Nikolay Ivanov (Techno): "What is important for programs is the accuracy of their algorithms"

A programmer from Krasnoyarsk Nikolay Ivanov (Techno) is a leader among the developers in terms of the number of completed orders - he has implemented already more than 200 applications in the Jobs service. In this interview, he is talking about the Jobs service, its specific features and challengers faced by programmers.

How to build and optimize a volatility-based trading system (Chaikin Volatility - CHV)

In this article, we will provide another volatility-based indicator named Chaikin Volatility. We will understand how to build a custom indicator after identifying how it can be used and constructed. We will share some simple strategies that can be used and then test them to understand which one can be better.

Econometric tools for forecasting volatility: GARCH model

The article describes the properties of the non-linear model of conditional heteroscedasticity (GARCH). The iGARCH indicator has been built on its basis for predicting volatility one step ahead. The ALGLIB numerical analysis library is used to estimate the model parameters.

Neural networks made easy (Part 76): Exploring diverse interaction patterns with Multi-future Transformer

This article continues the topic of predicting the upcoming price movement. I invite you to get acquainted with the Multi-future Transformer architecture. Its main idea is to decompose the multimodal distribution of the future into several unimodal distributions, which allows you to effectively simulate various models of interaction between agents on the scene.

Developing a trading Expert Advisor from scratch (Part 9): A conceptual leap (II)

In this article, we will place Chart Trade in a floating window. In the previous part, we created a basic system which enables the use of templates within a floating window.

Neural Networks in Trading: Parameter-Efficient Transformer with Segmented Attention (Final Part)

In the previous work, we discussed the theoretical aspects of the PSformer framework, which includes two major innovations in the classical Transformer architecture: the Parameter Shared (PS) mechanism and attention to spatio-temporal segments (SegAtt). In this article, we continue the work we started on implementing the proposed approaches using MQL5.

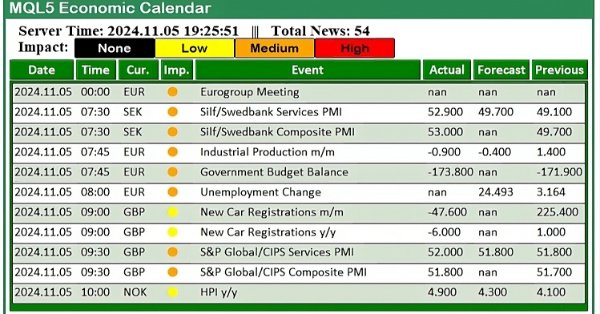

MQL5 Cookbook — Macroeconomic events database

The article discusses the possibilities of handling databases based on the SQLite engine. The CDatabase class has been formed for convenience and efficient use of OOP principles. It is subsequently involved in the creation and management of the database of macroeconomic events. The article provides the examples of using multiple methods of the CDatabase class.

Building AI-Powered Trading Systems in MQL5 (Part 1): Implementing JSON Handling for AI APIs

In this article, we develop a JSON parsing framework in MQL5 to handle data exchange for AI API integration, focusing on a JSON class for processing JSON structures. We implement methods to serialize and deserialize JSON data, supporting various data types like strings, numbers, and objects, essential for communicating with AI services like ChatGPT, enabling future AI-driven trading systems by ensuring accurate data handling and manipulation.

Creating a Dynamic Multi-Symbol, Multi-Period Relative Strength Indicator (RSI) Indicator Dashboard in MQL5

In this article, we develop a dynamic multi-symbol, multi-period RSI indicator dashboard in MQL5, providing traders real-time RSI values across various symbols and timeframes. The dashboard features interactive buttons, real-time updates, and color-coded indicators to help traders make informed decisions.

DoEasy. Controls (Part 6): Panel control, auto resizing the container to fit inner content

In the article, I will continue my work on the Panel WinForms object and implement its auto resizing to fit the general size of Dock objects located inside the panel. Besides, I will add the new properties to the Symbol library object.

The MQL5 Standard Library Explorer (Part 1): Introduction with CTrade, CiMA, and CiATR

The MQL5 Standard Library plays a vital role in developing trading algorithms for MetaTrader 5. In this discussion series, our goal is to master its application to simplify the creation of efficient trading tools for MetaTrader 5. These tools include custom Expert Advisors, indicators, and other utilities. We begin today by developing a trend-following Expert Advisor using the CTrade, CiMA, and CiATR classes. This is an especially important topic for everyone—whether you are a beginner or an experienced developer. Join this discussion to discover more.

Developing a trading Expert Advisor from scratch (Part 13): Time and Trade (II)

Today we will construct the second part of the Times & Trade system for market analysis. In the previous article "Times & Trade (I)" we discussed an alternative chart organization system, which would allow having an indicator for the quickest possible interpretation of deals executed in the market.

Data Science and Machine Learning (Part 23): Why LightGBM and XGBoost outperform a lot of AI models?

These advanced gradient-boosted decision tree techniques offer superior performance and flexibility, making them ideal for financial modeling and algorithmic trading. Learn how to leverage these tools to optimize your trading strategies, improve predictive accuracy, and gain a competitive edge in the financial markets.

Timeseries in DoEasy library (part 48): Multi-period multi-symbol indicators on one buffer in a subwindow

The article considers an example of creating multi-symbol multi-period standard indicators using a single indicator buffer for construction and working in the indicator subwindow. I am going to prepare the library classes for working with standard indicators working in the program main window and having more than one buffer for displaying their data.

Population optimization algorithms

This is an introductory article on optimization algorithm (OA) classification. The article attempts to create a test stand (a set of functions), which is to be used for comparing OAs and, perhaps, identifying the most universal algorithm out of all widely known ones.

Implementing the Generalized Hurst Exponent and the Variance Ratio test in MQL5

In this article, we investigate how the Generalized Hurst Exponent and the Variance Ratio test can be utilized to analyze the behaviour of price series in MQL5.

Neural Networks in Trading: An Agent with Layered Memory

Layered memory approaches that mimic human cognitive processes enable the processing of complex financial data and adaptation to new signals, thereby improving the effectiveness of investment decisions in dynamic markets.

DRAKON visual programming language — communication tool for MQL developers and customers

DRAKON is a visual programming language designed to simplify interaction between specialists from different fields (biologists, physicists, engineers...) with programmers in Russian space projects (for example, in the Buran reusable spacecraft project). In this article, I will talk about how DRAKON makes the creation of algorithms accessible and intuitive, even if you have never encountered code, and also how it is easier for customers to explain their thoughts when ordering trading robots, and for programmers to make fewer mistakes in complex functions.

Build Self Optimizing Expert Advisors in MQL5 (Part 6): Stop Out Prevention

Join us in our discussion today as we look for an algorithmic procedure to minimize the total number of times we get stopped out of winning trades. The problem we faced is significantly challenging, and most solutions given in community discussions lack set and fixed rules. Our algorithmic approach to solving the problem increased the profitability of our trades and reduced our average loss per trade. However, there are further advancements to be made to completely filter out all trades that will be stopped out, our solution is a good first step for anyone to try.

From Novice to Expert: Creating a Liquidity Zone Indicator

The extent of liquidity zones and the magnitude of the breakout range are key variables that substantially affect the probability of a retest occurring. In this discussion, we outline the complete process for developing an indicator that incorporates these ratios.

Introduction to MQL5 (Part 16): Building Expert Advisors Using Technical Chart Patterns

This article introduces beginners to building an MQL5 Expert Advisor that identifies and trades a classic technical chart pattern — the Head and Shoulders. It covers how to detect the pattern using price action, draw it on the chart, set entry, stop loss, and take profit levels, and automate trade execution based on the pattern.

Category Theory (Part 9): Monoid-Actions

This article continues the series on category theory implementation in MQL5. Here we continue monoid-actions as a means of transforming monoids, covered in the previous article, leading to increased applications.

Graphics in DoEasy library (Part 85): Graphical object collection - adding newly created objects

In this article, I will complete the development of the descendant classes of the abstract graphical object class and start implementing the ability to store these objects in the collection class. In particular, I will create the functionality for adding newly created standard graphical objects to the collection class.

Developing Trend Trading Strategies Using Machine Learning

This study introduces a novel methodology for the development of trend-following trading strategies. This section describes the process of annotating training data and using it to train classifiers. This process yields fully operational trading systems designed to run on MetaTrader 5.

Developing a Trading Strategy: Using a Volume-Bound Approach

In the world of technical analysis, price often takes center stage. Traders meticulously map out support, resistance, and patterns, yet frequently ignore the critical force that drives these movements: volume. This article delves into a novel approach to volume analysis: the Volume Boundary indicator. This transformation, utilizing sophisticated smoothing functions like the butterfly and triple sine curves, allows for clearer interpretation and the development of systematic trading strategies.

Introduction to MQL5 (Part 6): A Beginner's Guide to Array Functions in MQL5 (II)

Embark on the next phase of our MQL5 journey. In this insightful and beginner-friendly article, we'll look into the remaining array functions, demystifying complex concepts to empower you to craft efficient trading strategies. We’ll be discussing ArrayPrint, ArrayInsert, ArraySize, ArrayRange, ArrarRemove, ArraySwap, ArrayReverse, and ArraySort. Elevate your algorithmic trading expertise with these essential array functions. Join us on the path to MQL5 mastery!

Trading with the MQL5 Economic Calendar (Part 2): Creating a News Dashboard Panel

In this article, we create a practical news dashboard panel using the MQL5 Economic Calendar to enhance our trading strategy. We begin by designing the layout, focusing on key elements like event names, importance, and timing, before moving into the setup within MQL5. Finally, we implement a filtering system to display only the most relevant news, giving traders quick access to impactful economic events.

Modified Grid-Hedge EA in MQL5 (Part IV): Optimizing Simple Grid Strategy (I)

In this fourth part, we revisit the Simple Hedge and Simple Grid Expert Advisors (EAs) developed earlier. Our focus shifts to refining the Simple Grid EA through mathematical analysis and a brute force approach, aiming for optimal strategy usage. This article delves deep into the mathematical optimization of the strategy, setting the stage for future exploration of coding-based optimization in later installments.

Introduction to MQL5 (Part 25): Building an EA that Trades with Chart Objects (II)

This article explains how to build an Expert Advisor (EA) that interacts with chart objects, particularly trend lines, to identify and trade breakout and reversal opportunities. You will learn how the EA confirms valid signals, manages trade frequency, and maintains consistency with user-selected strategies.

Revisiting Murray system

Graphical price analysis systems are deservedly popular among traders. In this article, I am going to describe the complete Murray system, including its famous levels, as well as some other useful techniques for assessing the current price position and making a trading decision.

Neural networks made easy (Part 31): Evolutionary algorithms

In the previous article, we started exploring non-gradient optimization methods. We got acquainted with the genetic algorithm. Today, we will continue this topic and will consider another class of evolutionary algorithms.

Cycles and Forex

Cycles are of great importance in our lives. Day and night, seasons, days of the week and many other cycles of different nature are present in the life of any person. In this article, we will consider cycles in financial markets.

Cycles and trading

This article is about using cycles in trading. We will consider building a trading strategy based on cyclical models.

Price Action Analysis Toolkit Development (Part 41): Building a Statistical Price-Level EA in MQL5

Statistics has always been at the heart of financial analysis. By definition, statistics is the discipline that collects, analyzes, interprets, and presents data in meaningful ways. Now imagine applying that same framework to candlesticks—compressing raw price action into measurable insights. How helpful would it be to know, for a specific period of time, the central tendency, spread, and distribution of market behavior? In this article, we introduce exactly that approach, showing how statistical methods can transform candlestick data into clear, actionable signals.

Graphics in DoEasy library (Part 100): Making improvements in handling extended standard graphical objects

In the current article, I will eliminate obvious flaws in simultaneous handling of extended (and standard) graphical objects and form objects on canvas, as well as fix errors detected during the test performed in the previous article. The article concludes this section of the library description.

Interview with Enbo Lu (ATC 2012)

"Be sure to participate in the Automated Trading Championships, where you can get a truly invaluable experience!" - this is the motto of contestant Enbo Lu (luenbo) from China. He appeared in the TOP-10 of Automated Trading Championship 2012 last week and is now consistently trying to reach the podium.

William Gann methods (Part I): Creating Gann Angles indicator

What is the essence of Gann Theory? How are Gann angles constructed? We will create Gann Angles indicator for MetaTrader 5.

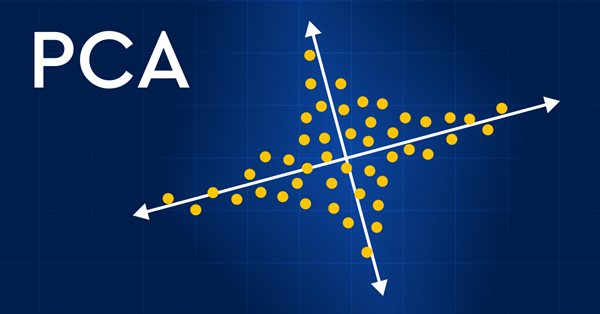

Data Science and Machine Learning (Part 13): Improve your financial market analysis with Principal Component Analysis (PCA)

Revolutionize your financial market analysis with Principal Component Analysis (PCA)! Discover how this powerful technique can unlock hidden patterns in your data, uncover latent market trends, and optimize your investment strategies. In this article, we explore how PCA can provide a new lens for analyzing complex financial data, revealing insights that would be missed by traditional approaches. Find out how applying PCA to financial market data can give you a competitive edge and help you stay ahead of the curve

DoEasy. Controls (Part 7): Text label control

In the current article, I will create the class of the WinForms text label control object. Such an object will have the ability to position its container anywhere, while its own functionality will repeat the functionality of the MS Visual Studio text label. We will be able to set font parameters for a displayed text.

Risk manager for algorithmic trading

The objectives of this article are to prove the necessity of using a risk manager and to implement the principles of controlled risk in algorithmic trading in a separate class, so that everyone can verify the effectiveness of the risk standardization approach in intraday trading and investing in financial markets. In this article, we will create a risk manager class for algorithmic trading. This is a logical continuation of the previous article in which we discussed the creation of a risk manager for manual trading.