FX Correlation Matrix

- Indicators

- INTRAQUOTES

- Version: 1.6

- Updated: 15 July 2025

- Activations: 5

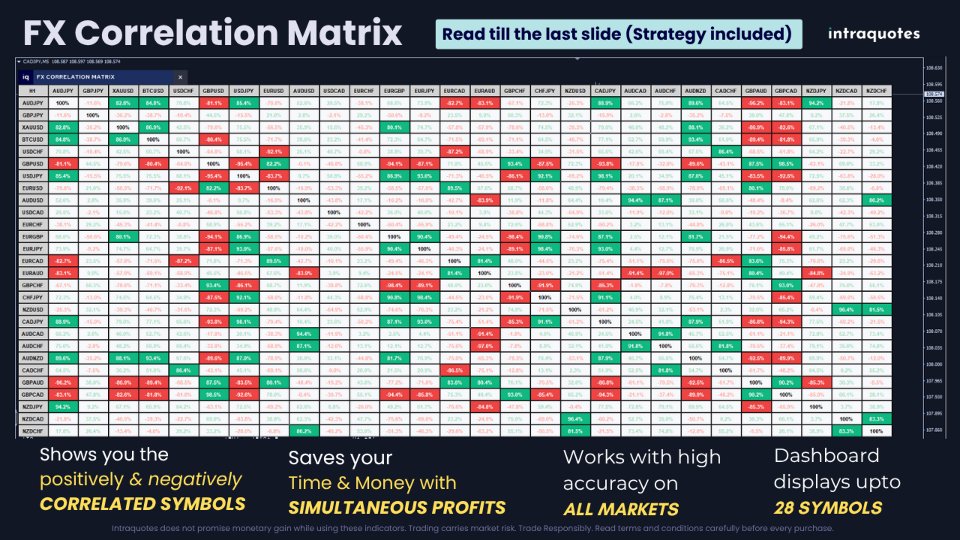

FX Correlation Matrix is a powerful multi-timeframe dashboard that helps traders analyze real-time currency correlations of upto 28 symbols at a glance. With customizable settings, sleek design, and manual symbol selection option, it enhances trade accuracy, reduces risk, and identifies profitable correlation-based opportunities.

- Get the Metatrader 5 Version here.

- Get it FAST! Price is increasing soon!

Disclaimer:

- Due to regulatory restrictions, our service is unavailable in certain countries such as India, Pakistan, and Bangladesh.

- Our products are available only on mql5.com.

- We never contact anyone or sell our products privately.

- We do not provide any personal trading advice.

- We do not sell any of the Intraquotes products on Telegram or any other platform, or website.

- Multi-Timeframe, Multi-Currency Dashboard – Analyze correlation across multiple forex pairs and timeframes in one dashboard at a glance.

- Adaptable Dashboard Sizes – Supports SD, HD, Full HD, and 4K monitors for an optimized trading experience.

- User-Friendly Interface – Reposition & customize the dashboard for seamless trading.

- 5 PC Activation – Use the indicator across multiple brokers and devices for greater flexibility.

Recommendation: Use this indicator on a separate chart for an optimal performance.

1. Why is the FX Correlation Matrix Indicator Extremely Useful?

- Enhances Trading Accuracy – Identify strong and weak currency correlations to make better trading decisions.

- Maximizes Profitable Trade Opportunities – Detect positively and negatively correlated pairs to capitalize on profits.

This tool is perfect for traders who understand forex correlation and want to enhance trade accuracy, minimize risk, and maximize profits. Whether you're a scalper, intraday trader, or swing trader, the FX Correlation Matrix helps you trade smarter.

Note: This indicator can not be used solely to make any final trading decision. This tool helps to confirm your trading decision before your place your trade. You must place a trade after analysing its trend direction, if any price action formation took place, and nearby support & resistance levels to avoid any financial loss.

3. Learn More at intraquotes MQL5 Channel

If you want to learn more about how our indicator works and how you can take profitable trades, follow our intraquotes official MQL5 channel. We post daily market analysis using our indicators to train our followers how to study the chart with this indicator, where to set targets, and how to take profitable trades. We help you build confidence with daily market analysis using our indicators so that you can trade confidently.

Subscribe to intraquotes MQL5 channel for daily market updates, analysis, and much more.

4. Supported Symbols List

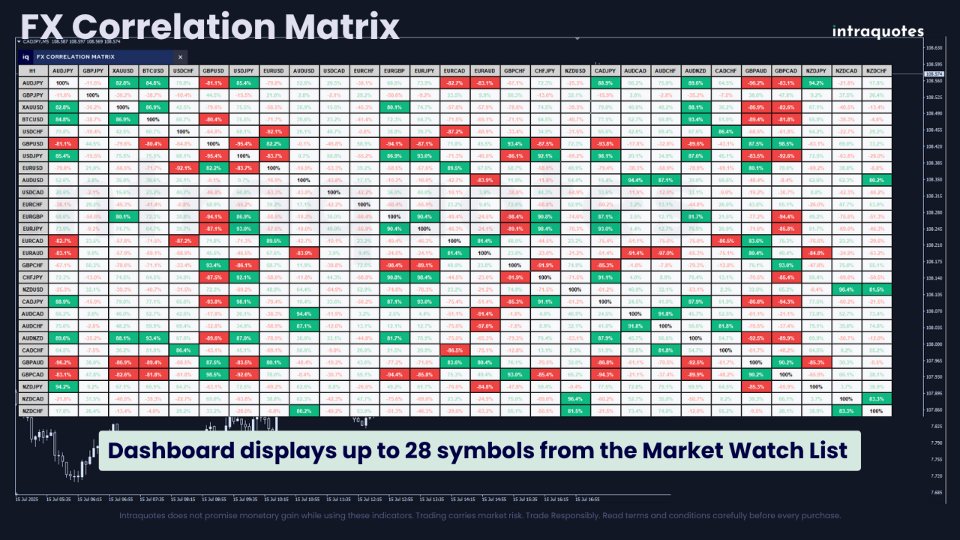

Works with forex major & minor pairs, metals, indices, cryptocurrencies, and more across all timeframes.

5. Symbol Limit:

The indicator supports up to 2 dashboards across 2 charts at a time, allowing you to monitor up to 56 symbols simultaneously.

6. Applicable Timeframes

Applicable across all 9 timeframes: 1M, 5M, 15M, 30M, 1H, 4H, 1D, 1W, MN.

7. Backtesting Note:

In Strategy Tester, only one symbol displays, custom symbols and full 28-symbol data aren’t supported.

8. How to Get Started with FX Correlation?

- After purchasing, open MetaTrader Software, log in to your account, and open Toolbox - Market - Purchased.

- Install the indicator.

- Open Navigator - Market - Drag & drop the indicator to the chart.

-

Follow the matrix dashboard to track the correlation for confident trading.

9. How Does FX Correlation Matrix Work? (Easy Explanation)

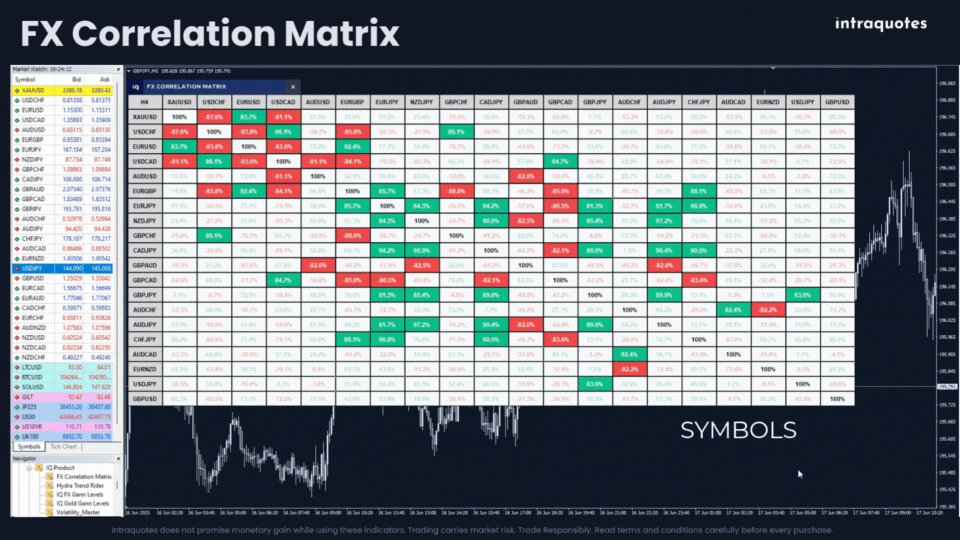

- Monitors Multi-Currency Correlations – Provides real-time correlation values in percentage format.

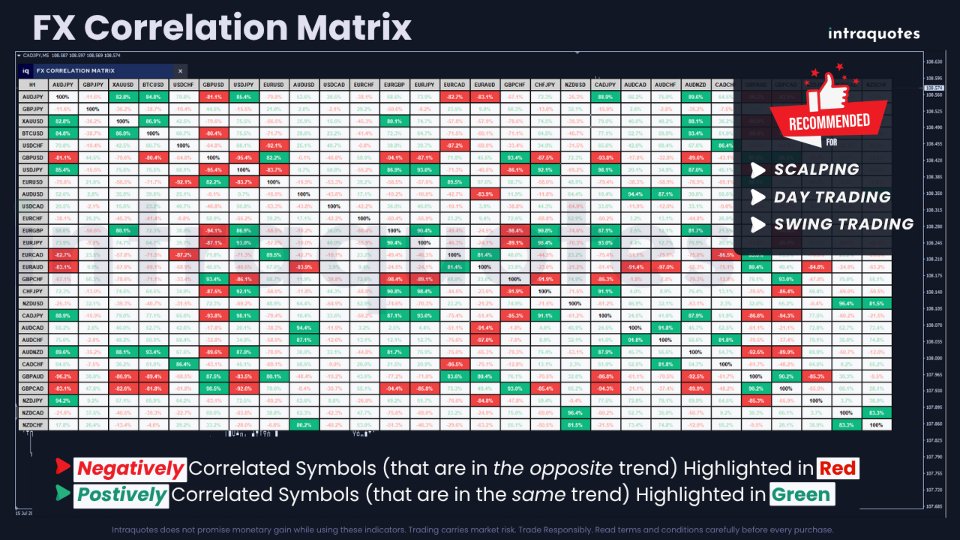

- Positive & Negative Correlation Signals – Green highlights strong positive correlations, while red indicates negative correlation of divergent pairs.

- Supports Basket Trading Strategies – Helps traders manage multiple trades across correlated assets.

10. Indicator Features (In Details)

Multi-Timeframe, Multi-Currency Dashboard:

Visualize correlations across multiple symbols and timeframes with ease. This powerful dashboard gives you a clear picture of how currency pairs are moving in relation to one another, allowing you to capitalize on cross-pair opportunities and enhance your trading strategy.

5 PC Activation for Multiple Brokers:

Trade across multiple broker platforms with the flexibility of five PC activations. Whether you're working with different brokers or switching between accounts, this feature ensures smooth and uninterrupted access to the indicator.

Eye-Pleasing Aesthetic Design:

The Forex Correlation Dashboard is not only functional but also designed with aesthetics in mind. Its sleek, modern interface is easy on the eyes, allowing you to focus on trading without visual distractions.

User Conveniences:

Enjoy a highly intuitive interface that simplifies your trading experience. The Forex Correlation Dashboard is designed with traders’ convenience in mind, providing easy navigation, quick access to data, and seamless functionality.

Adaptable Dashboard Sizes:

Whether you’re using a standard monitor or a 4K display, the indicator adjusts perfectly with four different dashboard sizes to choose from. This adaptability ensures you can monitor the market in the way that best suits your needs.

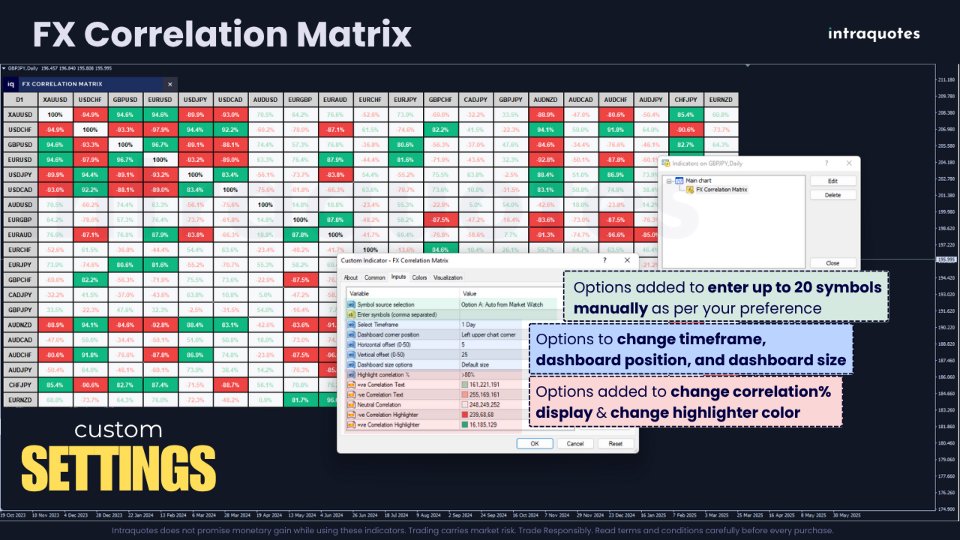

11. Indicator Input Settings

- Manual Symbol Selection – You can either choose auto-selection, where the dashboard automatically displays the st 20 symbols from the Market Watch list, or you can manually enter up to 20 symbols as per your preference.

- Customizable Timeframes – Choose any timeframe for instant correlation analysis.

- Correlation Percentage Adjustment – The indicator has an option to change the correlation % starting from greater than 50% to greater than 90%. Adjust the period to suit your trading strategy. This feature allows you to fine-tune your analysis for maximum accuracy.

- Symbols Rearrangement – You can drag and move the symbols up and down in the market Watch list to change their position in the indicator dashboard (see the gif in the screenshot section).

- Changing Symbol Highlighter Color - We have given the option to change the symbol highlighter color as per your preference.

Note: Indicator does not have buffer output for EA integration.

12. Indicator Strategies: Boost Profits with Correlation Analysis

Identifying Strong Currency Correlations:

Symbols are often interrelated, and understanding these correlations can be the key to unlocking profitable trades. By analyzing how pairs move in relation to one another, you can identify strong correlations that help you predict price movements across multiple pairs.

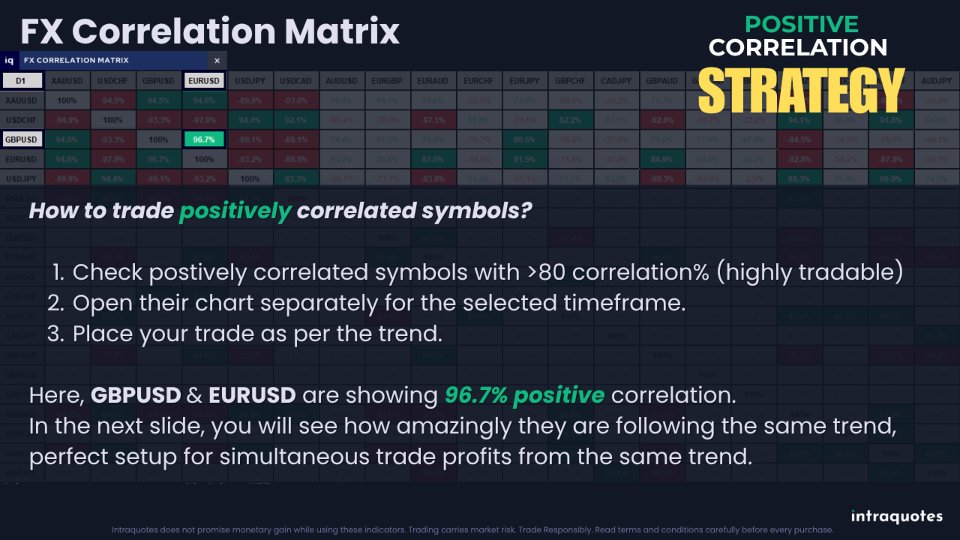

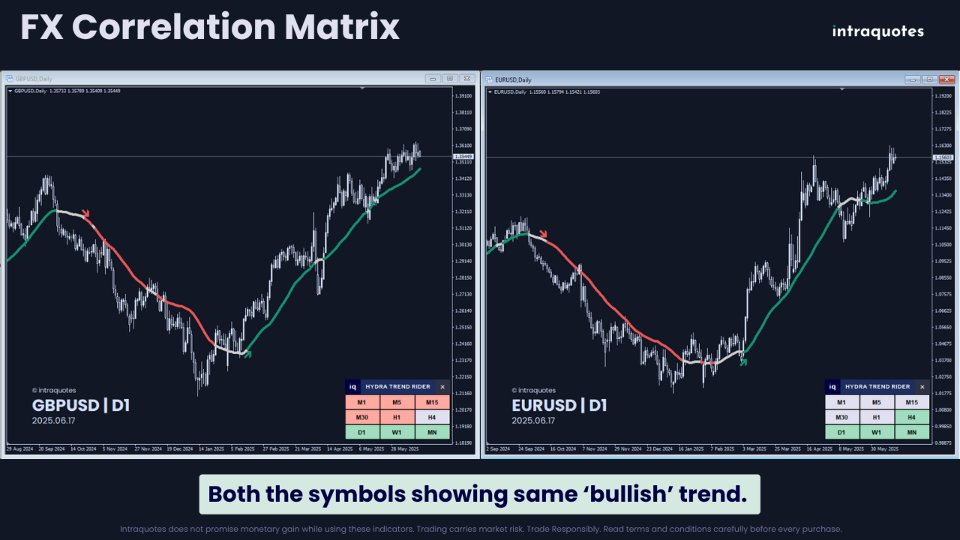

- Understanding Positive Correlation:

If two symbols are highlighted in green with a high correlation %, it means both the symbols are following the same trend (either both are bullish, or both are bearish). If you plan to place trade in one, you can place trade in the other one to maximize your profits, and gain simultaneously from both the trades. (Follow the example of Positive correlation strategy in the screenshot section)

- Correlation lesser than 50% - Not so tradable.

- Correlation between 50% to 60% - Tradable but not preferred.

- Correlation between 60% to 90% - Tradable (following similar trend)

- Correlation greater than 90% - Highly Tradable (strongly following similar trend)

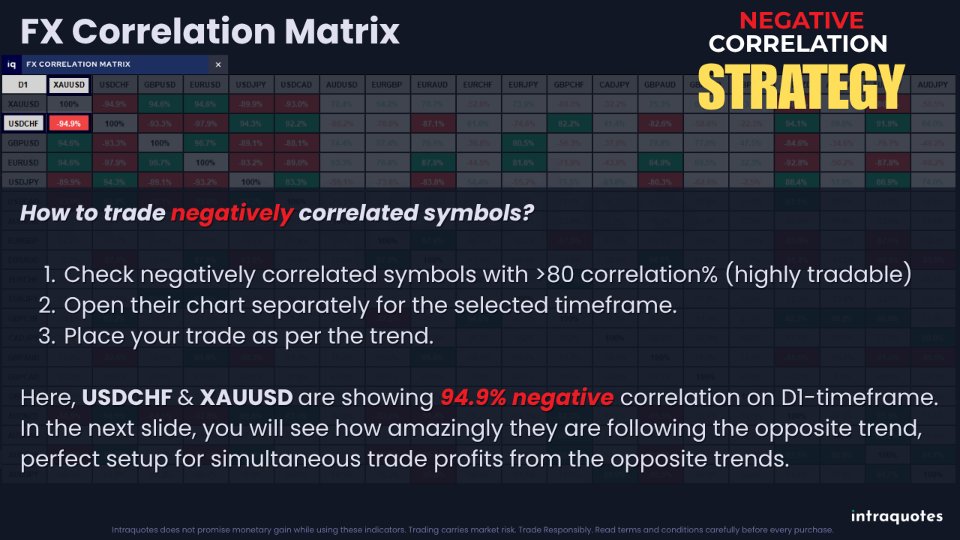

- Understanding Negative Correlation

If two symbols are highlighted in red with a high correlation %, it means both the symbols are following the opposite trend (if one is bullish, the other one will be bearish). If you plan to place a buy trade in one, you will have to place sell trade in the other one to gain simultaneously from both the trades showing divergent movement. (Follow the example of Negative correlation strategy in the screenshot section).

- Correlation lesser than 50% - Not so tradable.

- Correlation between 50% to 60% - Tradable but not preferred.

- Correlation between 60% to 90% - Tradable (following opposite trend)

- Correlation greater than 90% - Highly Tradable (strongly following opposite trend)

Reducing Risk through Diversification:

Currency correlations allow you to reduce risk by spreading your trades across correlated pairs. With the Forex Correlation Dashboard Indicator, you can easily spot opportunities for positively and negatively correlated pairs and build a more balanced trading portfolio.

Capitalizing on Divergences:

When two positively correlated pairs begin to diverge, it can signal potential trade opportunities as well. This indicator helps you spot such divergences early, giving you a head start in capturing profitable trades when the pairs realign.

13. Merging it with other Indicators

This indicator is a tool to confirm and validate your decision. You need to have a strategy thats works based on trend analysis, candlesticks, and price action. Often traders enter a trade at a wrong time & suffer financial loss.Traders often struggle with these basics and often get confused about where to enter and exit, take wrong decisions and fail most of the time, end up feeling frustrating.

If you are one of them, we have built a system that works like a charm to solve this issue. Check out the IQ Gann levels indicators (for both FX & Gold) to know the powerful Gann Support & Resistance levels where the market reacts accurately. These levels are plotted way early before the market even reaches there. This way you will know whether you can enter the market or not or if the market is about to hit the Gann level and react,enter range, or the trend is about to reverse after hitting any Gann level. This paired up with the Hydra Trend Rider Multi-Timeframe dashboard, you can get a solid trend confirmation, signalling how long the trend will stay the same, or reverse or enter a range helping you decide how long you can ride the trend and make profits confidently.

14. Indicator Troubleshooting:

An issue with symbol order: Symbols are displayed in reverse order and not starting from the first ten of the market list.

Solution:

This issue can differ from one broker to another. To address this, prioritize the symbols you frequently use for trading by placing them at the top of the Market Watch section. Conceal any unnecessary symbols to enhance indicator performance.

An issue with loading data correctly on Indicator:

Solution:

- Load all desired symbols in your market watch before applying the indicator.

- Ensure the MetaTrader historical data is loaded for the chosen symbols in the chart.

- If encountering "Data not synchronized" issues, allow 5-10 minutes for your terminal to load, ensuring a seamless experience.

How to Do a Visual Backtest with Our Indicator:

Step 1: Download the entire history center database first. Press the shortcut key F2 to access the History Center.

Step 2: Click on the download button.

Step 3: After the download completes, close, and restart the MetaTrader.

Possible Issues with Backtesting:

Problem 1: You see a message that says "Waiting for update" on the chart while backtesting.

Solution: This means that you don't have enough data or a poor internet connection. To avoid this, make sure you download the full History Center data as explained above.

Problem 2: Metatrader freezes during backtest.

Solution: This also happens because of insufficient data or a bad internet connection. Fix the internet connection before starting and follow the steps again.

15. Support & Updates:

- For assistance, send us a direct message on MQL5.

- Follow our channel for updates and market insights.

- If you encounter any technical issues with the indicator, contact us directly on MQL5.

Take your trading to the next level with the FX Correlation Matrix—a powerful tool designed to help you trade smarter, reduce risk, and capitalize on currency correlations. Whether you're looking for confirmation signals, trend alignment, or diversification, this indicator provides the ultimate market insight. Get it now and maximize your trading potential!

Risk Disclosure: Trading financial markets carries inherent risks and may not be suitable for every investor. This indicator is designed as a tool to assist in trading decisions but does not guarantee profits or prevent losses, which could exceed your initial investment. Past performance is not a reliable indicator of future outcomes. Users are encouraged to fully understand the risks and seek independent financial advice if needed. Any trading decisions made using this indicator are at the user's discretion and responsibility.

Related topics: correlation analysis, multiple timeframe trend analysis, candlestick charts, bar charts, trend dashboard, scalping, day trading, position trading, swing trading, trade following, trend riding, indicator, trend following, trend reversal, MetaTrader software, currency pairs, market analysis, chart window, mobile alert, trading strategy, multiple timeframe, dashboard, 4K monitors, currency correlation dashboard.

Excellent developer—friendly and responsive! With Version 1.5, the FX Correlation Matrix becomes a truly powerful tool that helps understand the movement of a large portion of currency pairs. From me, it's 5 stars—both for the collaboration and the flawless result. This dashboard is a must-have for any trader. Congratulations!