Global Market Sentiment

- Indicators

- Raka

- Version: 1.0

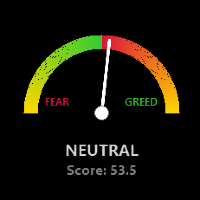

Global Market Risk Sentiment Meter

1. Abstraction

The Global Market Risk Sentiment Meter is a sophisticated analytical tool designed for the MetaTrader 5 (MQL5) platform. Unlike traditional indicators that analyze a single asset in isolation, this utility employs an Inter-Market Analysis approach to reconstruct the psychological state of the global financial markets. By aggregating real-time data from US Indices, Global Equities, Cryptocurrencies, and Safe Haven assets (Gold and the US Dollar), the indicator calculates a composite "Greed and Fear" score. This data is visualized through a high-definition, custom-drawn gauge meter providing traders with an immediate, heads-up display of global risk appetite. The system features an intelligent symbol resolution engine that automatically adapts to varying broker symbol naming conventions, ensuring robust compatibility across different trading environments.

2. Technological Architecture

The indicator is built upon a modular Object-Oriented Programming (OOP) architecture, leveraging the advanced capabilities of the MQL5 language.

A. High-Fidelity Graphics

The visual interface is constructed using the Bitmap standard library, bypassing standard chart objects for pixel-perfect rendering.

-

Gradient Interpolation: The gauge arc utilizes a linear interpolation algorithm (MixColor) to render a smooth color gradient, transitioning seamlessly from Crimson (Extreme Fear) to Gold (Neutral) and Lime Green (Extreme Greed). This replaces the blocky, segmented look of traditional indicators with a modern, anti-aliased aesthetic.

-

Trigonometric Rendering: The needle movement and arc segments are calculated using trigonometric functions (Sine/Cosine) to map the 0-100 sentiment score to a semi-circular radian coordinate system.

B. Responsive Auto-Positioning

The dashboard features a responsive layout engine driven by the OnChartEvent handler. It supports six anchor positions (Upper-Left, Middle-Right, Lower-Left, etc.). Crucially, it employs a Smart Anchoring algorithm that calculates absolute pixel coordinates based on the chart window size. This prevents the dashboard from being clipped or hidden when placed at the bottom of the screen, automatically adjusting its vertical offset to remain fully visible during window resizing.

3. Functional Logic and Financial Methodology

The core function of the indicator is to quantify "Money Flow"—specifically, whether capital is flowing into risk assets or fleeing into safety.

A. The Basket Approach

The sentiment score is derived from a weighted average of four distinct asset classes:

-

US Equities (Risk-On): Includes S&P 500, NASDAQ 100, and Dow Jones Industrial Average.

-

Global Equities (Risk-On): Includes DAX (Germany), FTSE (UK), Nikkei (Japan), and others.

-

Cryptocurrencies (Speculative Risk-On): Includes Bitcoin and Ethereum, serving as a high-sensitivity gauge for liquidity appetite.

-

Safe Havens (Risk-Off): Includes Gold (XAUUSD) and the US Dollar Index (DXY).

B. Scoring and Smoothing

The raw composite score is smoothed using an Exponential Moving Average (EMA) to filter out market noise and prevent the needle from jittering. The final output is a normalized value between 0 and 100:

-

0 - 25: Extreme Fear (Strong Sell / Capitulation)

-

25 - 45: Fear (Bearish Bias)

-

45 - 55: Neutral (Consolidation)

-

55 - 75: Greed (Bullish Bias)

-

75 - 100: Extreme Greed (Euphoria / Overbought)

4. Usage Guide

Installation and Setup

-

Attach the indicator to any chart (Timeframe H1 or H4 is recommended for stable sentiment reading).

-

Input Parameters:

-

Position: Select the desired location on the screen (e.g., POS_UPPER_RIGHT).

-

Radius: Adjust the size of the gauge (default is 100 pixels).

-

Historical Period: Define the sensitivity of the momentum calculation (default is 14).

-

-

The indicator will automatically scan your Market Watch. Note: Ensure that major indices and commodities are visible in your Market Watch for the most accurate calculation.

Interpretation for Trading

-

Contrarian Trading: Look for Extreme Fear (Score < 20) as a potential buying opportunity (bottom fishing) when price hits a support level. Conversely, Extreme Greed (Score > 80) may signal an impending correction or reversal.

-

Trend Confirmation: If the gauge is consistently in the Greed (60-75) zone, it confirms a healthy uptrend. Do not short the market purely based on Greed unless it hits "Extreme" levels accompanied by price action reversal patterns.

-

Divergence: If the asset price is making a new high, but the Sentiment Gauge is failing to reach new highs (or dropping towards Neutral), it indicates a weakening of the global risk appetite, warning of a potential trend failure.

Visual Cues

-

Red Zone: Markets are in distress; liquidity is seeking safety.

-

Green Zone: Markets are optimistic; capital is flowing into equities and crypto.

-

Needle Position: Updates in real-time with every tick, providing an instant pulse of the market.