Creating a ticker tape panel: Improved version

How do you like the idea of reviving the basic version of our ticker tape panel? The first thing we will do is change the panel to be able to add an image, such as an asset logo or some other image, so that the user could quickly and easily identify the displayed symbol.

Developing a Replay System — Market simulation (Part 06): First improvements (I)

In this article, we will begin to stabilize the entire system, without which we might not be able to proceed to the next steps.

Price Action Analysis Toolkit Development (Part 11): Heikin Ashi Signal EA

MQL5 offers endless opportunities to develop automated trading systems tailored to your preferences. Did you know it can even perform complex mathematical calculations? In this article, we introduce the Japanese Heikin-Ashi technique as an automated trading strategy.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 2): Sending Signals from MQL5 to Telegram

In this article, we create an MQL5-Telegram integrated Expert Advisor that sends moving average crossover signals to Telegram. We detail the process of generating trading signals from moving average crossovers, implementing the necessary code in MQL5, and ensuring the integration works seamlessly. The result is a system that provides real-time trading alerts directly to your Telegram group chat.

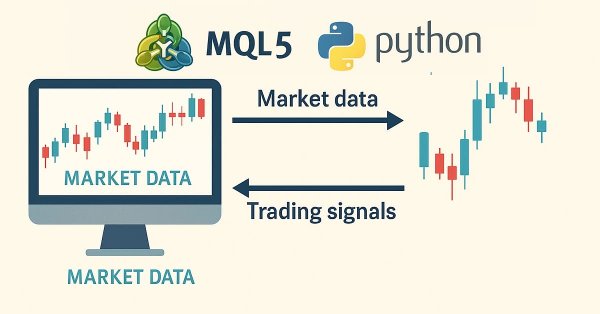

Trend Prediction with LSTM for Trend-Following Strategies

Long Short-Term Memory (LSTM) is a type of recurrent neural network (RNN) designed to model sequential data by effectively capturing long-term dependencies and addressing the vanishing gradient problem. In this article, we will explore how to utilize LSTM to predict future trends, enhancing the performance of trend-following strategies. The article will cover the introduction of key concepts and the motivation behind development, fetching data from MetaTrader 5, using that data to train the model in Python, integrating the machine learning model into MQL5, and reflecting on the results and future aspirations based on statistical backtesting.

MQL5 Market Turns One Year Old

One year has passed since the launch of sales in MQL5 Market. It was a year of hard work, which turned the new service into the largest store of trading robots and technical indicators for MetaTrader 5 platform.

Timeseries in DoEasy library (part 53): Abstract base indicator class

The article considers creation of an abstract indicator which further will be used as the base class to create objects of library’s standard and custom indicators.

Introduction to MQL5 (Part 3): Mastering the Core Elements of MQL5

Explore the fundamentals of MQL5 programming in this beginner-friendly article, where we demystify arrays, custom functions, preprocessors, and event handling, all explained with clarity making every line of code accessible. Join us in unlocking the power of MQL5 with a unique approach that ensures understanding at every step. This article sets the foundation for mastering MQL5, emphasizing the explanation of each line of code, and providing a distinct and enriching learning experience.

MQL5 Market Results for Q1 2013

Since its founding, the store of trading robots and technical indicators MQL5 Market has already attracted more than 250 developers who have published 580 products. The first quarter of 2013 has turned out to be quite successful for some MQL5 Market sellers who have managed to make handsome profit by selling their products.

Reimagining Classic Strategies (Part 19): Deep Dive Into Moving Average Crossovers

This article revisits the classic moving average crossover strategy and examines why it often fails in noisy, fast-moving markets. It presents five alternative filtering methods designed to strengthen signal quality and remove weak or unprofitable trades. The discussion highlights how statistical models can learn and correct the errors that human intuition and traditional rules miss. Readers leave with a clearer understanding of how to modernize an outdated strategy and of the pitfalls of relying solely on metrics like RMSE in financial modeling.

Larry Williams Market Secrets (Part 11): Detecting Smash Day Reversals with a Custom Indicator

We convert Larry Williams’ Smash Day reversal rules into a practical MQL5 indicator that flags confirmed setups with arrows. Step by step, the text shows buffer binding, plot properties, historical mapping, and real‑time updates inside OnCalculate. Adjustable lookback parameters and clean chart rendering help you detect valid reversals quickly while keeping final trade decisions discretionary and context‑driven.

Improve Your Trading Charts With Interactive GUI's in MQL5 (Part II): Movable GUI (II)

Unlock the potential of dynamic data representation in your trading strategies and utilities with our in-depth guide to creating movable GUIs in MQL5. Delve into the fundamental principles of object-oriented programming and discover how to design and implement single or multiple movable GUIs on the same chart with ease and efficiency.

MetaTrader 5 Machine Learning Blueprint (Part 5): Sequential Bootstrapping—Debiasing Labels, Improving Returns

Sequential bootstrapping reshapes bootstrap sampling for financial machine learning by actively avoiding temporally overlapping labels, producing more independent training samples, sharper uncertainty estimates, and more robust trading models. This practical guide explains the intuition, shows the algorithm step‑by‑step, provides optimized code patterns for large datasets, and demonstrates measurable performance gains through simulations and real backtests.

Graphics in DoEasy library (Part 84): Descendant classes of the abstract standard graphical object

In this article, I will consider creation of descendant objects for the terminal abstract standard graphical object. The class object describes the properties that are common for all graphical objects. So, it is simply some kind of a graphical object. To clarify its affiliation with a real graphical object, we need to set the properties inherent in this particular graphical object in the descendant object class.

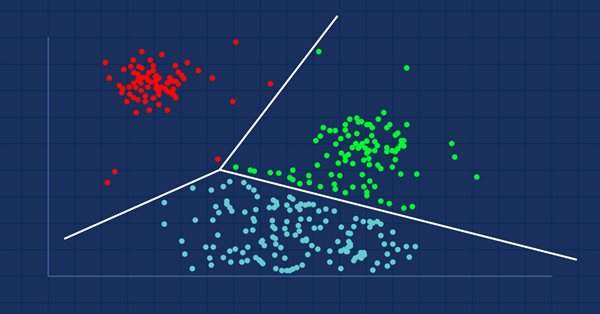

Data Science and Machine Learning (Part 15): SVM, A Must-Have Tool in Every Trader's Toolbox

Discover the indispensable role of Support Vector Machines (SVM) in shaping the future of trading. This comprehensive guide explores how SVM can elevate your trading strategies, enhance decision-making, and unlock new opportunities in the financial markets. Dive into the world of SVM with real-world applications, step-by-step tutorials, and expert insights. Equip yourself with the essential tool that can help you navigate the complexities of modern trading. Elevate your trading game with SVM—a must-have for every trader's toolbox.

Сode Lock Algorithm (CLA)

In this article, we will rethink code locks, transforming them from security mechanisms into tools for solving complex optimization problems. Discover the world of code locks viewed not as simple security devices, but as inspiration for a new approach to optimization. We will create a whole population of "locks", where each lock represents a unique solution to the problem. We will then develop an algorithm that will "pick" these locks and find optimal solutions in a variety of areas, from machine learning to trading systems development.

Creating a Trading Administrator Panel in MQL5 (Part I): Building a Messaging Interface

This article discusses the creation of a Messaging Interface for MetaTrader 5, aimed at System Administrators, to facilitate communication with other traders directly within the platform. Recent integrations of social platforms with MQL5 allow for quick signal broadcasting across different channels. Imagine being able to validate sent signals with just a click—either "YES" or "NO." Read on to learn more.

Who Is Who in MQL5.community?

The MQL5.com website remembers all of you quite well! How many of your threads are epic, how popular your articles are and how often your programs in the Code Base are downloaded – this is only a small part of what is remembered at MQL5.com. Your achievements are available in your profile, but what about the overall picture? In this article we will show the general picture of all MQL5.community members achievements.

Example of new Indicator and Conditional LSTM

This article explores the development of an Expert Advisor (EA) for automated trading that combines technical analysis with deep learning predictions.

Andrey Voitenko (avoitenko): "Developers benefit from the ideas that they code? Nonsense!"

A Ukrainian developer Andrey Voitenko (avoitenko) is an active participant of the "Jobs" service at mql5.com, helping traders from all over the world to implement their ideas. Last year Andrey's Expert Advisor was on the fourth place in the Automated Trading Championship 2010, being slightly behind the bronze winner. This time we are discussing the Jobs service with Andrey.

Developing a Custom Market Sentiment Indicator

In this article we are developing a custom market sentiment indicator to classify conditions into bullish, bearish, risk-on, risk-off, or neutral. Using multi-timeframe, the indicator can provide traders with a clearer perspective of overall market bias and short-term confirmations.

DoEasy. Controls (Part 18): Functionality for scrolling tabs in TabControl

In this article, I will place header scrolling control buttons in TabControl WinForms object in case the header bar does not fit the size of the control. Besides, I will implement the shift of the header bar when clicking on the cropped tab header.

Statistical Arbitrage Through Mean Reversion in Pairs Trading: Beating the Market by Math

This article describes the fundamentals of portfolio-level statistical arbitrage. Its goal is to facilitate the understanding of the principles of statistical arbitrage to readers without deep math knowledge and propose a starting point conceptual framework. The article includes a working Expert Advisor, some notes about its one-year backtest, and the respective backtest configuration settings (.ini file) for the reproduction of the experiment.

Self Optimizing Expert Advisors in MQL5 (Part 11): A Gentle Introduction to the Fundamentals of Linear Algebra

In this discussion, we will set the foundation for using powerful linear, algebra tools that are implemented in the MQL5 matrix and vector API. For us to make proficient use of this API, we need to have a firm understanding of the principles in linear algebra that govern intelligent use of these methods. This article aims to get the reader an intuitive level of understanding of some of the most important rules of linear algebra that we, as algorithmic traders in MQL5 need,to get started, taking advantage of this powerful library.

Neural networks made easy (Part 33): Quantile regression in distributed Q-learning

We continue studying distributed Q-learning. Today we will look at this approach from the other side. We will consider the possibility of using quantile regression to solve price prediction tasks.

Automated exchange grid trading using stop pending orders on Moscow Exchange (MOEX)

The article considers the grid trading approach based on stop pending orders and implemented in an MQL5 Expert Advisor on the Moscow Exchange (MOEX). When trading in the market, one of the simplest strategies is a grid of orders designed to "catch" the market price.

Interview with Mariusz Zarnowski (ATC 2012)

As December 28 is approaching, the list of leaders of the Automated Trading Championship 2012 is becoming clearer. With only two weeks to go until the end of the Championship, Mariusz Zarnowski (zrn) from Poland stands a good chance to be in the top three. His EA has already demonstrated how it can triple the initial deposit in just a couple of weeks.

Timeseries in DoEasy library (part 52): Cross-platform nature of multi-period multi-symbol single-buffer standard indicators

In the article, consider creation of multi-symbol multi-period standard indicator Accumulation/Distribution. Slightly improve library classes with respect to indicators so that, the programs developed for outdated platform MetaTrader 4 based on this library could work normally when switching over to MetaTrader 5.

Price Action Analysis Toolkit Development (Part 16): Introducing Quarters Theory (II) — Intrusion Detector EA

In our previous article, we introduced a simple script called "The Quarters Drawer." Building on that foundation, we are now taking the next step by creating a monitor Expert Advisor (EA) to track these quarters and provide oversight regarding potential market reactions at these levels. Join us as we explore the process of developing a zone detection tool in this article.

Gain An Edge Over Any Market (Part V): FRED EURUSD Alternative Data

In today’s discussion, we used alternative Daily data from the St. Louis Federal Reserve on the Broad US-Dollar Index and a collection of other macroeconomic indicators to predict the EURUSD future exchange rate. Unfortunately, while the data appears to have almost perfect correlation, we failed to realize any material gains in our model accuracy, possibly suggesting to us that investors may be better off using ordinary market quotes instead.

From Novice to Expert: Auto-Geometric Analysis System

Geometric patterns offer traders a concise way to interpret price action. Many analysts draw trend lines, rectangles, and other shapes by hand, and then base trading decisions on the formations they see. In this article, we explore an automated alternative: harnessing MQL5 to detect and analyze the most popular geometric patterns. We’ll break down the methodology, discuss implementation details, and highlight how automated pattern recognition can sharpen a trader's market insights.

Experiments with neural networks (Part 3): Practical application

In this article series, I use experimentation and non-standard approaches to develop a profitable trading system and check whether neural networks can be of any help for traders. MetaTrader 5 is approached as a self-sufficient tool for using neural networks in trading.

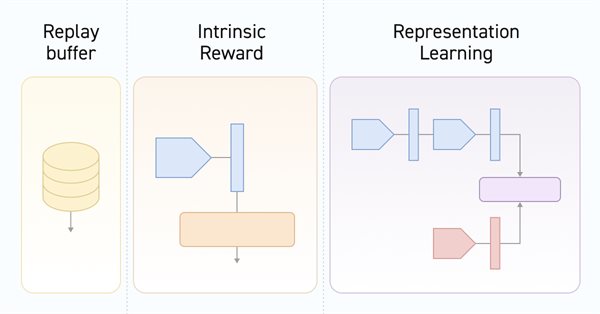

Neural networks made easy (Part 55): Contrastive intrinsic control (CIC)

Contrastive training is an unsupervised method of training representation. Its goal is to train a model to highlight similarities and differences in data sets. In this article, we will talk about using contrastive training approaches to explore different Actor skills.

Building a Custom Market Regime Detection System in MQL5 (Part 2): Expert Advisor

This article details building an adaptive Expert Advisor (MarketRegimeEA) using the regime detector from Part 1. It automatically switches trading strategies and risk parameters for trending, ranging, or volatile markets. Practical optimization, transition handling, and a multi-timeframe indicator are included.

Data Science and Machine Learning (Part 08): K-Means Clustering in plain MQL5

Data mining is crucial to a data scientist and a trader because very often, the data isn't as straightforward as we think it is. The human eye can not understand the minor underlying pattern and relationships in the dataset, maybe the K-means algorithm can help us with that. Let's find out...

Developing a trading Expert Advisor from scratch (Part 17): Accessing data on the web (III)

In this article we continue considering how to obtain data from the web and to use it in an Expert Advisor. This time we will proceed to developing an alternative system.

Price Action Analysis Toolkit Development (Part 35): Training and Deploying Predictive Models

Historical data is far from “trash”—it’s the foundation of any robust market analysis. In this article, we’ll take you step‑by‑step from collecting that history to using it to train a predictive model, and finally deploying that model for live price forecasts. Read on to learn how!

Currency pair strength indicator in pure MQL5

We are going to develop a professional indicator for currency strength analysis in MQL5. This step-by-step guide will show you how to develop a powerful trading tool with a visual dashboard for MetaTrader 5. You will learn how to calculate the strength of currency pairs across multiple timeframes (H1, H4, D1), implement dynamic data updates, and create a user-friendly interface.

Data Science and ML (Part 28): Predicting Multiple Futures for EURUSD, Using AI

It is a common practice for many Artificial Intelligence models to predict a single future value. However, in this article, we will delve into the powerful technique of using machine learning models to predict multiple future values. This approach, known as multistep forecasting, allows us to predict not only tomorrow's closing price but also the day after tomorrow's and beyond. By mastering multistep forecasting, traders and data scientists can gain deeper insights and make more informed decisions, significantly enhancing their predictive capabilities and strategic planning.

Advanced Variables and Data Types in MQL5

Variables and data types are very important topics not only in MQL5 programming but also in any programming language. MQL5 variables and data types can be categorized as simple and advanced ones. In this article, we will identify and learn about advanced ones because we already mentioned simple ones in a previous article.