MQL5 Trading Tools (Part 6): Dynamic Holographic Dashboard with Pulse Animations and Controls

In this article, we create a dynamic holographic dashboard in MQL5 for monitoring symbols and timeframes with RSI, volatility alerts, and sorting options. We add pulse animations, interactive buttons, and holographic effects to make the tool visually engaging and responsive.

Non-linear regression models on the stock exchange

Non-linear regression models on the stock exchange: Is it possible to predict financial markets? Let's consider creating a model for forecasting prices for EURUSD, and make two robots based on it - in Python and MQL5.

DoEasy. Controls (Part 29): ScrollBar auxiliary control

In this article, I will start developing the ScrollBar auxiliary control element and its derivative objects — vertical and horizontal scrollbars. A scrollbar is used to scroll the content of the form if it goes beyond the container. Scrollbars are usually located at the bottom and to the right of the form. The horizontal one at the bottom scrolls content left and right, while the vertical one scrolls up and down.

Experiments with neural networks (Part 4): Templates

In this article, I will use experimentation and non-standard approaches to develop a profitable trading system and check whether neural networks can be of any help for traders. MetaTrader 5 as a self-sufficient tool for using neural networks in trading. Simple explanation.

Population optimization algorithms: Artificial Bee Colony (ABC)

In this article, we will study the algorithm of an artificial bee colony and supplement our knowledge with new principles of studying functional spaces. In this article, I will showcase my interpretation of the classic version of the algorithm.

Developing a multi-currency Expert Advisor (Part 19): Creating stages implemented in Python

So far we have considered the automation of launching sequential procedures for optimizing EAs exclusively in the standard strategy tester. But what if we would like to perform some handling of the obtained data using other means between such launches? We will attempt to add the ability to create new optimization stages performed by programs written in Python.

Mastering JSON: Create Your Own JSON Reader from Scratch in MQL5

Experience a step-by-step guide on creating a custom JSON parser in MQL5, complete with object and array handling, error checking, and serialization. Gain practical insights into bridging your trading logic and structured data with this flexible solution for handling JSON in MetaTrader 5.

Benefiting from Forex market seasonality

We are all familiar with the concept of seasonality, for example, we are all accustomed to rising prices for fresh vegetables in winter or rising fuel prices during severe frosts, but few people know that similar patterns exist in the Forex market.

Neural Networks in Trading: Scene-Aware Object Detection (HyperDet3D)

We invite you to get acquainted with a new approach to detecting objects using hypernetworks. A hypernetwork generates weights for the main model, which allows taking into account the specifics of the current market situation. This approach allows us to improve forecasting accuracy by adapting the model to different trading conditions.

Introduction to MQL5 (Part 20): Introduction to Harmonic Patterns

In this article, we explore the fundamentals of harmonic patterns, their structures, and how they are applied in trading. You’ll learn about Fibonacci retracements, extensions, and how to implement harmonic pattern detection in MQL5, setting the foundation for building advanced trading tools and Expert Advisors.

DRAW_ARROW drawing type in multi-symbol multi-period indicators

In this article, we will look at drawing arrow multi-symbol multi-period indicators. We will also improve the class methods for correct display of arrows showing data from arrow indicators calculated on a symbol/period that does not correspond to the symbol/period of the current chart.

MQL5 Wizard Techniques you should know (Part 25): Multi-Timeframe Testing and Trading

Strategies that are based on multiple time frames cannot be tested in wizard assembled Expert Advisors by default because of the MQL5 code architecture used in the assembly classes. We explore a possible work around this limitation for strategies that look to use multiple time frames in a case study with the quadratic moving average.

Neural Networks in Trading: A Multimodal, Tool-Augmented Agent for Financial Markets (Final Part)

We continue to develop the algorithms for FinAgent, a multimodal financial trading agent designed to analyze multimodal market dynamics data and historical trading patterns.

Population optimization algorithms: Stochastic Diffusion Search (SDS)

The article discusses Stochastic Diffusion Search (SDS), which is a very powerful and efficient optimization algorithm based on the principles of random walk. The algorithm allows finding optimal solutions in complex multidimensional spaces, while featuring a high speed of convergence and the ability to avoid local extrema.

Monitoring trading with push notifications — example of a MetaTrader 5 service

In this article, we will look at creating a service app for sending notifications to a smartphone about trading results. We will learn how to handle lists of Standard Library objects to organize a selection of objects by required properties.

Moving to MQL5 Algo Forge (Part 4): Working with Versions and Releases

We'll continue developing the Simple Candles and Adwizard projects, while also describing the finer aspects of using the MQL5 Algo Forge version control system and repository.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs(IV) — Test Trading Strategy

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

MQL5 Trading Tools (Part 2): Enhancing the Interactive Trade Assistant with Dynamic Visual Feedback

In this article, we upgrade our Trade Assistant Tool by adding drag-and-drop panel functionality and hover effects to make the interface more intuitive and responsive. We refine the tool to validate real-time order setups, ensuring accurate trade configurations relative to market prices. We also backtest these enhancements to confirm their reliability.

Developing a multi-currency Expert Advisor (Part 2): Transition to virtual positions of trading strategies

Let's continue developing a multi-currency EA with several strategies working in parallel. Let's try to move all the work associated with opening market positions from the strategy level to the level of the EA managing the strategies. The strategies themselves will trade only virtually, without opening market positions.

Interview with Egidijus Bockus (ATC 2012)

"I examined many indicators before realizing that they are not necessary for making money on Forex" - our present interviewee Egidijus Bockus (Egidijus) told us boldly. We have all reasons to take his words seriously, as his Expert Advisor occupies the third place with more than $32 000 beginning from the third week of the Automated Trading Championship 2012.

Interview with Alexander Prishchenko (ATC 2012)

What can be more complicated than a multicurrency trading robot? Surely, it is an automated strategy based on Elliott Wave Principle. Can we imagine something more complicated than that? Yes, we can. It is a multicurrency Expert Advisor using Elliott Waves on each currency pair! Alexander Prishchenko (Crucian) believes that even a newcomer can learn the rules.

Neuro-symbolic systems in algorithmic trading: Combining symbolic rules and neural networks

The article describes the experience of developing a hybrid trading system that combines classical technical analysis with neural networks. The author provides a detailed analysis of the system architecture from basic pattern analysis and neural network structure to the mechanisms behind trading decisions, and shares real code and practical observations.

Understand and efficiently use OpenCL API by recreating built-in support as DLL on Linux (Part 1): Motivation and validation

Bulit-in OpenCL support in MetaTrader 5 still has a major problem especially the one about device selection error 5114 resulting from unable to create an OpenCL context using CL_USE_GPU_ONLY, or CL_USE_GPU_DOUBLE_ONLY although it properly detects GPU. It works fine with directly using of ordinal number of GPU device we found in Journal tab, but that's still considered a bug, and users should not hard-code a device. We will solve it by recreating an OpenCL support as DLL with C++ on Linux. Along the journey, we will get to know OpenCL from concept to best practices in its API usage just enough for us to put into great use later when we deal with DLL implementation in C++ and consume it with MQL5.

Deconstructing examples of trading strategies in the client terminal

The article uses block diagrams to examine the logic of the candlestick-based training EAs located in the Experts\Free Robots folder of the terminal.

Category Theory in MQL5 (Part 3)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL5 community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that provides insight while hopefully furthering the use of this remarkable field in Traders' strategy development.

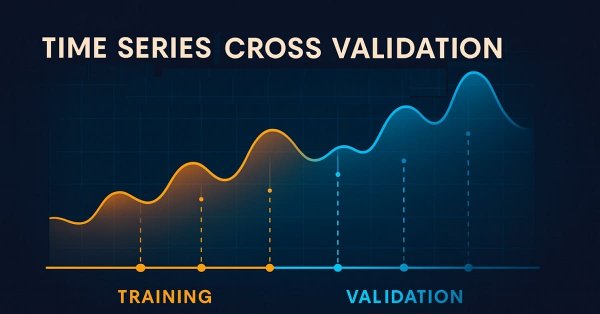

Overcoming The Limitation of Machine Learning (Part 5): A Quick Recap of Time Series Cross Validation

In this series of articles, we look at the challenges faced by algorithmic traders when deploying machine-learning-powered trading strategies. Some challenges within our community remain unseen because they demand deeper technical understanding. Today’s discussion acts as a springboard toward examining the blind spots of cross-validation in machine learning. Although often treated as routine, this step can easily produce misleading or suboptimal results if handled carelessly. This article briefly revisits the essentials of time series cross-validation to prepare us for more in-depth insight into its hidden blind spots.

Implementing the SHA-256 Cryptographic Algorithm from Scratch in MQL5

Building DLL-free cryptocurrency exchange integrations has long been a challenge, but this solution provides a complete framework for direct market connectivity.

MetaTrader Meets Google Sheets with Pythonanywhere: A Guide to Secure Data Flow

This article demonstrates a secure way to export MetaTrader data to Google Sheets. Google Sheet is the most valuable solution as it is cloud based and the data saved in there can be accessed anytime and from anywhere. So traders can access trading and related data exported to google sheet and do further analysis for future trading anytime and wherever they are at the moment.

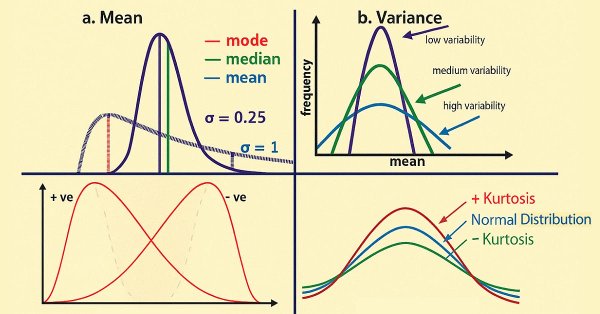

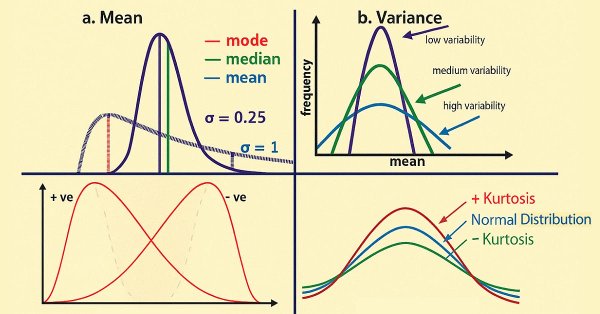

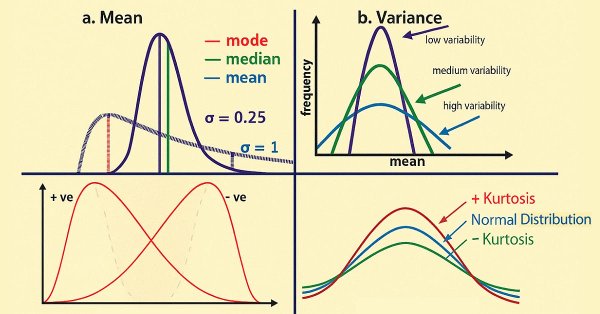

Automating Trading Strategies in MQL5 (Part 39): Statistical Mean Reversion with Confidence Intervals and Dashboard

In this article, we develop an MQL5 Expert Advisor for statistical mean reversion trading, calculating moments like mean, variance, skewness, kurtosis, and Jarque-Bera statistics over a specified period to identify non-normal distributions and generate buy/sell signals based on confidence intervals with adaptive thresholds

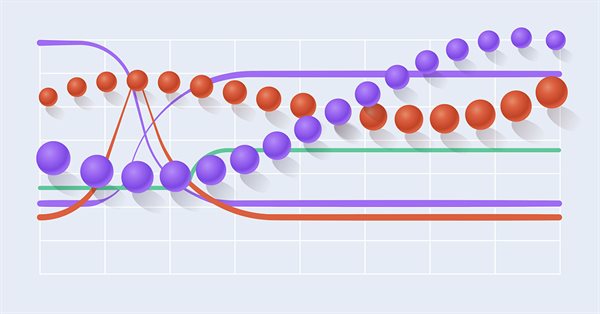

Neural Networks Made Easy (Part 94): Optimizing the Input Sequence

When working with time series, we always use the source data in their historical sequence. But is this the best option? There is an opinion that changing the sequence of the input data will improve the efficiency of the trained models. In this article I invite you to get acquainted with one of the methods for optimizing the input sequence.

Population optimization algorithms: Firefly Algorithm (FA)

In this article, I will consider the Firefly Algorithm (FA) optimization method. Thanks to the modification, the algorithm has turned from an outsider into a real rating table leader.

How to view deals directly on the chart without weltering in trading history

In this article, we will create a simple tool for convenient viewing of positions and deals directly on the chart with key navigation. This will allow traders to visually examine individual deals and receive all the information about trading results right on the spot.

News Trading Made Easy (Part 3): Performing Trades

In this article, our news trading expert will begin opening trades based on the economic calendar stored in our database. In addition, we will improve the expert's graphics to display more relevant information about upcoming economic calendar events.

Automating Trading Strategies in MQL5 (Part 39): Statistical Mean Reversion with Confidence Intervals and Dashboard

In this article, we develop an MQL5 Expert Advisor for statistical mean reversion trading, calculating moments like mean, variance, skewness, kurtosis, and Jarque-Bera statistics over a specified period to identify non-normal distributions and generate buy/sell signals based on confidence intervals with adaptive thresholds

Timeseries in DoEasy library (part 50): Multi-period multi-symbol standard indicators with a shift

In the article, let’s improve library methods for correct display of multi-symbol multi-period standard indicators, which lines are displayed on the current symbol chart with a shift set in the settings. As well, let’s put things in order in methods of work with standard indicators and remove the redundant code to the library area in the final indicator program.

Finding custom currency pair patterns in Python using MetaTrader 5

Are there any repeating patterns and regularities in the Forex market? I decided to create my own pattern analysis system using Python and MetaTrader 5. A kind of symbiosis of math and programming for conquering Forex.

Automating Trading Strategies in MQL5 (Part 39): Statistical Mean Reversion with Confidence Intervals and Dashboard

In this article, we develop an MQL5 Expert Advisor for statistical mean reversion trading, calculating moments like mean, variance, skewness, kurtosis, and Jarque-Bera statistics over a specified period to identify non-normal distributions and generate buy/sell signals based on confidence intervals with adaptive thresholds

Matrix Utils, Extending the Matrices and Vector Standard Library Functionality

Matrix serves as the foundation of machine learning algorithms and computers in general because of their ability to effectively handle large mathematical operations, The Standard library has everything one needs but let's see how we can extend it by introducing several functions in the utils file, that are not yet available in the library

Integrating ML models with the Strategy Tester (Part 3): Managing CSV files (II)

This material provides a complete guide to creating a class in MQL5 for efficient management of CSV files. We will see the implementation of methods for opening, writing, reading, and transforming data. We will also consider how to use them to store and access information. In addition, we will discuss the limitations and the most important aspects of using such a class. This article ca be a valuable resource for those who want to learn how to process CSV files in MQL5.

Creating a market making algorithm in MQL5

How do market makers work? Let's consider this issue and create a primitive market-making algorithm.