Automating Trading Strategies in MQL5 (Part 39): Statistical Mean Reversion with Confidence Intervals and Dashboard

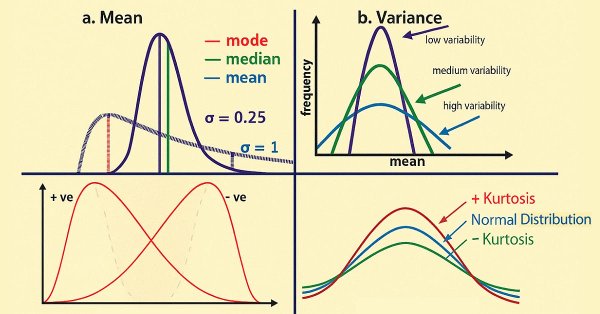

In this article, we develop an MQL5 Expert Advisor for statistical mean reversion trading, calculating moments like mean, variance, skewness, kurtosis, and Jarque-Bera statistics over a specified period to identify non-normal distributions and generate buy/sell signals based on confidence intervals with adaptive thresholds

Reimagining Classic Strategies (Part 18): Searching For Candlestick Patterns

This article helps new community members search for and discover their own candlestick patterns. Describing these patterns can be daunting, as it requires manually searching and creatively identifying improvements. Here, we introduce the engulfing candlestick pattern and show how it can be enhanced for more profitable trading applications.

From Novice to Expert: Forex Market Periods

Every market period has a beginning and an end, each closing with a price that defines its sentiment—much like any candlestick session. Understanding these reference points allows us to gauge the prevailing market mood, revealing whether bullish or bearish forces are in control. In this discussion, we take an important step forward by developing a new feature within the Market Periods Synchronizer—one that visualizes Forex market sessions to support more informed trading decisions. This tool can be especially powerful for identifying, in real time, which side—bulls or bears—dominates the session. Let’s explore this concept and uncover the insights it offers.

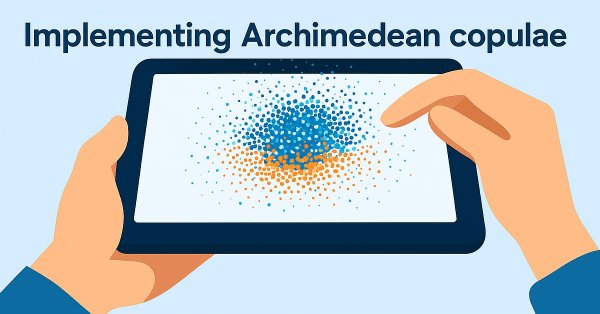

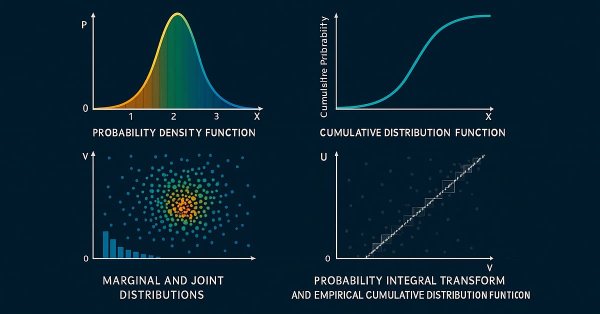

Bivariate Copulae in MQL5 (Part 2): Implementing Archimedean copulae in MQL5

In the second installment of the series, we discuss the properties of bivariate Archimedean copulae and their implementation in MQL5. We also explore applying copulae to the development of a simple pairs trading strategy.

Statistical Arbitrage Through Cointegrated Stocks (Part 7): Scoring System 2

This article describes two additional scoring criteria used for selection of baskets of stocks to be traded in mean-reversion strategies, more specifically, in cointegration based statistical arbitrage. It complements a previous article where liquidity and strength of the cointegration vectors were presented, along with the strategic criteria of timeframe and lookback period, by including the stability of the cointegration vectors and the time to mean reversion (half-time). The article includes the commented results of a backtest with the new filters applied and the files required for its reproduction are also provided.

Circle Search Algorithm (CSA)

The article presents a new metaheuristic optimization Circle Search Algorithm (CSA) based on the geometric properties of a circle. The algorithm uses the principle of moving points along tangents to find the optimal solution, combining the phases of global exploration and local exploitation.

MetaTrader 5 Machine Learning Blueprint (Part 5): Sequential Bootstrapping—Debiasing Labels, Improving Returns

Sequential bootstrapping reshapes bootstrap sampling for financial machine learning by actively avoiding temporally overlapping labels, producing more independent training samples, sharper uncertainty estimates, and more robust trading models. This practical guide explains the intuition, shows the algorithm step‑by‑step, provides optimized code patterns for large datasets, and demonstrates measurable performance gains through simulations and real backtests.

Market Simulation (Part 05): Creating the C_Orders Class (II)

In this article, I will explain how Chart Trade, together with the Expert Advisor, will process a request to close all of the users' open positions. This may sound simple, but there are a few complications that you need to know how to manage.

Price Action Analysis Toolkit Development (Part 48): Multi-Timeframe Harmony Index with Weighted Bias Dashboard

This article introduces the “Multi-Timeframe Harmony Index”—an advanced Expert Advisor for MetaTrader 5 that calculates a weighted bias from multiple timeframes, smooths the readings using EMA, and displays the results in a clean chart panel dashboard. It includes customizable alerts and automatic buy/sell signal plotting when strong bias thresholds are crossed. Suitable for traders who use multi-timeframe analysis to align entries with overall market structure.

From Novice to Expert: Revealing the Candlestick Shadows (Wicks)

In this discussion, we take a step forward to uncover the underlying price action hidden within candlestick wicks. By integrating a wick visualization feature into the Market Periods Synchronizer, we enhance the tool with greater analytical depth and interactivity. This upgraded system allows traders to visualize higher-timeframe price rejections directly on lower-timeframe charts, revealing detailed structures that were once concealed within the shadows.

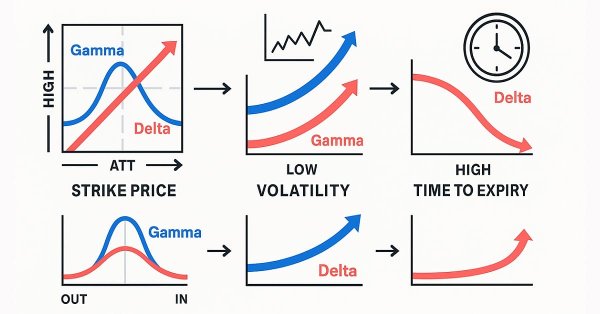

Black-Scholes Greeks: Gamma and Delta

Gamma and Delta measure how an option’s value reacts to changes in the underlying asset’s price. Delta represents the rate of change of the option’s price relative to the underlying, while Gamma measures how Delta itself changes as price moves. Together, they describe an option’s directional sensitivity and convexity—critical for dynamic hedging and volatility-based trading strategies.

Machine Learning Blueprint (Part 4): The Hidden Flaw in Your Financial ML Pipeline — Label Concurrency

Discover how to fix a critical flaw in financial machine learning that causes overfit models and poor live performance—label concurrency. When using the triple-barrier method, your training labels overlap in time, violating the core IID assumption of most ML algorithms. This article provides a hands-on solution through sample weighting. You will learn how to quantify temporal overlap between trading signals, calculate sample weights that reflect each observation's unique information, and implement these weights in scikit-learn to build more robust classifiers. Learning these essential techniques will make your trading models more robust, reliable and profitable.

Price Action Analysis Toolkit Development (Part 47): Tracking Forex Sessions and Breakouts in MetaTrader 5

Global market sessions shape the rhythm of the trading day, and understanding their overlap is vital to timing entries and exits. In this article, we’ll build an interactive trading sessions EA that brings those global hours to life directly on your chart. The EA automatically plots color‑coded rectangles for the Asia, Tokyo, London, and New York sessions, updating in real time as each market opens or closes. It features on‑chart toggle buttons, a dynamic information panel, and a scrolling ticker headline that streams live status and breakout messages. Tested on different brokers, this EA combines precision with style—helping traders see volatility transitions, identify cross‑session breakouts, and stay visually connected to the global market’s pulse.

Statistical Arbitrage Through Cointegrated Stocks (Part 6): Scoring System

In this article, we propose a scoring system for mean-reversion strategies based on statistical arbitrage of cointegrated stocks. The article suggests criteria that go from liquidity and transaction costs to the number of cointegration ranks and time to mean-reversion, while taking into account the strategic criteria of data frequency (timeframe) and the lookback period for cointegration tests, which are evaluated before the score ranking properly. The files required for the reproduction of the backtest are provided, and their results are commented on as well.

From Novice to Expert: Parameter Control Utility

Imagine transforming the traditional EA or indicator input properties into a real-time, on-chart control interface. This discussion builds upon our foundational work in the Market Periods Synchronizer indicator, marking a significant evolution in how we visualize and manage higher-timeframe (HTF) market structures. Here, we turn that concept into a fully interactive utility—a dashboard that brings dynamic control and enhanced multi-period price action visualization directly onto the chart. Join us as we explore how this innovation reshapes the way traders interact with their tools.

Overcoming The Limitation of Machine Learning (Part 6): Effective Memory Cross Validation

In this discussion, we contrast the classical approach to time series cross-validation with modern alternatives that challenge its core assumptions. We expose key blind spots in the traditional method—especially its failure to account for evolving market conditions. To address these gaps, we introduce Effective Memory Cross-Validation (EMCV), a domain-aware approach that questions the long-held belief that more historical data always improves performance.

Market Simulation (Part 04): Creating the C_Orders Class (I)

In this article, we will start creating the C_Orders class to be able to send orders to the trading server. We'll do this little by little, as our goal is to explain in detail how this will happen through the messaging system.

Royal Flush Optimization (RFO)

The original Royal Flush Optimization algorithm offers a new approach to solving optimization problems, replacing the classic binary coding of genetic algorithms with a sector-based approach inspired by poker principles. RFO demonstrates how simplifying basic principles can lead to an efficient and practical optimization method. The article presents a detailed analysis of the algorithm and test results.

Price Action Analysis Toolkit Development (Part 46): Designing an Interactive Fibonacci Retracement EA with Smart Visualization in MQL5

Fibonacci tools are among the most popular instruments used by technical analysts. In this article, we’ll build an Interactive Fibonacci EA that draws retracement and extension levels that react dynamically to price movement, delivering real‑time alerts, stylish lines, and a scrolling news‑style headline. Another key advantage of this EA is flexibility; you can manually type the high (A) and low (B) swing values directly on the chart, giving you exact control over the market range you want to analyze.

Dialectic Search (DA)

The article introduces the dialectical algorithm (DA), a new global optimization method inspired by the philosophical concept of dialectics. The algorithm exploits a unique division of the population into speculative and practical thinkers. Testing shows impressive performance of up to 98% on low-dimensional problems and overall efficiency of 57.95%. The article explains these metrics and presents a detailed description of the algorithm and the results of experiments on different types of functions.

Building a Trading System (Part 5): Managing Gains Through Structured Trade Exits

For many traders, it's a familiar pain point: watching a trade come within a whisker of your profit target, only to reverse and hit your stop-loss. Or worse, seeing a trailing stop close you out at breakeven before the market surges toward your original target. This article focuses on using multiple entries at different Reward-to-Risk Ratios to systematically secure gains and reduce overall risk exposure.

Biological neuron for forecasting financial time series

We will build a biologically correct system of neurons for time series forecasting. The introduction of a plasma-like environment into the neural network architecture creates a kind of "collective intelligence," where each neuron influences the system's operation not only through direct connections, but also through long-range electromagnetic interactions. Let's see how the neural brain modeling system will perform in the market.

Price Action Analysis Toolkit Development (Part 45): Creating a Dynamic Level-Analysis Panel in MQL5

In this article, we explore a powerful MQL5 tool that let's you test any price level you desire with just one click. Simply enter your chosen level and press analyze, the EA instantly scans historical data, highlights every touch and breakout on the chart, and displays statistics in a clean, organized dashboard. You'll see exactly how often price respected or broke through your level, and whether it behaved more like support or resistance. Continue reading to explore the detailed procedure.

Creating volatility forecast indicator using Python

In this article, we will forecast future extreme volatility using binary classification. Besides, we will develop an extreme volatility forecast indicator using machine learning.

Bivariate Copulae in MQL5 (Part 1): Implementing Gaussian and Student's t-Copulae for Dependency Modeling

This is the first part of an article series presenting the implementation of bivariate copulae in MQL5. This article presents code implementing Gaussian and Student's t-copulae. It also delves into the fundamentals of statistical copulae and related topics. The code is based on the Arbitragelab Python package by Hudson and Thames.

From Novice to Expert: Market Periods Synchronizer

In this discussion, we introduce a Higher-to-Lower Timeframe Synchronizer tool designed to solve the problem of analyzing market patterns that span across higher timeframe periods. The built-in period markers in MetaTrader 5 are often limited, rigid, and not easily customizable for non-standard timeframes. Our solution leverages the MQL5 language to develop an indicator that provides a dynamic and visual way to align higher timeframe structures within lower timeframe charts. This tool can be highly valuable for detailed market analysis. To learn more about its features and implementation, I invite you to join the discussion.

Market Simulation (Part 03): A Matter of Performance

Often we have to take a step back and then move forward. In this article, we will show all the changes necessary to ensure that the Mouse and Chart Trade indicators do not break. As a bonus, we'll also cover other changes that have occurred in other header files that will be widely used in the future.

Price Action Analysis Toolkit Development (Part 44): Building a VWMA Crossover Signal EA in MQL5

This article introduces a VWMA crossover signal tool for MetaTrader 5, designed to help traders identify potential bullish and bearish reversals by combining price action with trading volume. The EA generates clear buy and sell signals directly on the chart, features an informative panel, and allows for full user customization, making it a practical addition to your trading strategy.

Time Evolution Travel Algorithm (TETA)

This is my own algorithm. The article presents the Time Evolution Travel Algorithm (TETA) inspired by the concept of parallel universes and time streams. The basic idea of the algorithm is that, although time travel in the conventional sense is impossible, we can choose a sequence of events that lead to different realities.

Building a Trading System (Part 4): How Random Exits Influence Trading Expectancy

Many traders have experienced this situation, often stick to their entry criteria but struggle with trade management. Even with the right setups, emotional decision-making—such as panic exits before trades reach their take-profit or stop-loss levels—can lead to a declining equity curve. How can traders overcome this issue and improve their results? This article will address these questions by examining random win-rates and demonstrating, through Monte Carlo simulation, how traders can refine their strategies by taking profits at reasonable levels before the original target is reached.

Evolutionary trading algorithm with reinforcement learning and extinction of feeble individuals (ETARE)

In this article, I introduce an innovative trading algorithm that combines evolutionary algorithms with deep reinforcement learning for Forex trading. The algorithm uses the mechanism of extinction of inefficient individuals to optimize the trading strategy.

From Novice to Expert: Demystifying Hidden Fibonacci Retracement Levels

In this article, we explore a data-driven approach to discovering and validating non-standard Fibonacci retracement levels that markets may respect. We present a complete workflow tailored for implementation in MQL5, beginning with data collection and bar or swing detection, and extending through clustering, statistical hypothesis testing, backtesting, and integration into an MetaTrader 5 Fibonacci tool. The goal is to create a reproducible pipeline that transforms anecdotal observations into statistically defensible trading signals.

Market Simulation (Part 02): Cross Orders (II)

Unlike what was done in the previous article, here we will test the selection option using an Expert Advisor. Although this is not a final solution yet, it will be enough for now. With the help of this article, you will be able to understand how to implement one of the possible solutions.

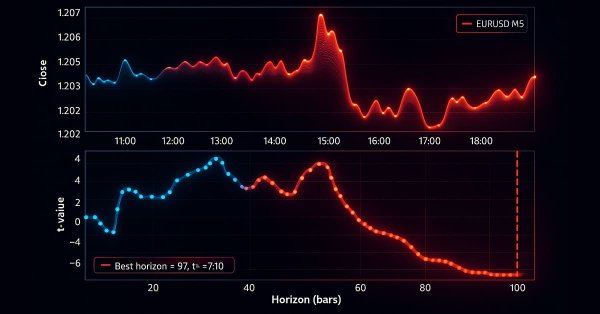

MetaTrader 5 Machine Learning Blueprint (Part 3): Trend-Scanning Labeling Method

We have built a robust feature engineering pipeline using proper tick-based bars to eliminate data leakage and solved the critical problem of labeling with meta-labeled triple-barrier signals. This installment covers the advanced labeling technique, trend-scanning, for adaptive horizons. After covering the theory, an example shows how trend-scanning labels can be used with meta-labeling to improve on the classic moving average crossover strategy.

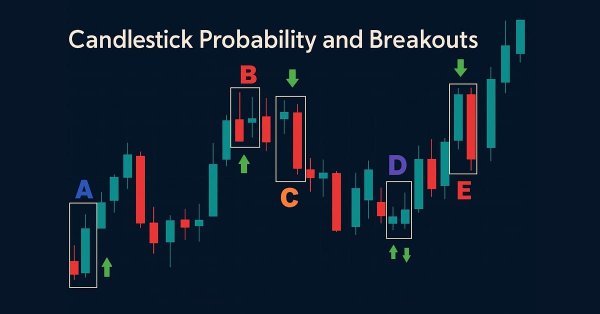

Price Action Analysis Toolkit Development (Part 43): Candlestick Probability and Breakouts

Enhance your market analysis with the MQL5-native Candlestick Probability EA, a lightweight tool that transforms raw price bars into real-time, instrument-specific probability insights. It classifies Pinbars, Engulfing, and Doji patterns at bar close, uses ATR-aware filtering, and optional breakout confirmation. The EA calculates raw and volume-weighted follow-through percentages, helping you understand each pattern's typical outcome on specific symbols and timeframes. On-chart markers, a compact dashboard, and interactive toggles allow easy validation and focus. Export detailed CSV logs for offline testing. Use it to develop probability profiles, optimize strategies, and turn pattern recognition into a measurable edge.

Price movement discretization methods in Python

We will look at price discretization methods using Python + MQL5. In this article, I will share my practical experience developing a Python library that implements a wide range of approaches to bar formation — from classic Volume and Range bars to more exotic methods like Renko and Kagi. We will consider three-line breakout candles and range bars analyzing their statistics and trying to define how else the prices can be represented discretely.

Price Action Analysis Toolkit Development (Part 42): Interactive Chart Testing with Button Logic and Statistical Levels

In a world where speed and precision matter, analysis tools need to be as smart as the markets we trade. This article presents an EA built on button logic—an interactive system that instantly transforms raw price data into meaningful statistical levels. With a single click, it calculates and displays mean, deviation, percentiles, and more, turning advanced analytics into clear on-chart signals. It highlights the zones where price is most likely to bounce, retrace, or break, making analysis both faster and more practical.

Cyclic Parthenogenesis Algorithm (CPA)

The article considers a new population optimization algorithm - Cyclic Parthenogenesis Algorithm (CPA), inspired by the unique reproductive strategy of aphids. The algorithm combines two reproduction mechanisms — parthenogenesis and sexual reproduction — and also utilizes the colonial structure of the population with the possibility of migration between colonies. The key features of the algorithm are adaptive switching between different reproductive strategies and a system of information exchange between colonies through the flight mechanism.

Statistical Arbitrage Through Cointegrated Stocks (Part 5): Screening

This article proposes an asset screening process for a statistical arbitrage trading strategy through cointegrated stocks. The system starts with the regular filtering by economic factors, like asset sector and industry, and finishes with a list of criteria for a scoring system. For each statistical test used in the screening, a respective Python class was developed: Pearson correlation, Engle-Granger cointegration, Johansen cointegration, and ADF/KPSS stationarity. These Python classes are provided along with a personal note from the author about the use of AI assistants for software development.

How to build and optimize a cycle-based trading system (Detrended Price Oscillator - DPO)

This article explains how to design and optimise a trading system using the Detrended Price Oscillator (DPO) in MQL5. It outlines the indicator's core logic, demonstrating how it identifies short-term cycles by filtering out long-term trends. Through a series of step-by-step examples and simple strategies, readers will learn how to code it, define entry and exit signals, and conduct backtesting. Finally, the article presents practical optimization methods to enhance performance and adapt the system to changing market conditions.