Population optimization algorithms: Bacterial Foraging Optimization (BFO)

E. coli bacterium foraging strategy inspired scientists to create the BFO optimization algorithm. The algorithm contains original ideas and promising approaches to optimization and is worthy of further study.

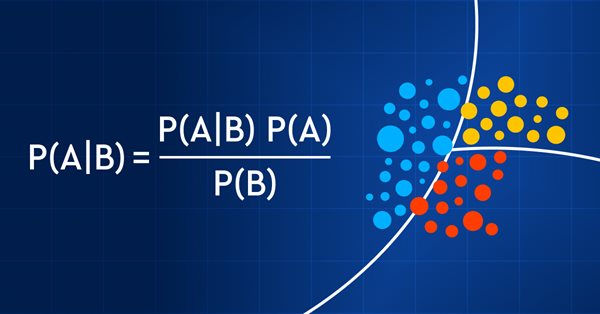

Data Science and Machine Learning (Part 11): Naïve Bayes, Probability theory in Trading

Trading with probability is like walking on a tightrope - it requires precision, balance, and a keen understanding of risk. In the world of trading, the probability is everything. It's the difference between success and failure, profit and loss. By leveraging the power of probability, traders can make informed decisions, manage risk effectively, and achieve their financial goals. So, whether you're a seasoned investor or a novice trader, understanding probability is the key to unlocking your trading potential. In this article, we'll explore the exciting world of trading with probability and show you how to take your trading game to the next level.

Category Theory in MQL5 (Part 3)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL5 community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that provides insight while hopefully furthering the use of this remarkable field in Traders' strategy development.

Population optimization algorithms: Invasive Weed Optimization (IWO)

The amazing ability of weeds to survive in a wide variety of conditions has become the idea for a powerful optimization algorithm. IWO is one of the best algorithms among the previously reviewed ones.

Population optimization algorithms: Bat algorithm (BA)

In this article, I will consider the Bat Algorithm (BA), which shows good convergence on smooth functions.

Population optimization algorithms: Firefly Algorithm (FA)

In this article, I will consider the Firefly Algorithm (FA) optimization method. Thanks to the modification, the algorithm has turned from an outsider into a real rating table leader.

Measuring Indicator Information

Machine learning has become a popular method for strategy development. Whilst there has been more emphasis on maximizing profitability and prediction accuracy , the importance of processing the data used to build predictive models has not received a lot of attention. In this article we consider using the concept of entropy to evaluate the appropriateness of indicators to be used in predictive model building as documented in the book Testing and Tuning Market Trading Systems by Timothy Masters.

Matrix Utils, Extending the Matrices and Vector Standard Library Functionality

Matrix serves as the foundation of machine learning algorithms and computers in general because of their ability to effectively handle large mathematical operations, The Standard library has everything one needs but let's see how we can extend it by introducing several functions in the utils file, that are not yet available in the library

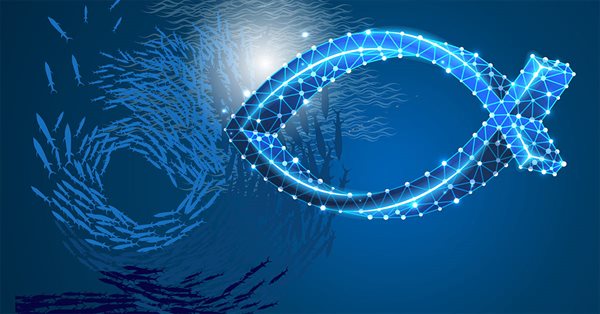

Population optimization algorithms: Fish School Search (FSS)

Fish School Search (FSS) is a new optimization algorithm inspired by the behavior of fish in a school, most of which (up to 80%) swim in an organized community of relatives. It has been proven that fish aggregations play an important role in the efficiency of foraging and protection from predators.

Category Theory in MQL5 (Part 2)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL5 community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that attracts comments and discussion while hopefully furthering the use of this remarkable field in Traders' strategy development.

Population optimization algorithms: Cuckoo Optimization Algorithm (COA)

The next algorithm I will consider is cuckoo search optimization using Levy flights. This is one of the latest optimization algorithms and a new leader in the leaderboard.

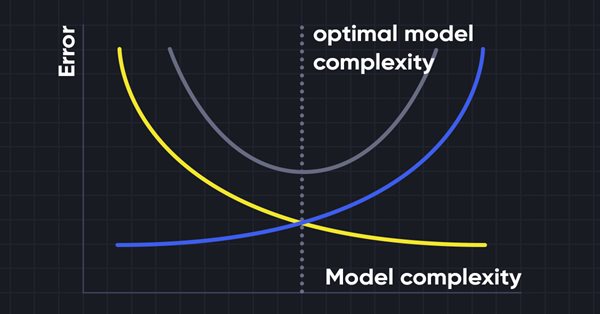

Data Science and Machine Learning (Part 10): Ridge Regression

Ridge regression is a simple technique to reduce model complexity and prevent over-fitting which may result from simple linear regression

Population optimization algorithms: Grey Wolf Optimizer (GWO)

Let's consider one of the newest modern optimization algorithms - Grey Wolf Optimization. The original behavior on test functions makes this algorithm one of the most interesting among the ones considered earlier. This is one of the top algorithms for use in training neural networks, smooth functions with many variables.

Population optimization algorithms: Artificial Bee Colony (ABC)

In this article, we will study the algorithm of an artificial bee colony and supplement our knowledge with new principles of studying functional spaces. In this article, I will showcase my interpretation of the classic version of the algorithm.

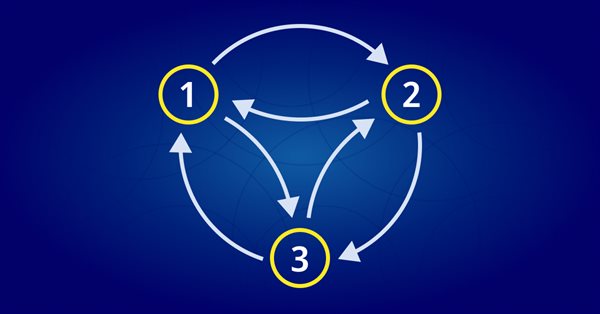

MQL5 Wizard techniques you should know (Part 05): Markov Chains

Markov chains are a powerful mathematical tool that can be used to model and forecast time series data in various fields, including finance. In financial time series modelling and forecasting, Markov chains are often used to model the evolution of financial assets over time, such as stock prices or exchange rates. One of the main advantages of Markov chain models is their simplicity and ease of use.

Mountain or Iceberg charts

How do you like the idea of adding a new chart type to the MetaTrader 5 platform? Some people say it lacks a few things that other platforms offer. But the truth is, MetaTrader 5 is a very practical platform as it allows you to do things that can't be done (or at least can't be done easily) in many other platforms.

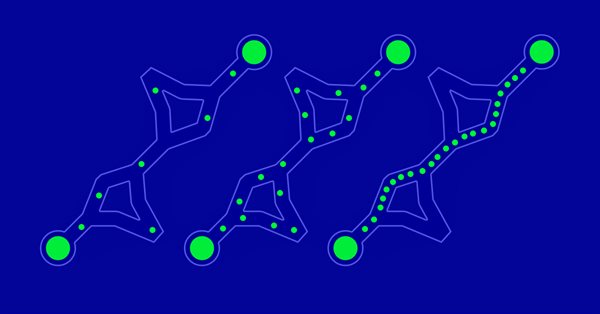

Population optimization algorithms: Ant Colony Optimization (ACO)

This time I will analyze the Ant Colony optimization algorithm. The algorithm is very interesting and complex. In the article, I make an attempt to create a new type of ACO.

Category Theory in MQL5 (Part 1)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that attracts comments and discussion while hopefully furthering the use of this remarkable field in Traders' strategy development.

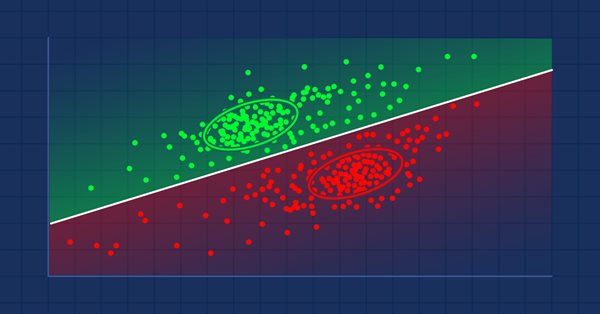

MQL5 Wizard techniques you should know (Part 04): Linear Discriminant Analysis

Todays trader is a philomath who is almost always looking up new ideas, trying them out, choosing to modify them or discard them; an exploratory process that should cost a fair amount of diligence. These series of articles will proposition that the MQL5 wizard should be a mainstay for traders in this effort.

Developing an Expert Advisor from scratch (Part 30): CHART TRADE as an indicator?

Today we are going to use Chart Trade again, but this time it will be an on-chart indicator which may or may not be present on the chart.

Population optimization algorithms: Particle swarm (PSO)

In this article, I will consider the popular Particle Swarm Optimization (PSO) algorithm. Previously, we discussed such important characteristics of optimization algorithms as convergence, convergence rate, stability, scalability, as well as developed a test stand and considered the simplest RNG algorithm.

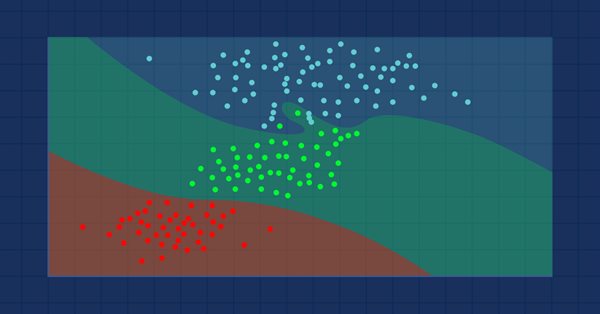

Data Science and Machine Learning (Part 09): The K-Nearest Neighbors Algorithm (KNN)

This is a lazy algorithm that doesn't learn from the training dataset, it stores the dataset instead and acts immediately when it's given a new sample. As simple as it is, it is used in a variety of real-world applications.

Neural networks made easy (Part 27): Deep Q-Learning (DQN)

We continue to study reinforcement learning. In this article, we will get acquainted with the Deep Q-Learning method. The use of this method has enabled the DeepMind team to create a model that can outperform a human when playing Atari computer games. I think it will be useful to evaluate the possibilities of the technology for solving trading problems.

Neural networks made easy (Part 26): Reinforcement Learning

We continue to study machine learning methods. With this article, we begin another big topic, Reinforcement Learning. This approach allows the models to set up certain strategies for solving the problems. We can expect that this property of reinforcement learning will open up new horizons for building trading strategies.

Neural networks made easy (Part 25): Practicing Transfer Learning

In the last two articles, we developed a tool for creating and editing neural network models. Now it is time to evaluate the potential use of Transfer Learning technology using practical examples.

Market math: profit, loss and costs

In this article, I will show you how to calculate the total profit or loss of any trade, including commission and swap. I will provide the most accurate mathematical model and use it to write the code and compare it with the standard. Besides, I will also try to get on the inside of the main MQL5 function to calculate profit and get to the bottom of all the necessary values from the specification.

Population optimization algorithms

This is an introductory article on optimization algorithm (OA) classification. The article attempts to create a test stand (a set of functions), which is to be used for comparing OAs and, perhaps, identifying the most universal algorithm out of all widely known ones.

Neural networks made easy (Part 22): Unsupervised learning of recurrent models

We continue to study unsupervised learning algorithms. This time I suggest that we discuss the features of autoencoders when applied to recurrent model training.

Neural networks made easy (Part 21): Variational autoencoders (VAE)

In the last article, we got acquainted with the Autoencoder algorithm. Like any other algorithm, it has its advantages and disadvantages. In its original implementation, the autoenctoder is used to separate the objects from the training sample as much as possible. This time we will talk about how to deal with some of its disadvantages.

Data Science and Machine Learning (Part 07): Polynomial Regression

Unlike linear regression, polynomial regression is a flexible model aimed to perform better at tasks the linear regression model could not handle, Let's find out how to make polynomial models in MQL5 and make something positive out of it.

Risk and capital management using Expert Advisors

This article is about what you can not see in a backtest report, what you should expect using automated trading software, how to manage your money if you are using expert advisors, and how to cover a significant loss to remain in the trading activity when you are using automated procedures.

Neural networks made easy (Part 20): Autoencoders

We continue to study unsupervised learning algorithms. Some readers might have questions regarding the relevance of recent publications to the topic of neural networks. In this new article, we get back to studying neural networks.

Matrix and Vector operations in MQL5

Matrices and vectors have been introduced in MQL5 for efficient operations with mathematical solutions. The new types offer built-in methods for creating concise and understandable code that is close to mathematical notation. Arrays provide extensive capabilities, but there are many cases in which matrices are much more efficient.

The price movement model and its main provisions (Part 2): Probabilistic price field evolution equation and the occurrence of the observed random walk

The article considers the probabilistic price field evolution equation and the upcoming price spike criterion. It also reveals the essence of price values on charts and the mechanism for the occurrence of a random walk of these values.

Neural networks made easy (Part 19): Association rules using MQL5

We continue considering association rules. In the previous article, we have discussed theoretical aspect of this type of problem. In this article, I will show the implementation of the FP Growth method using MQL5. We will also test the implemented solution using real data.

Neural networks made easy (Part 18): Association rules

As a continuation of this series of articles, let's consider another type of problems within unsupervised learning methods: mining association rules. This problem type was first used in retail, namely supermarkets, to analyze market baskets. In this article, we will talk about the applicability of such algorithms in trading.

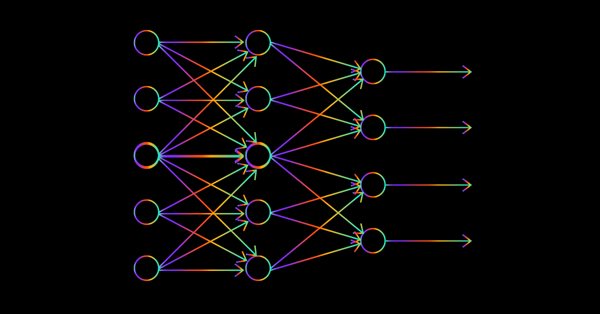

Data Science and Machine Learning — Neural Network (Part 02): Feed forward NN Architectures Design

There are minor things to cover on the feed-forward neural network before we are through, the design being one of them. Let's see how we can build and design a flexible neural network to our inputs, the number of hidden layers, and the nodes for each of the network.

Metamodels in machine learning and trading: Original timing of trading orders

Metamodels in machine learning: Auto creation of trading systems with little or no human intervention — The model decides when and how to trade on its own.

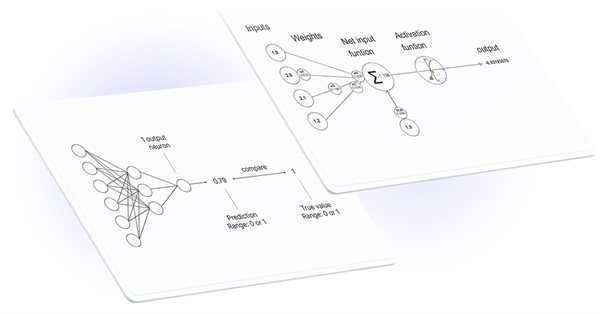

Data Science and Machine Learning — Neural Network (Part 01): Feed Forward Neural Network demystified

Many people love them but a few understand the whole operations behind Neural Networks. In this article I will try to explain everything that goes behind closed doors of a feed-forward multi-layer perception in plain English.

Neural networks made easy (Part 17): Dimensionality reduction

In this part we continue discussing Artificial Intelligence models. Namely, we study unsupervised learning algorithms. We have already discussed one of the clustering algorithms. In this article, I am sharing a variant of solving problems related to dimensionality reduction.