Neural Networks in Trading: Memory Augmented Context-Aware Learning for Cryptocurrency Markets (Final Part)

The MacroHFT framework for high-frequency cryptocurrency trading uses context-aware reinforcement learning and memory to adapt to dynamic market conditions. At the end of this article, we will test the implemented approaches on real historical data to assess their effectiveness.

The MQL5 Standard Library Explorer (Part 2): Connecting Library Components

Today, we take an important step toward helping every developer understand how to read class structures and quickly build Expert Advisors using the MQL5 Standard Library. The library is rich and expandable, yet it can feel like being handed a complex toolkit without a manual. Here we share and discuss an alternative integration routine—a concise, repeatable workflow that shows how to connect classes reliably in real projects.

Overcoming The Limitation of Machine Learning (Part 2): Lack of Reproducibility

The article explores why trading results can differ significantly between brokers, even when using the same strategy and financial symbol, due to decentralized pricing and data discrepancies. The piece helps MQL5 developers understand why their products may receive mixed reviews on the MQL5 Marketplace, and urges developers to tailor their approaches to specific brokers to ensure transparent and reproducible outcomes. This could grow to become an important domain-bound best practice that will serve our community well if the practice were to be widely adopted.

MQL5 Wizard Techniques you should know (Part 68): Using Patterns of TRIX and the Williams Percent Range with a Cosine Kernel Network

We follow up our last article, where we introduced the indicator pair of TRIX and Williams Percent Range, by considering how this indicator pairing could be extended with Machine Learning. TRIX and William’s Percent are a trend and support/ resistance complimentary pairing. Our machine learning approach uses a convolution neural network that engages the cosine kernel in its architecture when fine-tuning the forecasts of this indicator pairing. As always, this is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

Neural Networks in Trading: Hierarchical Dual-Tower Transformer (Final Part)

We continue to build the Hidformer hierarchical dual-tower transformer model designed for analyzing and forecasting complex multivariate time series. In this article, we will bring the work we started earlier to its logical conclusion — we will test the model on real historical data.

From Novice to Expert: Market Periods Synchronizer

In this discussion, we introduce a Higher-to-Lower Timeframe Synchronizer tool designed to solve the problem of analyzing market patterns that span across higher timeframe periods. The built-in period markers in MetaTrader 5 are often limited, rigid, and not easily customizable for non-standard timeframes. Our solution leverages the MQL5 language to develop an indicator that provides a dynamic and visual way to align higher timeframe structures within lower timeframe charts. This tool can be highly valuable for detailed market analysis. To learn more about its features and implementation, I invite you to join the discussion.

Data Science and ML (Part 44): Forex OHLC Time series Forecasting using Vector Autoregression (VAR)

Explore how Vector Autoregression (VAR) models can forecast Forex OHLC (Open, High, Low, and Close) time series data. This article covers VAR implementation, model training, and real-time forecasting in MetaTrader 5, helping traders analyze interdependent currency movements and improve their trading strategies.

MQL5 Wizard Techniques you should know (Part 52): Accelerator Oscillator

The Accelerator Oscillator is another Bill Williams Indicator that tracks price momentum's acceleration and not just its pace. Although much like the Awesome oscillator we reviewed in a recent article, it seeks to avoid the lagging effects by focusing more on acceleration as opposed to just speed. We examine as always what patterns we can get from this and also what significance each could have in trading via a wizard assembled Expert Advisor.

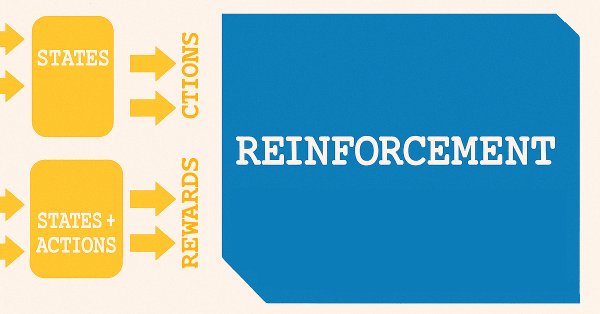

MQL5 Wizard Techniques you should know (Part 47): Reinforcement Learning with Temporal Difference

Temporal Difference is another algorithm in reinforcement learning that updates Q-Values basing on the difference between predicted and actual rewards during agent training. It specifically dwells on updating Q-Values without minding their state-action pairing. We therefore look to see how to apply this, as we have with previous articles, in a wizard assembled Expert Advisor.

MQL5 Wizard Techniques you should know (Part 85): Using Patterns of Stochastic-Oscillator and the FrAMA with Beta VAE Inference Learning

This piece follows up ‘Part-84’, where we introduced the pairing of Stochastic and the Fractal Adaptive Moving Average. We now shift focus to Inference Learning, where we look to see if laggard patterns in the last article could have their fortunes turned around. The Stochastic and FrAMA are a momentum-trend complimentary pairing. For our inference learning, we are revisiting the Beta algorithm of a Variational Auto Encoder. We also, as always, do the implementation of a custom signal class designed for integration with the MQL5 Wizard.

Introduction to MQL5 (Part 28): Mastering API and WebRequest Function in MQL5 (II)

This article teaches you how to retrieve and extract price data from external platforms using APIs and the WebRequest function in MQL5. You’ll learn how URLs are structured, how API responses are formatted, how to convert server data into readable strings, and how to identify and extract specific values from JSON responses.

Neural Networks in Trading: Reducing Memory Consumption with Adam-mini Optimization

One of the directions for increasing the efficiency of the model training and convergence process is the improvement of optimization methods. Adam-mini is an adaptive optimization method designed to improve on the basic Adam algorithm.

MQL5 Wizard Techniques you should know (Part 33): Gaussian Process Kernels

Gaussian Process Kernels are the covariance function of the Normal Distribution that could play a role in forecasting. We explore this unique algorithm in a custom signal class of MQL5 to see if it could be put to use as a prime entry and exit signal.

MQL5 Wizard Techniques you should know (Part 54): Reinforcement Learning with hybrid SAC and Tensors

Soft Actor Critic is a Reinforcement Learning algorithm that we looked at in a previous article, where we also introduced python and ONNX to these series as efficient approaches to training networks. We revisit the algorithm with the aim of exploiting tensors, computational graphs that are often exploited in Python.

MQL5 Wizard Techniques you should know (Part 20): Symbolic Regression

Symbolic Regression is a form of regression that starts with minimal to no assumptions on what the underlying model that maps the sets of data under study would look like. Even though it can be implemented by Bayesian Methods or Neural Networks, we look at how an implementation with Genetic Algorithms can help customize an expert signal class usable in the MQL5 wizard.

Population optimization algorithms: Artificial Multi-Social Search Objects (MSO)

This is a continuation of the previous article considering the idea of social groups. The article explores the evolution of social groups using movement and memory algorithms. The results will help to understand the evolution of social systems and apply them in optimization and search for solutions.

Neural networks made easy (Part 63): Unsupervised Pretraining for Decision Transformer (PDT)

We continue to discuss the family of Decision Transformer methods. From previous article, we have already noticed that training the transformer underlying the architecture of these methods is a rather complex task and requires a large labeled dataset for training. In this article we will look at an algorithm for using unlabeled trajectories for preliminary model training.

MQL5 Wizard Techniques you should know (Part 60): Inference Learning (Wasserstein-VAE) with Moving Average and Stochastic Oscillator Patterns

We wrap our look into the complementary pairing of the MA & Stochastic oscillator by examining what role inference-learning can play in a post supervised-learning & reinforcement-learning situation. There are clearly a multitude of ways one can choose to go about inference learning in this case, our approach, however, is to use variational auto encoders. We explore this in python before exporting our trained model by ONNX for use in a wizard assembled Expert Advisor in MetaTrader.

Optimizing Trend Strength: Trading in Trend Direction and Strength

This is a specialized trend-following EA that makes both short and long-term analyses, trading decisions, and executions based on the overall trend and its strength. This article will explore in detail an EA that is specifically designed for traders who are patient, disciplined, and focused enough to only execute trades and hold their positions only when trading with strength and in the trend direction without changing their bias frequently, especially against the trend, until take-profit targets are hit.

News Trading Made Easy (Part 4): Performance Enhancement

This article will dive into methods to improve the expert's runtime in the strategy tester, the code will be written to divide news event times into hourly categories. These news event times will be accessed within their specified hour. This ensures that the EA can efficiently manage event-driven trades in both high and low-volatility environments.

Optimizing Liquidity Raids: Mastering the Difference Between Liquidity Raids and Market Structure Shifts

This is an article about a specialized trend-following EA that aims to clearly elaborate how to utilize trading setups after liquidity raids. This article will explore in detail an EA that is specifically designed for traders who are keen on optimizing and utilizing liquidity raids and purges as entry criteria for their trades and trading decisions. It will also explore how to correctly differentiate between liquidity raids and market structure shifts and how to validate and utilize each of them when they occur, thus trying to mitigate losses that occur from traders confusing the two.

Developing a Replay System (Part 30): Expert Advisor project — C_Mouse class (IV)

Today we will learn a technique that can help us a lot in different stages of our professional life as a programmer. Often it is not the platform itself that is limited, but the knowledge of the person who talks about the limitations. This article will tell you that with common sense and creativity you can make the MetaTrader 5 platform much more interesting and versatile without resorting to creating crazy programs or anything like that, and create simple yet safe and reliable code. We will use our creativity to modify existing code without deleting or adding a single line to the source code.

MQL5 Wizard Techniques you should know (Part 35): Support Vector Regression

Support Vector Regression is an idealistic way of finding a function or ‘hyper-plane’ that best describes the relationship between two sets of data. We attempt to exploit this in time series forecasting within custom classes of the MQL5 wizard.

Neural Networks in Trading: Multi-Task Learning Based on the ResNeXt Model (Final Part)

We continue exploring a multi-task learning framework based on ResNeXt, which is characterized by modularity, high computational efficiency, and the ability to identify stable patterns in data. Using a single encoder and specialized "heads" reduces the risk of model overfitting and improves the quality of forecasts.

MQL5 Wizard Techniques you should know (Part 40): Parabolic SAR

The Parabolic Stop-and-Reversal (SAR) is an indicator for trend confirmation and trend termination points. Because it is a laggard in identifying trends its primary purpose has been in positioning trailing stop losses on open positions. We, however, explore if indeed it could be used as an Expert Advisor signal, thanks to custom signal classes of wizard assembled Expert Advisors.

MQL5 Wizard Techniques you should know (Part 81): Using Patterns of Ichimoku and the ADX-Wilder with Beta VAE Inference Learning

This piece follows up ‘Part-80’, where we examined the pairing of Ichimoku and the ADX under a Reinforcement Learning framework. We now shift focus to Inference Learning. Ichimoku and ADX are complimentary as already covered, however we are going to revisit the conclusions of the last article related to pipeline use. For our inference learning, we are using the Beta algorithm of a Variational Auto Encoder. We also stick with the implementation of a custom signal class designed for integration with the MQL5 Wizard.

MQL5 Wizard Techniques you should know (Part 10). The Unconventional RBM

Restrictive Boltzmann Machines are at the basic level, a two-layer neural network that is proficient at unsupervised classification through dimensionality reduction. We take its basic principles and examine if we were to re-design and train it unorthodoxly, we could get a useful signal filter.

Neural Networks in Trading: Two-Dimensional Connection Space Models (Chimera)

In this article, we will explore the innovative Chimera framework: a two-dimensional state-space model that uses neural networks to analyze multivariate time series. This method offers high accuracy with low computational cost, outperforming traditional approaches and Transformer architectures.

Neural networks made easy (Part 70): Closed-Form Policy Improvement Operators (CFPI)

In this article, we will get acquainted with an algorithm that uses closed-form policy improvement operators to optimize Agent actions in offline mode.

Neural networks made easy (Part 77): Cross-Covariance Transformer (XCiT)

In our models, we often use various attention algorithms. And, probably, most often we use Transformers. Their main disadvantage is the resource requirement. In this article, we will consider a new algorithm that can help reduce computing costs without losing quality.

MQL5 Trading Tools (Part 14): Pixel-Perfect Scrollable Text Canvas with Antialiasing and Rounded Scrollbar

In this article, we enhance the canvas-based price dashboard in MQL5 by adding a pixel-perfect scrollable text panel for usage guides, overcoming native scrolling limitations through custom antialiasing and a rounded scrollbar design with hover-expand functionality. The text panel supports themed backgrounds with opacity, dynamic line wrapping for content like instructions and contacts, and interactive navigation via up/down buttons, slider dragging, and mouse wheel scrolling within the body area.

MQL5 Wizard Techniques you should know (Part 23): CNNs

Convolutional Neural Networks are another machine learning algorithm that tend to specialize in decomposing multi-dimensioned data sets into key constituent parts. We look at how this is typically achieved and explore a possible application for traders in another MQL5 wizard signal class.

Using the MQL5 Economic Calendar for News Filtering (Part 1): Implementing Pre- and Post-News Windows in MQL5

We build a calendar‑driven news filter entirely in MQL5, avoiding web requests and external DLLs. Part 1 covers loading and caching events, mapping them to symbols by currency, filtering by impact level, defining pre/post windows, and blocking new trades during active news, with optional pre‑news position closure. The result is a configurable, prop‑firm‑friendly control that reduces false pauses and protects entries during volatility.

The MQL5 Standard Library Explorer (Part 8) : The Hybrid Trades Journal Logging with CFile

In this article, we explore the File Operations classes of the MQL5 Standard Library to build a robust reporting module that automatically generates Excel-ready CSV files. Along the way, we clearly distinguish between manually executed trades and algorithmically executed orders, laying the groundwork for reliable, auditable trade reporting.

Neural networks made easy (Part 69): Density-based support constraint for the behavioral policy (SPOT)

In offline learning, we use a fixed dataset, which limits the coverage of environmental diversity. During the learning process, our Agent can generate actions beyond this dataset. If there is no feedback from the environment, how can we be sure that the assessments of such actions are correct? Maintaining the Agent's policy within the training dataset becomes an important aspect to ensure the reliability of training. This is what we will talk about in this article.

Neural Networks in Trading: Hyperbolic Latent Diffusion Model (HypDiff)

The article considers methods of encoding initial data in hyperbolic latent space through anisotropic diffusion processes. This helps to more accurately preserve the topological characteristics of the current market situation and improves the quality of its analysis.

Introduction to MQL5 (Part 33): Mastering API and WebRequest Function in MQL5 (VII)

This article demonstrates how to integrate the Google Generative AI API with MetaTrader 5 using MQL5. You will learn how to structure API requests, handle server responses, extract AI-generated content, manage rate limits, and save the results to a text file for easy access.

Overcoming The Limitation of Machine Learning (Part 8): Nonparametric Strategy Selection

This article shows how to configure a black-box model to automatically uncover strong trading strategies using a data-driven approach. By using Mutual Information to prioritize the most learnable signals, we can build smarter and more adaptive models that outperform conventional methods. Readers will also learn to avoid common pitfalls like overreliance on surface-level metrics, and instead develop strategies rooted in meaningful statistical insight.

MQL5 Trading Tools (Part 16): Improved Super-Sampling Anti-Aliasing (SSAA) and High-Resolution Rendering

We add supersampling‑driven anti‑aliasing and high‑resolution rendering to the MQL5 canvas dashboard, then downsample to the target size. The article implements rounded rectangle fills and borders, rounded triangle arrows, and a custom scrollbar with theming for the stats and text panels. These tools help you build smoother, more legible UI components in MetaTrader 5.

Price-Driven CGI Model: Advanced Data Post-Processing and Implementation

In this article, we will explore the development of a fully customizable Price Data export script using MQL5, marking new advancements in the simulation of the Price Man CGI Model. We have implemented advanced refinement techniques to ensure that the data is user-friendly and optimized for animation purposes. Additionally, we will uncover the capabilities of Blender 3D in effectively working with and visualizing price data, demonstrating its potential for creating dynamic and engaging animations.