Multi Currency Net Strength

- Indicators

- Pieter Gerhardus Van Zyl

- Version: 1.0

- Activations: 5

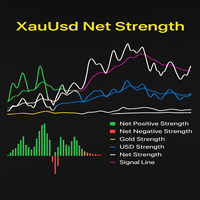

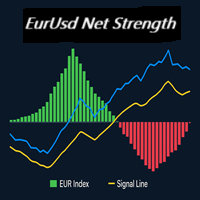

The Multi Currency Net Strength indicator is a professional analytical tool designed to measure and visualize the relative power of major currencies across multiple pairs simultaneously. Unlike single-pair oscillators or strength meters, this indicator aggregates information from a wide basket of instruments, giving a more holistic view of how a base currency is performing compared to its counterpart.

Displayed in a separate window, the indicator combines several visual elements:

-

Green/Red Histogram: Represents the net strength balance between the base and quote currencies. Green areas suggest relative strength in favor of one currency, while red areas highlight weakness.

-

Base & Quote Strength Lines: These lines track the performance of each currency individually, helping traders see whether movements are driven by the base, the quote, or both.

-

Net Strength Line: Shows the difference between the two currencies’ strengths, offering a simplified picture of who is in control.

-

Signal Line: A smoothed overlay of the net line, providing crossover points often used as trend or momentum signals.

-

Strength Difference & Momentum Lines: Additional tools to capture short-term acceleration, divergence, and changes in trend energy.

How to Use It in Trading

-

Trend Confirmation: When the histogram and net line are consistently positive (or negative), it reflects dominance of one side, confirming the direction of the prevailing trend.

-

Crossovers: Intersections between the net strength and its signal line can serve as potential entry or exit signals, depending on whether bullish or bearish pressure is increasing.

-

Currency Battles: Comparing the base and quote strength lines helps traders identify whether moves are caused by base currency strength, quote currency weakness, or both—crucial for cross-pair decision making.

-

Zero Line Dynamics: Crosses above or below the zero line highlight potential shifts in market sentiment.

-

Alerts: Built-in alerts notify traders of key crossover or breakout events without the need to constantly monitor the chart.

Practical Application:

This indicator works best when combined with price action or support/resistance analysis. It is especially useful for traders dealing with multiple currency pairs or gold-related pairs, allowing them to identify the strongest and weakest currencies at any given time and align trades with broad market flows.