LCF Theta Vector

- Experts

- Artur Brud

- Version: 10.1

- Updated: 7 August 2019

- Activations: 7

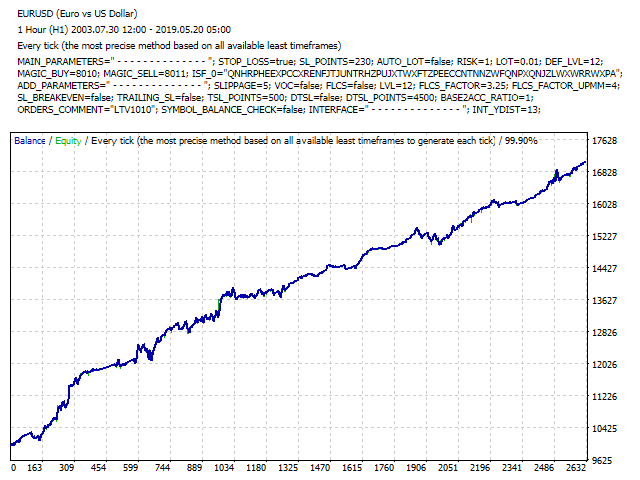

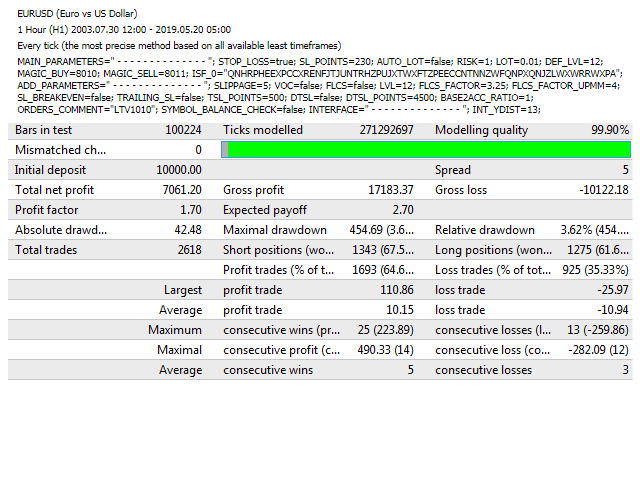

LCF Theta Vector is mid/long term return EA based on custom variation of RSI indicator in assistance of vector algorithm and built-in AUTO_OPTIMIZER module that allows for dynamic adaptation to current market conditions (no user calibration needed) - the specific result is chosen on the basis of several different coefficients. EA can be run on different symbols and timeframes but for reducing demand on computing power, internal parameters are narrowed and it is highly recommended to run it on this pairs and time frames with recommended settings:

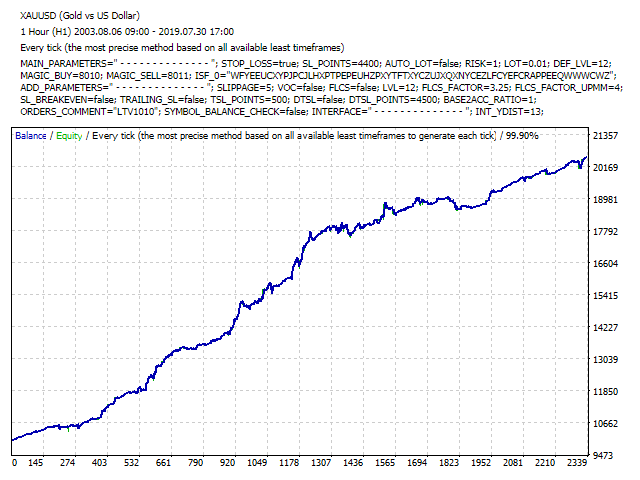

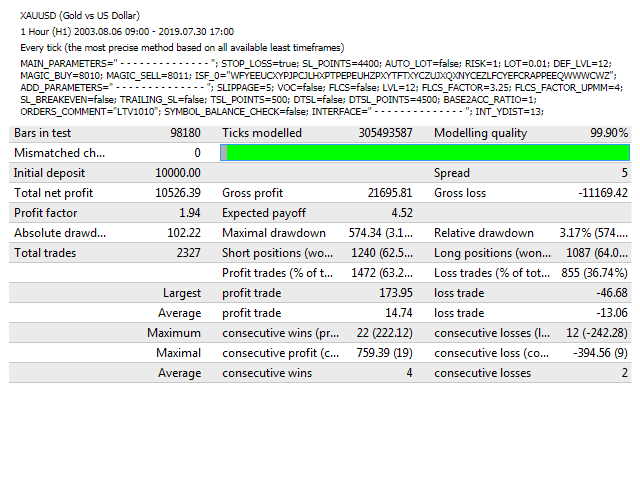

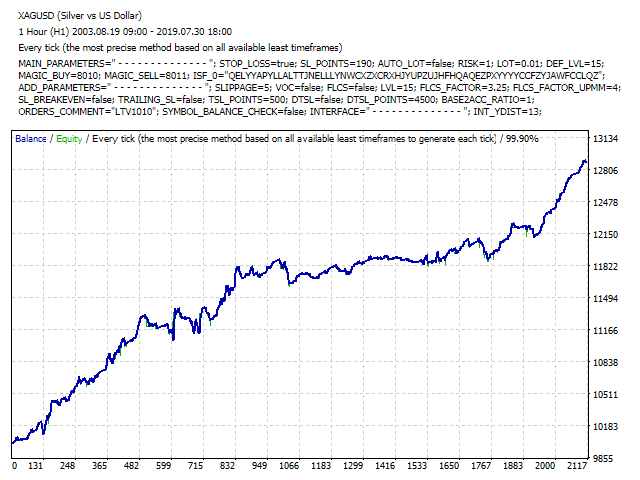

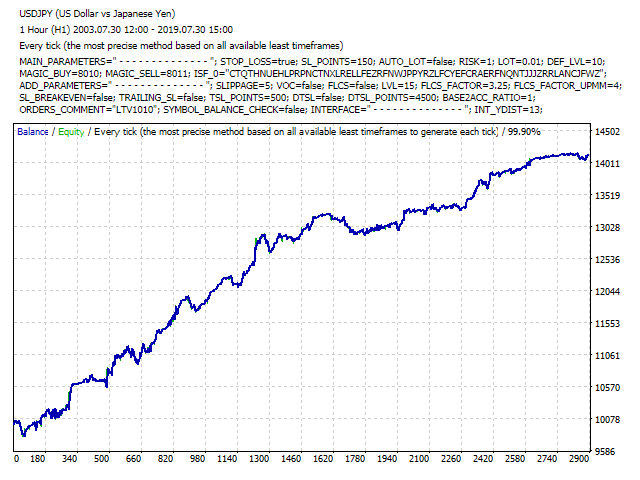

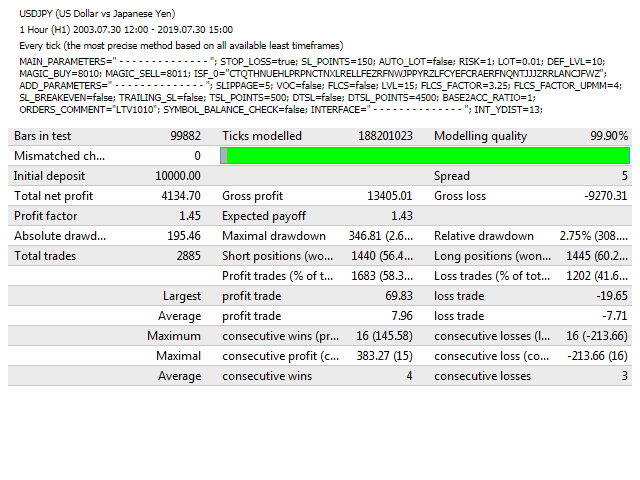

| Symbol | TF | SL | LVL |

|---|---|---|---|

| XAUUSD | H1 | 4400 | 12 |

| EURUSD | H1 | 230 | 12 |

| USDJPY | H1 | 150 | 10 |

| XAGUSD | H1 | 190 | 15 |

Default parameters are dedicated for EURUSD symbol at H1 time frame.

Implemented Modules:

- AUTO_OPTIMIZER - takes a piece of the market, then it makes from hundreds to even thousands of simulations with various parameters combinations, results are being further calculated and best result is applied for next period. For each symbol which is susceptible to used method, usable variants are narrowed to increase work speed and prevent from price anomalies. Some variants must be excluded for some symbols, becouse even if they have good results in simulation they don't have good performance in next period of time.

- AUTO_LOT - auto-calculation of LOT value based on Stop Loss points (even if Stop Loss=false), Base/Account currency ratio and Auto LOT risk % values according to actual account balance. In most cases EA automatically obtain or calculate Base/Account currency ratio value. Otherwise it returns alert and value should be inserted manually (exchange ratio between margin and account currencies).

- FLC

- DTSL

Requirements:

- Hedging account;

- Recommended initial capital 1000+ USD (if minimum LOT=0.01) and 10000+ USD (if minimum LOT= 0.1) for each pair;

- About 2000 bars of history on chart;

- In some cases patience of the user (on XAGUSD there is average 8 trades per month).

Inputs:

- Stop Loss - if true, use classic stop loss (required to enable additional stoploss mechanics).

- Stop Loss points - initial stop loss value in points* (Stop Loss Dependencies).

- Auto LOT calculation - if true, use AUTO_LOT module.

- Auto LOT risk % - maximum risk per trade in percentage of current account balance (recommended range: 1-3).

- Fixed LOT - fixed LOT value (if AUTO_LOT=false).

- Max LVL - max number of subsequent orders (separately for buy and sell, recommended range: 5-15).

- Buy order MAGIC - unique number for buy orders.

- Sell order MAGIC - unique number for sell orders.

- Symbol (pair) category - set "Supported" if it will be used on supported pairs, otherwise set "Unsupported".

- ISF key - key for IS filter used in optimization process (necessary for supported pairs).

Additional parameters:

- Order Slippage - standard slippage value for order requests in points*.

- VOC system:

- if true, in state (R/0) EA will not open additional orders.

- if false, in state (R/0) EA will use last known good result to open next orders.

- FLC system - floating level control (requiers Stop Loss=true)

- FLC.LVL - last known LVL value (returned be EA in deinitialization process, otherwise same as Max LVL value)

- FLC.F1 - FLC factor 1 value (double above 1)

- FLC.F2 - FLC factor 2 value (double above 2)

- Stop Loss Breakeven - if true, use standard break-even mechanic (according to SL_POINTS value).

- Trailing Stop Loss - if true, use standard trailing stop loss mechanic (accoirding to TSL_POINTS value).

- Trailing Stop Loss points - trailing stop loss value in points*.

- DTSL module - if true, use DTSL mechanics (according to DTSL_POINTS value).

- DTSL points - DTSL take profit value in points*.

- Margin / Account currency ratio - exchange rate between "margin_currency" from symbol specification and account currency (should be obtained automatically).

- Order comment - comment for orders.

- Check Symbol Balance - if true, enables summary profit or loss on this symbol in information panel (default false)

Interface parameters:

- Interface Y-axis shift - shift of interface on Y axis

* points means smallest possible value change (see MQL4 language specification)

请问是否有最新的参数设置 我用的是9.7 版本设置用的是最早的905的效果很好 但是还是想问问有没有9.7版本的设置