GEN RSI hunter

- Indicators

- Gede Egi Narditya

- Version: 1.2

- Updated: 5 August 2025

INDICATOR: GEN RSI Hunter

Developer: gedeegi

General Description

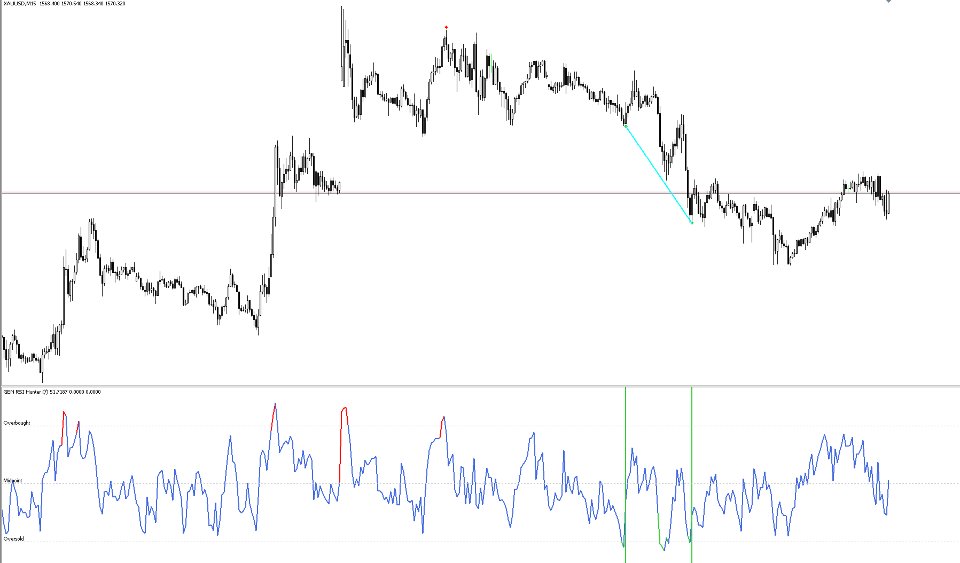

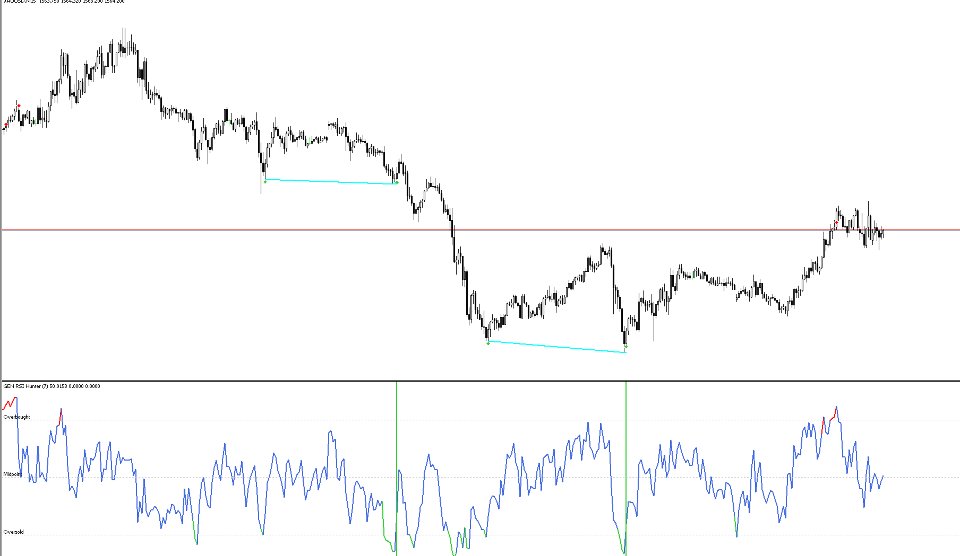

GEN RSI Hunter is a technical indicator based on the Relative Strength Index (RSI) that automatically detects potential BUY and SELL signals based on overbought/oversold conditions and price reversal patterns. This indicator is perfect for traders who want to capture short-term swing opportunities using price action confirmation and price patterns like Double Top and Double Bottom.

Signals are confirmed by breakout candles and validation of previous swing highs/lows. The indicator also includes an automatic notification system (alerts, push, and email) as well as visual marks on the chart.

Key Features

- Flexible RSI measurement with adjustable period length and price source.

- BUY signals are identified when the price shows a reversal from an oversold condition.

- SELL signals appear when the price reacts from an overbought condition.

- Automatic detection of Double Bottom and Double Top patterns.

- Signal visualization in the form of arrows and pattern lines on the chart.

- Option to manually show or hide chart objects.

- Real-time notification system:

- Pop-up alerts

- Push notifications to a device

- Automatic emails

Input Parameters

RSI Settings

- Lookback: The number of bars to detect swing highs/lows.

- RSI Overbought: The upper RSI level for sell signals.

- RSI Oversold: The lower RSI level for buy signals.

- RSI Length: The RSI period.

- RSI Source: The price type used (Close, Open, etc.).

Visual Settings

- Show Chart Signals: Display visual signals on the chart.

- Signal Prefix: The prefix for signal object names (for object management purposes).

Pattern Line Settings

- Double Top Line Color: The line color for the double top pattern.

- Double Bottom Line Color: The line color for the double bottom pattern.

Notification Settings

- Enable Alerts: Enable sound notifications when a signal appears.

- Enable Push: Send push notifications to the MetaTrader app.

- Enable Email: Send notifications via email.

Signal Logic

- The RSI is below the oversold level or above the overbought level.

- Candle confirmation based on open/close prices and previous swing high/low movements.

- A buy signal requires a reversal pattern from a swing low + a bullish confirmation candle.

- A sell signal requires a reversal pattern from a swing high + a bearish confirmation candle.

- If a double signal occurs (Double Top or Bottom), the indicator will automatically draw the pattern line.

Usage

- RSI-based scalping and swing trading.

- Early detection of price reversals with price action validation.

- A complement to oscillator-based trading systems.