Developing a Replay System (Part 26): Expert Advisor project — C_Terminal class

We can now start creating an Expert Advisor for use in the replay/simulation system. However, we need something improved, not a random solution. Despite this, we should not be intimidated by the initial complexity. It's important to start somewhere, otherwise we end up ruminating about the difficulty of a task without even trying to overcome it. That's what programming is all about: overcoming obstacles through learning, testing, and extensive research.

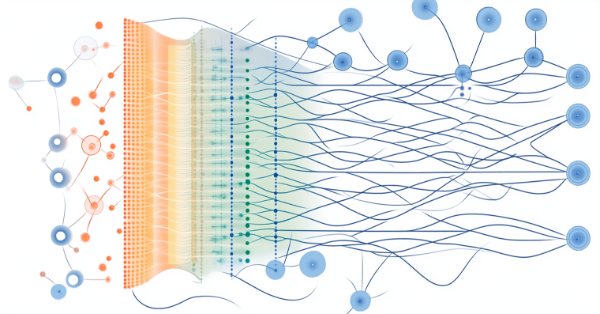

Neural Networks in Trading: Unified Trajectory Generation Model (UniTraj)

Understanding agent behavior is important in many different areas, but most methods focus on just one of the tasks (understanding, noise removal, or prediction), which reduces their effectiveness in real-world scenarios. In this article, we will get acquainted with a model that can adapt to solving various problems.

Data Science and Machine Learning (Part 20): Algorithmic Trading Insights, A Faceoff Between LDA and PCA in MQL5

Uncover the secrets behind these powerful dimensionality reduction techniques as we dissect their applications within the MQL5 trading environment. Delve into the nuances of Linear Discriminant Analysis (LDA) and Principal Component Analysis (PCA), gaining a profound understanding of their impact on strategy development and market analysis.

Trading with the MQL5 Economic Calendar (Part 5): Enhancing the Dashboard with Responsive Controls and Filter Buttons

In this article, we create buttons for currency pair filters, importance levels, time filters, and a cancel option to improve dashboard control. These buttons are programmed to respond dynamically to user actions, allowing seamless interaction. We also automate their behavior to reflect real-time changes on the dashboard. This enhances the overall functionality, mobility, and responsiveness of the panel.

From Novice to Expert: Animated News Headline Using MQL5 (IX) — Multiple Symbol Management on a single chart for News Trading

News trading often requires managing multiple positions and symbols within a very short time due to heightened volatility. In today’s discussion, we address the challenges of multi-symbol trading by integrating this feature into our News Headline EA. Join us as we explore how algorithmic trading with MQL5 makes multi-symbol trading more efficient and powerful.

MQL5 Wizard Techniques you should know (Part 37): Gaussian Process Regression with Linear and Matérn Kernels

Linear Kernels are the simplest matrix of its kind used in machine learning for linear regression and support vector machines. The Matérn kernel on the other hand is a more versatile version of the Radial Basis Function we looked at in an earlier article, and it is adept at mapping functions that are not as smooth as the RBF would assume. We build a custom signal class that utilizes both kernels in forecasting long and short conditions.

Trading with the MQL5 Economic Calendar (Part 4): Implementing Real-Time News Updates in the Dashboard

This article enhances our Economic Calendar dashboard by implementing real-time news updates to keep market information current and actionable. We integrate live data fetching techniques in MQL5 to update events on the dashboard continuously, improving the responsiveness of the interface. This update ensures that we can access the latest economic news directly from the dashboard, optimizing trading decisions based on the freshest data.

Neural networks made easy (Part 46): Goal-conditioned reinforcement learning (GCRL)

In this article, we will have a look at yet another reinforcement learning approach. It is called goal-conditioned reinforcement learning (GCRL). In this approach, an agent is trained to achieve different goals in specific scenarios.

Neural networks made easy (Part 78): Decoder-free Object Detector with Transformer (DFFT)

In this article, I propose to look at the issue of building a trading strategy from a different angle. We will not predict future price movements, but will try to build a trading system based on the analysis of historical data.

Market Reactions and Trading Strategies in Response to Dividend Announcements: Evaluating the Efficient Market Hypothesis in Stock Trading

In this article, we will analyse the impact of dividend announcements on stock market returns and see how investors can earn more returns than those offered by the market when they expect a company to announce dividends. In doing so, we will also check the validity of the Efficient Market Hypothesis in the context of the Indian Stock Market.

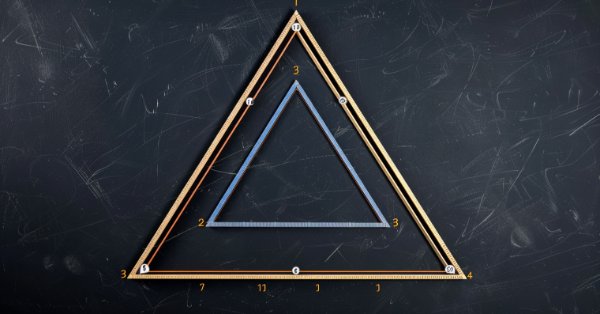

Archery Algorithm (AA)

The article takes a detailed look at the archery-inspired optimization algorithm, with an emphasis on using the roulette method as a mechanism for selecting promising areas for "arrows". The method allows evaluating the quality of solutions and selecting the most promising positions for further study.

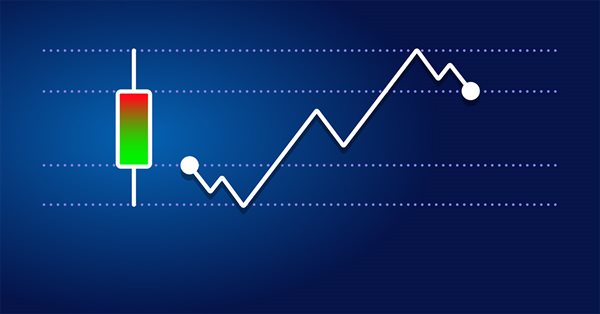

Creating Custom Indicators in MQL5 (Part 4): Smart WaveTrend Crossover with Dual Oscillators

In this article, we develop a custom indicator in MQL5 called Smart WaveTrend Crossover, utilizing dual WaveTrend oscillators—one for generating crossover signals and another for trend filtering—with customizable parameters for channel, average, and moving average lengths. The indicator plots colored candles based on the trend direction, displays buy and sell arrow signals on crossovers, and includes options to enable trend confirmation and adjust visual elements like colors and offsets.

Category Theory in MQL5 (Part 22): A different look at Moving Averages

In this article we attempt to simplify our illustration of concepts covered in these series by dwelling on just one indicator, the most common and probably the easiest to understand. The moving average. In doing so we consider significance and possible applications of vertical natural transformations.

Statistical Arbitrage Through Cointegrated Stocks (Part 1): Engle-Granger and Johansen Cointegration Tests

This article aims to provide a trader-friendly, gentle introduction to the most common cointegration tests, along with a simple guide to understanding their results. The Engle-Granger and Johansen cointegration tests can reveal statistically significant pairs or groups of assets that share long-term dynamics. The Johansen test is especially useful for portfolios with three or more assets, as it calculates the strength of cointegrating vectors all at once.

MQL5 Wizard Techniques you should know (Part 56): Bill Williams Fractals

The Fractals by Bill Williams is a potent indicator that is easy to overlook when one initially spots it on a price chart. It appears too busy and probably not incisive enough. We aim to draw away this curtain on this indicator by examining what its various patterns could accomplish when examined with forward walk tests on all, with wizard assembled Expert Advisor.

Developing a Replay System — Market simulation (Part 14): Birth of the SIMULATOR (IV)

In this article we will continue the simulator development stage. this time we will see how to effectively create a RANDOM WALK type movement. This type of movement is very intriguing because it forms the basis of everything that happens in the capital market. In addition, we will begin to understand some concepts that are fundamental to those conducting market analysis.

Developing a Replay System — Market simulation (Part 11): Birth of the SIMULATOR (I)

In order to use the data that forms the bars, we must abandon replay and start developing a simulator. We will use 1 minute bars because they offer the least amount of difficulty.

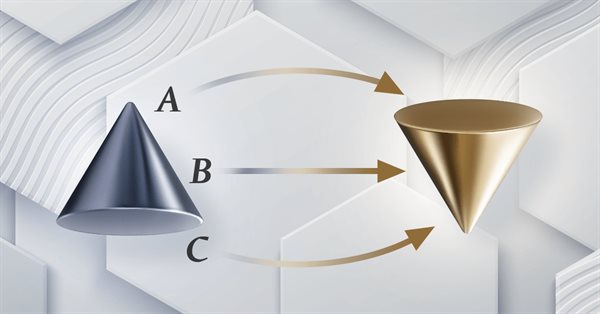

Design Patterns in software development and MQL5 (Part 2): Structural Patterns

In this article, we will continue our articles about Design Patterns after learning how much this topic is more important for us as developers to develop extendable, reliable applications not only by the MQL5 programming language but others as well. We will learn about another type of Design Patterns which is the structural one to learn how to design systems by using what we have as classes to form larger structures.

Self Optimizing Expert Advisors in MQL5 (Part 10): Matrix Factorization

Factorization is a mathematical process used to gain insights into the attributes of data. When we apply factorization to large sets of market data — organized in rows and columns — we can uncover patterns and characteristics of the market. Factorization is a powerful tool, and this article will show how you can use it within the MetaTrader 5 terminal, through the MQL5 API, to gain more profound insights into your market data.

Developing a multi-currency Expert Advisor (Part 6): Automating the selection of an instance group

After optimizing the trading strategy, we receive sets of parameters. We can use them to create several instances of trading strategies combined in one EA. Previously, we did this manually. Here we will try to automate this process.

Formulating Dynamic Multi-Pair EA (Part 2): Portfolio Diversification and Optimization

Portfolio Diversification and Optimization strategically spreads investments across multiple assets to minimize risk while selecting the ideal asset mix to maximize returns based on risk-adjusted performance metrics.

Neural Networks in Trading: Memory Augmented Context-Aware Learning (MacroHFT) for Cryptocurrency Markets

I invite you to explore the MacroHFT framework, which applies context-aware reinforcement learning and memory to improve high-frequency cryptocurrency trading decisions using macroeconomic data and adaptive agents.

Neural networks made easy (Part 45): Training state exploration skills

Training useful skills without an explicit reward function is one of the main challenges in hierarchical reinforcement learning. Previously, we already got acquainted with two algorithms for solving this problem. But the question of the completeness of environmental research remains open. This article demonstrates a different approach to skill training, the use of which directly depends on the current state of the system.

Neural networks made easy (Part 51): Behavior-Guided Actor-Critic (BAC)

The last two articles considered the Soft Actor-Critic algorithm, which incorporates entropy regularization into the reward function. This approach balances environmental exploration and model exploitation, but it is only applicable to stochastic models. The current article proposes an alternative approach that is applicable to both stochastic and deterministic models.

Developing Trading Strategy: Pseudo Pearson Correlation Approach

Generating new indicators from existing ones offers a powerful way to enhance trading analysis. By defining a mathematical function that integrates the outputs of existing indicators, traders can create hybrid indicators that consolidate multiple signals into a single, efficient tool. This article introduces a new indicator built from three oscillators using a modified version of the Pearson correlation function, which we call the Pseudo Pearson Correlation (PPC). The PPC indicator aims to quantify the dynamic relationship between oscillators and apply it within a practical trading strategy.

MQL5 Trading Toolkit (Part 4): Developing a History Management EX5 Library

Learn how to retrieve, process, classify, sort, analyze, and manage closed positions, orders, and deal histories using MQL5 by creating an expansive History Management EX5 Library in a detailed step-by-step approach.

Neural Networks in Trading: Lightweight Models for Time Series Forecasting

Lightweight time series forecasting models achieve high performance using a minimum number of parameters. This, in turn, reduces the consumption of computing resources and speeds up decision-making. Despite being lightweight, such models achieve forecast quality comparable to more complex ones.

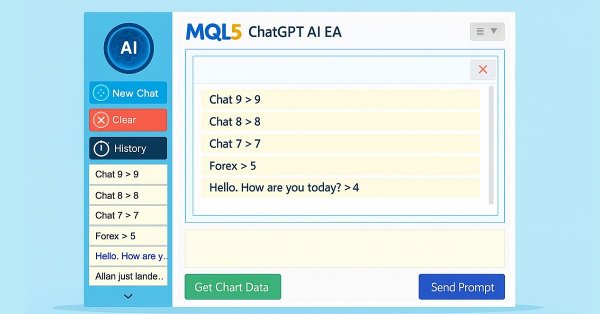

Building AI-Powered Trading Systems in MQL5 (Part 5): Adding a Collapsible Sidebar with Chat Popups

In Part 5 of our MQL5 AI trading system series, we enhance the ChatGPT-integrated Expert Advisor by introducing a collapsible sidebar, improving navigation with small and large history popups for seamless chat selection, while maintaining multiline input handling, persistent encrypted chat storage, and AI-driven trade signal generation from chart data.

MQL5 Wizard Techniques you should know (Part 61): Using Patterns of ADX and CCI with Supervised Learning

The ADX Oscillator and CCI oscillator are trend following and momentum indicators that can be paired when developing an Expert Advisor. We look at how this can be systemized by using all the 3 main training modes of Machine Learning. Wizard Assembled Expert Advisors allow us to evaluate the patterns presented by these two indicators, and we start by looking at how Supervised-Learning can be applied with these Patterns.

Neural Networks in Trading: Two-Dimensional Connection Space Models (Final Part)

We continue to explore the innovative Chimera framework – a two-dimensional state-space model that uses neural network technologies to analyze multidimensional time series. This method provides high forecasting accuracy with low computational cost.

Developing a Replay System — Market simulation (Part 09): Custom events

Here we'll see how custom events are triggered and how the indicator reports the state of the replay/simulation service.

Creating a Trading Administrator Panel in MQL5 (Part II): Enhancing Responsiveness and Quick Messaging

In this article, we will enhance the responsiveness of the Admin Panel that we previously created. Additionally, we will explore the significance of quick messaging in the context of trading signals.

Neural Networks in Trading: Contrastive Pattern Transformer

The Contrastive Transformer is designed to analyze markets both at the level of individual candlesticks and based on entire patterns. This helps improve the quality of market trend modeling. Moreover, the use of contrastive learning to align representations of candlesticks and patterns fosters self-regulation and improves the accuracy of forecasts.

From Novice to Expert: Implementation of Fibonacci Strategies in Post-NFP Market Trading

In financial markets, the laws of retracement remain among the most undeniable forces. It is a rule of thumb that price will always retrace—whether in large moves or even within the smallest tick patterns, which often appear as a zigzag. However, the retracement pattern itself is never fixed; it remains uncertain and subject to anticipation. This uncertainty explains why traders rely on multiple Fibonacci levels, each carrying a certain probability of influence. In this discussion, we introduce a refined strategy that applies Fibonacci techniques to address the challenges of trading shortly after major economic event announcements. By combining retracement principles with event-driven market behavior, we aim to uncover more reliable entry and exit opportunities. Join to explore the full discussion and see how Fibonacci can be adapted to post-event trading.

Neural Networks in Trading: Controlled Segmentation (Final Part)

We continue the work started in the previous article on building the RefMask3D framework using MQL5. This framework is designed to comprehensively study multimodal interaction and feature analysis in a point cloud, followed by target object identification based on a description provided in natural language.

Building A Candlestick Trend Constraint Model (Part 4): Customizing Display Style For Each Trend Wave

In this article, we will explore the capabilities of the powerful MQL5 language in drawing various indicator styles on Meta Trader 5. We will also look at scripts and how they can be used in our model.

Risk Management (Part 3): Building the Main Class for Risk Management

In this article, we will begin creating a core risk management class that will be key to controlling risks in the system. We will focus on building the foundations, defining the basic structures, variables and functions. In addition, we will implement the necessary methods for setting maximum profit and loss values, thereby laying the foundation for risk management.

MQL5 Wizard Techniques you should know (Part 27): Moving Averages and the Angle of Attack

The Angle of Attack is an often-quoted metric whose steepness is understood to strongly correlate with the strength of a prevailing trend. We look at how it is commonly used and understood and examine if there are changes that could be introduced in how it's measured for the benefit of a trade system that puts it in use.

Modelling Requotes in Tester and Expert Advisor Stability Analysis

Requote is a scourge for many Expert Advisors, especially for those that have rather sensitive conditions of entering/exiting a trade. In the article, a way to check up the EA for the requotes stability is offered.

Developing a multi-currency Expert Advisor (Part 15): Preparing EA for real trading

As we gradually approach to obtaining a ready-made EA, we need to pay attention to issues that seem secondary at the stage of testing a trading strategy, but become important when moving on to real trading.