Price Action Analysis Toolkit (Part 55): Designing a CPI Mini-Candle Overlay for Intra-bar Pressure

This article presents the design and MetaTrader 5 implementation of the Candle Pressure Index (CPI)—a CLV-based overlay that visualizes intra-Bar buying and selling pressure directly on price charts. The discussion focuses on candle structure, pressure classification, visualization mechanics, and a non-repainting, transition-based alert system designed for consistent behavior across timeframes and instruments.

Price Action Analysis Toolkit Development (Part 46): Designing an Interactive Fibonacci Retracement EA with Smart Visualization in MQL5

Fibonacci tools are among the most popular instruments used by technical analysts. In this article, we’ll build an Interactive Fibonacci EA that draws retracement and extension levels that react dynamically to price movement, delivering real‑time alerts, stylish lines, and a scrolling news‑style headline. Another key advantage of this EA is flexibility; you can manually type the high (A) and low (B) swing values directly on the chart, giving you exact control over the market range you want to analyze.

Revisiting Murray system

Graphical price analysis systems are deservedly popular among traders. In this article, I am going to describe the complete Murray system, including its famous levels, as well as some other useful techniques for assessing the current price position and making a trading decision.

Creating a Dynamic Multi-Symbol, Multi-Period Relative Strength Indicator (RSI) Indicator Dashboard in MQL5

In this article, we develop a dynamic multi-symbol, multi-period RSI indicator dashboard in MQL5, providing traders real-time RSI values across various symbols and timeframes. The dashboard features interactive buttons, real-time updates, and color-coded indicators to help traders make informed decisions.

Timeseries in DoEasy library (part 47): Multi-period multi-symbol standard indicators

In this article, I will start developing the methods of working with standard indicators, which will ultimately allow creating multi-symbol multi-period standard indicators based on library classes. Besides, I will add the "Skipped bars" event to the timeseries classes and eliminate excessive load from the main program code by moving the library preparation functions to CEngine class.

Introduction to MQL5 (Part 16): Building Expert Advisors Using Technical Chart Patterns

This article introduces beginners to building an MQL5 Expert Advisor that identifies and trades a classic technical chart pattern — the Head and Shoulders. It covers how to detect the pattern using price action, draw it on the chart, set entry, stop loss, and take profit levels, and automate trade execution based on the pattern.

Implementing the Janus factor in MQL5

Gary Anderson developed a method of market analysis based on a theory he dubbed the Janus Factor. The theory describes a set of indicators that can be used to reveal trends and assess market risk. In this article we will implement these tools in mql5.

Developing a Trading Strategy: Using a Volume-Bound Approach

In the world of technical analysis, price often takes center stage. Traders meticulously map out support, resistance, and patterns, yet frequently ignore the critical force that drives these movements: volume. This article delves into a novel approach to volume analysis: the Volume Boundary indicator. This transformation, utilizing sophisticated smoothing functions like the butterfly and triple sine curves, allows for clearer interpretation and the development of systematic trading strategies.

Developing a trading Expert Advisor from scratch (Part 14): Adding Volume At Price (II)

Today we will add some more resources to our EA. This interesting article can provide some new ideas and methods of presenting information. At the same time, it can assist in fixing minor flaws in your projects.

How to build and optimize a volume-based trading system (Chaikin Money Flow - CMF)

In this article, we will provide a volume-based indicator, Chaikin Money Flow (CMF) after identifying how it can be constructed, calculated, and used. We will understand how to build a custom indicator. We will share some simple strategies that can be used and then test them to understand which one is better.

Creating a ticker tape panel: Improved version

How do you like the idea of reviving the basic version of our ticker tape panel? The first thing we will do is change the panel to be able to add an image, such as an asset logo or some other image, so that the user could quickly and easily identify the displayed symbol.

Timeseries in DoEasy library (part 53): Abstract base indicator class

The article considers creation of an abstract indicator which further will be used as the base class to create objects of library’s standard and custom indicators.

William Gann methods (Part I): Creating Gann Angles indicator

What is the essence of Gann Theory? How are Gann angles constructed? We will create Gann Angles indicator for MetaTrader 5.

Introduction to MQL5 (Part 24): Building an EA that Trades with Chart Objects

This article teaches you how to create an Expert Advisor that detects support and resistance zones drawn on the chart and executes trades automatically based on them.

Improve Your Trading Charts With Interactive GUI's in MQL5 (Part II): Movable GUI (II)

Unlock the potential of dynamic data representation in your trading strategies and utilities with our in-depth guide to creating movable GUIs in MQL5. Delve into the fundamental principles of object-oriented programming and discover how to design and implement single or multiple movable GUIs on the same chart with ease and efficiency.

Timeseries in DoEasy library (part 52): Cross-platform nature of multi-period multi-symbol single-buffer standard indicators

In the article, consider creation of multi-symbol multi-period standard indicator Accumulation/Distribution. Slightly improve library classes with respect to indicators so that, the programs developed for outdated platform MetaTrader 4 based on this library could work normally when switching over to MetaTrader 5.

Developing a Custom Market Sentiment Indicator

In this article we are developing a custom market sentiment indicator to classify conditions into bullish, bearish, risk-on, risk-off, or neutral. Using multi-timeframe, the indicator can provide traders with a clearer perspective of overall market bias and short-term confirmations.

Price Action Analysis Toolkit Development (Part 16): Introducing Quarters Theory (II) — Intrusion Detector EA

In our previous article, we introduced a simple script called "The Quarters Drawer." Building on that foundation, we are now taking the next step by creating a monitor Expert Advisor (EA) to track these quarters and provide oversight regarding potential market reactions at these levels. Join us as we explore the process of developing a zone detection tool in this article.

Design Patterns in software development and MQL5 (Part 3): Behavioral Patterns 1

A new article from Design Patterns articles and we will take a look at one of its types which is behavioral patterns to understand how we can build communication methods between created objects effectively. By completing these Behavior patterns we will be able to understand how we can create and build a reusable, extendable, tested software.

Advanced Variables and Data Types in MQL5

Variables and data types are very important topics not only in MQL5 programming but also in any programming language. MQL5 variables and data types can be categorized as simple and advanced ones. In this article, we will identify and learn about advanced ones because we already mentioned simple ones in a previous article.

Building a Custom Market Regime Detection System in MQL5 (Part 1): Indicator

This article details creating an MQL5 Market Regime Detection System using statistical methods like autocorrelation and volatility. It provides code for classes to classify trending, ranging, and volatile conditions and a custom indicator.

Building A Candlestick Trend Constraint Model (Part 9): Multiple Strategies Expert Advisor (I)

Today, we will explore the possibilities of incorporating multiple strategies into an Expert Advisor (EA) using MQL5. Expert Advisors provide broader capabilities than just indicators and scripts, allowing for more sophisticated trading approaches that can adapt to changing market conditions. Find, more in this article discussion.

The Parafrac V2 Oscillator: Integrating Parabolic SAR with Average True Range

The Parafrac V2 Oscillator is an advanced technical analysis tool that integrates the Parabolic SAR with the Average True Range (ATR) to overcome limitations of its predecessor, which relied on fractals and was prone to signal spikes overshadowing previous and current signals. By leveraging ATR’s volatility measure, the version 2 offers a smoother, more reliable method for detecting trends, reversals, and divergences, helping traders reduce chart congestion and analysis paralysis.

Forex spread trading using seasonality

The article examines the possibilities of generating and providing reporting data on the use of the seasonality factor when trading spreads on Forex.

Developing A Custom Account Performace Matrix Indicator

This indicator acts as a discipline enforcer by tracking account equity, profit/loss, and drawdown in real-time while displaying a performance dashboard. It can help traders stay consistent, avoid overtrading, and comply with prop-firm challenge rules.

Discrete Hartley transform

In this article, we will consider one of the methods of spectral analysis and signal processing - the discrete Hartley transform. It allows filtering signals, analyzing their spectrum and much more. The capabilities of DHT are no less than those of the discrete Fourier transform. However, unlike DFT, DHT uses only real numbers, which makes it more convenient for implementation in practice, and the results of its application are more visual.

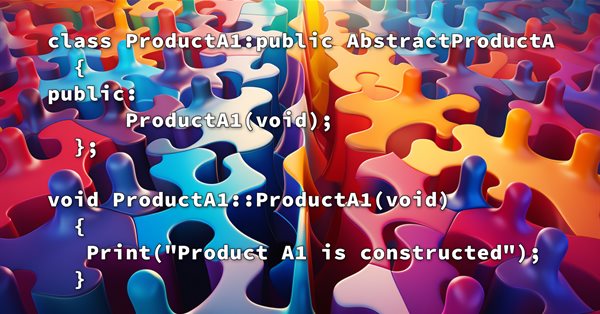

Design Patterns in software development and MQL5 (Part I): Creational Patterns

There are methods that can be used to solve many problems that can be repeated. Once understand how to use these methods it can be very helpful to create your software effectively and apply the concept of DRY ((Do not Repeat Yourself). In this context, the topic of Design Patterns will serve very well because they are patterns that provide solutions to well-described and repeated problems.

MQL5 Wizard Techniques you should know (Part 44): Average True Range (ATR) technical indicator

The ATR oscillator is a very popular indicator for acting as a volatility proxy, especially in the forex markets where volume data is scarce. We examine this, on a pattern basis as we have with prior indicators, and share strategies & test reports thanks to the MQL5 wizard library classes and assembly.

Timeseries in DoEasy library (part 51): Composite multi-period multi-symbol standard indicators

In the article, complete development of objects of multi-period multi-symbol standard indicators. Using Ichimoku Kinko Hyo standard indicator example, analyze creation of compound custom indicators which have auxiliary drawn buffers for displaying data on the chart.

MQL5 Wizard Techniques you should know (Part 83): Using Patterns of Stochastic Oscillator and the FrAMA — Behavioral Archetypes

The Stochastic Oscillator and the Fractal Adaptive Moving Average are another indicator pairing that could be used for their ability to compliment each other within an MQL5 Expert Advisor. We look at the Stochastic for its ability to pinpoint momentum shifts, while the FrAMA is used to provide confirmation of the prevailing trends. In exploring this indicator pairing, as always, we use the MQL5 wizard to build and test out their potential.

Larry Williams Market Secrets (Part 5): Automating the Volatility Breakout Strategy in MQL5

This article demonstrates how to automate Larry Williams’ volatility breakout strategy in MQL5 using a practical, step-by-step approach. You will learn how to calculate daily range expansions, derive buy and sell levels, manage risk with range-based stops and reward-based targets, and structure a professional Expert Advisor for MetaTrader 5. Designed for traders and developers looking to transform Larry Williams’ market concepts into a fully testable and deployable automated trading system.

Outline of MetaTrader Market (Infographics)

A few weeks ago we published the infographic on Freelance service. We also promised to reveal some statistics of the MetaTrader Market. Now, we invite you to examine the data we have gathered.

Building A Candlestick Trend Constraint Model(Part 3): Detecting changes in trends while using this system

This article explores how economic news releases, investor behavior, and various factors can influence market trend reversals. It includes a video explanation and proceeds by incorporating MQL5 code into our program to detect trend reversals, alert us, and take appropriate actions based on market conditions. This builds upon previous articles in the series.

Price Action Analysis Toolkit Development (Part 23): Currency Strength Meter

Do you know what really drives a currency pair’s direction? It’s the strength of each individual currency. In this article, we’ll measure a currency’s strength by looping through every pair it appears in. That insight lets us predict how those pairs may move based on their relative strengths. Read on to learn more.

MQL5 Wizard Techniques you should know (Part 42): ADX Oscillator

The ADX is another relatively popular technical indicator used by some traders to gauge the strength of a prevalent trend. Acting as a combination of two other indicators, it presents as an oscillator whose patterns we explore in this article with the help of MQL5 wizard assembly and its support classes.

Building A Candlestick Trend Constraint Model (Part 1): For EAs And Technical Indicators

This article is aimed at beginners and pro-MQL5 developers. It provides a piece of code to define and constrain signal-generating indicators to trends in higher timeframes. In this way, traders can enhance their strategies by incorporating a broader market perspective, leading to potentially more robust and reliable trading signals.

Price Action Analysis Toolkit Development (Part 12): External Flow (III) TrendMap

The flow of the market is determined by the forces between bulls and bears. There are specific levels that the market respects due to the forces acting on them. Fibonacci and VWAP levels are especially powerful in influencing market behavior. Join me in this article as we explore a strategy based on VWAP and Fibonacci levels for signal generation.

Chart Synchronization for Easier Technical Analysis

Chart Synchronization for Easier Technical Analysis is a tool that ensures all chart timeframes display consistent graphical objects like trendlines, rectangles, or indicators across different timeframes for a single symbol. Actions such as panning, zooming, or symbol changes are mirrored across all synced charts, allowing traders to seamlessly view and compare the same price action context in multiple timeframes.

Developing an MQTT client for MetaTrader 5: a TDD approach

This article reports the first attempts in the development of a native MQTT client for MQL5. MQTT is a Client Server publish/subscribe messaging transport protocol. It is lightweight, open, simple, and designed to be easy to implement. These characteristics make it ideal for use in many situations.

Trend criteria in trading

Trends are an important part of many trading strategies. In this article, we will look at some of the tools used to identify trends and their characteristics. Understanding and correctly interpreting trends can significantly improve trading efficiency and minimize risks.