MQL5 Wizard Techniques you should know (Part 12): Newton Polynomial

Newton’s polynomial, which creates quadratic equations from a set of a few points, is an archaic but interesting approach at looking at a time series. In this article we try to explore what aspects could be of use to traders from this approach as well as address its limitations.

Reimagining Classic Strategies (Part 14): Multiple Strategy Analysis

In this article, we continue our exploration of building an ensemble of trading strategies and using the MT5 genetic optimizer to tune the strategy parameters. Today, we analyzed the data in Python, showing our model could better predict which strategy would outperform, achieving higher accuracy than forecasting market returns directly. However, when we tested our application with its statistical models, our performance levels fell dismally. We subsequently discovered that the genetic optimizer unfortunately favored highly correlated strategies, prompting us to revise our method to keep vote weights fixed and focus optimization on indicator settings instead.

MQL5 Wizard Techniques you should know (Part 74): Using Patterns of Ichimoku and the ADX-Wilder with Supervised Learning

We follow up on our last article, where we introduced the indicator pair of the Ichimoku and the ADX, by looking at how this duo could be improved with Supervised Learning. Ichimoku and ADX are a support/resistance plus trend complimentary pairing. Our supervised learning approach uses a neural network that engages the Deep Spectral Mixture Kernel to fine tune the forecasts of this indicator pairing. As per usual, this is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

The MQL5 Standard Library Explorer (Part 4): Custom Signal Library

Today, we use the MQL5 Standard Library to build custom signal classes and let the MQL5 Wizard assemble a professional Expert Advisor for us. This approach simplifies development so that even beginner programmers can create robust EAs without in-depth coding knowledge, focusing instead on tuning inputs and optimizing performance. Join this discussion as we explore the process step by step.

MQL5 Wizard Techniques you should know (Part 62): Using Patterns of ADX and CCI with Reinforcement-Learning TRPO

The ADX Oscillator and CCI oscillator are trend following and momentum indicators that can be paired when developing an Expert Advisor. We continue where we left off in the last article by examining how in-use training, and updating of our developed model, can be made thanks to reinforcement-learning. We are using an algorithm we are yet to cover in these series, known as Trusted Region Policy Optimization. And, as always, Expert Advisor assembly by the MQL5 Wizard allows us to set up our model(s) for testing much quicker and also in a way where it can be distributed and tested with different signal types.

The case for using a Composite Data Set this Q4 in weighing SPDR XLY's next performance

We consider XLY, SPDR’s consumer discretionary spending ETF and see if with tools in MetaTrader’s IDE we can sift through an array of data sets in selecting what could work with a forecasting model with a forward outlook of not more than a year.

Sending Messages from MQL5 to Discord, Creating a Discord-MetaTrader 5 Bot

Similar to Telegram, Discord is capable of receiving information and messages in JSON format using it's communication API's, In this article, we are going to explore how you can use discord API's to send trading signals and updates from MetaTrader 5 to your Discord trading community.

Creating Dynamic MQL5 Graphical Interfaces through Resource-Driven Image Scaling with Bicubic Interpolation on Trading Charts

In this article, we explore dynamic MQL5 graphical interfaces, using bicubic interpolation for high-quality image scaling on trading charts. We detail flexible positioning options, enabling dynamic centering or corner anchoring with custom offsets.

MQL5 Wizard Techniques you should know (Part 34): Price-Embedding with an Unconventional RBM

Restricted Boltzmann Machines are a form of neural network that was developed in the mid 1980s at a time when compute resources were prohibitively expensive. At its onset, it relied on Gibbs Sampling and Contrastive Divergence in order to reduce dimensionality or capture the hidden probabilities/properties over input training data sets. We examine how Backpropagation can perform similarly when the RBM ‘embeds’ prices for a forecasting Multi-Layer-Perceptron.

Neural networks made easy (Part 61): Optimism issue in offline reinforcement learning

During the offline learning, we optimize the Agent's policy based on the training sample data. The resulting strategy gives the Agent confidence in its actions. However, such optimism is not always justified and can cause increased risks during the model operation. Today we will look at one of the methods to reduce these risks.

Self Optimizing Expert Advisors in MQL5 (Part 8): Multiple Strategy Analysis (3) — Weighted Voting Policy

This article explores how determining the optimal number of strategies in an ensemble can be a complex task that is easier to solve through the use of the MetaTrader 5 genetic optimizer. The MQL5 Cloud is also employed as a key resource for accelerating backtesting and optimization. All in all, our discussion here sets the stage for developing statistical models to evaluate and improve trading strategies based on our initial ensemble results.

Developing a multi-currency Expert Advisor (Part 24): Adding a new strategy (II)

In this article, we will continue to connect the new strategy to the created auto optimization system. Let's look at what changes need to be made to the optimization project creation EA, as well as the second and third stage EAs.

Neural Networks in Trading: Exploring the Local Structure of Data

Effective identification and preservation of the local structure of market data in noisy conditions is a critical task in trading. The use of the Self-Attention mechanism has shown promising results in processing such data; however, the classical approach does not account for the local characteristics of the underlying structure. In this article, I introduce an algorithm capable of incorporating these structural dependencies.

MQL5 Wizard Techniques you should know (Part 32): Regularization

Regularization is a form of penalizing the loss function in proportion to the discrete weighting applied throughout the various layers of a neural network. We look at the significance, for some of the various regularization forms, this can have in test runs with a wizard assembled Expert Advisor.

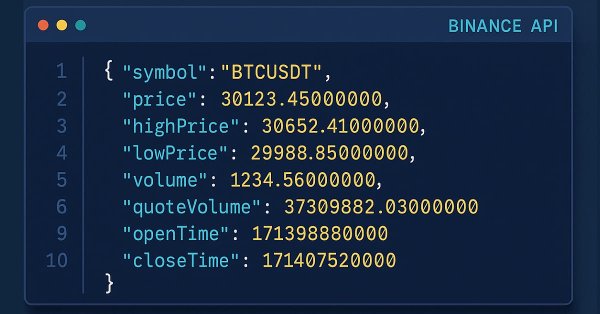

Introduction to MQL5 (Part 31): Mastering API and WebRequest Function in MQL5 (V)

Learn how to use WebRequest and external API calls to retrieve recent candle data, convert each value into a usable type, and save the information neatly in a table format. This step lays the groundwork for building an indicator that visualizes the data in candle format.

Neural Networks in Trading: Injection of Global Information into Independent Channels (InjectTST)

Most modern multimodal time series forecasting methods use the independent channels approach. This ignores the natural dependence of different channels of the same time series. Smart use of two approaches (independent and mixed channels) is the key to improving the performance of the models.

Data Science and ML (Part 45): Forex Time series forecasting using PROPHET by Facebook Model

The Prophet model, developed by Facebook, is a robust time series forecasting tool designed to capture trends, seasonality, and holiday effects with minimal manual tuning. It has been widely adopted for demand forecasting and business planning. In this article, we explore the effectiveness of Prophet in forecasting volatility in forex instruments, showcasing how it can be applied beyond traditional business use cases.

Neural Networks in Trading: Point Cloud Analysis (PointNet)

Direct point cloud analysis avoids unnecessary data growth and improves the performance of models in classification and segmentation tasks. Such approaches demonstrate high performance and robustness to perturbations in the original data.

MQL5 Wizard Techniques you should know (Part 82): Using Patterns of TRIX and the WPR with DQN Reinforcement Learning

In the last article, we examined the pairing of Ichimoku and the ADX under an Inference Learning framework. For this piece we revisit, Reinforcement Learning when used with an indicator pairing we considered last in ‘Part 68’. The TRIX and Williams Percent Range. Our algorithm for this review will be the Quantile Regression DQN. As usual, we present this as a custom signal class designed for implementation with the MQL5 Wizard.

Developing a Replay System (Part 29): Expert Advisor project — C_Mouse class (III)

After improving the C_Mouse class, we can focus on creating a class designed to create a completely new framework fr our analysis. We will not use inheritance or polymorphism to create this new class. Instead, we will change, or better said, add new objects to the price line. That's what we will do in this article. In the next one, we will look at how to change the analysis. All this will be done without changing the code of the C_Mouse class. Well, actually, it would be easier to achieve this using inheritance or polymorphism. However, there are other methods to achieve the same result.

MQL5 Wizard Techniques you should know (Part 76): Using Patterns of Awesome Oscillator and the Envelope Channels with Supervised Learning

We follow up on our last article, where we introduced the indicator couple of the Awesome-Oscillator and the Envelope Channel, by looking at how this pairing could be enhanced with Supervised Learning. The Awesome-Oscillator and Envelope-Channel are a trend-spotting and support/resistance complimentary mix. Our supervised learning approach is a CNN that engages the Dot Product Kernel with Cross-Time-Attention to size its kernels and channels. As per usual, this is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

MQL5 Trading Tools (Part 12): Enhancing the Correlation Matrix Dashboard with Interactivity

In this article, we enhance the correlation matrix dashboard in MQL5 with interactive features like panel dragging, minimizing/maximizing, hover effects on buttons and timeframes, and mouse event handling for improved user experience. We add sorting of symbols by average correlation strength in ascending/descending modes, toggle between correlation and p-value views, and incorporate light/dark theme switching with dynamic color updates.

HTTP and Connexus (Part 2): Understanding HTTP Architecture and Library Design

This article explores the fundamentals of the HTTP protocol, covering the main methods (GET, POST, PUT, DELETE), status codes and the structure of URLs. In addition, it presents the beginning of the construction of the Conexus library with the CQueryParam and CURL classes, which facilitate the manipulation of URLs and query parameters in HTTP requests.

Neural Networks in Trading: Transformer for the Point Cloud (Pointformer)

In this article, we will talk about algorithms for using attention methods in solving problems of detecting objects in a point cloud. Object detection in point clouds is important for many real-world applications.

Neural Networks in Trading: A Hybrid Trading Framework with Predictive Coding (Final Part)

We continue our examination of the StockFormer hybrid trading system, which combines predictive coding and reinforcement learning algorithms for financial time series analysis. The system is based on three Transformer branches with a Diversified Multi-Head Attention (DMH-Attn) mechanism that enables the capturing of complex patterns and interdependencies between assets. Previously, we got acquainted with the theoretical aspects of the framework and implemented the DMH-Attn mechanisms. Today, we will talk about the model architecture and training.

MQL5 Wizard Techniques you should know (Part 55): SAC with Prioritized Experience Replay

Replay buffers in Reinforcement Learning are particularly important with off-policy algorithms like DQN or SAC. This then puts the spotlight on the sampling process of this memory-buffer. While default options with SAC, for instance, use random selection from this buffer, Prioritized Experience Replay buffers fine tune this by sampling from the buffer based on a TD-score. We review the importance of Reinforcement Learning, and, as always, examine just this hypothesis (not the cross-validation) in a wizard assembled Expert Advisor.

Data Science and ML (Part 36): Dealing with Biased Financial Markets

Financial markets are not perfectly balanced. Some markets are bullish, some are bearish, and some exhibit some ranging behaviors indicating uncertainty in either direction, this unbalanced information when used to train machine learning models can be misleading as the markets change frequently. In this article, we are going to discuss several ways to tackle this issue.

Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention

We invite you to explore a framework that combines wavelet transforms and a multi-task self-attention model, aimed at improving the responsiveness and accuracy of forecasting in volatile market conditions. The wavelet transform allows asset returns to be decomposed into high and low frequencies, carefully capturing long-term market trends and short-term fluctuations.

Formulating Dynamic Multi-Pair EA (Part 6): Adaptive Spread Sensitivity for High-Frequency Symbol Switching

In this part, we will focus on designing an intelligent execution layer that continuously monitors and evaluates real-time spread conditions across multiple symbols. The EA dynamically adapts its symbol selection by enabling or disabling trading based on spread efficiency rather than fixed rules. This approach allows high-frequency multi-pair systems to prioritize cost-effective symbols.

Category Theory in MQL5 (Part 17): Functors and Monoids

This article, the final in our series to tackle functors as a subject, revisits monoids as a category. Monoids which we have already introduced in these series are used here to aid in position sizing, together with multi-layer perceptrons.

Neural networks are easy (Part 59): Dichotomy of Control (DoC)

In the previous article, we got acquainted with the Decision Transformer. But the complex stochastic environment of the foreign exchange market did not allow us to fully implement the potential of the presented method. In this article, I will introduce an algorithm that is aimed at improving the performance of algorithms in stochastic environments.

Developing a multi-currency Expert Advisor (Part 23): Putting in order the conveyor of automatic project optimization stages (II)

We aim to create a system for automatic periodic optimization of trading strategies used in one final EA. As the system evolves, it becomes increasingly complex, so it is necessary to look at it as a whole from time to time in order to identify bottlenecks and suboptimal solutions.

MQL5 Wizard Techniques you should know (Part 39): Relative Strength Index

The RSI is a popular momentum oscillator that measures pace and size of a security’s recent price change to evaluate over-and-under valued situations in the security’s price. These insights in speed and magnitude are key in defining reversal points. We put this oscillator to work in another custom signal class and examine the traits of some of its signals. We start, though, by wrapping up what we started previously on Bollinger Bands.

MQL5 Wizard Techniques you should know (Part 63): Using Patterns of DeMarker and Envelope Channels

The DeMarker Oscillator and the Envelope indicator are momentum and support/resistance tools that can be paired when developing an Expert Advisor. We therefore examine on a pattern by pattern basis what could be of use and what potentially avoid. We are using, as always, a wizard assembled Expert Advisor together with the Patterns-Usage functions that are built into the Expert Signal Class.

Neural Networks in Trading: Piecewise Linear Representation of Time Series

This article is somewhat different from my earlier publications. In this article, we will talk about an alternative representation of time series. Piecewise linear representation of time series is a method of approximating a time series using linear functions over small intervals.

MQL5 Wizard Techniques you should know (Part 45): Reinforcement Learning with Monte-Carlo

Monte-Carlo is the fourth different algorithm in reinforcement learning that we are considering with the aim of exploring its implementation in wizard assembled Expert Advisors. Though anchored in random sampling, it does present vast ways of simulation which we can look to exploit.

MQL5 Wizard Techniques you should know (Part 63): Using Patterns of DeMarker and Envelope Channels

The DeMarker Oscillator and the Envelope indicator are momentum and support/resistance tools that can be paired when developing an Expert Advisor. We therefore examine on a pattern by pattern basis what could be of use and what potentially avoid. We are using, as always, a wizard assembled Expert Advisor together with the Patterns-Usage functions that are built into the Expert Signal Class.

Introduction to MQL5 (Part 30): Mastering API and WebRequest Function in MQL5 (IV)

Discover a step-by-step tutorial that simplifies the extraction, conversion, and organization of candle data from API responses within the MQL5 environment. This guide is perfect for newcomers looking to enhance their coding skills and develop robust strategies for managing market data efficiently.

Requesting in Connexus (Part 6): Creating an HTTP Request and Response

In this sixth article of the Connexus library series, we will focus on a complete HTTP request, covering each component that makes up a request. We will create a class that represents the request as a whole, which will help us bring together the previously created classes.

Creating a Trading Administrator Panel in MQL5 (Part XI): Modern feature communications interface (I)

Today, we are focusing on the enhancement of the Communications Panel messaging interface to align with the standards of modern, high-performing communication applications. This improvement will be achieved by updating the CommunicationsDialog class. Join us in this article and discussion as we explore key insights and outline the next steps in advancing interface programming using MQL5.