SMC Market Blueprint

- Indicators

- Alex Amuyunzu Raymond

- Version: 1.2

- Activations: 5

SMC Market Blueprint

Institutional Market Structure Analyzer Based on Smart Money and ICT Concepts

Overview

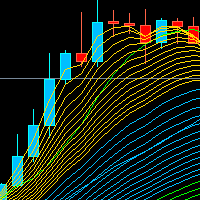

SMC Market Blueprint is a comprehensive institutional-grade indicator designed to decode the true structure of the market using Smart Money Concepts (SMC) and ICT (Inner Circle Trader) methodology. It maps the internal market framework — identifying structure shifts, liquidity zones, and order flow transitions across multiple timeframes — giving traders a clear blueprint of how institutional activity shapes price movement.

Unlike traditional trend or swing indicators, SMC Market Blueprint analyzes the formation and violation of structure in real time, revealing how liquidity is engineered and where price is most likely to react next. Every swing, break, and liquidity grab is algorithmically identified, allowing traders to align with the underlying institutional logic driving the market.

Core Logic

At its core, SMC Market Blueprint performs real-time market structure analysis using fractal-based swing logic to identify Higher Highs (HH), Lower Lows (LL), and key turning points. Once these are established, the indicator continuously tracks structure breaks (BOS) and changes of character (CHoCH), effectively distinguishing between bullish and bearish phases.In addition, the system maps critical liquidity zones and premium/discount areas, based on institutional concepts such as:

-

Internal Liquidity (ILQ): Local liquidity resting within current ranges, often engineered before deeper expansion.

-

True Liquidity (TLQ): External or structural liquidity above and below major swing points.

-

EPA Zones: Key equilibrium or premium/discount price zones reflecting institutional order flow balance.

-

VTA Ranges: Value Trade Areas showing accumulation or distribution behavior within structure.

Through this layered logic, the indicator forms a detailed “blueprint” of the market — identifying where price currently resides within the larger structure, where it is likely headed, and where institutional manipulation may occur next.

Key Features

-

Advanced HH/LL Detection

Automatically identifies Higher Highs, Higher Lows, Lower Highs, and Lower Lows, providing an immediate visual map of directional bias. -

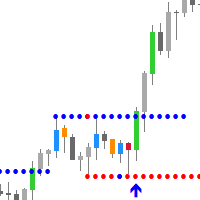

Break of Structure and Change of Character Recognition

Detects BOS and CHoCH events in real time to signal potential market reversals or structure shifts. -

Liquidity Zone Visualization

Highlights internal, external, and equilibrium liquidity pools that act as magnet levels for institutional price delivery. -

Multi-Timeframe Framework

Allows simultaneous analysis across multiple timeframes, showing the alignment between macro and micro structure. -

VTA Range Detection

Defines key value ranges to help identify accumulation and distribution behavior across market cycles. -

Full Customization Controls

Adjustable label sizes, colors, and visibility options for all components — structure points, liquidity levels, and range zones. -

Non-Repainting Core Engine

Once a structure or liquidity point is confirmed, it remains fixed. This makes the indicator suitable for live trading and backtesting without data distortion. -

Lightweight and Optimized Design

Engineered for performance — can run on multiple charts and timeframes simultaneously without affecting platform speed.

Input Parameters

-

UseStructure: Enables or disables structure logic.

-

StructureTimeframe: Selects the timeframe used for structure mapping (default H1).

-

MinTimeframe: Defines the minimum timeframe considered for structure detection.

-

StructureTopColor / StructureBottomColor: Defines color themes for top and bottom structures.

-

ShowHHLL: Enables or hides HH/LL labels.

-

HHLLBullColor / HHLLBearColor: Custom label colors for bullish and bearish structures.

-

StructureLabelSize: Adjusts the font size of structure labels (6–12).

Every setting is designed to give the trader full control over how structure and liquidity are displayed, providing clarity without clutter.

Practical Application

SMC Market Blueprint is built for traders who base their decisions on structure, order flow, and liquidity — not lagging signals. It is not a buy/sell signal generator; instead, it provides the structural foundation for understanding what the market is doing and why.

It can be used to:

-

Define directional bias by determining whether the current structure is bullish or bearish.

-

Wait for a Market Structure Shift or Change of Character as confirmation for entries.

-

Identify liquidity targets where price is likely to sweep stops or engineer reactions.

-

Align higher timeframe structure with lower timeframe precision entries.

-

Combine with Order Block, Fair Value Gap, or Imbalance tools for refined trade setups.

By focusing on how price constructs, violates, and reacts to structure, SMC Market Blueprint provides a true institutional perspective — helping traders align with the flow of smart money rather than fighting against it.

Summary

SMC Market Blueprint is more than an indicator — it is a structural framework designed to help traders read and interpret price action as institutions do. It translates Smart Money and ICT theory into a clear visual system that maps the entire price delivery process.

From swing mapping and liquidity zoning to structure shifts and range analysis, the indicator gives traders the analytical edge needed to anticipate market behavior with precision.

It is clean, efficient, and engineered for traders who want to understand, not just react.