Overcoming ONNX Integration Challenges

ONNX is a great tool for integrating complex AI code between different platforms, it is a great tool that comes with some challenges that one must address to get the most out of it, In this article we discuss the common issues you might face and how to mitigate them.

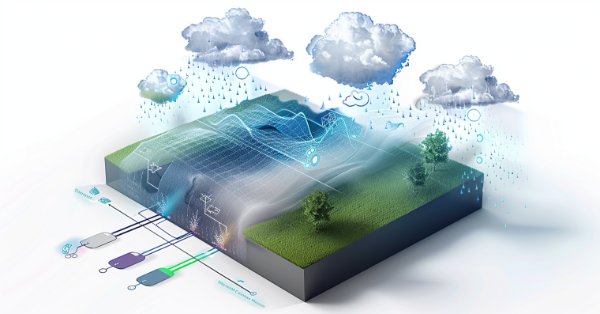

Neural Networks Made Easy (Part 92): Adaptive Forecasting in Frequency and Time Domains

The authors of the FreDF method experimentally confirmed the advantage of combined forecasting in the frequency and time domains. However, the use of the weight hyperparameter is not optimal for non-stationary time series. In this article, we will get acquainted with the method of adaptive combination of forecasts in frequency and time domains.

Neural Networks in Trading: Hybrid Graph Sequence Models (GSM++)

Hybrid graph sequence models (GSM++) combine the advantages of different architectures to provide high-fidelity data analysis and optimized computational costs. These models adapt effectively to dynamic market data, improving the presentation and processing of financial information.

Developing a Replay System (Part 27): Expert Advisor project — C_Mouse class (I)

In this article we will implement the C_Mouse class. It provides the ability to program at the highest level. However, talking about high-level or low-level programming languages is not about including obscene words or jargon in the code. It's the other way around. When we talk about high-level or low-level programming, we mean how easy or difficult the code is for other programmers to understand.

Neural networks made easy (Part 80): Graph Transformer Generative Adversarial Model (GTGAN)

In this article, I will get acquainted with the GTGAN algorithm, which was introduced in January 2024 to solve complex problems of generation architectural layouts with graph constraints.

From Novice to Expert: Forex Market Periods

Every market period has a beginning and an end, each closing with a price that defines its sentiment—much like any candlestick session. Understanding these reference points allows us to gauge the prevailing market mood, revealing whether bullish or bearish forces are in control. In this discussion, we take an important step forward by developing a new feature within the Market Periods Synchronizer—one that visualizes Forex market sessions to support more informed trading decisions. This tool can be especially powerful for identifying, in real time, which side—bulls or bears—dominates the session. Let’s explore this concept and uncover the insights it offers.

Developing a multi-currency Expert Advisor (Part 5): Variable position sizes

In the previous parts, the Expert Advisor (EA) under development was able to use only a fixed position size for trading. This is acceptable for testing, but is not advisable when trading on a real account. Let's make it possible to trade using variable position sizes.

Building a Keltner Channel Indicator with Custom Canvas Graphics in MQL5

In this article, we build a Keltner Channel indicator with custom canvas graphics in MQL5. We detail the integration of moving averages, ATR calculations, and enhanced chart visualization. We also cover backtesting to evaluate the indicator’s performance for practical trading insights.

Developing a multi-currency Expert Advisor (Part 14): Adaptive volume change in risk manager

The previously developed risk manager contained only basic functionality. Let's try to consider possible ways of its development, allowing us to improve trading results without interfering with the logic of trading strategies.

Application of Nash's Game Theory with HMM Filtering in Trading

This article delves into the application of John Nash's game theory, specifically the Nash Equilibrium, in trading. It discusses how traders can utilize Python scripts and MetaTrader 5 to identify and exploit market inefficiencies using Nash's principles. The article provides a step-by-step guide on implementing these strategies, including the use of Hidden Markov Models (HMM) and statistical analysis, to enhance trading performance.

MQL5 Trading Tools (Part 7): Informational Dashboard for Multi-Symbol Position and Account Monitoring

In this article, we develop an informational dashboard in MQL5 for monitoring multi-symbol positions and account metrics like balance, equity, and free margin. We implement a sortable grid with real-time updates, CSV export, and a glowing header effect to enhance usability and visual appeal.

Developing a Replay System (Part 59): A New Future

Having a proper understanding of different ideas allows us to do more with less effort. In this article, we'll look at why it's necessary to configure a template before the service can interact with the chart. Also, what if we improve the mouse pointer so we can do more things with it?

MQL5 Wizard Techniques you should know (Part 46): Ichimoku

The Ichimuko Kinko Hyo is a renown Japanese indicator that serves as a trend identification system. We examine this, on a pattern by pattern basis, as has been the case in previous similar articles, and also assess its strategies & test reports with the help of the MQL5 wizard library classes and assembly.

Portfolio optimization in Forex: Synthesis of VaR and Markowitz theory

How does portfolio trading work on Forex? How can Markowitz portfolio theory for portfolio proportion optimization and VaR model for portfolio risk optimization be synthesized? We create a code based on portfolio theory, where, on the one hand, we will get low risk, and on the other, acceptable long-term profitability.

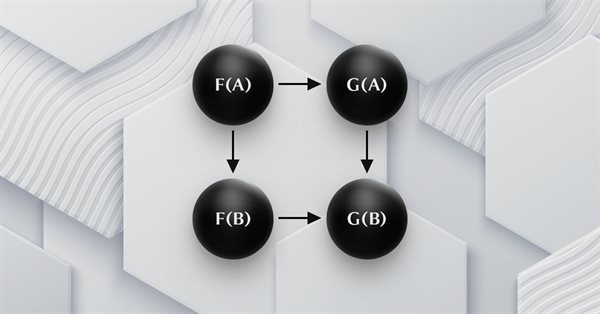

Category Theory in MQL5 (Part 18): Naturality Square

This article continues our series into category theory by introducing natural transformations, a key pillar within the subject. We look at the seemingly complex definition, then delve into examples and applications with this series’ ‘bread and butter’; volatility forecasting.

Atomic Orbital Search (AOS) algorithm: Modification

In the second part of the article, we will continue developing a modified version of the AOS (Atomic Orbital Search) algorithm focusing on specific operators to improve its efficiency and adaptability. After analyzing the fundamentals and mechanics of the algorithm, we will discuss ideas for improving its performance and the ability to analyze complex solution spaces, proposing new approaches to extend its functionality as an optimization tool.

Risk Management (Part 2): Implementing Lot Calculation in a Graphical Interface

In this article, we will look at how to improve and more effectively apply the concepts presented in the previous article using the powerful MQL5 graphical control libraries. We'll go step by step through the process of creating a fully functional GUI. I'll be explaining the ideas behind it, as well as the purpose and operation of each method used. Additionally, at the end of the article, we will test the panel we created to ensure it functions correctly and meets its stated goals.

Reimagining Classic Strategies in Python: MA Crossovers

In this article, we revisit the classic moving average crossover strategy to assess its current effectiveness. Given the amount of time since its inception, we explore the potential enhancements that AI can bring to this traditional trading strategy. By incorporating AI techniques, we aim to leverage advanced predictive capabilities to potentially optimize trade entry and exit points, adapt to varying market conditions, and enhance overall performance compared to conventional approaches.

Developing a multi-currency Expert Advisor (Part 21): Preparing for an important experiment and optimizing the code

For further progress it would be good to see if we can improve the results by periodically re-running the automatic optimization and generating a new EA. The stumbling block in many debates about the use of parameter optimization is the question of how long the obtained parameters can be used for trading in the future period while maintaining the profitability and drawdown at the specified levels. And is it even possible to do this?

News Trading Made Easy (Part 5): Performing Trades (II)

This article will expand on the trade management class to include buy-stop and sell-stop orders to trade news events and implement an expiration constraint on these orders to prevent any overnight trading. A slippage function will be embedded into the expert to try and prevent or minimize possible slippage that may occur when using stop orders in trading, especially during news events.

Developing a Replay System — Market simulation (Part 17): Ticks and more ticks (I)

Here we will see how to implement something really interesting, but at the same time very difficult due to certain points that can be very confusing. The worst thing that can happen is that some traders who consider themselves professionals do not know anything about the importance of these concepts in the capital market. Well, although we focus here on programming, understanding some of the issues involved in market trading is paramount to what we are going to implement.

Integrate Your Own LLM into EA (Part 4): Training Your Own LLM with GPU

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Neural networks made easy (Part 68): Offline Preference-guided Policy Optimization

Since the first articles devoted to reinforcement learning, we have in one way or another touched upon 2 problems: exploring the environment and determining the reward function. Recent articles have been devoted to the problem of exploration in offline learning. In this article, I would like to introduce you to an algorithm whose authors completely eliminated the reward function.

Neural Networks in Trading: Practical Results of the TEMPO Method

We continue our acquaintance with the TEMPO method. In this article we will evaluate the actual effectiveness of the proposed approaches on real historical data.

Developing a Replay System (Part 32): Order System (I)

Of all the things that we have developed so far, this system, as you will probably notice and eventually agree, is the most complex. Now we need to do something very simple: make our system simulate the operation of a trading server. This need to accurately implement the way the trading server operates seems like a no-brainer. At least in words. But we need to do this so that the everything is seamless and transparent for the user of the replay/simulation system.

Neural networks made easy (Part 60): Online Decision Transformer (ODT)

The last two articles were devoted to the Decision Transformer method, which models action sequences in the context of an autoregressive model of desired rewards. In this article, we will look at another optimization algorithm for this method.

Chaos theory in trading (Part 1): Introduction, application in financial markets and Lyapunov exponent

Can chaos theory be applied to financial markets? In this article, we will consider how conventional Chaos theory and chaotic systems are different from the concept proposed by Bill Williams.

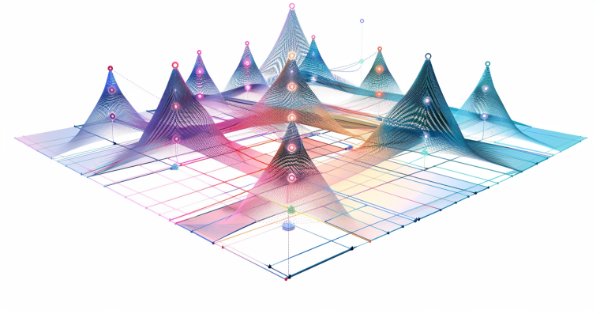

Neural Networks in Trading: State Space Models

A large number of the models we have reviewed so far are based on the Transformer architecture. However, they may be inefficient when dealing with long sequences. And in this article, we will get acquainted with an alternative direction of time series forecasting based on state space models.

Neural Networks Made Easy (Part 84): Reversible Normalization (RevIN)

We already know that pre-processing of the input data plays a major role in the stability of model training. To process "raw" input data online, we often use a batch normalization layer. But sometimes we need a reverse procedure. In this article, we discuss one of the possible approaches to solving this problem.

Building a Candlestick Trend Constraint Model (Part 10): Strategic Golden and Death Cross (EA)

Did you know that the Golden Cross and Death Cross strategies, based on moving average crossovers, are some of the most reliable indicators for identifying long-term market trends? A Golden Cross signals a bullish trend when a shorter moving average crosses above a longer one, while a Death Cross indicates a bearish trend when the shorter average moves below. Despite their simplicity and effectiveness, manually applying these strategies often leads to missed opportunities or delayed trades.

Creating a Trading Administrator Panel in MQL5 (Part V): Two-Factor Authentication (2FA)

Today, we will discuss enhancing security for the Trading Administrator Panel currently under development. We will explore how to implement MQL5 in a new security strategy, integrating the Telegram API for two-factor authentication (2FA). This discussion will provide valuable insights into the application of MQL5 in reinforcing security measures. Additionally, we will examine the MathRand function, focusing on its functionality and how it can be effectively utilized within our security framework. Continue reading to discover more!

Billiards Optimization Algorithm (BOA)

The BOA method is inspired by the classic game of billiards and simulates the search for optimal solutions as a game with balls trying to fall into pockets representing the best results. In this article, we will consider the basics of BOA, its mathematical model, and its efficiency in solving various optimization problems.

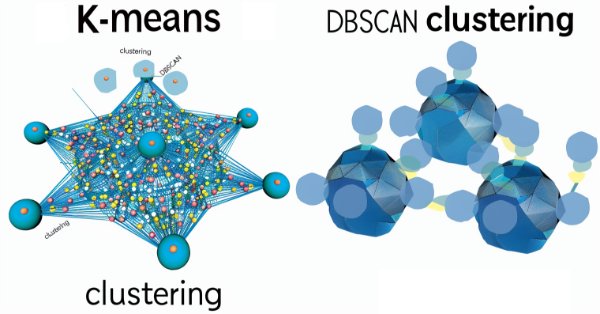

MQL5 Wizard Techniques you should know (Part 13): DBSCAN for Expert Signal Class

Density Based Spatial Clustering for Applications with Noise is an unsupervised form of grouping data that hardly requires any input parameters, save for just 2, which when compared to other approaches like k-means, is a boon. We delve into how this could be constructive for testing and eventually trading with Wizard assembled Expert Advisers

Price Action Analysis Toolkit Development (Part 40): Market DNA Passport

This article explores the unique identity of each currency pair through the lens of its historical price action. Inspired by the concept of genetic DNA, which encodes the distinct blueprint of every living being, we apply a similar framework to the markets, treating price action as the “DNA” of each pair. By breaking down structural behaviors such as volatility, swings, retracements, spikes, and session characteristics, the tool reveals the underlying profile that distinguishes one pair from another. This approach provides more profound insight into market behavior and equips traders with a structured way to align strategies with the natural tendencies of each instrument.

MQL5 Wizard Techniques you should know (Part 75): Using Awesome Oscillator and the Envelopes

The Awesome Oscillator by Bill Williams and the Envelopes Channel are a pairing that could be used complimentarily within an MQL5 Expert Advisor. We use the Awesome Oscillator for its ability to spot trends, while the envelopes channel is incorporated to define our support/resistance levels. In exploring this indicator pairing, we use the MQL5 wizard to build and test any potential these two may possess.

Developing a Replay System (Part 48): Understanding the concept of a service

How about learning something new? In this article, you will learn how to convert scripts into services and why it is useful to do so.

Neural Networks in Trading: Dual-Attention-Based Trend Prediction Model

We continue the discussion about the use of piecewise linear representation of time series, which was started in the previous article. Today we will see how to combine this method with other approaches to time series analysis to improve the price trend prediction quality.

Developing a multi-currency Expert Advisor (Part 3): Architecture revision

We have already made some progress in developing a multi-currency EA with several strategies working in parallel. Considering the accumulated experience, let's review the architecture of our solution and try to improve it before we go too far ahead.

Neural Networks in Trading: Multi-Task Learning Based on the ResNeXt Model

A multi-task learning framework based on ResNeXt optimizes the analysis of financial data, taking into account its high dimensionality, nonlinearity, and time dependencies. The use of group convolution and specialized heads allows the model to effectively extract key features from the input data.

Visualizing deals on a chart (Part 2): Data graphical display

Here we are going to develop a script from scratch that simplifies unloading print screens of deals for analyzing trading entries. All the necessary information on a single deal is to be conveniently displayed on one chart with the ability to draw different timeframes.