Neural networks made easy (Part 38): Self-Supervised Exploration via Disagreement

One of the key problems within reinforcement learning is environmental exploration. Previously, we have already seen the research method based on Intrinsic Curiosity. Today I propose to look at another algorithm: Exploration via Disagreement.

Neural networks made easy (Part 50): Soft Actor-Critic (model optimization)

In the previous article, we implemented the Soft Actor-Critic algorithm, but were unable to train a profitable model. Here we will optimize the previously created model to obtain the desired results.

Neural Networks in Trading: Hierarchical Vector Transformer (HiVT)

We invite you to get acquainted with the Hierarchical Vector Transformer (HiVT) method, which was developed for fast and accurate forecasting of multimodal time series.

Neural networks made easy (Part 43): Mastering skills without the reward function

The problem of reinforcement learning lies in the need to define a reward function. It can be complex or difficult to formalize. To address this problem, activity-based and environment-based approaches are being explored to learn skills without an explicit reward function.

Neural networks made easy (Part 48): Methods for reducing overestimation of Q-function values

In the previous article, we introduced the DDPG method, which allows training models in a continuous action space. However, like other Q-learning methods, DDPG is prone to overestimating Q-function values. This problem often results in training an agent with a suboptimal strategy. In this article, we will look at some approaches to overcome the mentioned issue.

Do Traders Need Services From Developers?

Algorithmic trading becomes more popular and needed, which naturally led to a demand for exotic algorithms and unusual tasks. To some extent, such complex applications are available in the Code Base or in the Market. Although traders have simple access to those apps in a couple of clicks, these apps may not satisfy all needs in full. In this case, traders look for developers who can write a desired application in the MQL5 Freelance section and assign an order.

Robustness Testing on Expert Advisors

In strategy development, there are many intricate details to consider, many of which are not highlighted for beginner traders. As a result, many traders, myself included, have had to learn these lessons the hard way. This article is based on my observations of common pitfalls that most beginner traders encounter when developing strategies on MQL5. It will offer a range of tips, tricks, and examples to help identify the disqualification of an EA and test the robustness of our own EAs in an easy-to-implement way. The goal is to educate readers, helping them avoid future scams when purchasing EAs as well as preventing mistakes in their own strategy development.

MQL5 Wizard Techniques you should know (Part 78): Gator and AD Oscillator Strategies for Market Resilience

The article presents the second half of a structured approach to trading with the Gator Oscillator and Accumulation/Distribution. By introducing five new patterns, the author shows how to filter false moves, detect early reversals, and align signals across timeframes. With clear coding examples and performance tests, the material bridges theory and practice for MQL5 developers.

Price Action Analysis Toolkit Development (Part 15): Introducing Quarters Theory (I) — Quarters Drawer Script

Points of support and resistance are critical levels that signal potential trend reversals and continuations. Although identifying these levels can be challenging, once you pinpoint them, you’re well-prepared to navigate the market. For further assistance, check out the Quarters Drawer tool featured in this article, it will help you identify both primary and minor support and resistance levels.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs(IV) — Test Trading Strategy

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Timeseries in DoEasy library (part 57): Indicator buffer data object

In the article, develop an object which will contain all data of one buffer for one indicator. Such objects will be necessary for storing serial data of indicator buffers. With their help, it will be possible to sort and compare buffer data of any indicators, as well as other similar data with each other.

Building A Candlestick Trend Constraint Model (Part 8): Expert Advisor Development (II)

Think about an independent Expert Advisor. Previously, we discussed an indicator-based Expert Advisor that also partnered with an independent script for drawing risk and reward geometry. Today, we will discuss the architecture of an MQL5 Expert Advisor, that integrates, all the features in one program.

Multiple Symbol Analysis With Python And MQL5 (Part 3): Triangular Exchange Rates

Traders often face drawdowns from false signals, while waiting for confirmation can lead to missed opportunities. This article introduces a triangular trading strategy using Silver’s pricing in Dollars (XAGUSD) and Euros (XAGEUR), along with the EURUSD exchange rate, to filter out noise. By leveraging cross-market relationships, traders can uncover hidden sentiment and refine their entries in real time.

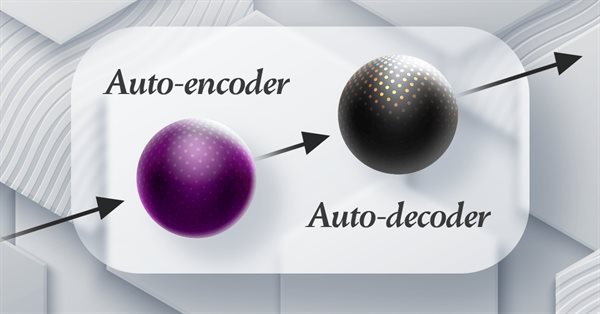

Neural Networks in Trading: Hyperbolic Latent Diffusion Model (Final Part)

The use of anisotropic diffusion processes for encoding the initial data in a hyperbolic latent space, as proposed in the HypDIff framework, assists in preserving the topological features of the current market situation and improves the quality of its analysis. In the previous article, we started implementing the proposed approaches using MQL5. Today we will continue the work we started and will bring it to its logical conclusion.

Reimagining Classic Strategies (Part II): Bollinger Bands Breakouts

This article explores a trading strategy that integrates Linear Discriminant Analysis (LDA) with Bollinger Bands, leveraging categorical zone predictions for strategic market entry signals.

Mastering File Operations in MQL5: From Basic I/O to Building a Custom CSV Reader

This article focuses on essential MQL5 file-handling techniques, spanning trade logs, CSV processing, and external data integration. It offers both conceptual understanding and hands-on coding guidance. Readers will learn to build a custom CSV importer class step-by-step, gaining practical skills for real-world applications.

MQL5 Wizard Techniques you should know (Part 71): Using Patterns of MACD and the OBV

The Moving-Average-Convergence-Divergence (MACD) oscillator and the On-Balance-Volume (OBV) oscillator are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. This pairing, as is practice in these article series, is complementary with the MACD affirming trends while OBV checks volume. As usual, we use the MQL5 wizard to build and test any potential these two may possess.

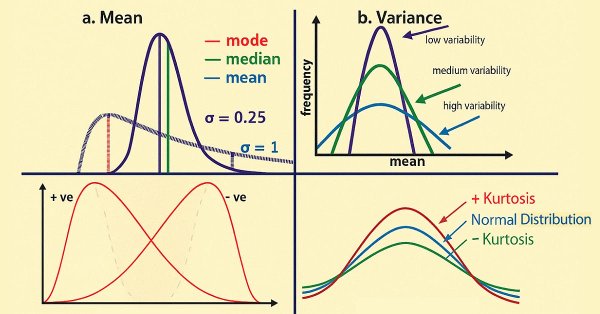

Automating Trading Strategies in MQL5 (Part 39): Statistical Mean Reversion with Confidence Intervals and Dashboard

In this article, we develop an MQL5 Expert Advisor for statistical mean reversion trading, calculating moments like mean, variance, skewness, kurtosis, and Jarque-Bera statistics over a specified period to identify non-normal distributions and generate buy/sell signals based on confidence intervals with adaptive thresholds

Developing a multi-currency Expert Advisor (Part 12): Developing prop trading level risk manager

In the EA being developed, we already have a certain mechanism for controlling drawdown. But it is probabilistic in nature, as it is based on the results of testing on historical price data. Therefore, the drawdown can sometimes exceed the maximum expected values (although with a small probability). Let's try to add a mechanism that ensures guaranteed compliance with the specified drawdown level.

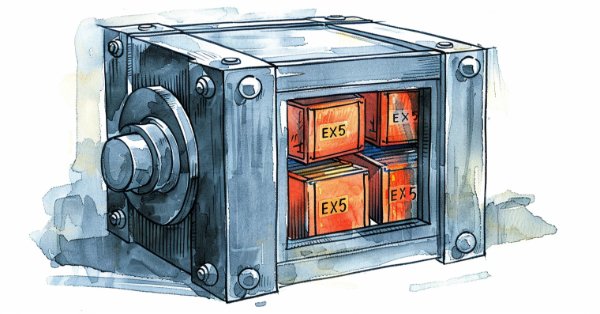

MQL5 Trading Toolkit (Part 1): Developing A Positions Management EX5 Library

Learn how to create a developer's toolkit for managing various position operations with MQL5. In this article, I will demonstrate how to create a library of functions (ex5) that will perform simple to advanced position management operations, including automatic handling and reporting of the different errors that arise when dealing with position management tasks with MQL5.

Neural networks made easy (Part 47): Continuous action space

In this article, we expand the range of tasks of our agent. The training process will include some aspects of money and risk management, which are an integral part of any trading strategy.

Category Theory in MQL5 (Part 20): A detour to Self-Attention and the Transformer

We digress in our series by pondering at part of the algorithm to chatGPT. Are there any similarities or concepts borrowed from natural transformations? We attempt to answer these and other questions in a fun piece, with our code in a signal class format.

Neural Networks in Trading: Enhancing Transformer Efficiency by Reducing Sharpness (Final Part)

SAMformer offers a solution to the key drawbacks of Transformer models in long-term time series forecasting, such as training complexity and poor generalization on small datasets. Its shallow architecture and sharpness-aware optimization help avoid suboptimal local minima. In this article, we will continue to implement approaches using MQL5 and evaluate their practical value.

MQL5 Wizard Techniques you should know (Part 17): Multicurrency Trading

Trading across multiple currencies is not available by default when an expert advisor is assembled via the wizard. We examine 2 possible hacks traders can make when looking to test their ideas off more than one symbol at a time.

From Novice to Expert: Reporting EA — Setting up the work flow

Brokerages often provide trading account reports at regular intervals, based on a predefined schedule. These firms, through their API technologies, have access to your account activity and trading history, allowing them to generate performance reports on your behalf. Similarly, the MetaTrader 5 terminal stores detailed records of your trading activity, which can be leveraged using MQL5 to create fully customized reports and define personalized delivery methods.

Developing a trading Expert Advisor from scratch (Part 26): Towards the future (I)

Today we will take our order system to the next level. But before that, we need to solve a few problems. Now we have some questions that are related to how we want to work and what things we do during the trading day.

Neural Networks in Trading: Using Language Models for Time Series Forecasting

We continue to study time series forecasting models. In this article, we get acquainted with a complex algorithm built on the use of a pre-trained language model.

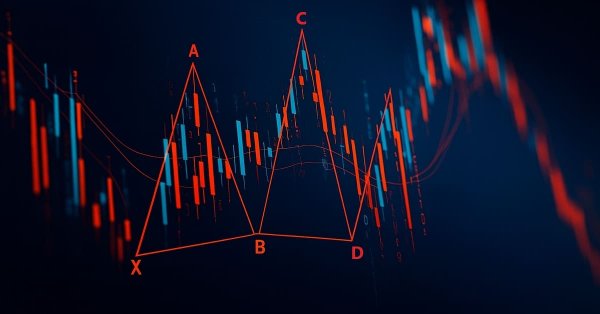

Introduction to MQL5 (Part 21): Automating Harmonic Pattern Detection

Learn how to detect and display the Gartley harmonic pattern in MetaTrader 5 using MQL5. This article explains each step of the process, from identifying swing points to applying Fibonacci ratios and plotting the full pattern on the chart for clear visual confirmation.

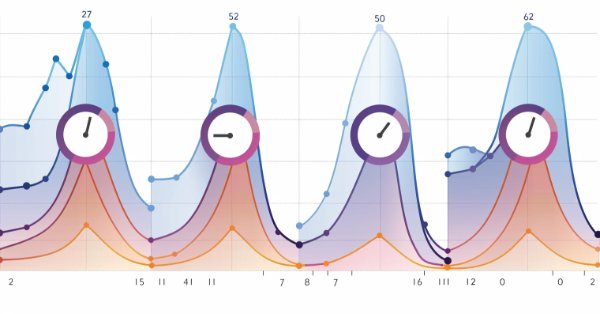

Seasonality Filtering and time period for Deep Learning ONNX models with python for EA

Can we benefit from seasonality when creating models for Deep Learning with Python? Does filtering data for the ONNX models help to get better results? What time period should we use? We will cover all of this over this article.

Neural Networks in Trading: An Agent with Layered Memory (Final Part)

We continue our work on creating the FinMem framework, which uses layered memory approaches that mimic human cognitive processes. This allows the model not only to effectively process complex financial data but also to adapt to new signals, significantly improving the accuracy and effectiveness of investment decisions in dynamically changing markets.

MQL5 Wizard Techniques you should know (Part 84): Using Patterns of Stochastic Oscillator and the FrAMA - Conclusion

The Stochastic Oscillator and the Fractal Adaptive Moving Average are an indicator pairing that could be used for their ability to compliment each other within an MQL5 Expert Advisor. We introduced this pairing in the last article, and now look to wrap up by considering its 5 last signal patterns. In exploring this, as always, we use the MQL5 wizard to build and test out their potential.

Automating Trading Strategies in MQL5 (Part 32): Creating a Price Action 5 Drives Harmonic Pattern System

In this article, we develop a 5 Drives pattern system in MQL5 that identifies bullish and bearish 5 Drives harmonic patterns using pivot points and Fibonacci ratios, executing trades with customizable entry, stop loss, and take-profit levels based on user-selected options. We enhance trader insight with visual feedback through chart objects like triangles, trendlines, and labels to clearly display the A-B-C-D-E-F pattern structure.

MQL5 Wizard Techniques you should know (Part 19): Bayesian Inference

Bayesian inference is the adoption of Bayes Theorem to update probability hypothesis as new information is made available. This intuitively leans to adaptation in time series analysis, and so we have a look at how we could use this in building custom classes not just for the signal but also money-management and trailing-stops.

Gain An Edge Over Any Market (Part II): Forecasting Technical Indicators

Did you know that we can gain more accuracy forecasting certain technical indicators than predicting the underlying price of a traded symbol? Join us to explore how to leverage this insight for better trading strategies.

Building A Candlestick Trend Constraint Model (Part 5): Notification System (Part I)

We will breakdown the main MQL5 code into specified code snippets to illustrate the integration of Telegram and WhatsApp for receiving signal notifications from the Trend Constraint indicator we are creating in this article series. This will help traders, both novices and experienced developers, grasp the concept easily. First, we will cover the setup of MetaTrader 5 for notifications and its significance to the user. This will help developers in advance to take notes to further apply in their systems.

Developing a multi-currency Expert Advisor (Part 4): Pending virtual orders and saving status

Having started developing a multi-currency EA, we have already achieved some results and managed to carry out several code improvement iterations. However, our EA was unable to work with pending orders and resume operation after the terminal restart. Let's add these features.

Practicing the development of trading strategies

In this article, we will make an attempt to develop our own trading strategy. Any trading strategy must be based on some kind of statistical advantage. Moreover, this advantage should exist for a long time.

Neural Networks Made Easy (Part 93): Adaptive Forecasting in Frequency and Time Domains (Final Part)

In this article, we continue the implementation of the approaches of the ATFNet model, which adaptively combines the results of 2 blocks (frequency and time) within time series forecasting.

From Novice to Expert: Automating Trade Discipline with an MQL5 Risk Enforcement EA

For many traders, the gap between knowing a risk rule and following it consistently is where accounts go to die. Emotional overrides, revenge trading, and simple oversight can dismantle even the best strategy. Today, we will transform the MetaTrader 5 platform into an unwavering enforcer of your trading rules by developing a Risk Enforcement Expert Advisor. Join this discussion to find out more.

Neural Networks in Trading: A Multi-Agent Self-Adaptive Model (Final Part)

In the previous article, we introduced the multi-agent self-adaptive framework MASA, which combines reinforcement learning approaches and self-adaptive strategies, providing a harmonious balance between profitability and risk in turbulent market conditions. We have built the functionality of individual agents within this framework. In this article, we will continue the work we started, bringing it to its logical conclusion.