Combinatorially Symmetric Cross Validation In MQL5

In this article we present the implementation of Combinatorially Symmetric Cross Validation in pure MQL5, to measure the degree to which a overfitting may occure after optimizing a strategy using the slow complete algorithm of the Strategy Tester.

Category Theory in MQL5 (Part 6): Monomorphic Pull-Backs and Epimorphic Push-Outs

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

MQL5 Trading Tools (Part 13): Creating a Canvas-Based Price Dashboard with Graph and Stats Panels

In this article, we develop a canvas-based price dashboard in MQL5 using the CCanvas class to create interactive panels for visualizing recent price graphs and account statistics, with support for background images, fog effects, and gradient fills. The system includes draggable and resizable features via mouse event handling, theme toggling between dark and light modes with dynamic color adjustments, and minimize/maximize controls for efficient chart space management.

Royal Flush Optimization (RFO)

The original Royal Flush Optimization algorithm offers a new approach to solving optimization problems, replacing the classic binary coding of genetic algorithms with a sector-based approach inspired by poker principles. RFO demonstrates how simplifying basic principles can lead to an efficient and practical optimization method. The article presents a detailed analysis of the algorithm and test results.

Developing a Replay System (Part 49): Things Get Complicated (I)

In this article, we'll complicate things a little. Using what was shown in the previous articles, we will start to open up the template file so that the user can use their own template. However, I will be making changes gradually, as I will also be refining the indicator to reduce the load on MetaTrader 5.

The MQL5 Standard Library Explorer (Part 3): Expert Standard Deviation Channel

In this discussion, we will develop an Expert Advisor using the CTrade and CStdDevChannel classes, while applying several filters to enhance profitability. This stage puts our previous discussion into practical application. Additionally, I’ll introduce another simple approach to help you better understand the MQL5 Standard Library and its underlying codebase. Join the discussion to explore these concepts in action.

Artificial Ecosystem-based Optimization (AEO) algorithm

The article considers a metaheuristic Artificial Ecosystem-based Optimization (AEO) algorithm, which simulates interactions between ecosystem components by creating an initial population of solutions and applying adaptive update strategies, and describes in detail the stages of AEO operation, including the consumption and decomposition phases, as well as different agent behavior strategies. The article introduces the features and advantages of this algorithm.

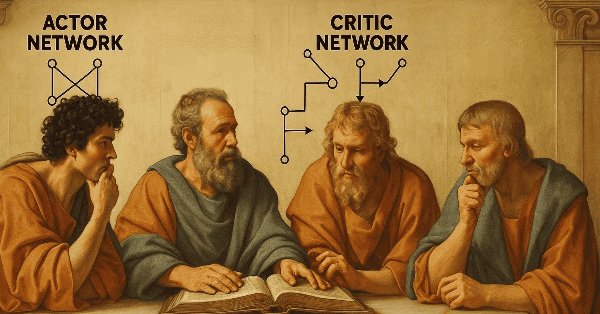

MQL5 Wizard Techniques you should know (Part 59): Reinforcement Learning (DDPG) with Moving Average and Stochastic Oscillator Patterns

We continue our last article on DDPG with MA and stochastic indicators by examining other key Reinforcement Learning classes crucial for implementing DDPG. Though we are mostly coding in python, the final product, of a trained network will be exported to as an ONNX to MQL5 where we integrate it as a resource in a wizard assembled Expert Advisor.

Creating Custom Indicators in MQL5 (Part 3): Multi-Gauge Enhancements with Sector and Round Styles

In this article, we enhance the gauge-based indicator in MQL5 to support multiple oscillators, allowing user selection through an enumeration for single or combined displays. We introduce sector and round gauge styles via derived classes from a base gauge framework, improving case rendering with arcs, lines, and polygons for a more refined visual appearance.

Statistical Arbitrage Through Cointegrated Stocks (Part 4): Real-time Model Updating

This article describes a simple but comprehensive statistical arbitrage pipeline for trading a basket of cointegrated stocks. It includes a fully functional Python script for data download and storage; correlation, cointegration, and stationarity tests, along with a sample Metatrader 5 Service implementation for database updating, and the respective Expert Advisor. Some design choices are documented here for reference and for helping in the experiment replication.

How to Become a Participant of Automated Trading Championship 2008?

The main purpose of the Championship is to popularize automated trading and accumulate practical information in this field of knowledge. As the Organizer of the Championship, we are doing our best to provide a fair competition and suppress all attempts to “play booty”. It is this reasoning that sets the strict Rules of the Championship.

Developing a Replay System — Market simulation (Part 16): New class system

We need to organize our work better. The code is growing, and if this is not done now, then it will become impossible. Let's divide and conquer. MQL5 allows the use of classes which will assist in implementing this task, but for this we need to have some knowledge about classes. Probably the thing that confuses beginners the most is inheritance. In this article, we will look at how to use these mechanisms in a practical and simple way.

MQL5 Wizard Techniques you should know (Part 36): Q-Learning with Markov Chains

Reinforcement Learning is one of the three main tenets in machine learning, alongside supervised learning and unsupervised learning. It is therefore concerned with optimal control, or learning the best long-term policy that will best suit the objective function. It is with this back-drop, that we explore its possible role in informing the learning-process to an MLP of a wizard assembled Expert Advisor.

Population optimization algorithms: Resistance to getting stuck in local extrema (Part II)

We continue our experiment that aims to examine the behavior of population optimization algorithms in the context of their ability to efficiently escape local minima when population diversity is low and reach global maxima. Research results are provided.

Developing a multi-currency Expert Advisor (Part 7): Selecting a group based on forward period

Previously, we evaluated the selection of a group of trading strategy instances, with the aim of improving the results of their joint operation, only on the same time period, in which the optimization of individual instances was carried out. Let's see what happens in the forward period.

MQL5 Wizard Techniques you should know (Part 41): Deep-Q-Networks

The Deep-Q-Network is a reinforcement learning algorithm that engages neural networks in projecting the next Q-value and ideal action during the training process of a machine learning module. We have already considered an alternative reinforcement learning algorithm, Q-Learning. This article therefore presents another example of how an MLP trained with reinforcement learning, can be used within a custom signal class.

Developing a Replay System (Part 47): Chart Trade Project (VI)

Finally, our Chart Trade indicator starts interacting with the EA, allowing information to be transferred interactively. Therefore, in this article, we will improve the indicator, making it functional enough to be used together with any EA. This will allow us to access the Chart Trade indicator and work with it as if it were actually connected with an EA. But we will do it in a much more interesting way than before.

Neural Networks in Trading: Mask-Attention-Free Approach to Price Movement Forecasting

In this article, we will discuss the Mask-Attention-Free Transformer (MAFT) method and its application in the field of trading. Unlike traditional Transformers that require data masking when processing sequences, MAFT optimizes the attention process by eliminating the need for masking, significantly improving computational efficiency.

MQL5 Wizard Techniques you should know (Part 66): Using Patterns of FrAMA and the Force Index with the Dot Product Kernel

The FrAMA Indicator and the Force Index Oscillator are trend and volume tools that could be paired when developing an Expert Advisor. We continue from our last article that introduced this pair by considering machine learning applicability to the pair. We are using a convolution neural network that uses the dot-product kernel in making forecasts with these indicators’ inputs. This is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

The case for using a Composite Data Set this Q4 in weighing SPDR XLY's next performance

We consider XLY, SPDR’s consumer discretionary spending ETF and see if with tools in MetaTrader’s IDE we can sift through an array of data sets in selecting what could work with a forecasting model with a forward outlook of not more than a year.

Creating a Trading Administrator Panel in MQL5 (Part III): Extending Built-in Classes for Theme Management (II)

In this discussion, we will carefully extend the existing Dialog library to incorporate theme management logic. Furthermore, we will integrate methods for theme switching into the CDialog, CEdit, and CButton classes utilized in our Admin Panel project. Continue reading for more insightful perspectives.

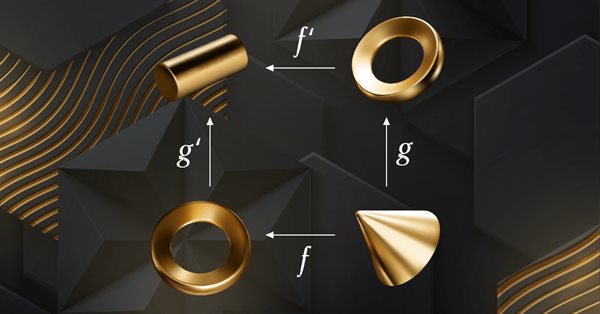

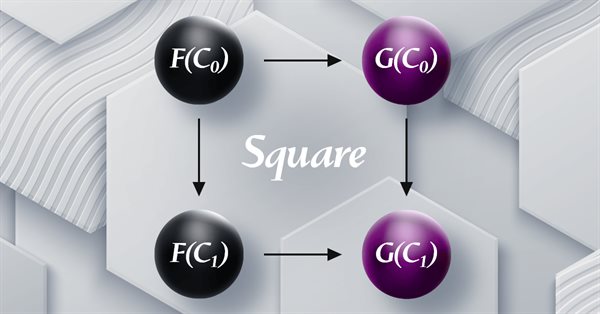

Category Theory in MQL5 (Part 19): Naturality Square Induction

We continue our look at natural transformations by considering naturality square induction. Slight restraints on multicurrency implementation for experts assembled with the MQL5 wizard mean we are showcasing our data classification abilities with a script. Principle applications considered are price change classification and thus its forecasting.

MQL5 Wizard Techniques you should know (Part 62): Using Patterns of ADX and CCI with Reinforcement-Learning TRPO

The ADX Oscillator and CCI oscillator are trend following and momentum indicators that can be paired when developing an Expert Advisor. We continue where we left off in the last article by examining how in-use training, and updating of our developed model, can be made thanks to reinforcement-learning. We are using an algorithm we are yet to cover in these series, known as Trusted Region Policy Optimization. And, as always, Expert Advisor assembly by the MQL5 Wizard allows us to set up our model(s) for testing much quicker and also in a way where it can be distributed and tested with different signal types.

MQL5 Wizard Techniques you should know (Part 12): Newton Polynomial

Newton’s polynomial, which creates quadratic equations from a set of a few points, is an archaic but interesting approach at looking at a time series. In this article we try to explore what aspects could be of use to traders from this approach as well as address its limitations.

MQL5 Wizard Techniques you should know (Part 65): Using Patterns of FrAMA and the Force Index

The Fractal Adaptive Moving Average (FrAMA) and the Force Index Oscillator are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. These two indicators complement each other a little bit because FrAMA is a trend following indicator while the Force Index is a volume based oscillator. As always, we use the MQL5 wizard to rapidly explore any potential these two may have.

MQL5 Wizard Techniques you should know (Part 53): Market Facilitation Index

The Market Facilitation Index is another Bill Williams Indicator that is intended to measure the efficiency of price movement in tandem with volume. As always, we look at the various patterns of this indicator within the confines of a wizard assembly signal class, and present a variety of test reports and analyses for the various patterns.

MQL5 Wizard Techniques you should know (Part 34): Price-Embedding with an Unconventional RBM

Restricted Boltzmann Machines are a form of neural network that was developed in the mid 1980s at a time when compute resources were prohibitively expensive. At its onset, it relied on Gibbs Sampling and Contrastive Divergence in order to reduce dimensionality or capture the hidden probabilities/properties over input training data sets. We examine how Backpropagation can perform similarly when the RBM ‘embeds’ prices for a forecasting Multi-Layer-Perceptron.

Neural networks made easy (Part 61): Optimism issue in offline reinforcement learning

During the offline learning, we optimize the Agent's policy based on the training sample data. The resulting strategy gives the Agent confidence in its actions. However, such optimism is not always justified and can cause increased risks during the model operation. Today we will look at one of the methods to reduce these risks.

Category Theory in MQL5 (Part 21): Natural Transformations with LDA

This article, the 21st in our series, continues with a look at Natural Transformations and how they can be implemented using linear discriminant analysis. We present applications of this in a signal class format, like in the previous article.

Developing a Replay System (Part 50): Things Get Complicated (II)

We will solve the chart ID problem and at the same time we will begin to provide the user with the ability to use a personal template for the analysis and simulation of the desired asset. The materials presented here are for didactic purposes only and should in no way be considered as an application for any purpose other than studying and mastering the concepts presented.

Price Action Analysis Toolkit Development (Part 45): Creating a Dynamic Level-Analysis Panel in MQL5

In this article, we explore a powerful MQL5 tool that let's you test any price level you desire with just one click. Simply enter your chosen level and press analyze, the EA instantly scans historical data, highlights every touch and breakout on the chart, and displays statistics in a clean, organized dashboard. You'll see exactly how often price respected or broke through your level, and whether it behaved more like support or resistance. Continue reading to explore the detailed procedure.

MQL5 Wizard Techniques you should know (Part 74): Using Patterns of Ichimoku and the ADX-Wilder with Supervised Learning

We follow up on our last article, where we introduced the indicator pair of the Ichimoku and the ADX, by looking at how this duo could be improved with Supervised Learning. Ichimoku and ADX are a support/resistance plus trend complimentary pairing. Our supervised learning approach uses a neural network that engages the Deep Spectral Mixture Kernel to fine tune the forecasts of this indicator pairing. As per usual, this is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

Permuting price bars in MQL5

In this article we present an algorithm for permuting price bars and detail how permutation tests can be used to recognize instances where strategy performance has been fabricated to deceive potential buyers of Expert Advisors.

Integrating MQL5 with data processing packages (Part 1): Advanced Data analysis and Statistical Processing

Integration enables seamless workflow where raw financial data from MQL5 can be imported into data processing packages like Jupyter Lab for advanced analysis including statistical testing.

Neural Networks in Trading: Exploring the Local Structure of Data

Effective identification and preservation of the local structure of market data in noisy conditions is a critical task in trading. The use of the Self-Attention mechanism has shown promising results in processing such data; however, the classical approach does not account for the local characteristics of the underlying structure. In this article, I introduce an algorithm capable of incorporating these structural dependencies.

Data Science and ML (Part 47): Forecasting the Market Using the DeepAR model in Python

In this article, we will attempt to predict the market with a decent model for time series forecasting named DeepAR. A model that is a combination of deep neural networks and autoregressive properties found in models like ARIMA and Vector Autoregressive (VAR).

MQL5 Wizard Techniques you should know (Part 32): Regularization

Regularization is a form of penalizing the loss function in proportion to the discrete weighting applied throughout the various layers of a neural network. We look at the significance, for some of the various regularization forms, this can have in test runs with a wizard assembled Expert Advisor.

Visualizing deals on a chart (Part 1): Selecting a period for analysis

Here we are going to develop a script from scratch that simplifies unloading print screens of deals for analyzing trading entries. All the necessary information on a single deal is to be conveniently displayed on one chart with the ability to draw different timeframes.

Developing a Replay System (Part 46): Chart Trade Project (V)

Tired of wasting time searching for that very file that you application needs in order to work? How about including everything in the executable? This way you won't have to search for the things. I know that many people use this form of distribution and storage, but there is a much more suitable way. At least as far as the distribution of executable files and their storage is concerned. The method that will be presented here can be very useful, since you can use MetaTrader 5 itself as an excellent assistant, as well as MQL5. Furthermore, it is not that difficult to understand.

Neural Networks in Trading: Injection of Global Information into Independent Channels (InjectTST)

Most modern multimodal time series forecasting methods use the independent channels approach. This ignores the natural dependence of different channels of the same time series. Smart use of two approaches (independent and mixed channels) is the key to improving the performance of the models.