Lot Size Risk Manager

- Utilities

- Volkan Yurci

- Version: 1.6

- Updated: 13 August 2019

Why do you need this script?

If you place lots of orders and re-calculate your risk for every order you placed, you definitely need such a script.

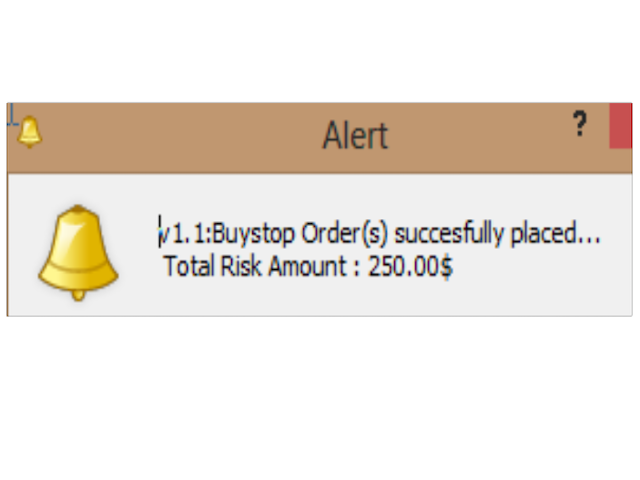

This script places one or (optional) two different orders with the following script inputs.

Utility parameters

- Operation Type - "Buy","Sell","Buylimit","Selllimit","Buystop","Sellstop"

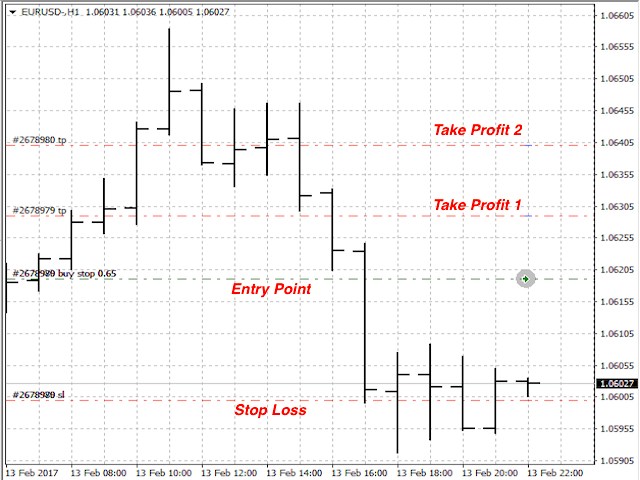

- Price - Entry price of the order(s).

- Stop Loss - Stop Loss of the order(s).

- Take Profit 1 - Take Profit of the first order.

- Take Profit 2 - Take Profit of the second order. (optional)

- Risk Ratio % - Places new order(s) according to this Risk Ratio (%) of Free Margin

- Comment - this comment will be displayed on the orders of the Trade window.

Calculation Example

Assume we need to open an order NZDJPY

- Price: 81.720

- Stop Loss: 80.900

- Risk pips: 81.720 - 80.900 = 820 pips. (x)

- Free Margin: 1280 $

- Risk Ratio %: %2

- Risk Amount: 1280 $ * %2 = 25.6 $ (y)

- Ask (USDJPY): 113.672 (z)

Lot = (y * z) / ( x * contract size(NZDJPY) )

If Only Take Profit 1 is determined lot value is equal to above calculated Lot.

If Take Profit 1 & Take Profit 2 are determined 2 positions are placed with Lot / 2 and have the same Stop Loss values.

It is totally free, no time, no lot, no parity etc. limitations.

Please report any bug issue or free development request (volkanyurci@gmail.com) upon your needs.

User didn't leave any comment to the rating