Interview with Tim Fass (ATC 2011)

A student from Germany Tim Fass (Tim) is participating in the Automated Trading Championship for the first time. Nevertheless, his Expert Advisor The_Wild_13 already got featured at the very top of the Championship rating and seems to be holding his position in the top ten. Tim told us about his Expert Advisor, his faith in the success of simple strategies and his wildest dreams.

Neural Networks in Trading: Using Language Models for Time Series Forecasting

We continue to study time series forecasting models. In this article, we get acquainted with a complex algorithm built on the use of a pre-trained language model.

Practicing the development of trading strategies

In this article, we will make an attempt to develop our own trading strategy. Any trading strategy must be based on some kind of statistical advantage. Moreover, this advantage should exist for a long time.

From Novice to Expert: Forex Market Periods

Every market period has a beginning and an end, each closing with a price that defines its sentiment—much like any candlestick session. Understanding these reference points allows us to gauge the prevailing market mood, revealing whether bullish or bearish forces are in control. In this discussion, we take an important step forward by developing a new feature within the Market Periods Synchronizer—one that visualizes Forex market sessions to support more informed trading decisions. This tool can be especially powerful for identifying, in real time, which side—bulls or bears—dominates the session. Let’s explore this concept and uncover the insights it offers.

MQL5 Wizard Techniques you should know (Part 19): Bayesian Inference

Bayesian inference is the adoption of Bayes Theorem to update probability hypothesis as new information is made available. This intuitively leans to adaptation in time series analysis, and so we have a look at how we could use this in building custom classes not just for the signal but also money-management and trailing-stops.

Developing a trading Expert Advisor from scratch (Part 26): Towards the future (I)

Today we will take our order system to the next level. But before that, we need to solve a few problems. Now we have some questions that are related to how we want to work and what things we do during the trading day.

MQL5 Wizard Techniques you should know (Part 46): Ichimoku

The Ichimuko Kinko Hyo is a renown Japanese indicator that serves as a trend identification system. We examine this, on a pattern by pattern basis, as has been the case in previous similar articles, and also assess its strategies & test reports with the help of the MQL5 wizard library classes and assembly.

Pure implementation of RSA encryption in MQL5

MQL5 lacks built-in asymmetric cryptography, making secure data exchange over insecure channels like HTTP difficult. This article presents a pure MQL5 implementation of RSA using PKCS#1 v1.5 padding, enabling safe transmission of AES session keys and small data blocks without external libraries. This approach provides HTTPS-like security over standard HTTP and even more, it fills an important gap in secure communication for MQL5 applications.

Building A Candlestick Trend Constraint Model (Part 5): Notification System (Part I)

We will breakdown the main MQL5 code into specified code snippets to illustrate the integration of Telegram and WhatsApp for receiving signal notifications from the Trend Constraint indicator we are creating in this article series. This will help traders, both novices and experienced developers, grasp the concept easily. First, we will cover the setup of MetaTrader 5 for notifications and its significance to the user. This will help developers in advance to take notes to further apply in their systems.

Building a Keltner Channel Indicator with Custom Canvas Graphics in MQL5

In this article, we build a Keltner Channel indicator with custom canvas graphics in MQL5. We detail the integration of moving averages, ATR calculations, and enhanced chart visualization. We also cover backtesting to evaluate the indicator’s performance for practical trading insights.

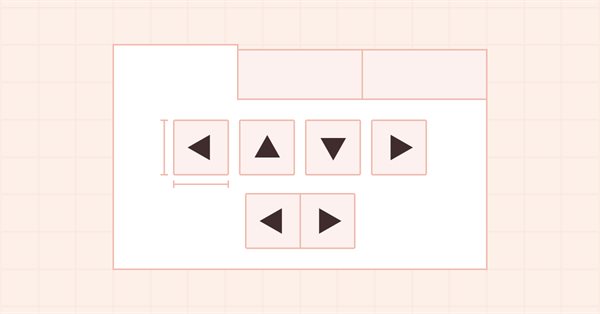

DoEasy. Controls (Part 17): Cropping invisible object parts, auxiliary arrow buttons WinForms objects

In this article, I will create the functionality for hiding object sections located beyond their containers. Besides, I will create auxiliary arrow button objects to be used as part of other WinForms objects.

Gain An Edge Over Any Market (Part II): Forecasting Technical Indicators

Did you know that we can gain more accuracy forecasting certain technical indicators than predicting the underlying price of a traded symbol? Join us to explore how to leverage this insight for better trading strategies.

Application of Nash's Game Theory with HMM Filtering in Trading

This article delves into the application of John Nash's game theory, specifically the Nash Equilibrium, in trading. It discusses how traders can utilize Python scripts and MetaTrader 5 to identify and exploit market inefficiencies using Nash's principles. The article provides a step-by-step guide on implementing these strategies, including the use of Hidden Markov Models (HMM) and statistical analysis, to enhance trading performance.

Price Action Analysis Toolkit Development (Part 14): Parabolic Stop and Reverse Tool

Embracing technical indicators in price action analysis is a powerful approach. These indicators often highlight key levels of reversals and retracements, offering valuable insights into market dynamics. In this article, we demonstrate how we developed an automated tool that generates signals using the Parabolic SAR indicator.

Developing a multi-currency Expert Advisor (Part 5): Variable position sizes

In the previous parts, the Expert Advisor (EA) under development was able to use only a fixed position size for trading. This is acceptable for testing, but is not advisable when trading on a real account. Let's make it possible to trade using variable position sizes.

Neural Networks in Trading: A Multi-Agent Self-Adaptive Model (Final Part)

In the previous article, we introduced the multi-agent self-adaptive framework MASA, which combines reinforcement learning approaches and self-adaptive strategies, providing a harmonious balance between profitability and risk in turbulent market conditions. We have built the functionality of individual agents within this framework. In this article, we will continue the work we started, bringing it to its logical conclusion.

Data Science and ML (Part 31): Using CatBoost AI Models for Trading

CatBoost AI models have gained massive popularity recently among machine learning communities due to their predictive accuracy, efficiency, and robustness to scattered and difficult datasets. In this article, we are going to discuss in detail how to implement these types of models in an attempt to beat the forex market.

Population optimization algorithms: Saplings Sowing and Growing up (SSG)

Saplings Sowing and Growing up (SSG) algorithm is inspired by one of the most resilient organisms on the planet demonstrating outstanding capability for survival in a wide variety of conditions.

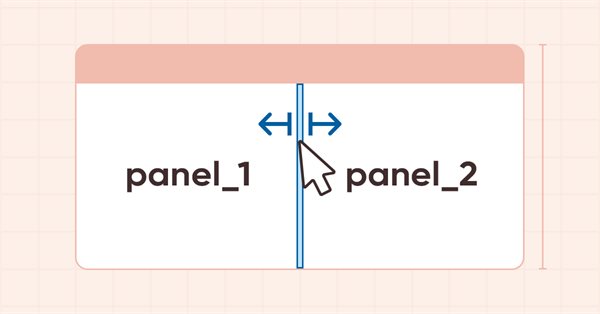

DoEasy. Controls (Part 24): Hint auxiliary WinForms object

In this article, I will revise the logic of specifying the base and main objects for all WinForms library objects, develop a new Hint base object and several of its derived classes to indicate the possible direction of moving the separator.

Trading Insights Through Volume: Moving Beyond OHLC Charts

Algorithmic trading system that combines volume analysis with machine learning techniques, specifically LSTM neural networks. Unlike traditional trading approaches that primarily focus on price movements, this system emphasizes volume patterns and their derivatives to predict market movements. The methodology incorporates three main components: volume derivatives analysis (first and second derivatives), LSTM predictions for volume patterns, and traditional technical indicators.

Neural Networks Made Easy (Part 93): Adaptive Forecasting in Frequency and Time Domains (Final Part)

In this article, we continue the implementation of the approaches of the ATFNet model, which adaptively combines the results of 2 blocks (frequency and time) within time series forecasting.

Developing a multi-currency Expert Advisor (Part 14): Adaptive volume change in risk manager

The previously developed risk manager contained only basic functionality. Let's try to consider possible ways of its development, allowing us to improve trading results without interfering with the logic of trading strategies.

Utilizing CatBoost Machine Learning model as a Filter for Trend-Following Strategies

CatBoost is a powerful tree-based machine learning model that specializes in decision-making based on stationary features. Other tree-based models like XGBoost and Random Forest share similar traits in terms of their robustness, ability to handle complex patterns, and interpretability. These models have a wide range of uses, from feature analysis to risk management. In this article, we're going to walk through the procedure of utilizing a trained CatBoost model as a filter for a classic moving average cross trend-following strategy.

Interview with Alexander Topchylo (ATC 2010)

Alexander Topchylo (Better) is the winner of the Automated Trading Championship 2007. Alexander is an expert in neural networks - his Expert Advisor based on a neural network was on top of best EAs of year 2007. In this interview Alexander tells us about his life after the Championships, his own business and new algorithms for trading systems.

Developing an MQTT client for MetaTrader 5: a TDD approach — Part 3

This article is the third part of a series describing our development steps of a native MQL5 client for the MQTT protocol. In this part, we describe in detail how we are using Test-Driven Development to implement the Operational Behavior part of the CONNECT/CONNACK packet exchange. At the end of this step, our client MUST be able to behave appropriately when dealing with any of the possible server outcomes from a connection attempt.

Neural Networks in Trading: Transformer with Relative Encoding

Self-supervised learning can be an effective way to analyze large amounts of unlabeled data. The efficiency is provided by the adaptation of models to the specific features of financial markets, which helps improve the effectiveness of traditional methods. This article introduces an alternative attention mechanism that takes into account the relative dependencies and relationships between inputs.

Interview with Andrea Zani (ATC 2011)

On the eleventh week of the Automated Trading Championship, Andrea Zani (sbraer) got featured very close to the top five of the competition. It is on the sixth place with about 47,000 USD now. Andrea's Expert Advisor AZXY has made only one losing deal, which was at the very beginning of the Championship. Since then, its equity curve has been steadily growing.

Category Theory in MQL5 (Part 2)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL5 community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that attracts comments and discussion while hopefully furthering the use of this remarkable field in Traders' strategy development.

Data Science and ML (Part 27): Convolutional Neural Networks (CNNs) in MetaTrader 5 Trading Bots — Are They Worth It?

Convolutional Neural Networks (CNNs) are renowned for their prowess in detecting patterns in images and videos, with applications spanning diverse fields. In this article, we explore the potential of CNNs to identify valuable patterns in financial markets and generate effective trading signals for MetaTrader 5 trading bots. Let us discover how this deep machine learning technique can be leveraged for smarter trading decisions.

DoEasy. Controls (Part 28): Bar styles in the ProgressBar control

In this article, I will develop display styles and description text for the progress bar of the ProgressBar control.

Reimagining Classic Strategies in Python: MA Crossovers

In this article, we revisit the classic moving average crossover strategy to assess its current effectiveness. Given the amount of time since its inception, we explore the potential enhancements that AI can bring to this traditional trading strategy. By incorporating AI techniques, we aim to leverage advanced predictive capabilities to potentially optimize trade entry and exit points, adapt to varying market conditions, and enhance overall performance compared to conventional approaches.

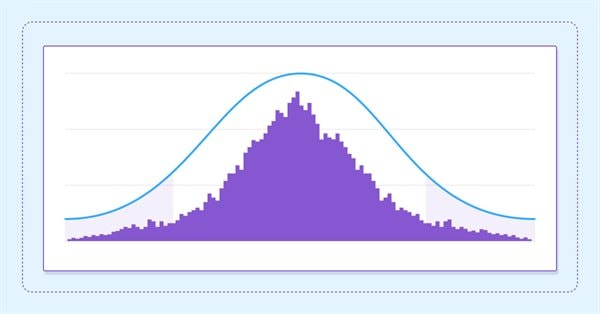

Estimate future performance with confidence intervals

In this article we delve into the application of boostrapping techniques as a means to estimate the future performance of an automated strategy.

Reimagining Classic Strategies (Part III): Forecasting Higher Highs And Lower Lows

In this series article, we will empirically analyze classic trading strategies to see if we can improve them using AI. In today's discussion, we tried to predict higher highs and lower lows using the Linear Discriminant Analysis model.

Using association rules in Forex data analysis

How to apply predictive rules of supermarket retail analytics to the real Forex market? How are purchases of cookies, milk and bread related to stock exchange transactions? The article discusses an innovative approach to algorithmic trading based on the use of association rules.

Quantization in machine learning (Part 1): Theory, sample code, analysis of implementation in CatBoost

The article considers the theoretical application of quantization in the construction of tree models and showcases the implemented quantization methods in CatBoost. No complex mathematical equations are used.

Population optimization algorithms: Nelder–Mead, or simplex search (NM) method

The article presents a complete exploration of the Nelder-Mead method, explaining how the simplex (function parameter space) is modified and rearranged at each iteration to achieve an optimal solution, and describes how the method can be improved.

Neural Networks Made Easy (Part 92): Adaptive Forecasting in Frequency and Time Domains

The authors of the FreDF method experimentally confirmed the advantage of combined forecasting in the frequency and time domains. However, the use of the weight hyperparameter is not optimal for non-stationary time series. In this article, we will get acquainted with the method of adaptive combination of forecasts in frequency and time domains.

Portfolio optimization in Forex: Synthesis of VaR and Markowitz theory

How does portfolio trading work on Forex? How can Markowitz portfolio theory for portfolio proportion optimization and VaR model for portfolio risk optimization be synthesized? We create a code based on portfolio theory, where, on the one hand, we will get low risk, and on the other, acceptable long-term profitability.

Alexander Anufrenko: "A danger foreseen is half avoided" (ATC 2010)

The risky development of Alexander Anufrenko (Anufrenko321) had been featured among the top three of the Championship for three weeks. Having suffered a catastrophic Stop Loss last week, his Expert Advisor lost about $60,000, but now once again he is approaching the leaders. In this interview the author of this interesting EA is describing the operating principles and characteristics of his application.

Creating a Trading Administrator Panel in MQL5 (Part VIII): Analytics Panel

Today, we delve into incorporating useful trading metrics within a specialized window integrated into the Admin Panel EA. This discussion focuses on the implementation of MQL5 to develop an Analytics Panel and highlights the value of the data it provides to trading administrators. The impact is largely educational, as valuable lessons are drawn from the development process, benefiting both upcoming and experienced developers. This feature demonstrates the limitless opportunities this development series offers in equipping trade managers with advanced software tools. Additionally, we'll explore the implementation of the PieChart and ChartCanvas classes as part of the continued expansion of the Trading Administrator panel’s capabilities.