MQL5 Wizard Techniques you should know (Part 25): Multi-Timeframe Testing and Trading

Strategies that are based on multiple time frames cannot be tested in wizard assembled Expert Advisors by default because of the MQL5 code architecture used in the assembly classes. We explore a possible work around this limitation for strategies that look to use multiple time frames in a case study with the quadratic moving average.

Data Science and Machine Learning (Part 25): Forex Timeseries Forecasting Using a Recurrent Neural Network (RNN)

Recurrent neural networks (RNNs) excel at leveraging past information to predict future events. Their remarkable predictive capabilities have been applied across various domains with great success. In this article, we will deploy RNN models to predict trends in the forex market, demonstrating their potential to enhance forecasting accuracy in forex trading.

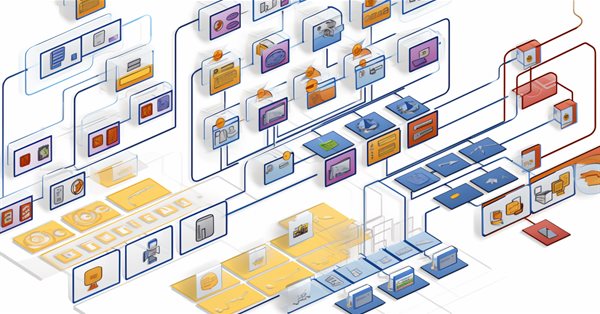

Developing a Replay System (Part 40): Starting the second phase (I)

Today we'll talk about the new phase of the replay/simulator system. At this stage, the conversation will become truly interesting and quite rich in content. I strongly recommend that you read the article carefully and use the links provided in it. This will help you understand the content better.

Developing a Replay System (Part 39): Paving the Path (III)

Before we proceed to the second stage of development, we need to revise some ideas. Do you know how to make MQL5 do what you need? Have you ever tried to go beyond what is contained in the documentation? If not, then get ready. Because we will be doing something that most people don't normally do.

Population optimization algorithms: Resistance to getting stuck in local extrema (Part I)

This article presents a unique experiment that aims to examine the behavior of population optimization algorithms in the context of their ability to efficiently escape local minima when population diversity is low and reach global maxima. Working in this direction will provide further insight into which specific algorithms can successfully continue their search using coordinates set by the user as a starting point, and what factors influence their success.

MQL5 Wizard Techniques you should know (Part 24): Moving Averages

Moving Averages are a very common indicator that are used and understood by most Traders. We explore possible use cases that may not be so common within MQL5 Wizard assembled Expert Advisors.

The base class of population algorithms as the backbone of efficient optimization

The article represents a unique research attempt to combine a variety of population algorithms into a single class to simplify the application of optimization methods. This approach not only opens up opportunities for the development of new algorithms, including hybrid variants, but also creates a universal basic test stand. This stand becomes a key tool for choosing the optimal algorithm depending on a specific task.

Data Science and Machine Learning (Part 24): Forex Time series Forecasting Using Regular AI Models

In the forex markets It is very challenging to predict the future trend without having an idea of the past. Very few machine learning models are capable of making the future predictions by considering past values. In this article, we are going to discuss how we can use classical(Non-time series) Artificial Intelligence models to beat the market

Integrating Hidden Markov Models in MetaTrader 5

In this article we demonstrate how Hidden Markov Models trained using Python can be integrated into MetaTrader 5 applications. Hidden Markov Models are a powerful statistical tool used for modeling time series data, where the system being modeled is characterized by unobservable (hidden) states. A fundamental premise of HMMs is that the probability of being in a given state at a particular time depends on the process's state at the previous time slot.

News Trading Made Easy (Part 2): Risk Management

In this article, inheritance will be introduced into our previous and new code. A new database design will be implemented to provide efficiency. Additionally, a risk management class will be created to tackle volume calculations.

MQL5 Wizard Techniques you should know (Part 21): Testing with Economic Calendar Data

Economic Calendar Data is not available for testing with Expert Advisors within Strategy Tester, by default. We look at how Databases could help in providing a work around this limitation. So, for this article we explore how SQLite databases can be used to archive Economic Calendar news such that wizard assembled Expert Advisors can use this to generate trade signals.

Data Science and Machine Learning (Part 23): Why LightGBM and XGBoost outperform a lot of AI models?

These advanced gradient-boosted decision tree techniques offer superior performance and flexibility, making them ideal for financial modeling and algorithmic trading. Learn how to leverage these tools to optimize your trading strategies, improve predictive accuracy, and gain a competitive edge in the financial markets.

Population optimization algorithms: Evolution of Social Groups (ESG)

We will consider the principle of constructing multi-population algorithms. As an example of this type of algorithm, we will have a look at the new custom algorithm - Evolution of Social Groups (ESG). We will analyze the basic concepts, population interaction mechanisms and advantages of this algorithm, as well as examine its performance in optimization problems.

Integrate Your Own LLM into EA (Part 3): Training Your Own LLM with CPU

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Modified Grid-Hedge EA in MQL5 (Part IV): Optimizing Simple Grid Strategy (I)

In this fourth part, we revisit the Simple Hedge and Simple Grid Expert Advisors (EAs) developed earlier. Our focus shifts to refining the Simple Grid EA through mathematical analysis and a brute force approach, aiming for optimal strategy usage. This article delves deep into the mathematical optimization of the strategy, setting the stage for future exploration of coding-based optimization in later installments.

Causal inference in time series classification problems

In this article, we will look at the theory of causal inference using machine learning, as well as the custom approach implementation in Python. Causal inference and causal thinking have their roots in philosophy and psychology and play an important role in our understanding of reality.

Spurious Regressions in Python

Spurious regressions occur when two time series exhibit a high degree of correlation purely by chance, leading to misleading results in regression analysis. In such cases, even though variables may appear to be related, the correlation is coincidental and the model may be unreliable.

MQL5 Wizard Techniques you should know (Part 20): Symbolic Regression

Symbolic Regression is a form of regression that starts with minimal to no assumptions on what the underlying model that maps the sets of data under study would look like. Even though it can be implemented by Bayesian Methods or Neural Networks, we look at how an implementation with Genetic Algorithms can help customize an expert signal class usable in the MQL5 wizard.

Population optimization algorithms: Binary Genetic Algorithm (BGA). Part II

In this article, we will look at the binary genetic algorithm (BGA), which models the natural processes that occur in the genetic material of living things in nature.

Population optimization algorithms: Binary Genetic Algorithm (BGA). Part I

In this article, we will explore various methods used in binary genetic and other population algorithms. We will look at the main components of the algorithm, such as selection, crossover and mutation, and their impact on the optimization. In addition, we will study data presentation methods and their impact on optimization results.

MQL5 Wizard Techniques you should know (Part 19): Bayesian Inference

Bayesian inference is the adoption of Bayes Theorem to update probability hypothesis as new information is made available. This intuitively leans to adaptation in time series analysis, and so we have a look at how we could use this in building custom classes not just for the signal but also money-management and trailing-stops.

A feature selection algorithm using energy based learning in pure MQL5

In this article we present the implementation of a feature selection algorithm described in an academic paper titled,"FREL: A stable feature selection algorithm", called Feature weighting as regularized energy based learning.

MQL5 Wizard Techniques you should know (Part 18): Neural Architecture Search with Eigen Vectors

Neural Architecture Search, an automated approach at determining the ideal neural network settings can be a plus when facing many options and large test data sets. We examine how when paired Eigen Vectors this process can be made even more efficient.

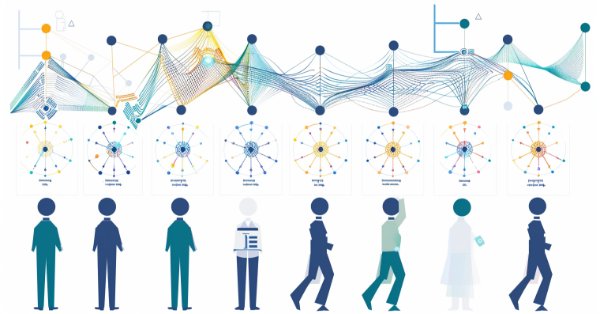

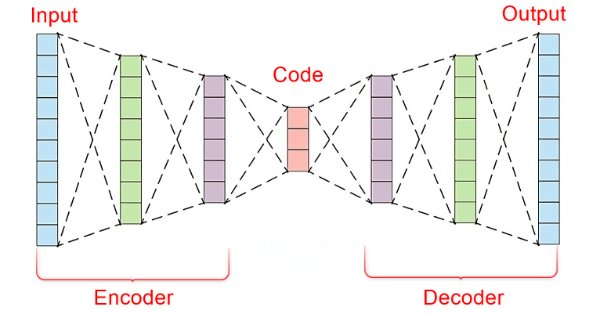

Data Science and Machine Learning (Part 22): Leveraging Autoencoders Neural Networks for Smarter Trades by Moving from Noise to Signal

In the fast-paced world of financial markets, separating meaningful signals from the noise is crucial for successful trading. By employing sophisticated neural network architectures, autoencoders excel at uncovering hidden patterns within market data, transforming noisy input into actionable insights. In this article, we explore how autoencoders are revolutionizing trading practices, offering traders a powerful tool to enhance decision-making and gain a competitive edge in today's dynamic markets.

Developing a Replay System (Part 38): Paving the Path (II)

Many people who consider themselves MQL5 programmers do not have the basic knowledge that I will outline in this article. Many people consider MQL5 to be a limited tool, but the actual reason is that they do not have the required knowledge. So, if you don't know something, don't be ashamed of it. It's better to feel ashamed for not asking. Simply forcing MetaTrader 5 to disable indicator duplication in no way ensures two-way communication between the indicator and the Expert Advisor. We are still very far from this, but the fact that the indicator is not duplicated on the chart gives us some confidence.

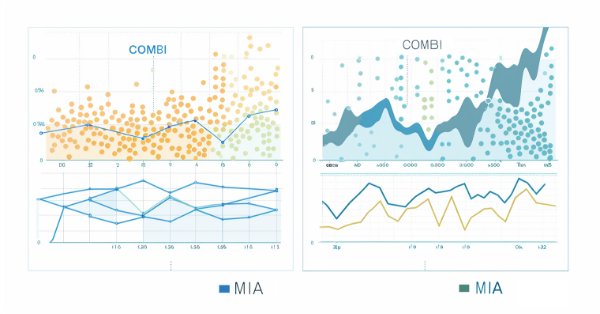

The Group Method of Data Handling: Implementing the Combinatorial Algorithm in MQL5

In this article we continue our exploration of the Group Method of Data Handling family of algorithms, with the implementation of the Combinatorial Algorithm along with its refined incarnation, the Combinatorial Selective Algorithm in MQL5.

Developing a Replay System (Part 37): Paving the Path (I)

In this article, we will finally begin to do what we wanted to do much earlier. However, due to the lack of "solid ground", I did not feel confident to present this part publicly. Now I have the basis to do this. I suggest that you focus as much as possible on understanding the content of this article. I mean not simply reading it. I want to emphasize that if you do not understand this article, you can completely give up hope of understanding the content of the following ones.

Developing a Replay System (Part 36): Making Adjustments (II)

One of the things that can make our lives as programmers difficult is assumptions. In this article, I will show you how dangerous it is to make assumptions: both in MQL5 programming, where you assume that the type will have a certain value, and in MetaTrader 5, where you assume that different servers work the same.

Population optimization algorithms: Micro Artificial immune system (Micro-AIS)

The article considers an optimization method based on the principles of the body's immune system - Micro Artificial Immune System (Micro-AIS) - a modification of AIS. Micro-AIS uses a simpler model of the immune system and simple immune information processing operations. The article also discusses the advantages and disadvantages of Micro-AIS compared to conventional AIS.

Developing a Replay System (Part 35): Making Adjustments (I)

Before we can move forward, we need to fix a few things. These are not actually the necessary fixes but rather improvements to the way the class is managed and used. The reason is that failures occurred due to some interaction within the system. Despite attempts to find out the cause of such failures in order to eliminate them, all these attempts were unsuccessful. Some of these cases make no sense, for example, when we use pointers or recursion in C/C++, the program crashes.

Population optimization algorithms: Bacterial Foraging Optimization - Genetic Algorithm (BFO-GA)

The article presents a new approach to solving optimization problems by combining ideas from bacterial foraging optimization (BFO) algorithms and techniques used in the genetic algorithm (GA) into a hybrid BFO-GA algorithm. It uses bacterial swarming to globally search for an optimal solution and genetic operators to refine local optima. Unlike the original BFO, bacteria can now mutate and inherit genes.

Developing a Replay System (Part 34): Order System (III)

In this article, we will complete the first phase of construction. Although this part is fairly quick to complete, I will cover details that were not discussed previously. I will explain some points that many do not understand. Do you know why you have to press the Shift or Ctrl key?

Population optimization algorithms: Evolution Strategies, (μ,λ)-ES and (μ+λ)-ES

The article considers a group of optimization algorithms known as Evolution Strategies (ES). They are among the very first population algorithms to use evolutionary principles for finding optimal solutions. We will implement changes to the conventional ES variants and revise the test function and test stand methodology for the algorithms.

Overcoming ONNX Integration Challenges

ONNX is a great tool for integrating complex AI code between different platforms, it is a great tool that comes with some challenges that one must address to get the most out of it, In this article we discuss the common issues you might face and how to mitigate them.

Developing a Replay System (Part 33): Order System (II)

Today we will continue to develop the order system. As you will see, we will be massively reusing what has already been shown in other articles. Nevertheless, you will receive a small reward in this article. First, we will develop a system that can be used with a real trading server, both from a demo account or from a real one. We will make extensive use of the MetaTrader 5 platform, which will provide us with all the necessary support from the beginning.

MQL5 Wizard Techniques you should know (Part 16): Principal Component Analysis with Eigen Vectors

Principal Component Analysis, a dimensionality reducing technique in data analysis, is looked at in this article, with how it could be implemented with Eigen values and vectors. As always, we aim to develop a prototype expert-signal-class usable in the MQL5 wizard.

News Trading Made Easy (Part 1): Creating a Database

News trading can be complicated and overwhelming, in this article we will go through steps to obtain news data. Additionally we will learn about the MQL5 Economic Calendar and what it has to offer.

Population optimization algorithms: Changing shape, shifting probability distributions and testing on Smart Cephalopod (SC)

The article examines the impact of changing the shape of probability distributions on the performance of optimization algorithms. We will conduct experiments using the Smart Cephalopod (SC) test algorithm to evaluate the efficiency of various probability distributions in the context of optimization problems.

Population optimization algorithms: Simulated Isotropic Annealing (SIA) algorithm. Part II

The first part was devoted to the well-known and popular algorithm - simulated annealing. We have thoroughly considered its pros and cons. The second part of the article is devoted to the radical transformation of the algorithm, which turns it into a new optimization algorithm - Simulated Isotropic Annealing (SIA).

Population optimization algorithms: Simulated Annealing (SA) algorithm. Part I

The Simulated Annealing algorithm is a metaheuristic inspired by the metal annealing process. In the article, we will conduct a thorough analysis of the algorithm and debunk a number of common beliefs and myths surrounding this widely known optimization method. The second part of the article will consider the custom Simulated Isotropic Annealing (SIA) algorithm.