Neural Networks in Trading: Point Cloud Analysis (PointNet)

Direct point cloud analysis avoids unnecessary data growth and improves the performance of models in classification and segmentation tasks. Such approaches demonstrate high performance and robustness to perturbations in the original data.

Creating a Trading Administrator Panel in MQL5 (Part IV): Login Security Layer

Imagine a malicious actor infiltrating the Trading Administrator room, gaining access to the computers and the Admin Panel used to communicate valuable insights to millions of traders worldwide. Such an intrusion could lead to disastrous consequences, such as the unauthorized sending of misleading messages or random clicks on buttons that trigger unintended actions. In this discussion, we will explore the security measures in MQL5 and the new security features we have implemented in our Admin Panel to safeguard against these threats. By enhancing our security protocols, we aim to protect our communication channels and maintain the trust of our global trading community. Find more insights in this article discussion.

Developing a Replay System (Part 43): Chart Trade Project (II)

Most people who want or dream of learning to program don't actually have a clue what they're doing. Their activity consists of trying to create things in a certain way. However, programming is not about tailoring suitable solutions. Doing it this way can create more problems than solutions. Here we will be doing something more advanced and therefore different.

Developing a Replay System (Part 40): Starting the second phase (I)

Today we'll talk about the new phase of the replay/simulator system. At this stage, the conversation will become truly interesting and quite rich in content. I strongly recommend that you read the article carefully and use the links provided in it. This will help you understand the content better.

Creating Dynamic MQL5 Graphical Interfaces through Resource-Driven Image Scaling with Bicubic Interpolation on Trading Charts

In this article, we explore dynamic MQL5 graphical interfaces, using bicubic interpolation for high-quality image scaling on trading charts. We detail flexible positioning options, enabling dynamic centering or corner anchoring with custom offsets.

Neural Networks in Trading: Transformer for the Point Cloud (Pointformer)

In this article, we will talk about algorithms for using attention methods in solving problems of detecting objects in a point cloud. Object detection in point clouds is important for many real-world applications.

Python-MetaTrader 5 Strategy Tester (Part 04): Tester 101

In this fascinating article, we build our very first trading robot in the simulator and run a strategy testing action that resembles how the MetaTrader 5 strategy tester works, then compare the outcome produced in a custom simulation against our favorite terminal.

Statistical Arbitrage Through Cointegrated Stocks (Part 5): Screening

This article proposes an asset screening process for a statistical arbitrage trading strategy through cointegrated stocks. The system starts with the regular filtering by economic factors, like asset sector and industry, and finishes with a list of criteria for a scoring system. For each statistical test used in the screening, a respective Python class was developed: Pearson correlation, Engle-Granger cointegration, Johansen cointegration, and ADF/KPSS stationarity. These Python classes are provided along with a personal note from the author about the use of AI assistants for software development.

Category Theory in MQL5 (Part 17): Functors and Monoids

This article, the final in our series to tackle functors as a subject, revisits monoids as a category. Monoids which we have already introduced in these series are used here to aid in position sizing, together with multi-layer perceptrons.

Neural networks are easy (Part 59): Dichotomy of Control (DoC)

In the previous article, we got acquainted with the Decision Transformer. But the complex stochastic environment of the foreign exchange market did not allow us to fully implement the potential of the presented method. In this article, I will introduce an algorithm that is aimed at improving the performance of algorithms in stochastic environments.

From Novice to Expert: Statistical Validation of Supply and Demand Zones

Today, we uncover the often overlooked statistical foundation behind supply and demand trading strategies. By combining MQL5 with Python through a Jupyter Notebook workflow, we conduct a structured, data-driven investigation aimed at transforming visual market assumptions into measurable insights. This article covers the complete research process, including data collection, Python-based statistical analysis, algorithm design, testing, and final conclusions. To explore the methodology and findings in detail, read the full article.

The MQL5 Standard Library Explorer (Part 4): Custom Signal Library

Today, we use the MQL5 Standard Library to build custom signal classes and let the MQL5 Wizard assemble a professional Expert Advisor for us. This approach simplifies development so that even beginner programmers can create robust EAs without in-depth coding knowledge, focusing instead on tuning inputs and optimizing performance. Join this discussion as we explore the process step by step.

Neural Networks in Trading: Hybrid Graph Sequence Models (Final Part)

We continue exploring hybrid graph sequence models (GSM++), which integrate the advantages of different architectures, providing high analysis accuracy and efficient distribution of computing resources. These models effectively identify hidden patterns, reducing the impact of market noise and improving forecasting quality.

Developing a Replay System (Part 69): Getting the Time Right (II)

Today we will look at why we need the iSpread feature. At the same time, we will understand how the system informs us about the remaining time of the bar when there is not a single tick available for it. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Market Simulation (Part 04): Creating the C_Orders Class (I)

In this article, we will start creating the C_Orders class to be able to send orders to the trading server. We'll do this little by little, as our goal is to explain in detail how this will happen through the messaging system.

Neural Networks in Trading: Piecewise Linear Representation of Time Series

This article is somewhat different from my earlier publications. In this article, we will talk about an alternative representation of time series. Piecewise linear representation of time series is a method of approximating a time series using linear functions over small intervals.

Neural networks made easy (Part 82): Ordinary Differential Equation models (NeuralODE)

In this article, we will discuss another type of models that are aimed at studying the dynamics of the environmental state.

Statistical Arbitrage Through Cointegrated Stocks (Part 3): Database Setup

This article presents a sample MQL5 Service implementation for updating a newly created database used as source for data analysis and for trading a basket of cointegrated stocks. The rationale behind the database design is explained in detail and the data dictionary is documented for reference. MQL5 and Python scripts are provided for the database creation, schema initialization, and market data insertion.

Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention

We invite you to explore a framework that combines wavelet transforms and a multi-task self-attention model, aimed at improving the responsiveness and accuracy of forecasting in volatile market conditions. The wavelet transform allows asset returns to be decomposed into high and low frequencies, carefully capturing long-term market trends and short-term fluctuations.

Chemical reaction optimization (CRO) algorithm (Part I): Process chemistry in optimization

In the first part of this article, we will dive into the world of chemical reactions and discover a new approach to optimization! Chemical reaction optimization (CRO) uses principles derived from the laws of thermodynamics to achieve efficient results. We will reveal the secrets of decomposition, synthesis and other chemical processes that became the basis of this innovative method.

MQL5 Wizard Techniques you should know (Part 45): Reinforcement Learning with Monte-Carlo

Monte-Carlo is the fourth different algorithm in reinforcement learning that we are considering with the aim of exploring its implementation in wizard assembled Expert Advisors. Though anchored in random sampling, it does present vast ways of simulation which we can look to exploit.

MQL5 Wizard Techniques you should know (Part 39): Relative Strength Index

The RSI is a popular momentum oscillator that measures pace and size of a security’s recent price change to evaluate over-and-under valued situations in the security’s price. These insights in speed and magnitude are key in defining reversal points. We put this oscillator to work in another custom signal class and examine the traits of some of its signals. We start, though, by wrapping up what we started previously on Bollinger Bands.

Python-MetaTrader 5 Strategy Tester (Part 03): MT5-Like Trading Operations — Handling and Managing

In this article we introduce Python-MetaTrader5-like ways of handling trading operations such as opening, closing, and modifying orders in the simulator. To ensure the simulation behaves like MT5, a strict validation layer for trade requests is implemented, taking into account symbol trading parameters and typical brokerage restrictions.

MQL5 Wizard Techniques you should know (Part 63): Using Patterns of DeMarker and Envelope Channels

The DeMarker Oscillator and the Envelope indicator are momentum and support/resistance tools that can be paired when developing an Expert Advisor. We therefore examine on a pattern by pattern basis what could be of use and what potentially avoid. We are using, as always, a wizard assembled Expert Advisor together with the Patterns-Usage functions that are built into the Expert Signal Class.

Data Science and ML (Part 36): Dealing with Biased Financial Markets

Financial markets are not perfectly balanced. Some markets are bullish, some are bearish, and some exhibit some ranging behaviors indicating uncertainty in either direction, this unbalanced information when used to train machine learning models can be misleading as the markets change frequently. In this article, we are going to discuss several ways to tackle this issue.

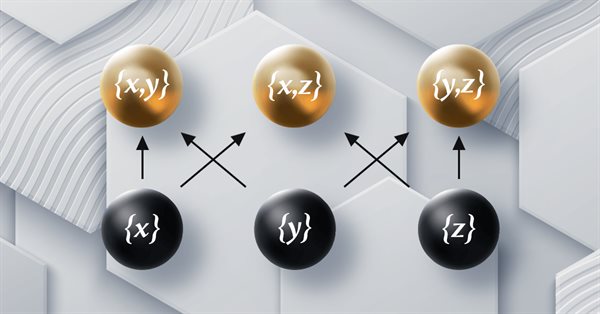

Category Theory in MQL5 (Part 12): Orders

This article which is part of a series that follows Category Theory implementation of Graphs in MQL5, delves in Orders. We examine how concepts of Order-Theory can support monoid sets in informing trade decisions by considering two major ordering types.

Neural Networks in Trading: Generalized 3D Referring Expression Segmentation

While analyzing the market situation, we divide it into separate segments, identifying key trends. However, traditional analysis methods often focus on one aspect and thus limit the proper perception. In this article, we will learn about a method that enables the selection of multiple objects to ensure a more comprehensive and multi-layered understanding of the situation.

Larry Williams Market Secrets (Part 3): Proving Non-Random Market Behavior with MQL5

Explore whether financial markets are truly random by recreating Larry Williams’ market behavior experiments using MQL5. This article demonstrates how simple price-action tests can reveal statistical market biases using a custom Expert Advisor.

Neural Networks in Trading: A Hybrid Trading Framework with Predictive Coding (Final Part)

We continue our examination of the StockFormer hybrid trading system, which combines predictive coding and reinforcement learning algorithms for financial time series analysis. The system is based on three Transformer branches with a Diversified Multi-Head Attention (DMH-Attn) mechanism that enables the capturing of complex patterns and interdependencies between assets. Previously, we got acquainted with the theoretical aspects of the framework and implemented the DMH-Attn mechanisms. Today, we will talk about the model architecture and training.

Neural Networks Made Easy (Part 90): Frequency Interpolation of Time Series (FITS)

By studying the FEDformer method, we opened the door to the frequency domain of time series representation. In this new article, we will continue the topic we started. We will consider a method with which we can not only conduct an analysis, but also predict subsequent states in a particular area.

Statistical Arbitrage Through Cointegrated Stocks (Part 7): Scoring System 2

This article describes two additional scoring criteria used for selection of baskets of stocks to be traded in mean-reversion strategies, more specifically, in cointegration based statistical arbitrage. It complements a previous article where liquidity and strength of the cointegration vectors were presented, along with the strategic criteria of timeframe and lookback period, by including the stability of the cointegration vectors and the time to mean reversion (half-time). The article includes the commented results of a backtest with the new filters applied and the files required for its reproduction are also provided.

MQL5 Wizard Techniques You Should Know (Part 15): Support Vector Machines with Newton's Polynomial

Support Vector Machines classify data based on predefined classes by exploring the effects of increasing its dimensionality. It is a supervised learning method that is fairly complex given its potential to deal with multi-dimensioned data. For this article we consider how it’s very basic implementation of 2-dimensioned data can be done more efficiently with Newton’s Polynomial when classifying price-action.

Developing a multi-currency Expert Advisor (Part 23): Putting in order the conveyor of automatic project optimization stages (II)

We aim to create a system for automatic periodic optimization of trading strategies used in one final EA. As the system evolves, it becomes increasingly complex, so it is necessary to look at it as a whole from time to time in order to identify bottlenecks and suboptimal solutions.

Neural Networks in Trading: Hierarchical Dual-Tower Transformer (Hidformer)

We invite you to get acquainted with the Hierarchical Double-Tower Transformer (Hidformer) framework, which was developed for time series forecasting and data analysis. The framework authors proposed several improvements to the Transformer architecture, which resulted in increased forecast accuracy and reduced computational resource consumption.

Creating Custom Indicators in MQL5 (Part 5): WaveTrend Crossover Evolution Using Canvas for Fog Gradients, Signal Bubbles, and Risk Management

In this article, we enhance the Smart WaveTrend Crossover indicator in MQL5 by integrating canvas-based drawing for fog gradient overlays, signal boxes that detect breakouts, and customizable buy/sell bubbles or triangles for visual alerts. We incorporate risk management features with dynamic take-profit and stop-loss levels calculated via candle multipliers or percentages, displayed through lines and a table, alongside options for trend filtering and box extensions.

Market Simulation (Part 02): Cross Orders (II)

Unlike what was done in the previous article, here we will test the selection option using an Expert Advisor. Although this is not a final solution yet, it will be enough for now. With the help of this article, you will be able to understand how to implement one of the possible solutions.

African Buffalo Optimization (ABO)

The article presents the African Buffalo Optimization (ABO) algorithm, a metaheuristic approach developed in 2015 based on the unique behavior of these animals. The article describes in detail the stages of the algorithm implementation and its efficiency in finding solutions to complex problems, which makes it a valuable tool in the field of optimization.

MQL5 Wizard Techniques you should know (14): Multi Objective Timeseries Forecasting with STF

Spatial Temporal Fusion which is using both ‘space’ and time metrics in modelling data is primarily useful in remote-sensing, and a host of other visual based activities in gaining a better understanding of our surroundings. Thanks to a published paper, we take a novel approach in using it by examining its potential to traders.

MQL5 Wizard Techniques you should know (Part 47): Reinforcement Learning with Temporal Difference

Temporal Difference is another algorithm in reinforcement learning that updates Q-Values basing on the difference between predicted and actual rewards during agent training. It specifically dwells on updating Q-Values without minding their state-action pairing. We therefore look to see how to apply this, as we have with previous articles, in a wizard assembled Expert Advisor.

Markets Positioning Codex in MQL5 (Part 1): Bitwise Learning for Nvidia

We commence a new article series that builds upon our earlier efforts laid out in the MQL5 Wizard series, by taking them further as we step up our approach to systematic trading and strategy testing. Within these new series, we’ll concentrate our focus on Expert Advisors that are coded to hold only a single type of position - primarily longs. Focusing on just one market trend can simplify analysis, lessen strategy complexity and expose some key insights, especially when dealing in assets beyond forex. Our series, therefore, will investigate if this is effective in equities and other non-forex assets, where long only systems usually correlate well with smart money or institution strategies.