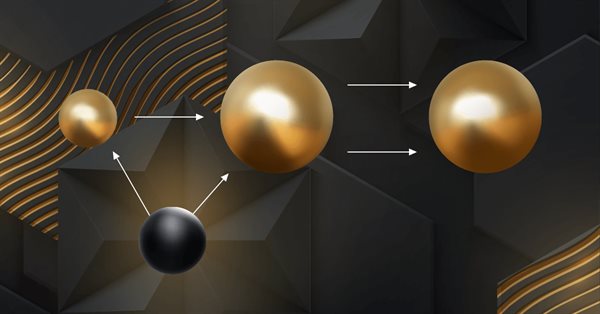

Turtle Shell Evolution Algorithm (TSEA)

This is a unique optimization algorithm inspired by the evolution of the turtle shell. The TSEA algorithm emulates the gradual formation of keratinized skin areas, which represent optimal solutions to a problem. The best solutions become "harder" and are located closer to the outer surface, while the less successful solutions remain "softer" and are located inside. The algorithm uses clustering of solutions by quality and distance, allowing to preserve less successful options and providing flexibility and adaptability.

Developing a Replay System (Part 26): Expert Advisor project — C_Terminal class

We can now start creating an Expert Advisor for use in the replay/simulation system. However, we need something improved, not a random solution. Despite this, we should not be intimidated by the initial complexity. It's important to start somewhere, otherwise we end up ruminating about the difficulty of a task without even trying to overcome it. That's what programming is all about: overcoming obstacles through learning, testing, and extensive research.

From Basic to Intermediate: Template and Typename (I)

In this article, we start considering one of the concepts that many beginners avoid. This is related to the fact that templates are not an easy topic, as many do not understand the basic principle underlying the template: overload of functions and procedures.

Developing Trading Strategy: Pseudo Pearson Correlation Approach

Generating new indicators from existing ones offers a powerful way to enhance trading analysis. By defining a mathematical function that integrates the outputs of existing indicators, traders can create hybrid indicators that consolidate multiple signals into a single, efficient tool. This article introduces a new indicator built from three oscillators using a modified version of the Pearson correlation function, which we call the Pseudo Pearson Correlation (PPC). The PPC indicator aims to quantify the dynamic relationship between oscillators and apply it within a practical trading strategy.

MQL5 Wizard Techniques you should know (Part 37): Gaussian Process Regression with Linear and Matérn Kernels

Linear Kernels are the simplest matrix of its kind used in machine learning for linear regression and support vector machines. The Matérn kernel on the other hand is a more versatile version of the Radial Basis Function we looked at in an earlier article, and it is adept at mapping functions that are not as smooth as the RBF would assume. We build a custom signal class that utilizes both kernels in forecasting long and short conditions.

Functions for activating neurons during training: The key to fast convergence?

This article presents a study of the interaction of different activation functions with optimization algorithms in the context of neural network training. Particular attention is paid to the comparison of the classical ADAM and its population version when working with a wide range of activation functions, including the oscillating ACON and Snake functions. Using a minimalistic MLP (1-1-1) architecture and a single training example, the influence of activation functions on the optimization is isolated from other factors. The article proposes an approach to manage network weights through the boundaries of activation functions and a weight reflection mechanism, which allows avoiding problems with saturation and stagnation in training.

Interview with Andrei Moraru (ATC 2011)

Ukrainian programmer Andrei Moraru (enivid) is an active participant of the Automated Trading Championship beginning from 2007. Andrei had already come in our view at that time and now we have decided to find out if there occured any changes in his attitude towards trading and selection of trading strategies for the past four years, and also to know about his new Expert Advisor.

Neural networks made easy (Part 46): Goal-conditioned reinforcement learning (GCRL)

In this article, we will have a look at yet another reinforcement learning approach. It is called goal-conditioned reinforcement learning (GCRL). In this approach, an agent is trained to achieve different goals in specific scenarios.

MQL5 Trading Toolkit (Part 4): Developing a History Management EX5 Library

Learn how to retrieve, process, classify, sort, analyze, and manage closed positions, orders, and deal histories using MQL5 by creating an expansive History Management EX5 Library in a detailed step-by-step approach.

Moving to MQL5 Algo Forge (Part 3): Using External Repositories in Your Own Projects

Let's explore how you can start integrating external code from any repository in the MQL5 Algo Forge storage into your own project. In this article, we finally turn to this promising, yet more complex, task: how to practically connect and use libraries from third-party repositories within MQL5 Algo Forge.

Price Action Analysis Toolkit Development (Part 54): Filtering Trends with EMA and Smoothed Price Action

This article explores a method that combines Heikin‑Ashi smoothing with EMA20 High and Low boundaries and an EMA50 trend filter to improve trade clarity and timing. It demonstrates how these tools can help traders identify genuine momentum, filter out noise, and better navigate volatile or trending markets.

From Novice to Expert: Implementation of Fibonacci Strategies in Post-NFP Market Trading

In financial markets, the laws of retracement remain among the most undeniable forces. It is a rule of thumb that price will always retrace—whether in large moves or even within the smallest tick patterns, which often appear as a zigzag. However, the retracement pattern itself is never fixed; it remains uncertain and subject to anticipation. This uncertainty explains why traders rely on multiple Fibonacci levels, each carrying a certain probability of influence. In this discussion, we introduce a refined strategy that applies Fibonacci techniques to address the challenges of trading shortly after major economic event announcements. By combining retracement principles with event-driven market behavior, we aim to uncover more reliable entry and exit opportunities. Join to explore the full discussion and see how Fibonacci can be adapted to post-event trading.

Formulating Dynamic Multi-Pair EA (Part 2): Portfolio Diversification and Optimization

Portfolio Diversification and Optimization strategically spreads investments across multiple assets to minimize risk while selecting the ideal asset mix to maximize returns based on risk-adjusted performance metrics.

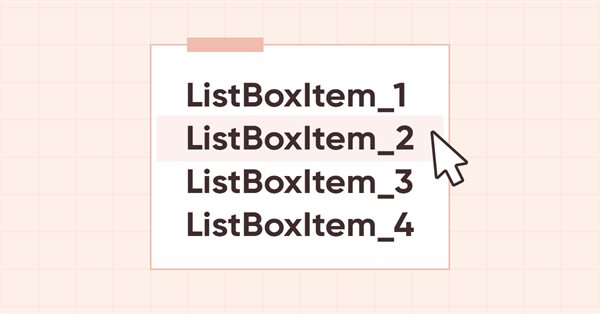

DoEasy. Controls (Part 12): Base list object, ListBox and ButtonListBox WinForms objects

In this article, I am going to create the base object of WinForms object lists, as well as the two new objects: ListBox and ButtonListBox.

Market Reactions and Trading Strategies in Response to Dividend Announcements: Evaluating the Efficient Market Hypothesis in Stock Trading

In this article, we will analyse the impact of dividend announcements on stock market returns and see how investors can earn more returns than those offered by the market when they expect a company to announce dividends. In doing so, we will also check the validity of the Efficient Market Hypothesis in the context of the Indian Stock Market.

Archery Algorithm (AA)

The article takes a detailed look at the archery-inspired optimization algorithm, with an emphasis on using the roulette method as a mechanism for selecting promising areas for "arrows". The method allows evaluating the quality of solutions and selecting the most promising positions for further study.

Neural Networks in Trading: Memory Augmented Context-Aware Learning (MacroHFT) for Cryptocurrency Markets

I invite you to explore the MacroHFT framework, which applies context-aware reinforcement learning and memory to improve high-frequency cryptocurrency trading decisions using macroeconomic data and adaptive agents.

Combine Fundamental And Technical Analysis Strategies in MQL5 For Beginners

In this article, we will discuss how to integrate trend following and fundamental principles seamlessly into one Expert Advisors to build a strategy that is more robust. This article will demonstrate how easy it is for anyone to get up and running building customized trading algorithms using MQL5.

Fortified Profit Architecture: Multi-Layered Account Protection

In this discussion, we introduce a structured, multi-layered defense system designed to pursue aggressive profit targets while minimizing exposure to catastrophic loss. The focus is on blending offensive trading logic with protective safeguards at every level of the trading pipeline. The idea is to engineer an EA that behaves like a “risk-aware predator”—capable of capturing high-value opportunities, but always with layers of insulation that prevent blindness to sudden market stress.

Self Optimizing Expert Advisors in MQL5 (Part 10): Matrix Factorization

Factorization is a mathematical process used to gain insights into the attributes of data. When we apply factorization to large sets of market data — organized in rows and columns — we can uncover patterns and characteristics of the market. Factorization is a powerful tool, and this article will show how you can use it within the MetaTrader 5 terminal, through the MQL5 API, to gain more profound insights into your market data.

The MQL5 Standard Library Explorer (Part 5): Multiple Signal Expert

In this session, we will build a sophisticated, multi-signal Expert Advisor using the MQL5 Standard Library. This approach allows us to seamlessly blend built-in signals with our own custom logic, demonstrating how to construct a powerful and flexible trading algorithm. For more, click to read further.

Market Simulation (Part 06): Transferring Information from MetaTrader 5 to Excel

Many people, especially non=programmers, find it very difficult to transfer information between MetaTrader 5 and other programs. One such program is Excel. Many use Excel as a way to manage and maintain their risk control. It is an excellent program and easy to learn, even for those who are not VBA programmers. Here we will look at how to establish a connection between MetaTrader 5 and Excel (a very simple method).

Neural networks made easy (Part 78): Decoder-free Object Detector with Transformer (DFFT)

In this article, I propose to look at the issue of building a trading strategy from a different angle. We will not predict future price movements, but will try to build a trading system based on the analysis of historical data.

Population optimization algorithms: Binary Genetic Algorithm (BGA). Part II

In this article, we will look at the binary genetic algorithm (BGA), which models the natural processes that occur in the genetic material of living things in nature.

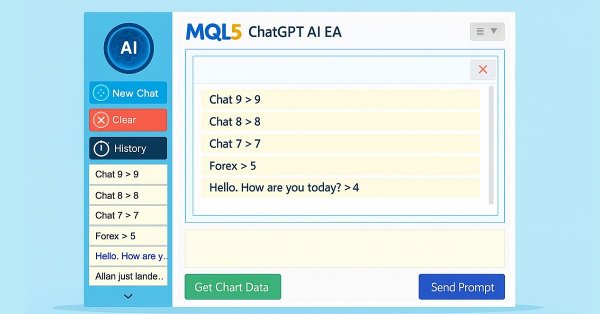

Building AI-Powered Trading Systems in MQL5 (Part 5): Adding a Collapsible Sidebar with Chat Popups

In Part 5 of our MQL5 AI trading system series, we enhance the ChatGPT-integrated Expert Advisor by introducing a collapsible sidebar, improving navigation with small and large history popups for seamless chat selection, while maintaining multiline input handling, persistent encrypted chat storage, and AI-driven trade signal generation from chart data.

Black Hole Algorithm (BHA)

The Black Hole Algorithm (BHA) uses the principles of black hole gravity to optimize solutions. In this article, we will look at how BHA attracts the best solutions while avoiding local extremes, and why this algorithm has become a powerful tool for solving complex problems. Learn how simple ideas can lead to impressive results in the world of optimization.

Category Theory in MQL5 (Part 5): Equalizers

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

Developing a multi-currency Expert Advisor (Part 6): Automating the selection of an instance group

After optimizing the trading strategy, we receive sets of parameters. We can use them to create several instances of trading strategies combined in one EA. Previously, we did this manually. Here we will try to automate this process.

Design Patterns in software development and MQL5 (Part 2): Structural Patterns

In this article, we will continue our articles about Design Patterns after learning how much this topic is more important for us as developers to develop extendable, reliable applications not only by the MQL5 programming language but others as well. We will learn about another type of Design Patterns which is the structural one to learn how to design systems by using what we have as classes to form larger structures.

Reimagining Classic Strategies (Part V): Multiple Symbol Analysis on USDZAR

In this series of articles, we revisit classical strategies to see if we can improve the strategy using AI. In today's article, we will examine a popular strategy of multiple symbol analysis using a basket of correlated securities, we will focus on the exotic USDZAR currency pair.

Price Action Analysis Toolkit Development (Part 8): Metrics Board

As one of the most powerful Price Action analysis toolkits, the Metrics Board is designed to streamline market analysis by instantly providing essential market metrics with just a click of a button. Each button serves a specific function, whether it’s analyzing high/low trends, volume, or other key indicators. This tool delivers accurate, real-time data when you need it most. Let’s dive deeper into its features in this article.

MQL5 Wizard Techniques you should know (Part 61): Using Patterns of ADX and CCI with Supervised Learning

The ADX Oscillator and CCI oscillator are trend following and momentum indicators that can be paired when developing an Expert Advisor. We look at how this can be systemized by using all the 3 main training modes of Machine Learning. Wizard Assembled Expert Advisors allow us to evaluate the patterns presented by these two indicators, and we start by looking at how Supervised-Learning can be applied with these Patterns.

Building MQL5-Like Trade Classes in Python for MetaTrader 5

MetaTrader 5 python package provides an easy way to build trading applications for the MetaTrader 5 platform in the Python language, while being a powerful and useful tool, this module isn't as easy as MQL5 programming language when it comes to making an algorithmic trading solution. In this article, we are going to build trade classes similar to the one offered in MQL5 to create a similar syntax and make it easier to make trading robots in Python as in MQL5.

DoEasy. Service functions (Part 1): Price patterns

In this article, we will start developing methods for searching for price patterns using timeseries data. A pattern has a certain set of parameters, common to any type of patterns. All data of this kind will be concentrated in the object class of the base abstract pattern. In the current article, we will create an abstract pattern class and a Pin Bar pattern class.

Neural Network in Practice: The First Neuron

In this article, we'll start building something simple and humble: a neuron. We will program it with a very small amount of MQL5 code. The neuron worked great in my tests. Let's go back a bit in this series of articles about neural networks to understand what I'm talking about.

Neural Networks in Trading: Lightweight Models for Time Series Forecasting

Lightweight time series forecasting models achieve high performance using a minimum number of parameters. This, in turn, reduces the consumption of computing resources and speeds up decision-making. Despite being lightweight, such models achieve forecast quality comparable to more complex ones.

Artificial Electric Field Algorithm (AEFA)

The article presents an artificial electric field algorithm (AEFA) inspired by Coulomb's law of electrostatic force. The algorithm simulates electrical phenomena to solve complex optimization problems using charged particles and their interactions. AEFA exhibits unique properties in the context of other algorithms related to laws of nature.

Market Simulation (Part 15): Sockets (IX)

In this article, we will discuss one of the possible solutions to what we have been trying to demonstrate—namely, how to allow an Excel user to perform an action in MetaTrader 5 without sending orders or opening or closing positions. The idea is that the user employs Excel to conduct fundamental analysis of a particular symbol. And by using only Excel, they can instruct an expert advisor running in MetaTrader 5 to open or close a specific position.

Category Theory in MQL5 (Part 22): A different look at Moving Averages

In this article we attempt to simplify our illustration of concepts covered in these series by dwelling on just one indicator, the most common and probably the easiest to understand. The moving average. In doing so we consider significance and possible applications of vertical natural transformations.