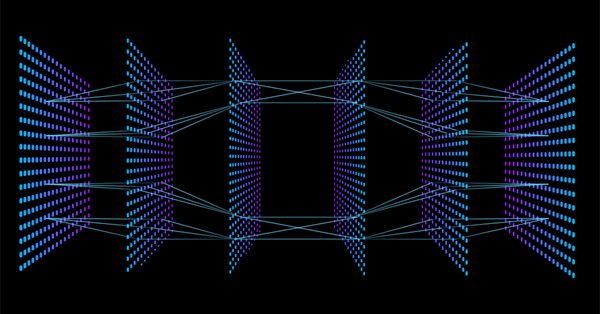

Neural networks made easy (Part 10): Multi-Head Attention

We have previously considered the mechanism of self-attention in neural networks. In practice, modern neural network architectures use several parallel self-attention threads to find various dependencies between the elements of a sequence. Let us consider the implementation of such an approach and evaluate its impact on the overall network performance.

Developing the symbol selection and navigation utility in MQL5 and MQL4

Experienced traders are well aware of the fact that most time-consuming things in trading are not opening and tracking positions but selecting symbols and looking for entry points. In this article, we will develop an EA simplifying the search for entry points on trading instruments provided by your broker.

MQL5 Cookbook: Developing a Framework for a Trading System Based on the Triple Screen Strategy

In this article, we will develop a framework for a trading system based on the Triple Screen strategy in MQL5. The Expert Advisor will not be developed from scratch. Instead, we will simply modify the program from the previous article "MQL5 Cookbook: Using Indicators to Set Trading Conditions in Expert Advisors" which already substantially serves our purpose. So the article will also demonstrate how you can easily modify patterns of ready-made programs.

Graphical Interfaces II: the Menu Item Element (Chapter 1)

In the second part of the series, we will show in detail the development of such interface elements as main menu and context menu. We will also mention drawing elements and create a special class for it. We will discuss in depth such question as managing program events including custom ones.

Learn how to design a trading system by MFI

The new article from our series about designing a trading system based on the most popular technical indicators considers a new technical indicator - the Money Flow Index (MFI). We will learn it in detail and develop a simple trading system by means of MQL5 to execute it in MetaTrader 5.

Graphical Interfaces VI: the Slider and the Dual Slider Controls (Chapter 2)

In the previous article, we have enriched our library with four controls frequently used in graphical interfaces: checkbox, edit, edit with checkbox and check combobox. The second chapter of the sixth part will be dedicated to the slider and the dual slider controls.

Risk and capital management using Expert Advisors

This article is about what you can not see in a backtest report, what you should expect using automated trading software, how to manage your money if you are using expert advisors, and how to cover a significant loss to remain in the trading activity when you are using automated procedures.

Using the CCanvas class in MQL applications

The article considers the use of the CCanvas class in MQL applications. The theory is accompanied by detailed explanations and examples for thorough understanding of CCanvas basics.

Using Layouts and Containers for GUI Controls: The CBox Class

This article presents an alternative method of GUI creation based on layouts and containers, using one layout manager — the CBox class. The CBox class is an auxiliary control that acts as a container for essential controls in a GUI panel. It can make designing graphical panels easier, and in some cases, reduce coding time.

Object-Oriented Approach to Building Multi-Timeframe and Multi-Currency Panels

This article describes how object-oriented programming can be used for creating multi-timeframe and multi-currency panels for MetaTrader 5. The main goal is to build a universal panel, which can be used for displaying many different kinds of data, such as prices, price changes, indicator values or custom buy/sell conditions without the need to modify the code of the panel itself.

Graphical Interfaces VI: the Checkbox Control, the Edit Control and their Mixed Types (Chapter 1)

This article is the beginning of the sixth part of the series dedicated to the development of the library for creating graphical interfaces in the MetaTrader terminals. In the first chapter, we are going to discuss the checkbox control, the edit control and their mixed types.

Trade Events in MetaTrader 5

A monitoring of the current state of a trade account implies controlling open positions and orders. Before a trade signal becomes a deal, it should be sent from the client terminal as a request to the trade server, where it will be placed in the order queue awaiting to be processed. Accepting of a request by the trade server, deleting it as it expires or conducting a deal on its basis - all those actions are followed by trade events; and the trade server informs the terminal about them.

Price Action Analysis Toolkit Development (Part 28): Opening Range Breakout Tool

At the start of each trading session, the market’s directional bias often becomes clear only after price moves beyond the opening range. In this article, we explore how to build an MQL5 Expert Advisor that automatically detects and analyzes Opening Range Breakouts, providing you with timely, data‑driven signals for confident intraday entries.

Deep Neural Networks (Part II). Working out and selecting predictors

The second article of the series about deep neural networks will consider the transformation and choice of predictors during the process of preparing data for training a model.

Universal Expert Advisor: CUnIndicator and Use of Pending Orders (Part 9)

The article describes the work with indicators through the universal CUnIndicator class. In addition, new methods of working with pending orders are considered. Please note: from this point on, the structure of the CStrategy project has undergone substantial changes. Now all its files are located in a single directory for the convenience of users.

Creating an EA that works automatically (Part 02): Getting started with the code

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. In the previous article, we discussed the first steps that anyone needs to understand before proceeding to creating an Expert Advisor that trades automatically. We considered the concepts and the structure.

Testing patterns that arise when trading currency pair baskets. Part I

We begin testing the patterns and trying the methods described in the articles about trading currency pair baskets. Let's see how oversold/overbought level breakthrough patterns are applied in practice.

Data Science and Machine Learning — Neural Network (Part 01): Feed Forward Neural Network demystified

Many people love them but a few understand the whole operations behind Neural Networks. In this article I will try to explain everything that goes behind closed doors of a feed-forward multi-layer perception in plain English.

Analysis of the Main Characteristics of Time Series

This article introduces a class designed to give a quick preliminary estimate of characteristics of various time series. As this takes place, statistical parameters and autocorrelation function are estimated, a spectral estimation of time series is carried out and a histogram is built.

MQL as a Markup Tool for the Graphical Interface of MQL Programs. Part 2

This paper continues checking the new conception to describe the window interface of MQL programs, using the structures of MQL. Automatically creating GUI based on the MQL markup provides additional functionality for caching and dynamically generating the elements and controlling the styles and new schemes for processing the events. Attached is an enhanced version of the standard library of controls.

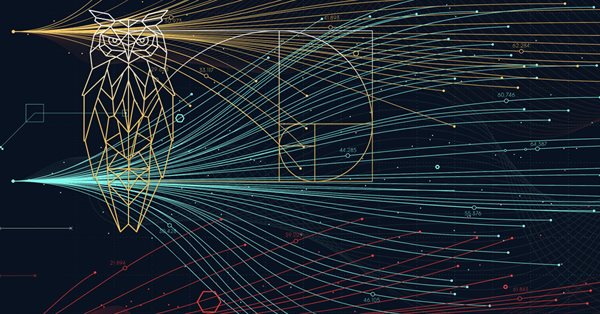

Creating a comprehensive Owl trading strategy

My strategy is based on the classic trading fundamentals and the refinement of indicators that are widely used in all types of markets. This is a ready-made tool allowing you to follow the proposed new profitable trading strategy.

MQL5 Cookbook: Writing the History of Deals to a File and Creating Balance Charts for Each Symbol in Excel

When communicating in various forums, I often used examples of my test results displayed as screenshots of Microsoft Excel charts. I have many times been asked to explain how such charts can be created. Finally, I now have some time to explain it all in this article.

Universal Expert Advisor: Trading in a Group and Managing a Portfolio of Strategies (Part 4)

In the last part of the series of articles about the CStrategy trading engine, we will consider simultaneous operation of multiple trading algorithms, will learn to load strategies from XML files, and will present a simple panel for selecting Expert Advisors from a single executable module, and managing their trading modes.

Selection and navigation utility in MQL5 and MQL4: Adding auto search for patterns and displaying detected symbols

In this article, we continue expanding the features of the utility for collecting and navigating through symbols. This time, we will create new tabs displaying only the symbols that satisfy some of the necessary parameters and find out how to easily add custom tabs with the necessary sorting rules.

MQL5 Cookbook: Processing of the TradeTransaction Event

This article considers capabilities of the MQL5 language from the point of view of the event-driven programming. The greatest advantage of this approach is that the program can receive information about phased implementation of a trade operation. The article also contains an example of receiving and processing information about ongoing trade operation using the TradeTransaction event handler. In my opinion, such an approach can be used for copying deals from one terminal to another.

Cross-Platform Expert Advisor: Reuse of Components from the MQL5 Standard Library

There exists some components in the MQL5 Standard Library that may prove to be useful in the MQL4 version of cross-platform expert advisors. This article deals with a method of making certain components of the MQL5 Standard Library compatible with the MQL4 compiler.

Build Self Optmising Expert Advisors in MQL5

Build expert advisors that look forward and adjust themselves to any market.

CatBoost machine learning algorithm from Yandex with no Python or R knowledge required

The article provides the code and the description of the main stages of the machine learning process using a specific example. To obtain the model, you do not need Python or R knowledge. Furthermore, basic MQL5 knowledge is enough — this is exactly my level. Therefore, I hope that the article will serve as a good tutorial for a broad audience, assisting those interested in evaluating machine learning capabilities and in implementing them in their programs.

Principles of Exchange Pricing through the Example of Moscow Exchange's Derivatives Market

This article describes the theory of exchange pricing and clearing specifics of Moscow Exchange's Derivatives Market. This is a comprehensive article for beginners who want to get their first exchange experience on derivatives trading, as well as for experienced forex traders who are considering trading on a centralized exchange platform.

Implementation of Indicators as Classes by Examples of Zigzag and ATR

Debate about an optimal way of calculating indicators is endless. Where should we calculate the indicator values - in the indicator itself or embed the entire logic in a Expert Advisor that uses it? The article describes one of the variants of moving the source code of a custom indicator iCustom right in the code of an Expert Advisor or script with optimization of calculations and modeling the prev_calculated value.

An Analysis of Why Expert Advisors Fail

This article presents an analysis of currency data to better understand why expert advisors can have good performance in some regions of time and poor performance in other regions of time.

Graphical interfaces X: Advanced management of lists and tables. Code optimization (build 7)

The library code needs to be optimized: it should be more regularized, which is — more readable and comprehensible for studying. In addition, we will continue to develop the controls created previously: lists, tables and scrollbars.

Scalping Orderflow for MQL5

This MetaTrader 5 Expert Advisor implements a Scalping OrderFlow strategy with advanced risk management. It uses multiple technical indicators to identify trading opportunities based on order flow imbalances. Backtesting shows potential profitability but highlights the need for further optimization, especially in risk management and trade outcome ratios. Suitable for experienced traders, it requires thorough testing and understanding before live deployment.

Naive Bayes classifier for signals of a set of indicators

The article analyzes the application of the Bayes' formula for increasing the reliability of trading systems by means of using signals from multiple independent indicators. Theoretical calculations are verified with a simple universal EA, configured to work with arbitrary indicators.

Social Trading. Can a profitable signal be made even better?

Most subscribers choose a trade signal by the beauty of the balance curve and by the number of subscribers. This is why many today's providers care of beautiful statistics rather than of real signal quality, often playing with lot sizes and artificially reducing the balance curve to an ideal appearance. This paper deals with the reliability criteria and the methods a provider may use to enhance its signal quality. An exemplary analysis of a specific signal history is presented, as well as methods that would help a provider to make it more profitable and less risky.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 1): Sending Messages from MQL5 to Telegram

In this article, we create an Expert Advisor (EA) in MQL5 to send messages to Telegram using a bot. We set up the necessary parameters, including the bot's API token and chat ID, and then perform an HTTP POST request to deliver the messages. Later, we handle the response to ensure successful delivery and troubleshoot any issues that arise in case of failure. This ensures we send messages from MQL5 to Telegram via the created bot.