Developing a Replay System (Part 44): Chart Trade Project (III)

In the previous article I explained how you can manipulate template data for use in OBJ_CHART. In that article, I only outlined the topic without going into details, since in that version the work was done in a very simplified way. This was done to make it easier to explain the content, because despite the apparent simplicity of many things, some of them were not so obvious, and without understanding the simplest and most basic part, you would not be able to truly understand the entire picture.

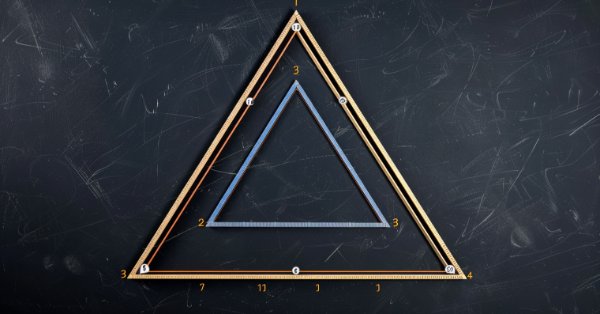

Brain Storm Optimization algorithm (Part I): Clustering

In this article, we will look at an innovative optimization method called BSO (Brain Storm Optimization) inspired by a natural phenomenon called "brainstorming". We will also discuss a new approach to solving multimodal optimization problems the BSO method applies. It allows finding multiple optimal solutions without the need to pre-determine the number of subpopulations. We will also consider the K-Means and K-Means++ clustering methods.

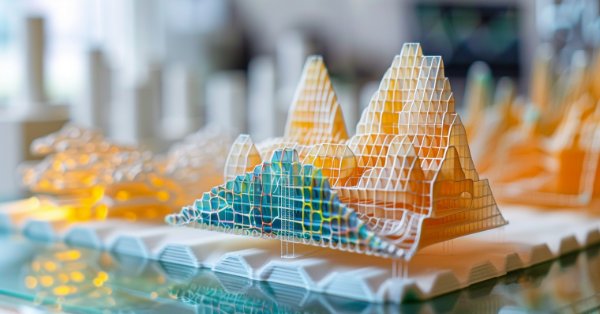

Matrix Factorization: The Basics

Since the goal here is didactic, we will proceed as simply as possible. That is, we will implement only what we need: matrix multiplication. You will see today that this is enough to simulate matrix-scalar multiplication. The most significant difficulty that many people encounter when implementing code using matrix factorization is this: unlike scalar factorization, where in almost all cases the order of the factors does not change the result, this is not the case when using matrices.

Automating Trading Strategies with Parabolic SAR Trend Strategy in MQL5: Crafting an Effective Expert Advisor

In this article, we will automate the trading strategies with Parabolic SAR Strategy in MQL5: Crafting an Effective Expert Advisor. The EA will make trades based on trends identified by the Parabolic SAR indicator.

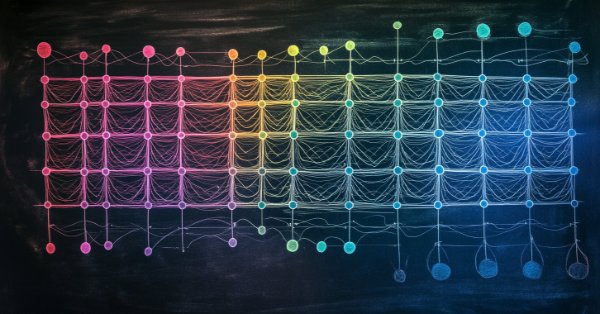

MQL5 Wizard Techniques you should know (Part 34): Price-Embedding with an Unconventional RBM

Restricted Boltzmann Machines are a form of neural network that was developed in the mid 1980s at a time when compute resources were prohibitively expensive. At its onset, it relied on Gibbs Sampling and Contrastive Divergence in order to reduce dimensionality or capture the hidden probabilities/properties over input training data sets. We examine how Backpropagation can perform similarly when the RBM ‘embeds’ prices for a forecasting Multi-Layer-Perceptron.

Creating a Trading Administrator Panel in MQL5 (Part I): Building a Messaging Interface

This article discusses the creation of a Messaging Interface for MetaTrader 5, aimed at System Administrators, to facilitate communication with other traders directly within the platform. Recent integrations of social platforms with MQL5 allow for quick signal broadcasting across different channels. Imagine being able to validate sent signals with just a click—either "YES" or "NO." Read on to learn more.

Developing a multi-currency Expert Advisor (Part 7): Selecting a group based on forward period

Previously, we evaluated the selection of a group of trading strategy instances, with the aim of improving the results of their joint operation, only on the same time period, in which the optimization of individual instances was carried out. Let's see what happens in the forward period.

Integrating MQL5 with data processing packages (Part 2): Machine Learning and Predictive Analytics

In our series on integrating MQL5 with data processing packages, we delve in to the powerful combination of machine learning and predictive analysis. We will explore how to seamlessly connect MQL5 with popular machine learning libraries, to enable sophisticated predictive models for financial markets.

Non-stationary processes and spurious regression

The article demonstrates spurious regression occurring when attempting to apply regression analysis to non-stationary processes using Monte Carlo simulation.

MQL5 Wizard Techniques you should know (Part 33): Gaussian Process Kernels

Gaussian Process Kernels are the covariance function of the Normal Distribution that could play a role in forecasting. We explore this unique algorithm in a custom signal class of MQL5 to see if it could be put to use as a prime entry and exit signal.

Population optimization algorithms: Bird Swarm Algorithm (BSA)

The article explores the bird swarm-based algorithm (BSA) inspired by the collective flocking interactions of birds in nature. The different search strategies of individuals in BSA, including switching between flight, vigilance and foraging behavior, make this algorithm multifaceted. It uses the principles of bird flocking, communication, adaptability, leading and following to efficiently find optimal solutions.

MQL5 Wizard Techniques you should know (Part 32): Regularization

Regularization is a form of penalizing the loss function in proportion to the discrete weighting applied throughout the various layers of a neural network. We look at the significance, for some of the various regularization forms, this can have in test runs with a wizard assembled Expert Advisor.

Pattern Recognition Using Dynamic Time Warping in MQL5

In this article, we discuss the concept of dynamic time warping as a means of identifying predictive patterns in financial time series. We will look into how it works as well as present its implementation in pure MQL5.

Population optimization algorithms: Boids Algorithm

The article considers Boids algorithm based on unique examples of animal flocking behavior. In turn, the Boids algorithm serves as the basis for the creation of the whole class of algorithms united under the name "Swarm Intelligence".

Developing a robot in Python and MQL5 (Part 1): Data preprocessing

Developing a trading robot based on machine learning: A detailed guide. The first article in the series deals with collecting and preparing data and features. The project is implemented using the Python programming language and libraries, as well as the MetaTrader 5 platform.

News Trading Made Easy (Part 3): Performing Trades

In this article, our news trading expert will begin opening trades based on the economic calendar stored in our database. In addition, we will improve the expert's graphics to display more relevant information about upcoming economic calendar events.

MQL5 Wizard Techniques you should know (Part 31): Selecting the Loss Function

Loss Function is the key metric of machine learning algorithms that provides feedback to the training process by quantifying how well a given set of parameters are performing when compared to their intended target. We explore the various formats of this function in an MQL5 custom wizard class.

Data Science and ML (Part 29): Essential Tips for Selecting the Best Forex Data for AI Training Purposes

In this article, we dive deep into the crucial aspects of choosing the most relevant and high-quality Forex data to enhance the performance of AI models.

Time series clustering in causal inference

Clustering algorithms in machine learning are important unsupervised learning algorithms that can divide the original data into groups with similar observations. By using these groups, you can analyze the market for a specific cluster, search for the most stable clusters using new data, and make causal inferences. The article proposes an original method for time series clustering in Python.

MQL5 Wizard Techniques you should know (Part 30): Spotlight on Batch-Normalization in Machine Learning

Batch normalization is the pre-processing of data before it is fed into a machine learning algorithm, like a neural network. This is always done while being mindful of the type of Activation to be used by the algorithm. We therefore explore the different approaches that one can take in reaping the benefits of this, with the help of a wizard assembled Expert Advisor.

Developing a Replay System (Part 43): Chart Trade Project (II)

Most people who want or dream of learning to program don't actually have a clue what they're doing. Their activity consists of trying to create things in a certain way. However, programming is not about tailoring suitable solutions. Doing it this way can create more problems than solutions. Here we will be doing something more advanced and therefore different.

Integrating MQL5 with data processing packages (Part 1): Advanced Data analysis and Statistical Processing

Integration enables seamless workflow where raw financial data from MQL5 can be imported into data processing packages like Jupyter Lab for advanced analysis including statistical testing.

Build Self Optimizing Expert Advisors With MQL5 And Python (Part II): Tuning Deep Neural Networks

Machine learning models come with various adjustable parameters. In this series of articles, we will explore how to customize your AI models to fit your specific market using the SciPy library.

Data Science and ML (Part 28): Predicting Multiple Futures for EURUSD, Using AI

It is a common practice for many Artificial Intelligence models to predict a single future value. However, in this article, we will delve into the powerful technique of using machine learning models to predict multiple future values. This approach, known as multistep forecasting, allows us to predict not only tomorrow's closing price but also the day after tomorrow's and beyond. By mastering multistep forecasting, traders and data scientists can gain deeper insights and make more informed decisions, significantly enhancing their predictive capabilities and strategic planning.

Role of random number generator quality in the efficiency of optimization algorithms

In this article, we will look at the Mersenne Twister random number generator and compare it with the standard one in MQL5. We will also find out the influence of the random number generator quality on the results of optimization algorithms.

Causal analysis of time series using transfer entropy

In this article, we discuss how statistical causality can be applied to identify predictive variables. We will explore the link between causality and transfer entropy, as well as present MQL5 code for detecting directional transfers of information between two variables.

MQL5 Wizard Techniques you should know (Part 29): Continuation on Learning Rates with MLPs

We wrap up our look at learning rate sensitivity to the performance of Expert Advisors by primarily examining the Adaptive Learning Rates. These learning rates aim to be customized for each parameter in a layer during the training process and so we assess potential benefits vs the expected performance toll.

Developing a Replay System (Part 42): Chart Trade Project (I)

Let's create something more interesting. I don't want to spoil the surprise, so follow the article for a better understanding. From the very beginning of this series on developing the replay/simulator system, I was saying that the idea is to use the MetaTrader 5 platform in the same way both in the system we are developing and in the real market. It is important that this is done properly. No one wants to train and learn to fight using one tool while having to use another one during the fight.

Hybridization of population algorithms. Sequential and parallel structures

Here we will dive into the world of hybridization of optimization algorithms by looking at three key types: strategy mixing, sequential and parallel hybridization. We will conduct a series of experiments combining and testing relevant optimization algorithms.

Data Science and ML (Part 27): Convolutional Neural Networks (CNNs) in MetaTrader 5 Trading Bots — Are They Worth It?

Convolutional Neural Networks (CNNs) are renowned for their prowess in detecting patterns in images and videos, with applications spanning diverse fields. In this article, we explore the potential of CNNs to identify valuable patterns in financial markets and generate effective trading signals for MetaTrader 5 trading bots. Let us discover how this deep machine learning technique can be leveraged for smarter trading decisions.

Population optimization algorithms: Resistance to getting stuck in local extrema (Part II)

We continue our experiment that aims to examine the behavior of population optimization algorithms in the context of their ability to efficiently escape local minima when population diversity is low and reach global maxima. Research results are provided.

GIT: What is it?

In this article, I will introduce a very important tool for developers. If you are not familiar with GIT, read this article to get an idea of what it is and how to use it with MQL5.

Data Science and ML (Part 26): The Ultimate Battle in Time Series Forecasting — LSTM vs GRU Neural Networks

In the previous article, we discussed a simple RNN which despite its inability to understand long-term dependencies in the data, was able to make a profitable strategy. In this article, we are discussing both the Long-Short Term Memory(LSTM) and the Gated Recurrent Unit(GRU). These two were introduced to overcome the shortcomings of a simple RNN and to outsmart it.

SP500 Trading Strategy in MQL5 For Beginners

Discover how to leverage MQL5 to forecast the S&P 500 with precision, blending in classical technical analysis for added stability and combining algorithms with time-tested principles for robust market insights.

Portfolio Optimization in Python and MQL5

This article explores advanced portfolio optimization techniques using Python and MQL5 with MetaTrader 5. It demonstrates how to develop algorithms for data analysis, asset allocation, and trading signal generation, emphasizing the importance of data-driven decision-making in modern financial management and risk mitigation.

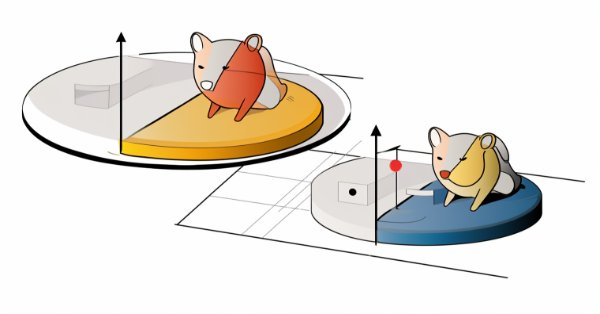

Price Driven CGI Model: Theoretical Foundation

Let's discuss the data manipulation algorithm, as we dive deeper into conceptualizing the idea of using price data to drive CGI objects. Think about transferring the effects of events, human emotions and actions on financial asset prices to a real-life model. This study delves into leveraging price data to influence the scale of a CGI object, controlling growth and emotions. These visible effects can establish a fresh analytical foundation for traders. Further insights are shared in the article.

MQL5 Wizard Techniques you should know (Part 27): Moving Averages and the Angle of Attack

The Angle of Attack is an often-quoted metric whose steepness is understood to strongly correlate with the strength of a prevailing trend. We look at how it is commonly used and understood and examine if there are changes that could be introduced in how it's measured for the benefit of a trade system that puts it in use.

Eigenvectors and eigenvalues: Exploratory data analysis in MetaTrader 5

In this article we explore different ways in which the eigenvectors and eigenvalues can be applied in exploratory data analysis to reveal unique relationships in data.

MQL5 Wizard Techniques you should know (Part 26): Moving Averages and the Hurst Exponent

The Hurst Exponent is a measure of how much a time series auto-correlates over the long term. It is understood to be capturing the long-term properties of a time series and therefore carries some weight in time series analysis even outside of economic/ financial time series. We however, focus on its potential benefit to traders by examining how this metric could be paired with moving averages to build a potentially robust signal.

Developing a Replay System (Part 41): Starting the second phase (II)

If everything seemed right to you up to this point, it means you're not really thinking about the long term, when you start developing applications. Over time you will no longer need to program new applications, you will just have to make them work together. So let's see how to finish assembling the mouse indicator.