Noise Killer Kernel Line

- Indicators

- Alex Amuyunzu Raymond

- Version: 1.0

- Activations: 5

Advanced Kernel Smoother - Professional Multi-Kernel Regression Indicator

The Advanced Kernel Smoother represents a sophisticated approach to price action analysis, utilizing advanced mathematical kernel regression techniques to filter market noise and identify high-probability trading opportunities with exceptional clarity.

Core Technology

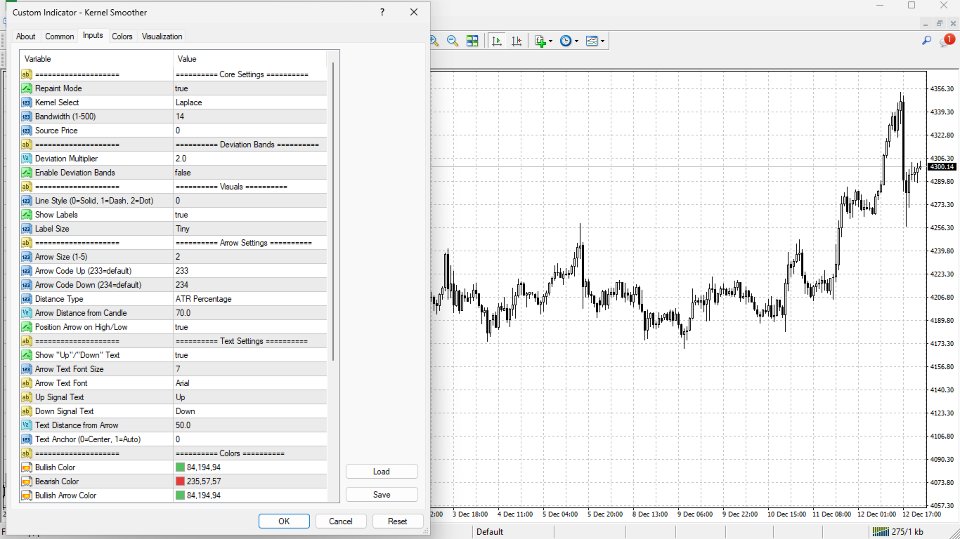

This indicator employs 17 different kernel functions - including Gaussian, Laplace, Epanechnikov, Silverman, and more - each offering unique characteristics for smoothing price data. Unlike traditional moving averages that apply equal or linearly declining weights, kernel regression uses probabilistic weighting functions that adapt intelligently to price movements, delivering superior signal quality and reduced lag.

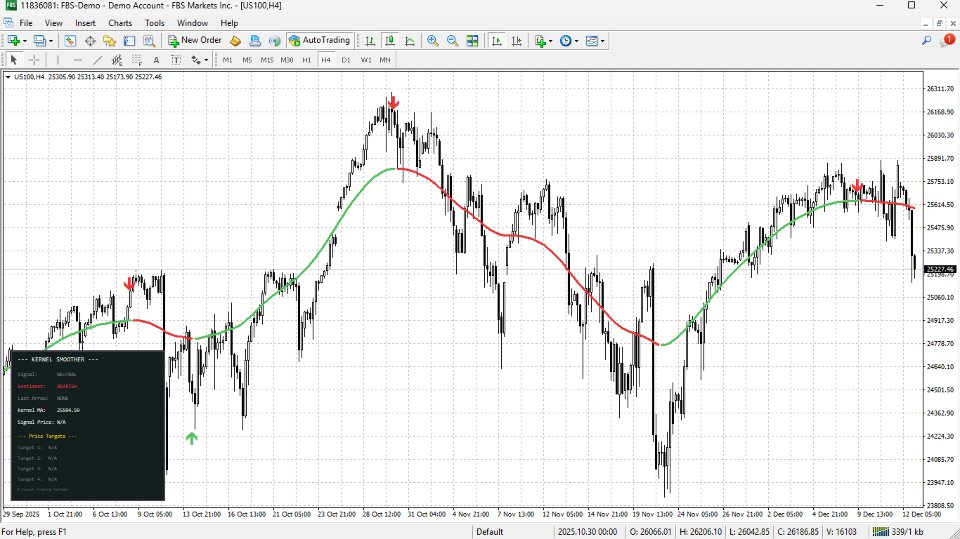

Dual Operating Modes

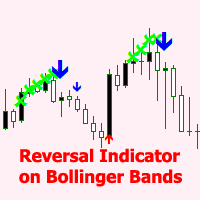

Choose between Repaint Mode for optimal visual clarity and real-time market analysis, or Non-Repaint Mode for backtesting and signal verification. This flexibility ensures the indicator serves both discretionary traders seeking visual confirmation and systematic traders requiring historical accuracy.

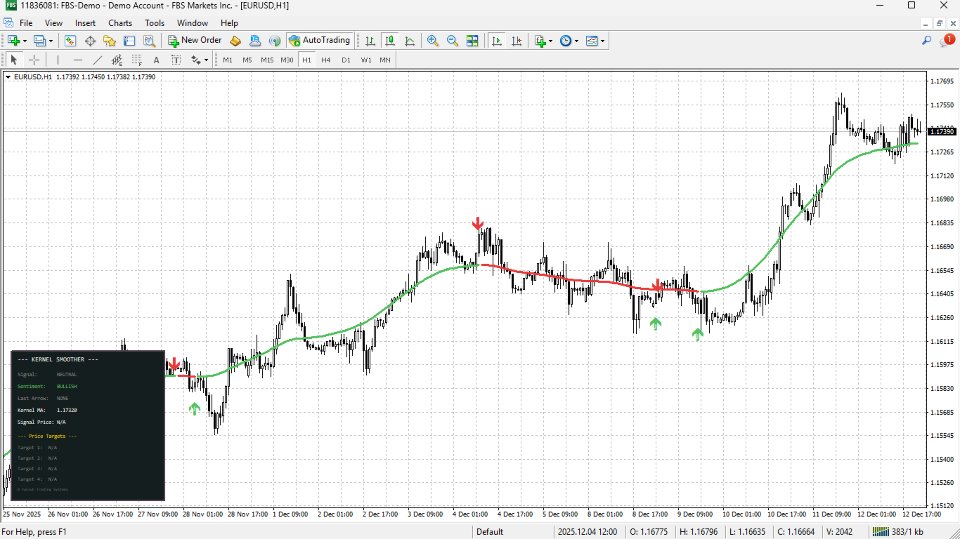

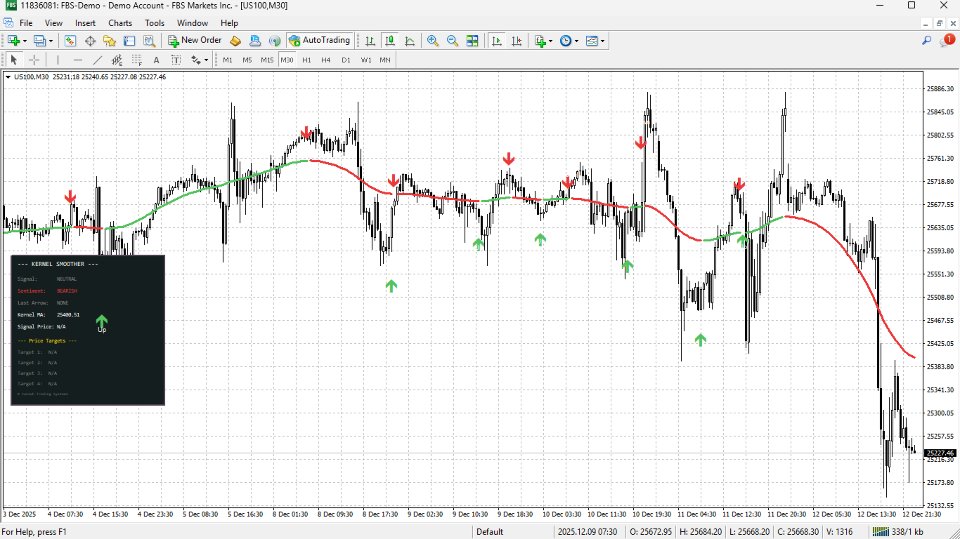

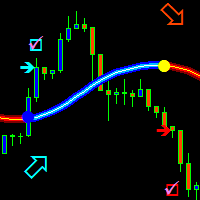

Intelligent Signal Detection

The system automatically identifies trend reversals and momentum shifts through sophisticated delta analysis, marking key turning points with customizable arrow signals. Each signal is calculated based on kernel value crossovers, providing mathematically sound entry and exit points rather than arbitrary threshold breaks.

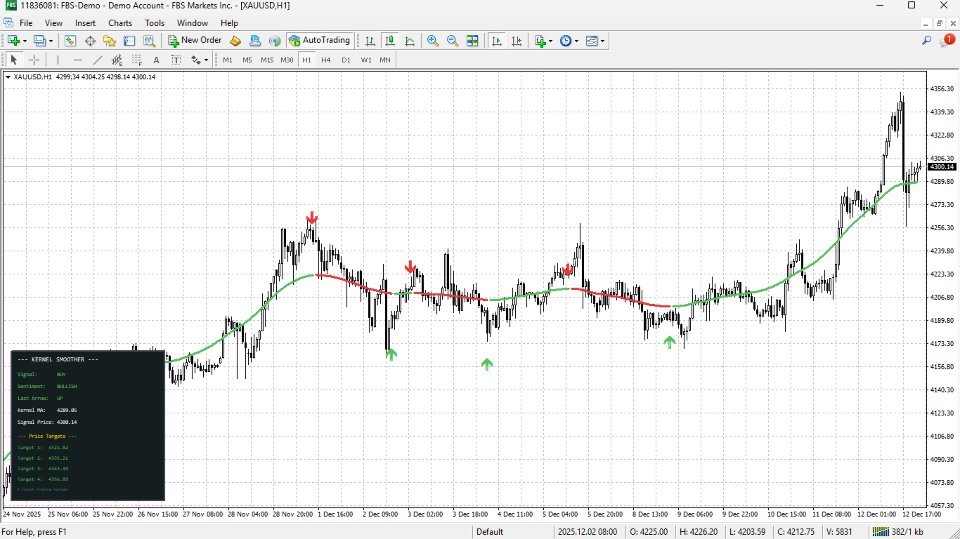

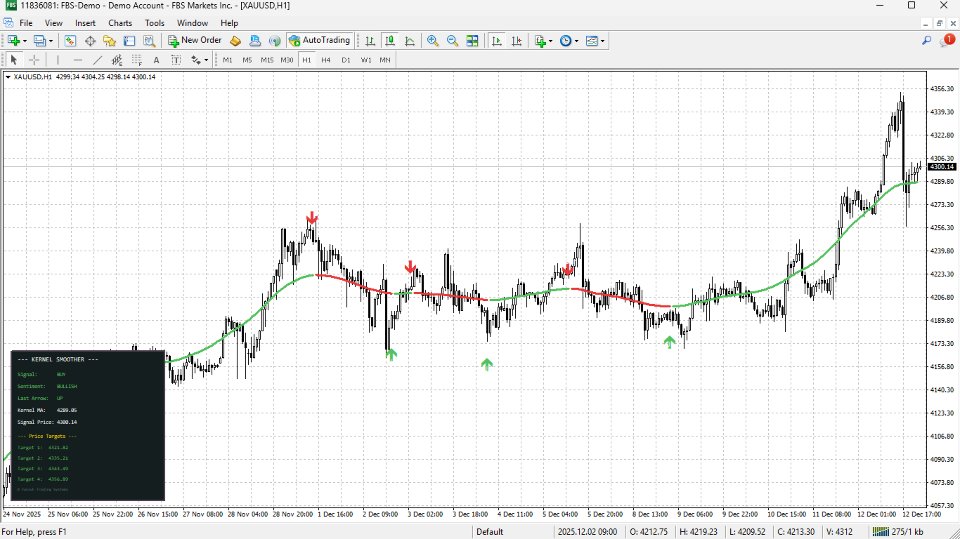

Professional Dashboard Panel

An integrated real-time dashboard displays critical market information at a glance. Monitor current signal state, market sentiment relative to the kernel line, last arrow direction, kernel moving average value, and signal price - all updated continuously as market conditions evolve.

Advanced Price Projection System

Upon signal generation, the indicator calculates four progressive price targets using ATR-based projections and Fibonacci extensions. These targets provide logical profit-taking levels and help traders manage position sizing across multiple take-profit zones.

Deviation Bands

Optional upper and lower deviation bands create a dynamic volatility envelope around the kernel line. These bands expand and contract with market volatility, offering additional context for overbought and oversold conditions while respecting the underlying trend structure.

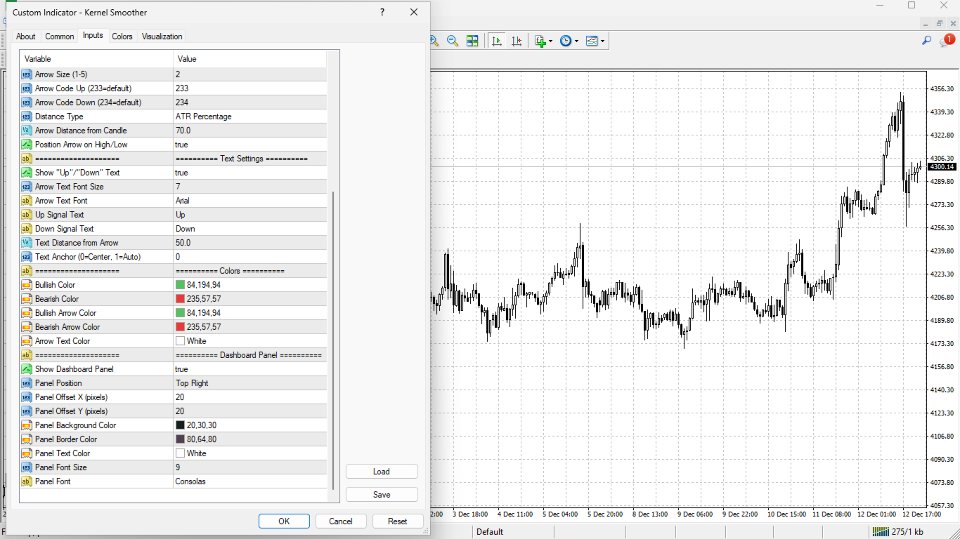

Comprehensive Customization

Every visual element is fully customizable. Adjust bandwidth parameters to control smoothing intensity, select from multiple price sources, configure arrow positioning using pips, ATR percentage, or points, and tailor all colors, sizes, and text elements to match your chart aesthetic and trading style.

Professional Visual Design

The indicator features smooth, color-transitioning lines that change based on directional bias. Bullish and bearish states are clearly distinguished through intelligent color coding, while customizable line styles and widths ensure optimal visibility across any timeframe or chart background.

Performance Optimized

Built with efficiency in mind, the indicator uses pre-calculated weight arrays and optimized algorithms to deliver real-time performance even on lower-powered systems. The new bar detection system prevents unnecessary recalculations, ensuring smooth chart operation without lag or freezing.

Positioning Flexibility

Position the dashboard panel in any corner of your chart with precise pixel-level control. The panel adapts seamlessly to different screen sizes and chart layouts, maintaining perfect visibility whether you trade on multiple monitors or a single laptop screen.

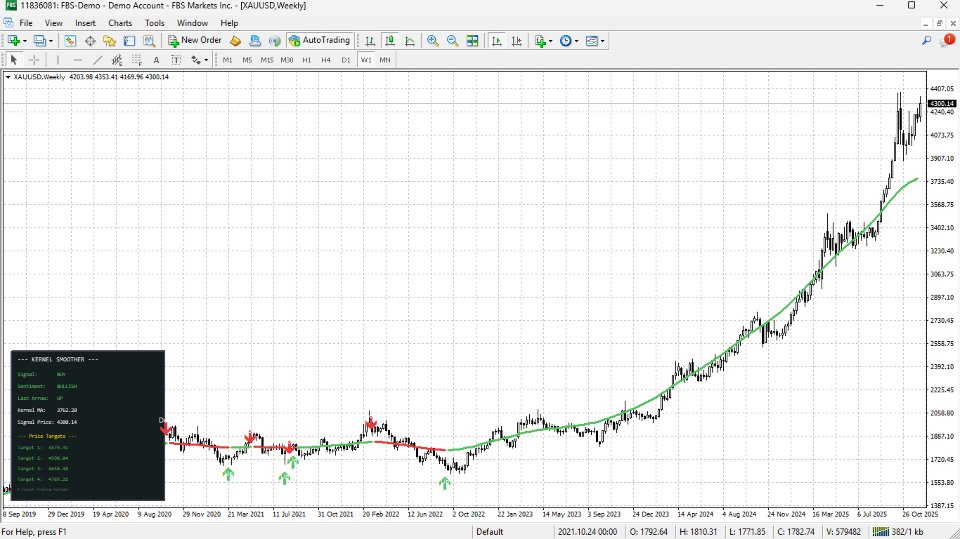

Universal Application

Suitable for all markets - forex, stocks, commodities, cryptocurrencies, and indices. Works effectively across all timeframes from scalping on M1 charts to position trading on daily and weekly charts. The mathematical foundation remains robust regardless of market conditions or asset volatility.

What Sets This Apart

Most smoothing indicators rely on simple moving average calculations or single-kernel approaches. The Advanced Kernel Smoother provides access to 17 distinct mathematical kernels, each with unique response characteristics. This variety allows traders to match the indicator's behavior precisely to their trading style and market conditions, something impossible with standard indicators.

The combination of advanced mathematics, real-time analytics, price projections, and professional visual design creates a complete trading system within a single indicator. Whether you are a beginner seeking clear directional guidance or an experienced trader requiring sophisticated analytical tools, the Advanced Kernel Smoother delivers institutional-grade analysis with retail-friendly usability.

Technical Specifications

Supports all standard price types including Close, Open, High, Low, Median, Typical, and Weighted. Bandwidth adjustable from 1 to 500 bars for extreme flexibility. Deviation multiplier allows precise volatility band calibration. Arrow codes fully customizable for personal preference. All text elements support custom fonts and sizing.

Perfect For

Trend followers seeking smooth, reliable directional signals. Swing traders looking for high-probability reversal points. Day traders requiring low-lag responsive indicators. Position traders wanting to filter daily noise from weekly trends. Any trader seeking to elevate their technical analysis with mathematically sound, visually clear, and operationally flexible tools.

The Advanced Kernel Smoother transforms complex mathematical concepts into actionable trading signals, delivered through an intuitive interface that respects both the science of market analysis and the art of trading execution.