Trading with the MQL5 Economic Calendar (Part 10): Draggable Dashboard and Interactive Hover Effects for Seamless News Navigation

In this article, we enhance the MQL5 Economic Calendar by introducing a draggable dashboard that allows us to reposition the interface for better chart visibility. We implement hover effects for buttons to improve interactivity and ensure seamless navigation with a dynamically positioned scrollbar.

Neural Networks Made Easy (Part 83): The "Conformer" Spatio-Temporal Continuous Attention Transformer Algorithm

This article introduces the Conformer algorithm originally developed for the purpose of weather forecasting, which in terms of variability and capriciousness can be compared to financial markets. Conformer is a complex method. It combines the advantages of attention models and ordinary differential equations.

Developing a multi-currency Expert Advisor (Part 20): Putting in order the conveyor of automatic project optimization stages (I)

We have already created quite a few components that help arrange auto optimization. During the creation, we followed the traditional cyclical structure: from creating minimal working code to refactoring and obtaining improved code. It is time to start clearing up our database, which is also a key component in the system we are creating.

Statistical Arbitrage Through Cointegrated Stocks (Part 2): Expert Advisor, Backtests, and Optimization

This article presents a sample Expert Advisor implementation for trading a basket of four Nasdaq stocks. The stocks were initially filtered based on Pearson correlation tests. The filtered group was then tested for cointegration with Johansen tests. Finally, the cointegrated spread was tested for stationarity with the ADF and KPSS tests. Here we will see some notes about this process and the results of the backtests after a small optimization.

Alternative risk return metrics in MQL5

In this article we present the implementation of several risk return metrics billed as alternatives to the Sharpe ratio and examine hypothetical equity curves to analyze their characteristics.

GUI: Tips and Tricks for creating your own Graphic Library in MQL

We'll go through the basics of GUI libraries so that you can understand how they work or even start making your own.

Developing a Replay System (Part 42): Chart Trade Project (I)

Let's create something more interesting. I don't want to spoil the surprise, so follow the article for a better understanding. From the very beginning of this series on developing the replay/simulator system, I was saying that the idea is to use the MetaTrader 5 platform in the same way both in the system we are developing and in the real market. It is important that this is done properly. No one wants to train and learn to fight using one tool while having to use another one during the fight.

Developing a Replay System — Market simulation (Part 24): FOREX (V)

Today we will remove a limitation that has been preventing simulations based on the Last price and will introduce a new entry point specifically for this type of simulation. The entire operating mechanism will be based on the principles of the forex market. The main difference in this procedure is the separation of Bid and Last simulations. However, it is important to note that the methodology used to randomize the time and adjust it to be compatible with the C_Replay class remains identical in both simulations. This is good because changes in one mode lead to automatic improvements in the other, especially when it comes to handling time between ticks.

Build Self Optimizing Expert Advisors in MQL5 (Part 7): Trading With Multiple Periods At Once

In this series of articles, we have considered multiple different ways of identifying the best period to use our technical indicators with. Today, we shall demonstrate to the reader how they can instead perform the opposite logic, that is to say, instead of picking the single best period to use, we will demonstrate to the reader how to employ all available periods effectively. This approach reduces the amount of data discarded, and offers alternative use cases for machine learning algorithms beyond ordinary price prediction.

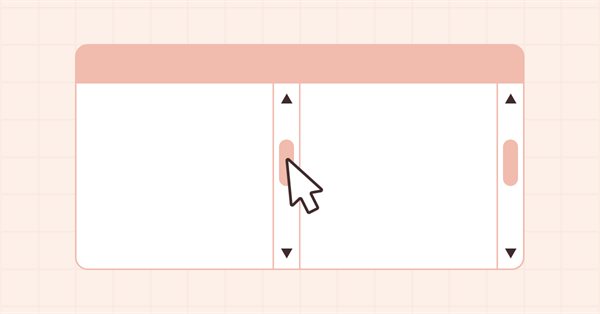

DoEasy. Controls (Part 31): Scrolling the contents of the ScrollBar control

In this article, I will implement the functionality of scrolling the contents of the container using the buttons of the horizontal scrollbar.

Developing a Replay System — Market simulation (Part 13): Birth of the SIMULATOR (III)

Here we will simplify a few elements related to the work in the next article. I'll also explain how you can visualize what the simulator generates in terms of randomness.

Introduction to MQL5 (Part 27): Mastering API and WebRequest Function in MQL5

This article introduces how to use the WebRequest() function and APIs in MQL5 to communicate with external platforms. You’ll learn how to create a Telegram bot, obtain chat and group IDs, and send, edit, and delete messages directly from MT5, building a strong foundation for mastering API integration in your future MQL5 projects.

From Basic to Intermediate: Operators

In this article we will look at the main operators. Although the topic is simple to understand, there are certain points that are of great importance when it comes to including mathematical expressions in the code format. Without an adequate understanding of these details, programmers with little or no experience eventually give up trying to create their own solutions.

Neural networks made easy (Part 42): Model procrastination, reasons and solutions

In the context of reinforcement learning, model procrastination can be caused by several reasons. The article considers some of the possible causes of model procrastination and methods for overcoming them.

Mastering Log Records (Part 1): Fundamental Concepts and First Steps in MQL5

Welcome to the beginning of another journey! This article opens a special series where we will create, step by step, a library for log manipulation, tailored for those who develop in the MQL5 language.

Neural Networks Made Easy (Part 95): Reducing Memory Consumption in Transformer Models

Transformer architecture-based models demonstrate high efficiency, but their use is complicated by high resource costs both at the training stage and during operation. In this article, I propose to get acquainted with algorithms that allow to reduce memory usage of such models.

A Generic Optimization Formulation (GOF) to Implement Custom Max with Constraints

In this article we will present a way to implement optimization problems with multiple objectives and constraints when selecting "Custom Max" in the Setting tab of the MetaTrader 5 terminal. As an example, the optimization problem could be: Maximize Profit Factor, Net Profit, and Recovery Factor, such that the Draw Down is less than 10%, the number of consecutive losses is less than 5, and the number of trades per week is more than 5.

MetaTrader 5 Machine Learning Blueprint (Part 6): Engineering a Production-Grade Caching System

Tired of watching progress bars instead of testing trading strategies? Traditional caching fails financial ML, leaving you with lost computations and frustrating restarts. We've engineered a sophisticated caching architecture that understands the unique challenges of financial data—temporal dependencies, complex data structures, and the constant threat of look-ahead bias. Our three-layer system delivers dramatic speed improvements while automatically invalidating stale results and preventing costly data leaks. Stop waiting for computations and start iterating at the pace the markets demand.

Population optimization algorithms: Differential Evolution (DE)

In this article, we will consider the algorithm that demonstrates the most controversial results of all those discussed previously - the differential evolution (DE) algorithm.

From Basic to Intermediate: Template and Typename (V)

In this article, we'll explore one last simple use case for templates, and discuss the benefits and necessity of using typename in your code. Although this article may seem a bit complicated at first, it is important to understand it properly in order to use templates and typename later.

Quantitative approach to risk management: Applying VaR model to optimize multi-currency portfolio using Python and MetaTrader 5

This article explores the potential of the Value at Risk (VaR) model for multi-currency portfolio optimization. Using the power of Python and the functionality of MetaTrader 5, we demonstrate how to implement VaR analysis for efficient capital allocation and position management. From theoretical foundations to practical implementation, the article covers all aspects of applying one of the most robust risk calculation systems – VaR – in algorithmic trading.

Neural Network in Practice: Sketching a Neuron

In this article we will build a basic neuron. And although it looks simple, and many may consider this code completely trivial and meaningless, I want you to have fun studying this simple sketch of a neuron. Don't be afraid to modify the code, understanding it fully is the goal.

Reimagining Classic Strategies (Part X): Can AI Power The MACD?

Join us as we empirically analyzed the MACD indicator, to test if applying AI to a strategy, including the indicator, would yield any improvements in our accuracy on forecasting the EURUSD. We simultaneously assessed if the indicator itself is easier to predict than price, as well as if the indicator's value is predictive of future price levels. We will furnish you with the information you need to decide whether you should consider investing your time into integrating the MACD in your AI trading strategies.

MetaTrader tick info access from MQL5 services to Python application using sockets

Sometimes everything is not programmable in the MQL5 language. And even if it is possible to convert existing advanced libraries in MQL5, it would be time-consuming. This article tries to show that we can bypass Windows OS dependency by transporting tick information such as bid, ask and time with MetaTrader services to a Python application using sockets.

Multiple Symbol Analysis With Python And MQL5 (Part I): NASDAQ Integrated Circuit Makers

Join us as we discuss how you can use AI to optimize your position sizing and order quantities to maximize the returns of your portfolio. We will showcase how to algorithmically identify an optimal portfolio and tailor your portfolio to your returns expectations or risk tolerance levels. In this discussion, we will use the SciPy library and the MQL5 language to create an optimal and diversified portfolio using all the data we have.

Developing a Replay System — Market simulation (Part 23): FOREX (IV)

Now the creation occurs at the same point where we converted ticks into bars. This way, if something goes wrong during the conversion process, we will immediately notice the error. This is because the same code that places 1-minute bars on the chart during fast forwarding is also used for the positioning system to place bars during normal performance. In other words, the code that is responsible for this task is not duplicated anywhere else. This way we get a much better system for both maintenance and improvement.

Angular Analysis of Price Movements: A Hybrid Model for Predicting Financial Markets

What is angular analysis of financial markets? How to use price action angles and machine learning to make accurate forecasts with 67% accuracy? How to combine a regression and classification model with angular features and obtain a working algorithm? What does Gann have to do with it? Why are price movement angles a good indicator for machine learning?

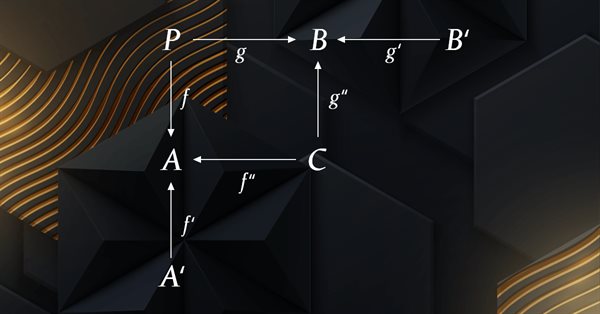

Category Theory in MQL5 (Part 4): Spans, Experiments, and Compositions

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL5 community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that provides insight while hopefully furthering the use of this remarkable field in Traders' strategy development.

MQL5 Wizard Techniques you should know (Part 26): Moving Averages and the Hurst Exponent

The Hurst Exponent is a measure of how much a time series auto-correlates over the long term. It is understood to be capturing the long-term properties of a time series and therefore carries some weight in time series analysis even outside of economic/ financial time series. We however, focus on its potential benefit to traders by examining how this metric could be paired with moving averages to build a potentially robust signal.

MQL5 Wizard Techniques you should know (Part 69): Using Patterns of SAR and the RVI

The Parabolic-SAR (SAR) and the Relative Vigour Index (RVI) are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. This indicator pair, like those we’ve covered in the past, is also complementary since SAR defines the trend while RVI checks momentum. As usual, we use the MQL5 wizard to build and test any potential this indicator pairing may have.

Risk-Based Trade Placement EA with On-Chart UI (Part 2): Adding Interactivity and Logic

Learn how to build an interactive MQL5 Expert Advisor with an on-chart control panel. Know how to compute risk-based lot sizes and place trades directly from the chart.

Data label for time series mining (Part 4):Interpretability Decomposition Using Label Data

This series of articles introduces several time series labeling methods, which can create data that meets most artificial intelligence models, and targeted data labeling according to needs can make the trained artificial intelligence model more in line with the expected design, improve the accuracy of our model, and even help the model make a qualitative leap!

Neural networks made easy (Part 57): Stochastic Marginal Actor-Critic (SMAC)

Here I will consider the fairly new Stochastic Marginal Actor-Critic (SMAC) algorithm, which allows building latent variable policies within the framework of entropy maximization.

Risk-Based Trade Placement EA with On-Chart UI (Part 2): Adding Interactivity and Logic

Learn how to build an interactive MQL5 Expert Advisor with an on-chart control panel. Know how to compute risk-based lot sizes and place trades directly from the chart.

Population optimization algorithms: Mind Evolutionary Computation (MEC) algorithm

The article considers the algorithm of the MEC family called the simple mind evolutionary computation algorithm (Simple MEC, SMEC). The algorithm is distinguished by the beauty of its idea and ease of implementation.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs (II)-LoRA-Tuning

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Neural networks made easy (Part 40): Using Go-Explore on large amounts of data

This article discusses the use of the Go-Explore algorithm over a long training period, since the random action selection strategy may not lead to a profitable pass as training time increases.

MQL5 Wizard Techniques you should know (Part 69): Using Patterns of SAR and the RVI

The Parabolic-SAR (SAR) and the Relative Vigour Index (RVI) are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. This indicator pair, like those we’ve covered in the past, is also complementary since SAR defines the trend while RVI checks momentum. As usual, we use the MQL5 wizard to build and test any potential this indicator pairing may have.

Developing a Replay System (Part 70): Getting the Time Right (III)

In this article, we will look at how to use the CustomBookAdd function correctly and effectively. Despite its apparent simplicity, it has many nuances. For example, it allows you to tell the mouse indicator whether a custom symbol is on auction, being traded, or the market is closed. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Introduction to MQL5 (Part 22): Building an Expert Advisor for the 5-0 Harmonic Pattern

This article explains how to detect and trade the 5-0 harmonic pattern in MQL5, validate it using Fibonacci levels, and display it on the chart.