Apex Arrow MQL4

- Indicators

- German Pablo Gori

- Version: 1.50

- Activations: 12

# 📈 Apex Arrows – Professional Trading Signals Indicator

## 📊 General Description

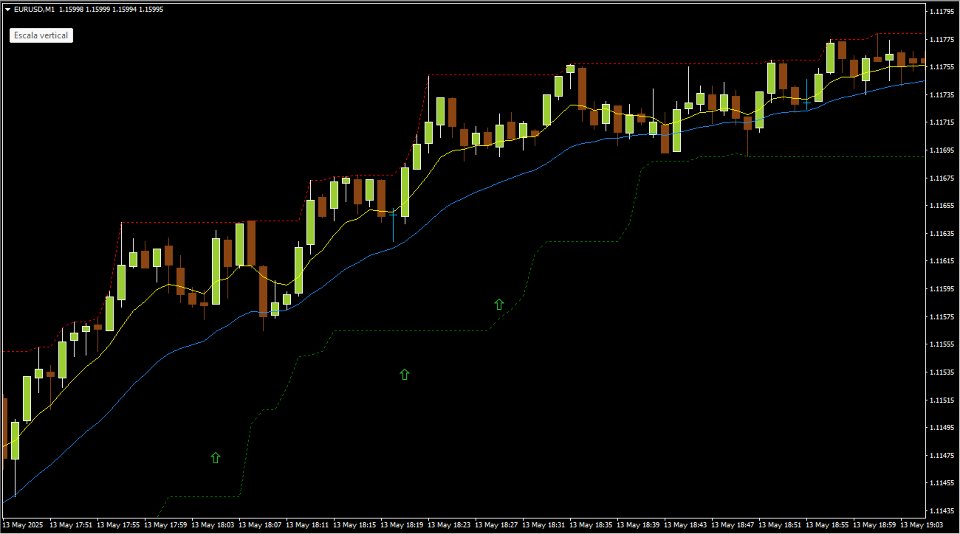

**Apex Arrows** is a powerful technical indicator specifically designed for advanced traders seeking accurate and automated real-time signals. This indicator combines multiple technical strategies into a single visually intuitive tool, ideal for trading markets such as forex, indices, and commodities on the **MetaTrader 4/5** platform.

Based on Exponential Moving Averages (EMA), RSI, Stochastic, ADX, and automatic calculation of dynamic support and resistance levels, **Apex Arrows** provides clear signals with advanced filters to minimize false positives and maximize success probability.

## 🔍 Key Features

### Indicator Type

- **Chart Window Indicator** (displayed directly over price)

- **Multi-component indicator** with 6 independent data buffers

- **Automatic signal system** with customizable alerts

### Visual Components

1. **Buy Arrows** (Lime Green): Long entry signals

2. **Sell Arrows** (Red): Short entry signals

3. **Fast EMA** (Yellow): Short-term trend line

4. **Slow EMA** (Dodger Blue): Medium-term trend line

5. **Support Lines** (Dashed Green): Dynamic support levels

6. **Resistance Lines** (Dashed Red): Dynamic resistance levels

## ⚙️ Configurable Parameters

### Technical Settings

- **FastEMA**: 8 (default) – Fast EMA to capture momentum

- **SlowEMA**: 21 (default) – Filters market noise

- **TrendEMA**: 50 (default) – Defines main trend direction

- **RSI_Period**: 14 (default)

- **RSI_Overbought**: 70 – Overbought zone

- **RSI_Oversold**: 30 – Oversold zone

- **Stoch_K**: 5 – Stochastic K period

- **Stoch_D**: 3 – Stochastic D period

- **Stoch_Slowing**: 3 – Stochastic smoothing

- **ADX_Period**: 14 – Standard period to measure trend strength

- **ADX_MinLevel**: 25.0 – Minimum threshold to confirm strong trends

### Support & Resistance Settings

- **SupportResistancePeriod**: 20 (default)

### Alerts Settings

- **ShowAlerts**: true (default) – On-screen pop-up alerts

- **SendNotifications**: false (default) – Push notification option

- **AlertOffsetPips**: 10.0 (default) – Distance between arrow and price

## 🎯 Signal Logic

### Buy Conditions

- Price **above** Trend EMA (50)

- **Bullish crossover** of EMAs (8 > 21) or bullish stochastic crossover

- **Positive momentum** (rising EMAs)

- **ADX > 25** (clear and solid trend)

- **RSI in neutral zone** (30–70)

### Sell Conditions

- Price **below** Trend EMA (50)

- **Bearish crossover** of EMAs (8 < 21) or bearish stochastic crossover

- **Negative momentum** (falling EMAs)

- **ADX > 25** (clear and solid trend)

- **RSI in neutral zone** (30–70)

## 📈 Recommended Trading Styles

### 1. **Scalping** (Main Use)

- **Timeframes**: M1, M5, M15

- **Recommended Sessions**: London (08:00–12:00 GMT), New York (13:00–17:00 GMT)

- **Advantage**: Fast signals with high frequency and quality

### 2. **Day Trading**

- **Timeframes**: M15, M30, H1

- **Recommended Sessions**: High volatility hours

- **Advantage**: Fewer signals but higher reliability

### 3. **Swing Trading** (Secondary Use)

- **Timeframes**: H1, H4

- **Advantage**: Captures broader trends with less market noise

## 💱 Recommended Currency Pairs

### ✅ **Major Pairs** (Optimal)

- **EUR/USD** – High liquidity, low spreads

- **GBP/USD** – Moderate to high volatility

- **USD/JPY** – Clear technical movements

- **AUD/USD** – Ideal for Asian session

### 🟡 **Minor Pairs** (Acceptable)

- **EUR/GBP** – Low volatility

- **EUR/CHF** – Smooth movements

- **GBP/JPY** – High volatility (requires risk management)

### ❌ **Avoid**

- Exotic pairs (high spreads, low liquidity)

- Pairs with major fundamental events

## ⏰ Optimal Usage Hours

### 🕐 **London Session** (08:00–12:00 GMT)

- **Best for**: EUR/USD, GBP/USD, EUR/GBP

- **Features**: High liquidity, reduced spreads

### 🔄 **London-New York Overlap** (13:00–17:00 GMT)

- **Best for**: All major pairs

- **Features**: Maximum volatility and opportunities

### 🕑 **New York Session** (13:00–22:00 GMT)

- **Best for**: USD/JPY, USD/CAD

- **Features**: Clear and defined trends

### ⚠️ **Avoid**

- Low liquidity hours (22:00–08:00 GMT)

- Fridays after 15:00 GMT

- Major holiday days

## 🛡️ Recommended Risk Management

- **Stop Loss**: 1–2 ATR from entry price

- **Take Profit**: Risk/reward ratio of 1:1.5 to 1:2

- **Position Size**: 1–2% of capital per trade

- **Max Simultaneous Trades**: 3–5 active trades

Thank you for choosing **Apex Arrows**, a professional and versatile tool for confident trading in financial markets. Start making better decisions today!