Statistical Arbitrage Through Cointegrated Stocks (Part 1): Engle-Granger and Johansen Cointegration Tests

This article aims to provide a trader-friendly, gentle introduction to the most common cointegration tests, along with a simple guide to understanding their results. The Engle-Granger and Johansen cointegration tests can reveal statistically significant pairs or groups of assets that share long-term dynamics. The Johansen test is especially useful for portfolios with three or more assets, as it calculates the strength of cointegrating vectors all at once.

Developing a Replay System — Market simulation (Part 13): Birth of the SIMULATOR (III)

Here we will simplify a few elements related to the work in the next article. I'll also explain how you can visualize what the simulator generates in terms of randomness.

Neural networks made easy (Part 42): Model procrastination, reasons and solutions

In the context of reinforcement learning, model procrastination can be caused by several reasons. The article considers some of the possible causes of model procrastination and methods for overcoming them.

From Novice to Expert: The Essential Journey Through MQL5 Trading

Unlock your potential! You're surrounded by opportunities. Discover 3 top secrets to kickstart your MQL5 journey or take it to the next level. Let's dive into discussion of tips and tricks for beginners and pros alike.

Neural Networks Made Easy (Part 95): Reducing Memory Consumption in Transformer Models

Transformer architecture-based models demonstrate high efficiency, but their use is complicated by high resource costs both at the training stage and during operation. In this article, I propose to get acquainted with algorithms that allow to reduce memory usage of such models.

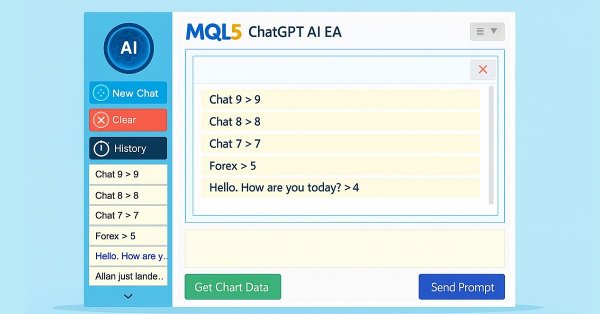

Building AI-Powered Trading Systems in MQL5 (Part 5): Adding a Collapsible Sidebar with Chat Popups

In Part 5 of our MQL5 AI trading system series, we enhance the ChatGPT-integrated Expert Advisor by introducing a collapsible sidebar, improving navigation with small and large history popups for seamless chat selection, while maintaining multiline input handling, persistent encrypted chat storage, and AI-driven trade signal generation from chart data.

Statistical Arbitrage Through Cointegrated Stocks (Part 6): Scoring System

In this article, we propose a scoring system for mean-reversion strategies based on statistical arbitrage of cointegrated stocks. The article suggests criteria that go from liquidity and transaction costs to the number of cointegration ranks and time to mean-reversion, while taking into account the strategic criteria of data frequency (timeframe) and the lookback period for cointegration tests, which are evaluated before the score ranking properly. The files required for the reproduction of the backtest are provided, and their results are commented on as well.

Developing a Replay System — Market simulation (Part 23): FOREX (IV)

Now the creation occurs at the same point where we converted ticks into bars. This way, if something goes wrong during the conversion process, we will immediately notice the error. This is because the same code that places 1-minute bars on the chart during fast forwarding is also used for the positioning system to place bars during normal performance. In other words, the code that is responsible for this task is not duplicated anywhere else. This way we get a much better system for both maintenance and improvement.

MQL5 Trading Toolkit (Part 4): Developing a History Management EX5 Library

Learn how to retrieve, process, classify, sort, analyze, and manage closed positions, orders, and deal histories using MQL5 by creating an expansive History Management EX5 Library in a detailed step-by-step approach.

MQL5 Wizard Techniques you should know (Part 56): Bill Williams Fractals

The Fractals by Bill Williams is a potent indicator that is easy to overlook when one initially spots it on a price chart. It appears too busy and probably not incisive enough. We aim to draw away this curtain on this indicator by examining what its various patterns could accomplish when examined with forward walk tests on all, with wizard assembled Expert Advisor.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 7): Command Analysis for Indicator Automation on Charts

In this article, we explore how to integrate Telegram commands with MQL5 to automate the addition of indicators on trading charts. We cover the process of parsing user commands, executing them in MQL5, and testing the system to ensure smooth indicator-based trading

Developing a Replay System — Market simulation (Part 22): FOREX (III)

Although this is the third article on this topic, I must explain for those who have not yet understood the difference between the stock market and the foreign exchange market: the big difference is that in the Forex there is no, or rather, we are not given information about some points that actually occurred during the course of trading.

MQL5 Wizard Techniques you should know (Part 57): Supervised Learning with Moving Average and Stochastic Oscillator

Moving Average and Stochastic Oscillator are very common indicators that some traders may not use a lot because of their lagging nature. In a 3-part ‘miniseries' that considers the 3 main forms of machine learning, we look to see if this bias against these indicators is justified, or they might be holding an edge. We do our examination in wizard assembled Expert Advisors.

Developing a Replay System (Part 37): Paving the Path (I)

In this article, we will finally begin to do what we wanted to do much earlier. However, due to the lack of "solid ground", I did not feel confident to present this part publicly. Now I have the basis to do this. I suggest that you focus as much as possible on understanding the content of this article. I mean not simply reading it. I want to emphasize that if you do not understand this article, you can completely give up hope of understanding the content of the following ones.

Neural networks made easy (Part 57): Stochastic Marginal Actor-Critic (SMAC)

Here I will consider the fairly new Stochastic Marginal Actor-Critic (SMAC) algorithm, which allows building latent variable policies within the framework of entropy maximization.

Neural Networks in Trading: Multi-Task Learning Based on the ResNeXt Model

A multi-task learning framework based on ResNeXt optimizes the analysis of financial data, taking into account its high dimensionality, nonlinearity, and time dependencies. The use of group convolution and specialized heads allows the model to effectively extract key features from the input data.

Adaptive Smart Money Architecture (ASMA): Merging SMC Logic With Market Sentiment for Dynamic Strategy Switching

This topic explores how to build an Adaptive Smart Money Architecture (ASMA)—an intelligent Expert Advisor that merges Smart Money Concepts (Order Blocks, Break of Structure, Fair Value Gaps) with real-time market sentiment to automatically choose the best trading strategy depending on current market conditions.

Developing a Replay System — Market simulation (Part 19): Necessary adjustments

Here we will prepare the ground so that if we need to add new functions to the code, this will happen smoothly and easily. The current code cannot yet cover or handle some of the things that will be necessary to make meaningful progress. We need everything to be structured in order to enable the implementation of certain things with the minimal effort. If we do everything correctly, we can get a truly universal system that can very easily adapt to any situation that needs to be handled.

Price Action Analysis Toolkit Development (Part 37): Sentiment Tilt Meter

Market sentiment is one of the most overlooked yet powerful forces influencing price movement. While most traders rely on lagging indicators or guesswork, the Sentiment Tilt Meter (STM) EA transforms raw market data into clear, visual guidance, showing whether the market is leaning bullish, bearish, or staying neutral in real-time. This makes it easier to confirm trades, avoid false entries, and time market participation more effectively.

Developing a Replay System (Part 51): Things Get Complicated (III)

In this article, we will look into one of the most difficult issues in the field of MQL5 programming: how to correctly obtain a chart ID, and why objects are sometimes not plotted on the chart. The materials presented here are for didactic purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Multiple Symbol Analysis With Python And MQL5 (Part I): NASDAQ Integrated Circuit Makers

Join us as we discuss how you can use AI to optimize your position sizing and order quantities to maximize the returns of your portfolio. We will showcase how to algorithmically identify an optimal portfolio and tailor your portfolio to your returns expectations or risk tolerance levels. In this discussion, we will use the SciPy library and the MQL5 language to create an optimal and diversified portfolio using all the data we have.

Price Action Analysis Toolkit Development (Part 34): Turning Raw Market Data into Predictive Models Using an Advanced Ingestion Pipeline

Have you ever missed a sudden market spike or been caught off‑guard when one occurred? The best way to anticipate live events is to learn from historical patterns. Intending to train an ML model, this article begins by showing you how to create a script in MetaTrader 5 that ingests historical data and sends it to Python for storage—laying the foundation for your spike‑detection system. Read on to see each step in action.

Cross-validation and basics of causal inference in CatBoost models, export to ONNX format

The article proposes the method of creating bots using machine learning.

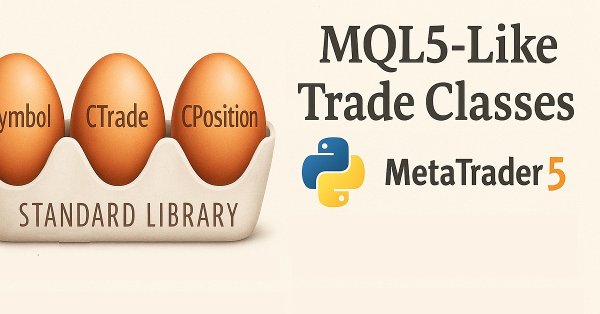

Building MQL5-Like Trade Classes in Python for MetaTrader 5

MetaTrader 5 python package provides an easy way to build trading applications for the MetaTrader 5 platform in the Python language, while being a powerful and useful tool, this module isn't as easy as MQL5 programming language when it comes to making an algorithmic trading solution. In this article, we are going to build trade classes similar to the one offered in MQL5 to create a similar syntax and make it easier to make trading robots in Python as in MQL5.

Price movement discretization methods in Python

We will look at price discretization methods using Python + MQL5. In this article, I will share my practical experience developing a Python library that implements a wide range of approaches to bar formation — from classic Volume and Range bars to more exotic methods like Renko and Kagi. We will consider three-line breakout candles and range bars analyzing their statistics and trying to define how else the prices can be represented discretely.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs (II)-LoRA-Tuning

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

MQL5 Wizard Techniques you should know (Part 28): GANs Revisited with a Primer on Learning Rates

The Learning Rate, is a step size towards a training target in many machine learning algorithms’ training processes. We examine the impact its many schedules and formats can have on the performance of a Generative Adversarial Network, a type of neural network that we had examined in an earlier article.

Developing a Replay System (Part 54): The Birth of the First Module

In this article, we will look at how to put together the first of a number of truly functional modules for use in the replay/simulator system that will also be of general purpose to serve other purposes. We are talking about the mouse module.

Neural Networks in Trading: A Complex Trajectory Prediction Method (Traj-LLM)

In this article, I would like to introduce you to an interesting trajectory prediction method developed to solve problems in the field of autonomous vehicle movements. The authors of the method combined the best elements of various architectural solutions.

Neural Networks in Trading: Controlled Segmentation

In this article. we will discuss a method of complex multimodal interaction analysis and feature understanding.

Neural networks made easy (Part 72): Trajectory prediction in noisy environments

The quality of future state predictions plays an important role in the Goal-Conditioned Predictive Coding method, which we discussed in the previous article. In this article I want to introduce you to an algorithm that can significantly improve the prediction quality in stochastic environments, such as financial markets.

Time series clustering in causal inference

Clustering algorithms in machine learning are important unsupervised learning algorithms that can divide the original data into groups with similar observations. By using these groups, you can analyze the market for a specific cluster, search for the most stable clusters using new data, and make causal inferences. The article proposes an original method for time series clustering in Python.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs(I)-Fine-tuning

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Building A Candlestick Trend Constraint Model (Part 5): Notification System (Part II)

Today, we are discussing a working Telegram integration for MetaTrader 5 Indicator notifications using the power of MQL5, in partnership with Python and the Telegram Bot API. We will explain everything in detail so that no one misses any point. By the end of this project, you will have gained valuable insights to apply in your projects.

Category Theory in MQL5 (Part 23): A different look at the Double Exponential Moving Average

In this article we continue with our theme in the last of tackling everyday trading indicators viewed in a ‘new’ light. We are handling horizontal composition of natural transformations for this piece and the best indicator for this, that expands on what we just covered, is the double exponential moving average (DEMA).

Risk Management (Part 2): Implementing Lot Calculation in a Graphical Interface

In this article, we will look at how to improve and more effectively apply the concepts presented in the previous article using the powerful MQL5 graphical control libraries. We'll go step by step through the process of creating a fully functional GUI. I'll be explaining the ideas behind it, as well as the purpose and operation of each method used. Additionally, at the end of the article, we will test the panel we created to ensure it functions correctly and meets its stated goals.

MQL5 Wizard Techniques you should know (Part 26): Moving Averages and the Hurst Exponent

The Hurst Exponent is a measure of how much a time series auto-correlates over the long term. It is understood to be capturing the long-term properties of a time series and therefore carries some weight in time series analysis even outside of economic/ financial time series. We however, focus on its potential benefit to traders by examining how this metric could be paired with moving averages to build a potentially robust signal.

Developing a Replay System — Market simulation (Part 12): Birth of the SIMULATOR (II)

Developing a simulator can be much more interesting than it seems. Today we'll take a few more steps in this direction because things are getting more interesting.

Neural networks made easy (Part 65): Distance Weighted Supervised Learning (DWSL)

In this article, we will get acquainted with an interesting algorithm that is built at the intersection of supervised and reinforcement learning methods.

MQL5 Wizard Techniques you should know (Part 69): Using Patterns of SAR and the RVI

The Parabolic-SAR (SAR) and the Relative Vigour Index (RVI) are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. This indicator pair, like those we’ve covered in the past, is also complementary since SAR defines the trend while RVI checks momentum. As usual, we use the MQL5 wizard to build and test any potential this indicator pairing may have.