PROP er T

- Experts

- Desai Tushar Dnyaneshwar

- Version: 1.0

- Activations: 5

PropGuardian — EA for prop-firm challenges

A purpose-built MQL5 Expert Advisor focused on passing funded-account challenges by combining automated trade management, dynamic equity allocation and strict drawdown control. Highly configurable risk/data points so you can tailor behavior to specific prop-firm rules. This is a tool to help you trade smarter — not a guarantee of a funded account.

PropGuardian is an MQL5 Expert Advisor engineered with one goal in mind: give traders programmatic control and guardrails tuned for the typical funded-account / prop-challenge environment. It doesn’t promise wins — it helps you manage risk, preserve equity, and present consistent behaviour that many prop firms look for.

Key capabilities:

-

Equity-aware position sizing — position size is calculated from live account equity (or balance) and supports fixed-fraction, fixed-lot, and volatility-adjusted sizing (ATR-based). Auto-recalculation every tick or every specified interval.

-

Customizable drawdown controls — set intraday, trailing, and total drawdown limits. When a configured drawdown threshold is reached the EA can: stop opening new trades, close all open trades, reduce risk percentage, or switch to a strict micro-size mode.

-

Challenge-mode profiles — save/load profiles that match common prop-firm rule-sets (max daily loss, max drawdown, minimum trading days, profit target). Quickly toggle between profiles when testing different challenges.

-

Trade filters and trade management — configurable entry filters (time-of-day, weekday, spread/latency thresholds), optional confirmation by indicator (user-selectable), flexible TP/SL and dynamic scaling (pyramiding rules, breakeven moves, partial take-profits).

-

Equity-protection automation — auto-pause trading after a sequence of losing trades, resume only after equity recovery or after a manual reset. Supports automatic session shutdown (e.g., end-of-day safe-close).

-

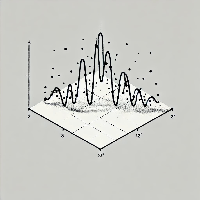

Comprehensive telemetry / logging — detailed per-trade annotations and optional external CSV logging: equity at entry, max adverse excursion (MAE), max favorable excursion (MFE), drawdown at trade close, reason codes for auto-stops. Ideal for audit and post-challenge reporting.

-

Risk-acceptance controls — hard stops at code level to prevent inputs that would create unacceptable risk (e.g., settings that would risk > X% of equity per trade).

-

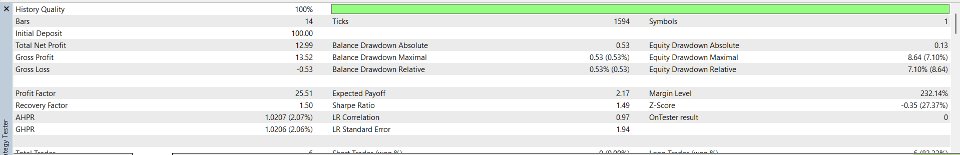

Backtest & forward-test friendly — built-in toggles to simulate slippage, commission scenarios, and typical prop-firm latency restrictions for more realistic testing.

-

Safe defaults + advanced mode — ships with conservative default settings for challenge-taking; switch to advanced mode to expose full parameter set for power users.

-

Notifications & alerts — push notifications, email, and terminal alerts for key events (drawdown hit, profile switched, trading paused/resumed).

-

Prop firms evaluate consistent, low-drawdown performance and rule compliance. PropGuardian is designed to automate compliance (drawdown caps, daily loss enforcement) and to produce auditable logs that show consistent risk-management — both things that support challenge passes when paired with a solid strategy.

-

Rapid profile switching makes it easy to adopt the exact ruleset of many popular prop firms without re-coding or manual reconfiguration.

-

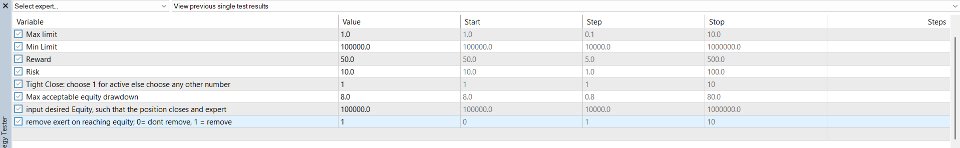

Risk mode: Fixed lot / % equity / ATR volatility sizing

-

Risk per trade: 0.1% — 5% (configurable)

-

Max daily loss (absolute $ / %): user-defined

-

Total challenge drawdown cap (absolute / %): user-defined

-

Auto-pause after N losing trades in a row: enabled/disabled + N

-

Max open trades & max exposure per symbol: numeric inputs

-

Pyramiding rules: allowed / not allowed / max levels

-

Telemetry: enable CSV logging, log frequency, custom fields

-

Profile matching — configure a profile that exactly mirrors the prop firm’s rules (daily loss, max drawdown, allowed instruments, trading hours).

-

Backtest with realistic costs — include spreads, commission and slippage approximations the firm enforces.

-

Forward-test on demo — run the EA in forward/demo mode using the profile for several weeks to collect telemetry.

-

Use conservative defaults for the live challenge — reduce risk per trade and enable stricter drawdown limits.

-

Keep audit logs — use the CSV/annotations for any review or submission the prop firm may require.

-

No guarantee of funding. This EA is a risk-management and automation tool — it cannot guarantee that you will pass any specific prop-firm challenge or be approved for funding. Market conditions, broker behaviour, latency, and your chosen strategy all materially affect outcomes.

-

You still need a robust strategy. PropGuardian manages risk and enforces rules; it is not a black-box “guaranteed winner.” Combine it with well-tested entry logic and sound trade ideas.

-

Broker / environment dependency. Behavior may vary across brokers (execution speed, slippage, hedging vs netting accounts, lot size constraints). Test thoroughly with your broker or the prop firm’s recommended broker/demo environment.

-

Past performance not indicative of future results. Backtests/simulations are helpful but not definitive.

-

Use prudently. Misconfiguration (e.g., setting unreasonable risk-per-trade) can still result in large losses. The EA includes hard-coded safety checks but you must use sensible inputs.

Disclaimer: PROPer-T is a trading tool designed to assist with risk management and automation for prop-firm challenges. It does not guarantee profits, account funding, or challenge approval. Trading involves substantial risk of loss. Users are solely responsible for configuring the EA and for all trading decisions. Past performance is not indicative of future results. Always test in a demo environment before using with live capital