Implementing Practical Modules from Other Languages in MQL5 (Part 04): time, date, and datetime modules from Python

Unlike MQL5, Python programming language offers control and flexibility when it comes to dealing with and manipulating time. In this article, we will implement similar modules for better handling of dates and time in MQL5 as in Python.

Introduction to MQL5 (Part 32): Mastering API and WebRequest Function in MQL5 (VI)

This article will show you how to visualize candle data obtained via the WebRequest function and API in candle format. We'll use MQL5 to read the candle data from a CSV file and display it as custom candles on the chart, since indicators cannot directly use the WebRequest function.

Forex Arbitrage Trading: Relationship Assessment Panel

This article presents the development of an arbitrage analysis panel in MQL5. How to get fair exchange rates on Forex in different ways? Create an indicator to obtain deviations of market prices from fair exchange rates, as well as to assess the benefits of arbitrage ways of exchanging one currency for another (as in triangular arbitrage).

MQL5 Wizard Techniques you should know (Part 40): Parabolic SAR

The Parabolic Stop-and-Reversal (SAR) is an indicator for trend confirmation and trend termination points. Because it is a laggard in identifying trends its primary purpose has been in positioning trailing stop losses on open positions. We, however, explore if indeed it could be used as an Expert Advisor signal, thanks to custom signal classes of wizard assembled Expert Advisors.

Arithmetic Optimization Algorithm (AOA): From AOA to SOA (Simple Optimization Algorithm)

In this article, we present the Arithmetic Optimization Algorithm (AOA) based on simple arithmetic operations: addition, subtraction, multiplication and division. These basic mathematical operations serve as the foundation for finding optimal solutions to various problems.

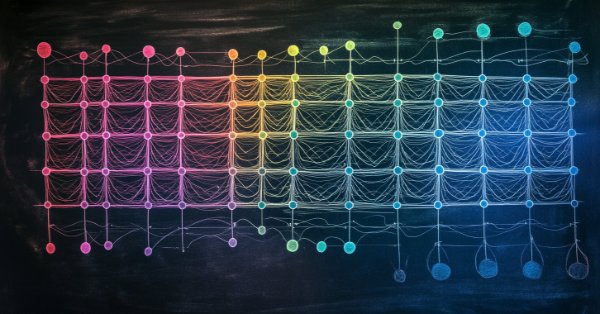

MQL5 Wizard Techniques you should know (Part 10). The Unconventional RBM

Restrictive Boltzmann Machines are at the basic level, a two-layer neural network that is proficient at unsupervised classification through dimensionality reduction. We take its basic principles and examine if we were to re-design and train it unorthodoxly, we could get a useful signal filter.

Neural Networks in Trading: Multi-Task Learning Based on the ResNeXt Model (Final Part)

We continue exploring a multi-task learning framework based on ResNeXt, which is characterized by modularity, high computational efficiency, and the ability to identify stable patterns in data. Using a single encoder and specialized "heads" reduces the risk of model overfitting and improves the quality of forecasts.

Neural networks made easy (Part 77): Cross-Covariance Transformer (XCiT)

In our models, we often use various attention algorithms. And, probably, most often we use Transformers. Their main disadvantage is the resource requirement. In this article, we will consider a new algorithm that can help reduce computing costs without losing quality.

Neural networks made easy (Part 70): Closed-Form Policy Improvement Operators (CFPI)

In this article, we will get acquainted with an algorithm that uses closed-form policy improvement operators to optimize Agent actions in offline mode.

Developing a Replay System (Part 57): Understanding a Test Service

One point to note: although the service code is not included in this article and will only be provided in the next one, I'll explain it since we'll be using that same code as a springboard for what we're actually developing. So, be attentive and patient. Wait for the next article, because every day everything becomes more interesting.

Atmosphere Clouds Model Optimization (ACMO): Theory

The article is devoted to the metaheuristic Atmosphere Clouds Model Optimization (ACMO) algorithm, which simulates the behavior of clouds to solve optimization problems. The algorithm uses the principles of cloud generation, movement and propagation, adapting to the "weather conditions" in the solution space. The article reveals how the algorithm's meteorological simulation finds optimal solutions in a complex possibility space and describes in detail the stages of ACMO operation, including "sky" preparation, cloud birth, cloud movement, and rain concentration.

MQL5 Trading Toolkit (Part 6): Expanding the History Management EX5 Library with the Last Filled Pending Order Functions

Learn how to create an EX5 module of exportable functions that seamlessly query and save data for the most recently filled pending order. In this comprehensive step-by-step guide, we will enhance the History Management EX5 library by developing dedicated and compartmentalized functions to retrieve essential properties of the last filled pending order. These properties include the order type, setup time, execution time, filling type, and other critical details necessary for effective pending orders trade history management and analysis.

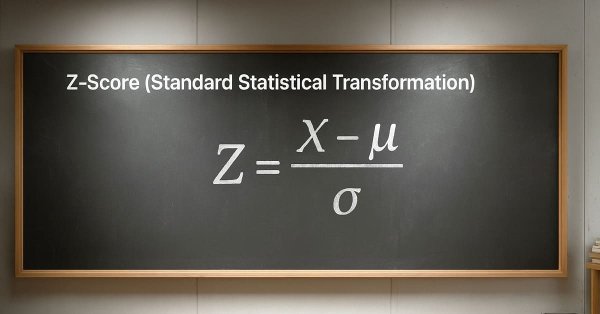

Self Optimizing Expert Advisors in MQL5 (Part 14): Viewing Data Transformations as Tuning Parameters of Our Feedback Controller

Preprocessing is a powerful yet quickly overlooked tuning parameter. It lives in the shadows of its bigger brothers: optimizers and shiny model architectures. Small percentage improvements here can have disproportionately large, compounding effects on profitability and risk. Too often, this largely unexplored science is boiled down to a simple routine, seen only as a means to an end, when in reality it is where signal can be directly amplified, or just as easily destroyed.

Optimizing Trend Strength: Trading in Trend Direction and Strength

This is a specialized trend-following EA that makes both short and long-term analyses, trading decisions, and executions based on the overall trend and its strength. This article will explore in detail an EA that is specifically designed for traders who are patient, disciplined, and focused enough to only execute trades and hold their positions only when trading with strength and in the trend direction without changing their bias frequently, especially against the trend, until take-profit targets are hit.

Developing a Replay System (Part 45): Chart Trade Project (IV)

The main purpose of this article is to introduce and explain the C_ChartFloatingRAD class. We have a Chart Trade indicator that works in a rather interesting way. As you may have noticed, we still have a fairly small number of objects on the chart, and yet we get the expected functionality. The values present in the indicator can be edited. The question is, how is this possible? This article will start to make things clearer.

Neural Networks in Trading: Two-Dimensional Connection Space Models (Chimera)

In this article, we will explore the innovative Chimera framework: a two-dimensional state-space model that uses neural networks to analyze multivariate time series. This method offers high accuracy with low computational cost, outperforming traditional approaches and Transformer architectures.

Analyzing Overbought and Oversold Trends Via Chaos Theory Approaches

We determine the overbought and oversold condition of the market according to chaos theory: integrating the principles of chaos theory, fractal geometry and neural networks to forecast financial markets. The study demonstrates the use of the Lyapunov exponent as a measure of market randomness and the dynamic adaptation of trading signals. The methodology includes an algorithm for generating fractal noise, hyperbolic tangent activation, and moment optimization.

Neural networks made easy (Part 69): Density-based support constraint for the behavioral policy (SPOT)

In offline learning, we use a fixed dataset, which limits the coverage of environmental diversity. During the learning process, our Agent can generate actions beyond this dataset. If there is no feedback from the environment, how can we be sure that the assessments of such actions are correct? Maintaining the Agent's policy within the training dataset becomes an important aspect to ensure the reliability of training. This is what we will talk about in this article.

Developing a Replay System (Part 55): Control Module

In this article, we will implement a control indicator so that it can be integrated into the message system we are developing. Although it is not very difficult, there are some details that need to be understood about the initialization of this module. The material presented here is for educational purposes only. In no way should it be considered as an application for any purpose other than learning and mastering the concepts shown.

Neural Networks in Trading: Hyperbolic Latent Diffusion Model (HypDiff)

The article considers methods of encoding initial data in hyperbolic latent space through anisotropic diffusion processes. This helps to more accurately preserve the topological characteristics of the current market situation and improves the quality of its analysis.

Implementing Practical Modules from Other Languages in MQL5 (Part 06): Python-Like File IO operations in MQL5

This article shows how to simplify complex MQL5 file operations by building a Python-style interface for effortless reading and writing. It explains how to recreate Python’s intuitive file-handling patterns through custom functions and classes. The result is a cleaner, more reliable approach to MQL5 file I/O.

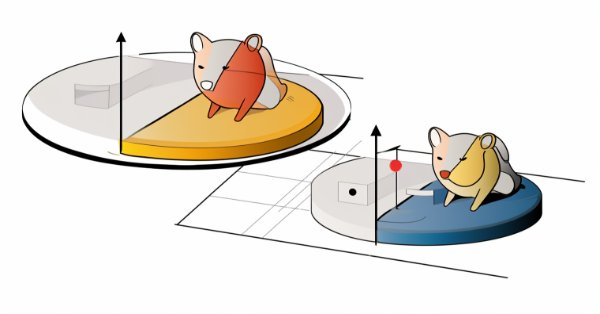

Developing a Replay System (Part 41): Starting the second phase (II)

If everything seemed right to you up to this point, it means you're not really thinking about the long term, when you start developing applications. Over time you will no longer need to program new applications, you will just have to make them work together. So let's see how to finish assembling the mouse indicator.

Developing a Replay System (Part 39): Paving the Path (III)

Before we proceed to the second stage of development, we need to revise some ideas. Do you know how to make MQL5 do what you need? Have you ever tried to go beyond what is contained in the documentation? If not, then get ready. Because we will be doing something that most people don't normally do.

Overcoming The Limitation of Machine Learning (Part 8): Nonparametric Strategy Selection

This article shows how to configure a black-box model to automatically uncover strong trading strategies using a data-driven approach. By using Mutual Information to prioritize the most learnable signals, we can build smarter and more adaptive models that outperform conventional methods. Readers will also learn to avoid common pitfalls like overreliance on surface-level metrics, and instead develop strategies rooted in meaningful statistical insight.

Developing a Replay System (Part 34): Order System (III)

In this article, we will complete the first phase of construction. Although this part is fairly quick to complete, I will cover details that were not discussed previously. I will explain some points that many do not understand. Do you know why you have to press the Shift or Ctrl key?

MQL5 Trading Tools (Part 14): Pixel-Perfect Scrollable Text Canvas with Antialiasing and Rounded Scrollbar

In this article, we enhance the canvas-based price dashboard in MQL5 by adding a pixel-perfect scrollable text panel for usage guides, overcoming native scrolling limitations through custom antialiasing and a rounded scrollbar design with hover-expand functionality. The text panel supports themed backgrounds with opacity, dynamic line wrapping for content like instructions and contacts, and interactive navigation via up/down buttons, slider dragging, and mouse wheel scrolling within the body area.

Integrating External Applications with MQL5 Community OAuth

Learn how to add “Sign in with MQL5” to your Android app using the OAuth 2.0 authorization code flow. The guide covers app registration, endpoints, redirect URI, Custom Tabs, deep-link handling, and a PHP backend that exchanges the code for an access token over HTTPS. You will authenticate real MQL5 users and access profile data such as rank and reputation.

Price Action Analysis Toolkit Development (Part 59): Using Geometric Asymmetry to Identify Precision Breakouts from Fractal Consolidation

While studying a wide range of breakout setups, I noticed that failed breakouts were rarely caused by a lack of volatility, but more often by weak internal structure. That observation led to the framework presented in this article. The approach identifies patterns where the final price leg shows superior length, steepness, and speed—clear signs of momentum accumulation ahead of directional expansion. By detecting these subtle geometric imbalances within consolidation, traders can anticipate higher-probability breakouts before price exits the range. Continue reading to see how this fractal-based, geometric framework translates structural imbalance into precise breakout signals.

Price-Driven CGI Model: Advanced Data Post-Processing and Implementation

In this article, we will explore the development of a fully customizable Price Data export script using MQL5, marking new advancements in the simulation of the Price Man CGI Model. We have implemented advanced refinement techniques to ensure that the data is user-friendly and optimized for animation purposes. Additionally, we will uncover the capabilities of Blender 3D in effectively working with and visualizing price data, demonstrating its potential for creating dynamic and engaging animations.

MQL5 Wizard Techniques you should know (Part 29): Continuation on Learning Rates with MLPs

We wrap up our look at learning rate sensitivity to the performance of Expert Advisors by primarily examining the Adaptive Learning Rates. These learning rates aim to be customized for each parameter in a layer during the training process and so we assess potential benefits vs the expected performance toll.

Larry Williams Market Secrets (Part 8): Combining Volatility, Structure and Time Filters

An in-depth walkthrough of building a Larry Williams inspired volatility breakout Expert Advisor in MQL5, combining swing structure, volatility-based entries, trade day of the week filtering, time filters, and flexible risk management, with a complete implementation and reproducible test setup.

Developing a Replay System (Part 56): Adapting the Modules

Although the modules already interact with each other properly, an error occurs when trying to use the mouse pointer in the replay service. We need to fix this before moving on to the next step. Additionally, we will fix an issue in the mouse indicator code. So this version will be finally stable and properly polished.

Markets Positioning Codex in MQL5 (Part 2): Bitwise Learning, with Multi-Patterns for Nvidia

We continue our new series on Market-Positioning, where we study particular assets, with specific trade directions over manageable test windows. We started this by considering Nvidia Corp stock in the last article, where we covered 5 signal patterns from the complimentary pairing of the RSI and DeMarker oscillators. For this article, we cover the remaining 5 patterns and also delve into multi-pattern options that not only feature untethered combinations of all ten, but also specialized combinations of just a pair.

MQL5 Trading Toolkit (Part 7): Expanding the History Management EX5 Library with the Last Canceled Pending Order Functions

Learn how to complete the creation of the final module in the History Manager EX5 library, focusing on the functions responsible for handling the most recently canceled pending order. This will provide you with the tools to efficiently retrieve and store key details related to canceled pending orders with MQL5.

Developing a Replay System (Part 58): Returning to Work on the Service

After a break in development and improvement of the service used for replay/simulator, we are resuming work on it. Now that we've abandoned the use of resources like terminal globals, we'll have to completely restructure some parts of it. Don't worry, this process will be explained in detail so that everyone can follow the development of our service.

Implementing Practical Modules from Other Languages in MQL5 (Part 05): The Logging module from Python, Log Like a Pro

Integrating Python's logging module with MQL5 empowers traders with a systematic logging approach, simplifying the process of monitoring, debugging, and documenting trading activities. This article explains the adaptation process, offering traders a powerful tool for maintaining clarity and organization in trading software development.

MQL5 Wizard Techniques you should know (Part 30): Spotlight on Batch-Normalization in Machine Learning

Batch normalization is the pre-processing of data before it is fed into a machine learning algorithm, like a neural network. This is always done while being mindful of the type of Activation to be used by the algorithm. We therefore explore the different approaches that one can take in reaping the benefits of this, with the help of a wizard assembled Expert Advisor.

Price Action Analysis Toolkit Development (Part 60): Objective Swing-Based Trendlines for Structural Analysis

We present a rule-based approach to trendlines that avoids indicator pivots and uses ordered swings derived from raw prices. The article walks through swing detection, size qualification via ATR or fixed thresholds, and validation of ascending and descending structures, then implements these rules in MQL5 with non-repainting drawing and selective output. You get a clear, repeatable way to track structural support and resistance that holds up across market conditions.

Graph Theory: Traversal Breadth-First Search (BFS) Applied in Trading

Breadth First Search (BFS) uses level-order traversal to model market structure as a directed graph of price swings evolving through time. By analyzing historical bars or sessions layer by layer, BFS prioritizes recent price behavior while still respecting deeper market memory.

Statistical Arbitrage Through Cointegrated Stocks (Part 10): Detecting Structural Breaks

This article presents the Chow test for detecting structural breaks in pair relationships and the application of the Cumulative Sum of Squares - CUSUM - for structural breaks monitoring and early detection. The article uses the Nvidia/Intel partnership announcement and the US Gov foreign trade tariff announcement as examples of slope inversion and intercept shift, respectively. Python scripts for all the tests are provided.