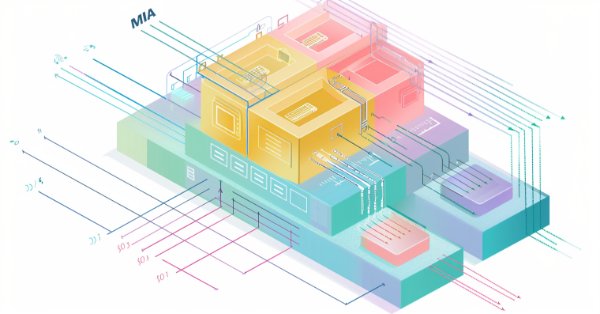

Ensemble methods to enhance classification tasks in MQL5

In this article, we present the implementation of several ensemble classifiers in MQL5 and discuss their efficacy in varying situations.

MQL5 Wizard Techniques you should know (Part 33): Gaussian Process Kernels

Gaussian Process Kernels are the covariance function of the Normal Distribution that could play a role in forecasting. We explore this unique algorithm in a custom signal class of MQL5 to see if it could be put to use as a prime entry and exit signal.

Population optimization algorithms: Artificial Multi-Social Search Objects (MSO)

This is a continuation of the previous article considering the idea of social groups. The article explores the evolution of social groups using movement and memory algorithms. The results will help to understand the evolution of social systems and apply them in optimization and search for solutions.

Neural Networks in Trading: Hierarchical Dual-Tower Transformer (Final Part)

We continue to build the Hidformer hierarchical dual-tower transformer model designed for analyzing and forecasting complex multivariate time series. In this article, we will bring the work we started earlier to its logical conclusion — we will test the model on real historical data.

MQL5 Wizard Techniques you should know (Part 20): Symbolic Regression

Symbolic Regression is a form of regression that starts with minimal to no assumptions on what the underlying model that maps the sets of data under study would look like. Even though it can be implemented by Bayesian Methods or Neural Networks, we look at how an implementation with Genetic Algorithms can help customize an expert signal class usable in the MQL5 wizard.

From Basic to Intermediate: Arrays and Strings (I)

In today's article, we'll start exploring some special data types. To begin, we'll define what a string is and explain how to use some basic procedures. This will allow us to work with this type of data, which can be interesting, although sometimes a little confusing for beginners. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Developing an MQL5 RL agent with RestAPI integration (Part 4): Organizing functions in classes in MQL5

This article discusses the transition from procedural coding to object-oriented programming (OOP) in MQL5 with an emphasis on integration with the REST API. Today we will discuss how to organize HTTP request functions (GET and POST) into classes. We will take a closer look at code refactoring and show how to replace isolated functions with class methods. The article contains practical examples and tests.

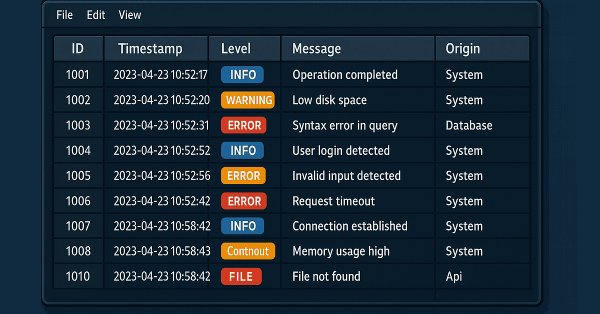

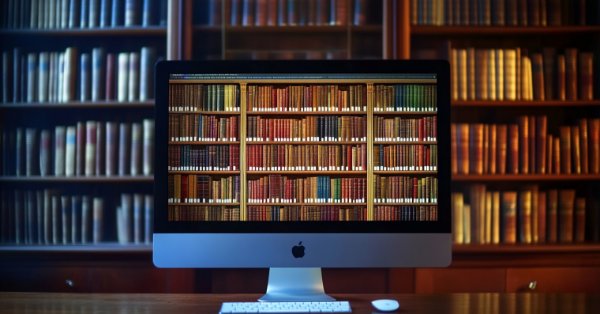

Mastering Log Records (Part 6): Saving logs to database

This article explores the use of databases to store logs in a structured and scalable way. It covers fundamental concepts, essential operations, configuration and implementation of a database handler in MQL5. Finally, it validates the results and highlights the benefits of this approach for optimization and efficient monitoring.

Neural Networks in Trading: Memory Augmented Context-Aware Learning for Cryptocurrency Markets (Final Part)

The MacroHFT framework for high-frequency cryptocurrency trading uses context-aware reinforcement learning and memory to adapt to dynamic market conditions. At the end of this article, we will test the implemented approaches on real historical data to assess their effectiveness.

MQL5 Wizard Techniques you should know (Part 54): Reinforcement Learning with hybrid SAC and Tensors

Soft Actor Critic is a Reinforcement Learning algorithm that we looked at in a previous article, where we also introduced python and ONNX to these series as efficient approaches to training networks. We revisit the algorithm with the aim of exploiting tensors, computational graphs that are often exploited in Python.

Neural networks made easy (Part 63): Unsupervised Pretraining for Decision Transformer (PDT)

We continue to discuss the family of Decision Transformer methods. From previous article, we have already noticed that training the transformer underlying the architecture of these methods is a rather complex task and requires a large labeled dataset for training. In this article we will look at an algorithm for using unlabeled trajectories for preliminary model training.

Successful Restaurateur Algorithm (SRA)

Successful Restaurateur Algorithm (SRA) is an innovative optimization method inspired by restaurant business management principles. Unlike traditional approaches, SRA does not discard weak solutions, but improves them by combining with elements of successful ones. The algorithm shows competitive results and offers a fresh perspective on balancing exploration and exploitation in optimization problems.

Bacterial Chemotaxis Optimization (BCO)

The article presents the original version of the Bacterial Chemotaxis Optimization (BCO) algorithm and its modified version. We will take a closer look at all the differences, with a special focus on the new version of BCOm, which simplifies the bacterial movement mechanism, reduces the dependence on positional history, and uses simpler math than the computationally heavy original version. We will also conduct the tests and summarize the results.

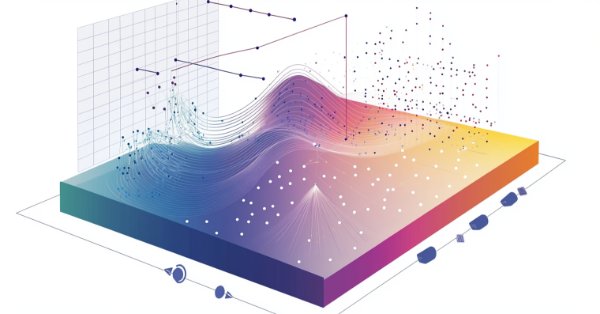

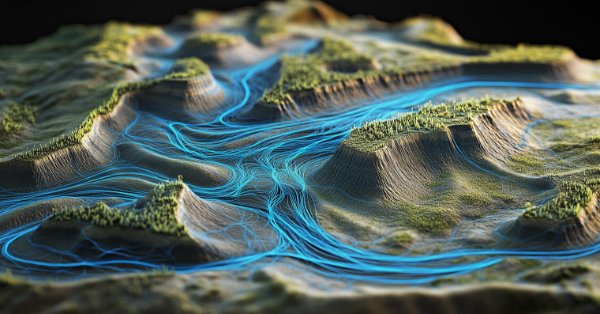

Multiple Symbol Analysis With Python And MQL5 (Part II): Principal Components Analysis For Portfolio Optimization

Managing trading account risk is a challenge for all traders. How can we develop trading applications that dynamically learn high, medium, and low-risk modes for various symbols in MetaTrader 5? By using PCA, we gain better control over portfolio variance. I’ll demonstrate how to create applications that learn these three risk modes from market data fetched from MetaTrader 5.

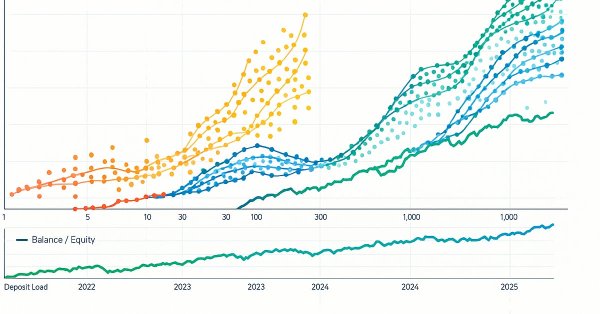

Overcoming The Limitation of Machine Learning (Part 4): Overcoming Irreducible Error Using Multiple Forecast Horizons

Machine learning is often viewed through statistical or linear algebraic lenses, but this article emphasizes a geometric perspective of model predictions. It demonstrates that models do not truly approximate the target but rather map it onto a new coordinate system, creating an inherent misalignment that results in irreducible error. The article proposes that multi-step predictions, comparing the model’s forecasts across different horizons, offer a more effective approach than direct comparisons with the target. By applying this method to a trading model, the article demonstrates significant improvements in profitability and accuracy without changing the underlying model.

Developing a Replay System (Part 64): Playing the service (V)

In this article, we will look at how to fix two errors in the code. However, I will try to explain them in a way that will help you, beginner programmers, understand that things don't always go as you expect. Anyway, this is an opportunity to learn. The content presented here is intended solely for educational purposes. In no way should this application be considered as a final document with any purpose other than to explore the concepts presented.

Population optimization algorithms: Micro Artificial immune system (Micro-AIS)

The article considers an optimization method based on the principles of the body's immune system - Micro Artificial Immune System (Micro-AIS) - a modification of AIS. Micro-AIS uses a simpler model of the immune system and simple immune information processing operations. The article also discusses the advantages and disadvantages of Micro-AIS compared to conventional AIS.

Developing a Replay System (Part 30): Expert Advisor project — C_Mouse class (IV)

Today we will learn a technique that can help us a lot in different stages of our professional life as a programmer. Often it is not the platform itself that is limited, but the knowledge of the person who talks about the limitations. This article will tell you that with common sense and creativity you can make the MetaTrader 5 platform much more interesting and versatile without resorting to creating crazy programs or anything like that, and create simple yet safe and reliable code. We will use our creativity to modify existing code without deleting or adding a single line to the source code.

Population optimization algorithms: Binary Genetic Algorithm (BGA). Part I

In this article, we will explore various methods used in binary genetic and other population algorithms. We will look at the main components of the algorithm, such as selection, crossover and mutation, and their impact on the optimization. In addition, we will study data presentation methods and their impact on optimization results.

From Novice to Expert: Market Periods Synchronizer

In this discussion, we introduce a Higher-to-Lower Timeframe Synchronizer tool designed to solve the problem of analyzing market patterns that span across higher timeframe periods. The built-in period markers in MetaTrader 5 are often limited, rigid, and not easily customizable for non-standard timeframes. Our solution leverages the MQL5 language to develop an indicator that provides a dynamic and visual way to align higher timeframe structures within lower timeframe charts. This tool can be highly valuable for detailed market analysis. To learn more about its features and implementation, I invite you to join the discussion.

Larry Williams Market Secrets (Part 3): Proving Non-Random Market Behavior with MQL5

Explore whether financial markets are truly random by recreating Larry Williams’ market behavior experiments using MQL5. This article demonstrates how simple price-action tests can reveal statistical market biases using a custom Expert Advisor.

Quantization in machine learning (Part 2): Data preprocessing, table selection, training CatBoost models

The article considers the practical application of quantization in the construction of tree models. The methods for selecting quantum tables and data preprocessing are considered. No complex mathematical equations are used.

Implementing Practical Modules from Other Languages in MQL5 (Part 01): Building the SQLite3 Library, Inspired by Python

The sqlite3 module in Python offers a straightforward approach for working with SQLite databases, it is fast and convenient. In this article, we are going to build a similar module on top of built-in MQL5 functions for working with databases to make it easier to work with SQLite3 databases in MQL5 as in Python.

MQL5 Wizard Techniques you should know (Part 35): Support Vector Regression

Support Vector Regression is an idealistic way of finding a function or ‘hyper-plane’ that best describes the relationship between two sets of data. We attempt to exploit this in time series forecasting within custom classes of the MQL5 wizard.

Creating a Trading Administrator Panel in MQL5 (Part VII): Trusted User, Recovery and Cryptography

Security prompts, such as those triggered every time you refresh the chart, add a new pair to the chat with the Admin Panel EA, or restart the terminal, can become tedious. In this discussion, we will explore and implement a feature that tracks the number of login attempts to identify a trusted user. After a set number of failed attempts, the application will transition to an advanced login procedure, which also facilitates passcode recovery for users who may have forgotten it. Additionally, we will cover how cryptography can be effectively integrated into the Admin Panel to enhance security.

From Basic to Intermediate: Definitions (I)

In this article we will do things that many will find strange and completely out of context, but which, if used correctly, will make your learning much more fun and interesting: we will be able to build quite interesting things based on what is shown here. This will allow you to better understand the syntax of the MQL5 language. The materials provided here are for educational purposes only. It should not be considered in any way as a final application. Its purpose is not to explore the concepts presented.

MQL5 Wizard Techniques you should know (Part 85): Using Patterns of Stochastic-Oscillator and the FrAMA with Beta VAE Inference Learning

This piece follows up ‘Part-84’, where we introduced the pairing of Stochastic and the Fractal Adaptive Moving Average. We now shift focus to Inference Learning, where we look to see if laggard patterns in the last article could have their fortunes turned around. The Stochastic and FrAMA are a momentum-trend complimentary pairing. For our inference learning, we are revisiting the Beta algorithm of a Variational Auto Encoder. We also, as always, do the implementation of a custom signal class designed for integration with the MQL5 Wizard.

MQL5 Wizard Techniques you should know (Part 18): Neural Architecture Search with Eigen Vectors

Neural Architecture Search, an automated approach at determining the ideal neural network settings can be a plus when facing many options and large test data sets. We examine how when paired Eigen Vectors this process can be made even more efficient.

From Basic to Intermediate: Template and Typename (IV)

In this article, we will take a very close look at how to solve the problem posed at the end of the previous article. There was an attempt to create a template of such type so that to be able to create a template for data union.

MQL5 Wizard Techniques you should know (Part 60): Inference Learning (Wasserstein-VAE) with Moving Average and Stochastic Oscillator Patterns

We wrap our look into the complementary pairing of the MA & Stochastic oscillator by examining what role inference-learning can play in a post supervised-learning & reinforcement-learning situation. There are clearly a multitude of ways one can choose to go about inference learning in this case, our approach, however, is to use variational auto encoders. We explore this in python before exporting our trained model by ONNX for use in a wizard assembled Expert Advisor in MetaTrader.

The Disagreement Problem: Diving Deeper into The Complexity Explainability in AI

In this article, we explore the challenge of understanding how AI works. AI models often make decisions in ways that are hard to explain, leading to what's known as the "disagreement problem". This issue is key to making AI more transparent and trustworthy.

Market Simulation (Part 03): A Matter of Performance

Often we have to take a step back and then move forward. In this article, we will show all the changes necessary to ensure that the Mouse and Chart Trade indicators do not break. As a bonus, we'll also cover other changes that have occurred in other header files that will be widely used in the future.

The Group Method of Data Handling: Implementing the Multilayered Iterative Algorithm in MQL5

In this article we describe the implementation of the Multilayered Iterative Algorithm of the Group Method of Data Handling in MQL5.

News Trading Made Easy (Part 4): Performance Enhancement

This article will dive into methods to improve the expert's runtime in the strategy tester, the code will be written to divide news event times into hourly categories. These news event times will be accessed within their specified hour. This ensures that the EA can efficiently manage event-driven trades in both high and low-volatility environments.

Gating mechanisms in ensemble learning

In this article, we continue our exploration of ensemble models by discussing the concept of gates, specifically how they may be useful in combining model outputs to enhance either prediction accuracy or model generalization.

Example of Causality Network Analysis (CNA) and Vector Auto-Regression Model for Market Event Prediction

This article presents a comprehensive guide to implementing a sophisticated trading system using Causality Network Analysis (CNA) and Vector Autoregression (VAR) in MQL5. It covers the theoretical background of these methods, provides detailed explanations of key functions in the trading algorithm, and includes example code for implementation.

Two-sample Kolmogorov-Smirnov test as an indicator of time series non-stationarity

The article considers one of the most famous non-parametric homogeneity tests – the two-sample Kolmogorov-Smirnov test. Both model data and real quotes are analyzed. The article also provides an example of constructing a non-stationarity indicator (iSmirnovDistance).

MQL5 Trading Toolkit (Part 5): Expanding the History Management EX5 Library with Position Functions

Discover how to create exportable EX5 functions to efficiently query and save historical position data. In this step-by-step guide, we will expand the History Management EX5 library by developing modules that retrieve key properties of the most recently closed position. These include net profit, trade duration, pip-based stop loss, take profit, profit values, and various other important details.

Artificial Showering Algorithm (ASHA)

The article presents the Artificial Showering Algorithm (ASHA), a new metaheuristic method developed for solving general optimization problems. Based on simulation of water flow and accumulation processes, this algorithm constructs the concept of an ideal field, in which each unit of resource (water) is called upon to find an optimal solution. We will find out how ASHA adapts flow and accumulation principles to efficiently allocate resources in a search space, and see its implementation and test results.

Client in Connexus (Part 7): Adding the Client Layer

In this article we continue the development of the connexus library. In this chapter we build the CHttpClient class responsible for sending a request and receiving an order. We also cover the concept of mocks, leaving the library decoupled from the WebRequest function, which allows greater flexibility for users.