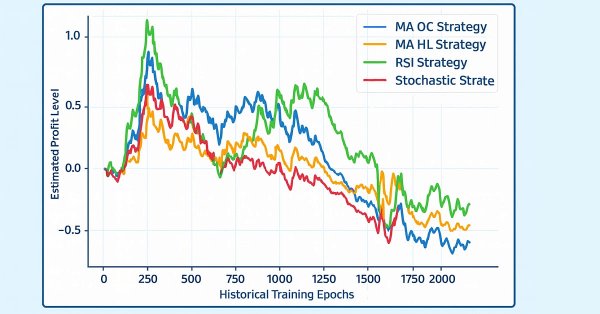

Overcoming The Limitation of Machine Learning (Part 7): Automatic Strategy Selection

This article demonstrates how to automatically identify potentially profitable trading strategies using MetaTrader 5. White-box solutions, powered by unsupervised matrix factorization, are faster to configure, more interpretable, and provide clear guidance on which strategies to retain. Black-box solutions, while more time-consuming, are better suited for complex market conditions that white-box approaches may not capture. Join us as we discuss how our trading strategies can help us carefully identify profitable strategies under any circumstance.

Forex arbitrage trading: Analyzing synthetic currencies movements and their mean reversion

In this article, we will examine the movements of synthetic currencies using Python and MQL5 and explore how feasible Forex arbitrage is today. We will also consider ready-made Python code for analyzing synthetic currencies and share more details on what synthetic currencies are in Forex.

MQL5 Trading Tools (Part 11): Correlation Matrix Dashboard (Pearson, Spearman, Kendall) with Heatmap and Standard Modes

In this article, we build a correlation matrix dashboard in MQL5 to compute asset relationships using Pearson, Spearman, and Kendall methods over a set timeframe and bars. The system offers standard mode with color thresholds and p-value stars, plus heatmap mode with gradient visuals for correlation strengths. It includes an interactive UI with timeframe selectors, mode toggles, and a dynamic legend for efficient analysis of symbol interdependencies.

Non-stationary processes and spurious regression

The article demonstrates spurious regression occurring when attempting to apply regression analysis to non-stationary processes using Monte Carlo simulation.

MQL5 Wizard Techniques you should know (Part 10). The Unconventional RBM

Restrictive Boltzmann Machines are at the basic level, a two-layer neural network that is proficient at unsupervised classification through dimensionality reduction. We take its basic principles and examine if we were to re-design and train it unorthodoxly, we could get a useful signal filter.

CRUD Operations in Firebase using MQL

This article offers a step-by-step guide to mastering CRUD (Create, Read, Update, Delete) operations in Firebase, focusing on its Realtime Database and Firestore. Discover how to use Firebase SDK methods to efficiently manage data in web and mobile apps, from adding new records to querying, modifying, and deleting entries. Explore practical code examples and best practices for structuring and handling data in real-time, empowering developers to build dynamic, scalable applications with Firebase’s flexible NoSQL architecture.

Reimagining Classic Strategies (Part VIII): Currency Markets And Precious Metals on the USDCAD

In this series of articles, we revisit well-known trading strategies to see if we can improve them using AI. In today's discussion, join us as we test whether there is a reliable relationship between precious metals and currencies.

Eigenvectors and eigenvalues: Exploratory data analysis in MetaTrader 5

In this article we explore different ways in which the eigenvectors and eigenvalues can be applied in exploratory data analysis to reveal unique relationships in data.

Arithmetic Optimization Algorithm (AOA): From AOA to SOA (Simple Optimization Algorithm)

In this article, we present the Arithmetic Optimization Algorithm (AOA) based on simple arithmetic operations: addition, subtraction, multiplication and division. These basic mathematical operations serve as the foundation for finding optimal solutions to various problems.

From Basic to Intermediate: Union (II)

Today we have a very funny and quite interesting article. We will look at Union and will try to solve the problem discussed earlier. We'll also explore some unusual situations that can arise when using union in applications. The materials presented here are intended for didactic purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Introduction to MQL5 (Part 28): Mastering API and WebRequest Function in MQL5 (II)

This article teaches you how to retrieve and extract price data from external platforms using APIs and the WebRequest function in MQL5. You’ll learn how URLs are structured, how API responses are formatted, how to convert server data into readable strings, and how to identify and extract specific values from JSON responses.

Neural networks made easy (Part 77): Cross-Covariance Transformer (XCiT)

In our models, we often use various attention algorithms. And, probably, most often we use Transformers. Their main disadvantage is the resource requirement. In this article, we will consider a new algorithm that can help reduce computing costs without losing quality.

MQL5 Wizard Techniques you should know (Part 40): Parabolic SAR

The Parabolic Stop-and-Reversal (SAR) is an indicator for trend confirmation and trend termination points. Because it is a laggard in identifying trends its primary purpose has been in positioning trailing stop losses on open positions. We, however, explore if indeed it could be used as an Expert Advisor signal, thanks to custom signal classes of wizard assembled Expert Advisors.

Market Simulation (Part 07): Sockets (I)

Sockets. Do you know what they are for or how to use them in MetaTrader 5? If the answer is no, let's start by studying them. In today's article, we'll cover the basics. Since there are several ways to do the same thing, and we are always interested in the result, I want to show that there is indeed a simple way to transfer data from MetaTrader 5 to other programs, such as Excel. However, the main idea is not to transfer data from MetaTrader 5 to Excel, but the opposite, that is, to transfer data from Excel or any other program to MetaTrader 5.

Neural networks made easy (Part 70): Closed-Form Policy Improvement Operators (CFPI)

In this article, we will get acquainted with an algorithm that uses closed-form policy improvement operators to optimize Agent actions in offline mode.

Implementing Practical Modules from Other Languages in MQL5 (Part 04): time, date, and datetime modules from Python

Unlike MQL5, Python programming language offers control and flexibility when it comes to dealing with and manipulating time. In this article, we will implement similar modules for better handling of dates and time in MQL5 as in Python.

Analyzing binary code of prices on the exchange (Part I): A new look at technical analysis

This article presents an innovative approach to technical analysis based on converting price movements into binary code. The author demonstrates how various aspects of market behavior — from simple price movements to complex patterns — can be encoded in a sequence of zeros and ones.

MQL5 Wizard Techniques you should know (Part 81): Using Patterns of Ichimoku and the ADX-Wilder with Beta VAE Inference Learning

This piece follows up ‘Part-80’, where we examined the pairing of Ichimoku and the ADX under a Reinforcement Learning framework. We now shift focus to Inference Learning. Ichimoku and ADX are complimentary as already covered, however we are going to revisit the conclusions of the last article related to pipeline use. For our inference learning, we are using the Beta algorithm of a Variational Auto Encoder. We also stick with the implementation of a custom signal class designed for integration with the MQL5 Wizard.

Statistical Arbitrage Through Cointegrated Stocks (Part 9): Backtesting Portfolio Weights Updates

This article describes the use of CSV files for backtesting portfolio weights updates in a mean-reversion-based strategy that uses statistical arbitrage through cointegrated stocks. It goes from feeding the database with the results of a Rolling Windows Eigenvector Comparison (RWEC) to comparing the backtest reports. In the meantime, the article details the role of each RWEC parameter and its impact in the overall backtest result, showing how the comparison of the relative drawdown can help us to further improve those parameters.

Developing a Replay System (Part 57): Understanding a Test Service

One point to note: although the service code is not included in this article and will only be provided in the next one, I'll explain it since we'll be using that same code as a springboard for what we're actually developing. So, be attentive and patient. Wait for the next article, because every day everything becomes more interesting.

Integrating MQL5 with Data Processing Packages (Part 6): Merging Market Feedback with Model Adaptation

In this part, we focus on how to merge real-time market feedback—such as live trade outcomes, volatility changes, and liquidity shifts—with adaptive model learning to maintain a responsive and self-improving trading system.

Developing a Replay System (Part 60): Playing the Service (I)

We have been working on just the indicators for a long time now, but now it's time to get the service working again and see how the chart is built based on the data provided. However, since the whole thing is not that simple, we will have to be attentive to understand what awaits us ahead.

A feature selection algorithm using energy based learning in pure MQL5

In this article we present the implementation of a feature selection algorithm described in an academic paper titled,"FREL: A stable feature selection algorithm", called Feature weighting as regularized energy based learning.

Market Simulation (Part 05): Creating the C_Orders Class (II)

In this article, I will explain how Chart Trade, together with the Expert Advisor, will process a request to close all of the users' open positions. This may sound simple, but there are a few complications that you need to know how to manage.

MQL5 Wizard Techniques you should know (Part 23): CNNs

Convolutional Neural Networks are another machine learning algorithm that tend to specialize in decomposing multi-dimensioned data sets into key constituent parts. We look at how this is typically achieved and explore a possible application for traders in another MQL5 wizard signal class.

Reimagining Classic Strategies in MQL5 (Part II): FTSE100 and UK Gilts

In this series of articles, we explore popular trading strategies and try to improve them using AI. In today's article, we revisit the classical trading strategy built on the relationship between the stock market and the bond market.

MQL5 Trading Toolkit (Part 6): Expanding the History Management EX5 Library with the Last Filled Pending Order Functions

Learn how to create an EX5 module of exportable functions that seamlessly query and save data for the most recently filled pending order. In this comprehensive step-by-step guide, we will enhance the History Management EX5 library by developing dedicated and compartmentalized functions to retrieve essential properties of the last filled pending order. These properties include the order type, setup time, execution time, filling type, and other critical details necessary for effective pending orders trade history management and analysis.

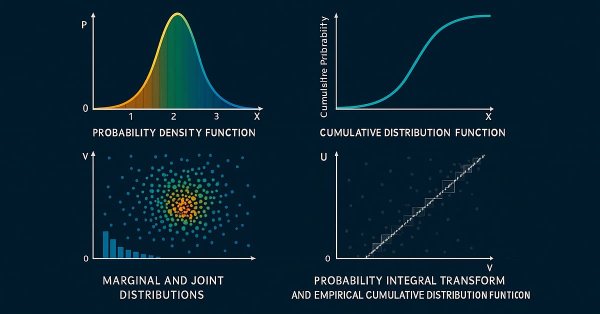

Bivariate Copulae in MQL5 (Part 1): Implementing Gaussian and Student's t-Copulae for Dependency Modeling

This is the first part of an article series presenting the implementation of bivariate copulae in MQL5. This article presents code implementing Gaussian and Student's t-copulae. It also delves into the fundamentals of statistical copulae and related topics. The code is based on the Arbitragelab Python package by Hudson and Thames.

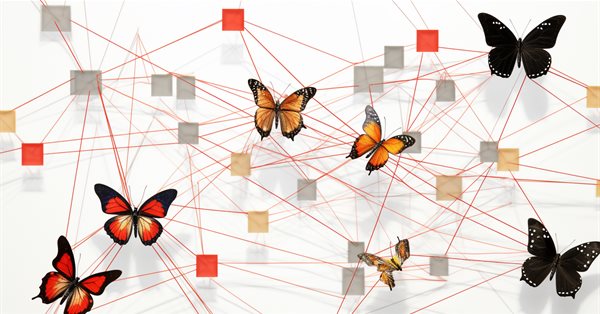

Adaptive Social Behavior Optimization (ASBO): Two-phase evolution

We continue dwelling on the topic of social behavior of living organisms and its impact on the development of a new mathematical model - ASBO (Adaptive Social Behavior Optimization). We will dive into the two-phase evolution, test the algorithm and draw conclusions. Just as in nature a group of living organisms join their efforts to survive, ASBO uses principles of collective behavior to solve complex optimization problems.

The case for using Hospital-Performance Data with Perceptrons, this Q4, in weighing SPDR XLV's next Performance

XLV is SPDR healthcare ETF and in an age where it is common to be bombarded by a wide array of traditional news items plus social media feeds, it can be pressing to select a data set for use with a model. We try to tackle this problem for this ETF by sizing up some of its critical data sets in MQL5.

Atmosphere Clouds Model Optimization (ACMO): Theory

The article is devoted to the metaheuristic Atmosphere Clouds Model Optimization (ACMO) algorithm, which simulates the behavior of clouds to solve optimization problems. The algorithm uses the principles of cloud generation, movement and propagation, adapting to the "weather conditions" in the solution space. The article reveals how the algorithm's meteorological simulation finds optimal solutions in a complex possibility space and describes in detail the stages of ACMO operation, including "sky" preparation, cloud birth, cloud movement, and rain concentration.

Introduction to MQL5 (Part 32): Mastering API and WebRequest Function in MQL5 (VI)

This article will show you how to visualize candle data obtained via the WebRequest function and API in candle format. We'll use MQL5 to read the candle data from a CSV file and display it as custom candles on the chart, since indicators cannot directly use the WebRequest function.

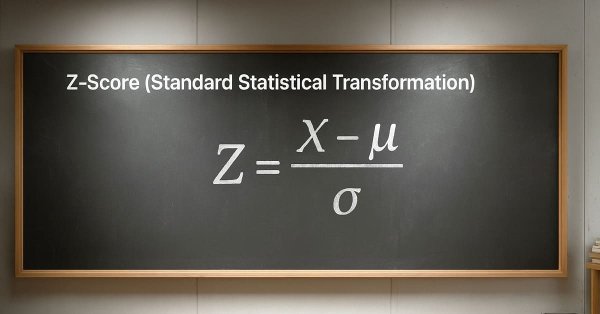

Self Optimizing Expert Advisors in MQL5 (Part 14): Viewing Data Transformations as Tuning Parameters of Our Feedback Controller

Preprocessing is a powerful yet quickly overlooked tuning parameter. It lives in the shadows of its bigger brothers: optimizers and shiny model architectures. Small percentage improvements here can have disproportionately large, compounding effects on profitability and risk. Too often, this largely unexplored science is boiled down to a simple routine, seen only as a means to an end, when in reality it is where signal can be directly amplified, or just as easily destroyed.

Neural networks made easy (Part 69): Density-based support constraint for the behavioral policy (SPOT)

In offline learning, we use a fixed dataset, which limits the coverage of environmental diversity. During the learning process, our Agent can generate actions beyond this dataset. If there is no feedback from the environment, how can we be sure that the assessments of such actions are correct? Maintaining the Agent's policy within the training dataset becomes an important aspect to ensure the reliability of training. This is what we will talk about in this article.

Developing a Replay System (Part 45): Chart Trade Project (IV)

The main purpose of this article is to introduce and explain the C_ChartFloatingRAD class. We have a Chart Trade indicator that works in a rather interesting way. As you may have noticed, we still have a fairly small number of objects on the chart, and yet we get the expected functionality. The values present in the indicator can be edited. The question is, how is this possible? This article will start to make things clearer.

Developing a Replay System (Part 55): Control Module

In this article, we will implement a control indicator so that it can be integrated into the message system we are developing. Although it is not very difficult, there are some details that need to be understood about the initialization of this module. The material presented here is for educational purposes only. In no way should it be considered as an application for any purpose other than learning and mastering the concepts shown.

Neural Networks in Trading: Hyperbolic Latent Diffusion Model (HypDiff)

The article considers methods of encoding initial data in hyperbolic latent space through anisotropic diffusion processes. This helps to more accurately preserve the topological characteristics of the current market situation and improves the quality of its analysis.

Developing a Replay System (Part 35): Making Adjustments (I)

Before we can move forward, we need to fix a few things. These are not actually the necessary fixes but rather improvements to the way the class is managed and used. The reason is that failures occurred due to some interaction within the system. Despite attempts to find out the cause of such failures in order to eliminate them, all these attempts were unsuccessful. Some of these cases make no sense, for example, when we use pointers or recursion in C/C++, the program crashes.

Reimagining Classic Strategies (Part VII) : Forex Markets And Sovereign Debt Analysis on the USDJPY

In today's article, we will analyze the relationship between future exchange rates and government bonds. Bonds are among the most popular forms of fixed income securities and will be the focus of our discussion.Join us as we explore whether we can improve a classic strategy using AI.

Population optimization algorithms: Bacterial Foraging Optimization - Genetic Algorithm (BFO-GA)

The article presents a new approach to solving optimization problems by combining ideas from bacterial foraging optimization (BFO) algorithms and techniques used in the genetic algorithm (GA) into a hybrid BFO-GA algorithm. It uses bacterial swarming to globally search for an optimal solution and genetic operators to refine local optima. Unlike the original BFO, bacteria can now mutate and inherit genes.