Price Action Analysis Toolkit Development (Part 12): External Flow (III) TrendMap

Introduction

During the market volatility of 2020 amid the COVID-19 crisis, traders looked to various technical tools to help gauge when a recovery might occur. Some even experimented with Fibonacci time zones to identify potential turning points based on historical price behavior. Although the alignment between Fibonacci projections and major rebounds is still a subject of debate, these tools offered one of several frameworks for navigating an uncertain environment as governments began implementing stimulus measures and economies gradually reopened.

In our previous Price Action Analysis Toolkit Development series, we examined a VWAP-based strategy that focused on how VWAP levels could influence market decisions—signaling a buy when the price was above VWAP and a sell when it was below. However, relying solely on VWAP can be problematic, particularly during periods of extreme market conditions when reversals may occur.

In this article, we take our analysis one step further by combining VWAP with Fibonacci levels to generate trading signals. Fibonacci retracement levels help identify potential areas of support and resistance, and when paired with VWAP, they can enhance the robustness of your trading strategy. We begin by explaining the underlying concepts, then outline the key functions in both the MQL5 EA and the Python script. Next, we delve into additional function details and discuss the expected outcomes, before summarizing the key insights. Please refer to the table of contents below.

Concept

Fibonacci retracement is based on ratios derived from the Fibonacci sequence, introduced by Leonardo Fibonacci in the 13th century, and is widely used in technical analysis to pinpoint potential support and resistance levels where price reversals might occur. Combining Fibonacci retracement with VWAP (Volume Weighted Average Price) provides us with a more robust trading tool, as VWAP incorporates both price and volume data to reflect the true market sentiment and liquidity. This integration enhances decision-making by confirming key reversal zones with volume-backed evidence, reducing false signals and offering a dynamic perspective on market behavior.

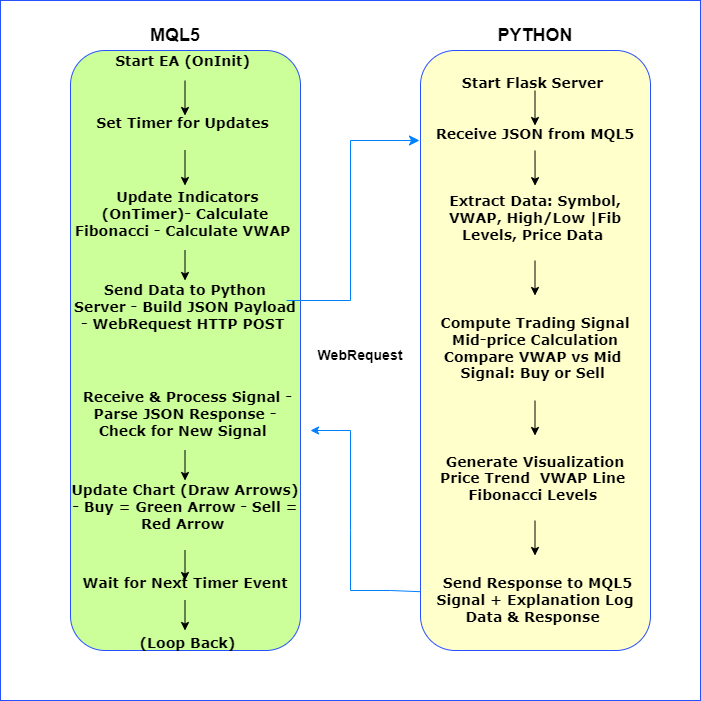

The TrendMap system is a trading signal generation framework that integrates MQL5 (MetaTrader 5 Expert Advisor) with a Python-based analytical server. The system processes Fibonacci retracement levels, VWAP (Volume Weighted Average Price), and price data to generate trading signals (Buy or Sell).

- If VWAP is below the 50% Fibonacci level (mid-price), Buy signal is generated.

- If VWAP is above the 50% Fibonacci level (mid-price), Sell signal is generated.

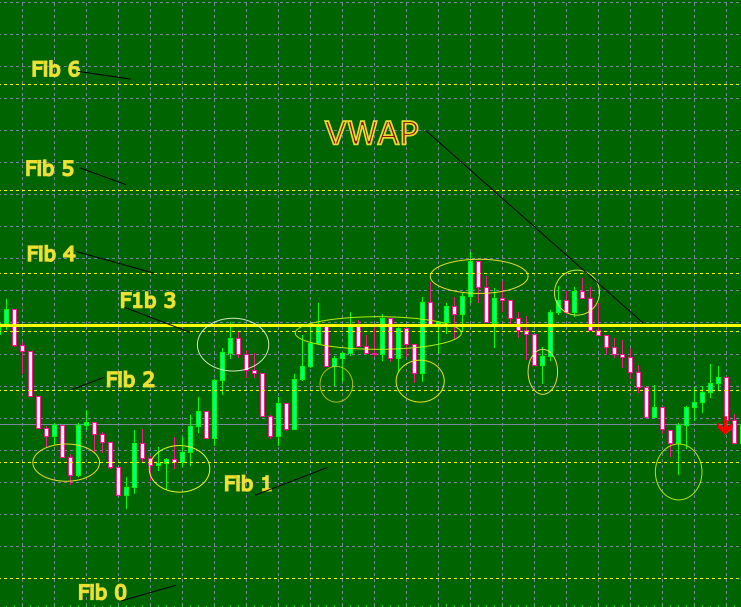

This ensures that signals are provided based on price action relative to both VWAP and Fibonacci retracement levels. Below, I have provided a diagram illustrating how the market interacts with Fibonacci levels and VWAP. This diagram represents the necessary conditions that our Python-based system monitors for signal generation.

- Fib 0 - 0%

- Fib 1 - 24%

- Fib 2 - 38%

- Fib 3 - 50%

- Fib 4 - 62%

- Fib 5 - 79%

- Fib 6 - 100%

Fib 3 represents the 50% retracement level, and we observe that the VWAP is above this level, indicating a potential reversal. Consequently, a sell signal is generated. I have also circled the levels where the price interacts with both the Fibonacci levels and the VWAP.

Fig 1. Price vs Fibonacci and VWAP

The MQL5 expert advisor integrates Fibonacci retracement levels and VWAP analysis to generate trading signals without executing trades. It calculates Fibonacci levels from a specified number of past bars, determines swing highs and lows, and computes VWAP to assess market trends. The EA sends this data to a Python server via HTTP, which analyzes the market conditions and returns a buy or sell signal. Upon receiving a new signal, the EA updates the chart by displaying the signal and drawing Fibonacci lines, the VWAP line, and arrows for visual representation.

The system operates on a timer-based approach, ensuring periodic updates while logging and tracking market changes. This script sets up a Flask server that takes in market data from the MQL5 EA, processes it, and returns a trading signal.

When the EA sends JSON data containing VWAP, Fibonacci retracement levels, swing high/low, and price data, the script evaluates whether VWAP is below or above the mid-price of the swing range to determine a "Buy" or "Sell" signal. At the same time, it generates a Matplotlib chart plotting VWAP, Fibonacci levels, and price data, saving the image for reference. The plotting runs in a separate thread to keep things smooth.

Everything is logged for tracking, and the server runs on 127.0.0.1:5110. Let's go through the flowchart below to get a full picture of the process.

Fig 2. Flowchart

Main Functions

MQL5 Expert Advisor

In this part, we’ll walk through the core functions that power our Fibonacci-VWAP EA in MQL5. The goal is to:

- Calculate Fibonacci retracement levels using swing highs and lows

- Determine VWAP (Volume Weighted Average Price) for trend confirmation

- Send market data to Python, which will perform more profound analysis and return a buy/sell signal

- Draw signal arrows on the chart once all conditions are met

Let’s break it down step by step.

1. Updating Fibonacci and VWAP Indicators

To begin, we must ensure that our Fibonacci retracement levels and VWAP are up-to-date before making generating any signal. We achieve this by calling two key functions. First, the CalculateFibonacciLevels() function is responsible for identifying the swing high and swing low points, as well as calculating the relevant Fibonacci retracement levels.

These levels are crucial for understanding potential support and resistance zones. The second function, CalculateVWAP(), computes the Volume Weighted Average Price (VWAP), which serves as an indicator for determining the overall market trend based on volume and price. By keeping these indicators updated, we make sure we are working with the most recent market data, which is essential for accurate analysis and decision-making.

void UpdateIndicators() { CalculateFibonacciLevels(InpTimeFrame, InpNumBars, g_SwingHigh, g_SwingLow, g_FibLevels); g_VWAP = CalculateVWAP(InpTimeFrame, InpNumBars); Print("Updated Indicators: SwingHigh=" + DoubleToString(g_SwingHigh, Digits()) + ", SwingLow=" + DoubleToString(g_SwingLow, Digits()) + ", VWAP=" + DoubleToString(g_VWAP, Digits())); }

2. Sending Market Data to Python

Once the Fibonacci and VWAP indicators are updated, the next step is to send the market data to Python for more advanced analysis. This is done by creating a JSON payload that includes all the essential information needed for further processing. The payload is structured to contain key data points such as the symbol and timeframe of the chart, the swing high and low points, the VWAP value, and the calculated Fibonacci levels. Additionally, we include recent price data for further market analysis. Once the data is structured into this JSON format, it is sent to the Python server through an HTTP request, where Python will process it and return a trading signal based on the calculations.

string BuildJSONPayload() { string jsonPayload = "{"; jsonPayload += "\"symbol\":\"" + Symbol() + "\","; jsonPayload += "\"timeframe\":\"" + EnumToString(InpTimeFrame) + "\","; jsonPayload += "\"swingHigh\":" + DoubleToString(g_SwingHigh, Digits()) + ","; jsonPayload += "\"swingLow\":" + DoubleToString(g_SwingLow, Digits()) + ","; jsonPayload += "\"vwap\":" + DoubleToString(g_VWAP, Digits()) + ","; jsonPayload += "\"fibLevels\":["; for(int i = 0; i < 7; i++) { jsonPayload += DoubleToString(g_FibLevels[i], 3); if(i < 6) jsonPayload += ","; } jsonPayload += "],"; jsonPayload += "\"priceData\":["; for(int i = 0; i < InpNumBars; i++) { jsonPayload += DoubleToString(iClose(Symbol(), InpTimeFrame, i), Digits()); if(i < InpNumBars - 1) jsonPayload += ","; } jsonPayload += "]}"; return jsonPayload; }

3. Communicating with Python and Receiving Signals

At this stage, the HTTP request is made, sending the JSON payload to the Python script. The Python server will then analyze the data and return a response containing a buy or sell signal. The HTTP request is built in a way that handles both the sending of data and the reception of responses, checking for any errors during the process. If the request is successful (indicated by a response code of 200), the response is parsed, and the relevant signal (buy, sell, or hold) is extracted from the JSON data returned by Python. This allows the MQL5 EA to integrate external computational power into its decision-making process, enabling more robust trading signals.

string SendDataToPython(string payload) { string headers = "Content-Type: application/json\r\n"; char postData[]; StringToCharArray(payload, postData); char result[]; string resultHeaders; int resCode = WebRequest("POST", InpPythonURL, headers, InpHTTPTimeout, postData, result, resultHeaders); if(resCode == 200) { string response = CharArrayToString(result); Print("HTTP Response: " + response); string signal = ParseSignalFromJSON(response); return signal; } else { Print("Error: WebRequest failed with code " + IntegerToString(resCode)); return ""; } }

4. Plotting Buy/Sell Signals on the Chart

After receiving the trading signal from Python, the next step is to visually represent that signal on the chart. This is done by drawing an arrow at the current market price to indicate the suggested action. If the signal is a buy signal, an upward-pointing arrow (green in color) is placed, and for a sell signal, a downward-pointing arrow (red) is drawn. This visual cue is crucial for traders to quickly interpret the trading suggestion without needing to analyze numbers.

The arrows are dynamically created using the ObjectCreate function, and their appearance (such as color and size) can be adjusted for better visibility. The use of these arrows makes the trading signals clear and accessible, even for those who might not be following every detail of the system's analysis.

void DrawSignalArrow(string signal) { int arrowCode = 0; color arrowColor = clrWhite; string lowerSignal = MyStringToLower(signal); if(lowerSignal == "buy") { arrowCode = 233; // Upward arrow arrowColor = clrLime; } else if(lowerSignal == "sell") { arrowCode = 234; // Downward arrow arrowColor = clrRed; } else { Print("Invalid signal: " + signal); return; } string arrowName = "SignalArrow_" + IntegerToString(TimeCurrent()); ObjectCreate(0, arrowName, OBJ_ARROW, 0, TimeCurrent(), iClose(Symbol(), PERIOD_CURRENT, 0)); ObjectSetInteger(0, arrowName, OBJPROP_ARROWCODE, arrowCode); ObjectSetInteger(0, arrowName, OBJPROP_COLOR, arrowColor); ObjectSetInteger(0, arrowName, OBJPROP_WIDTH, 2); }

Python Script

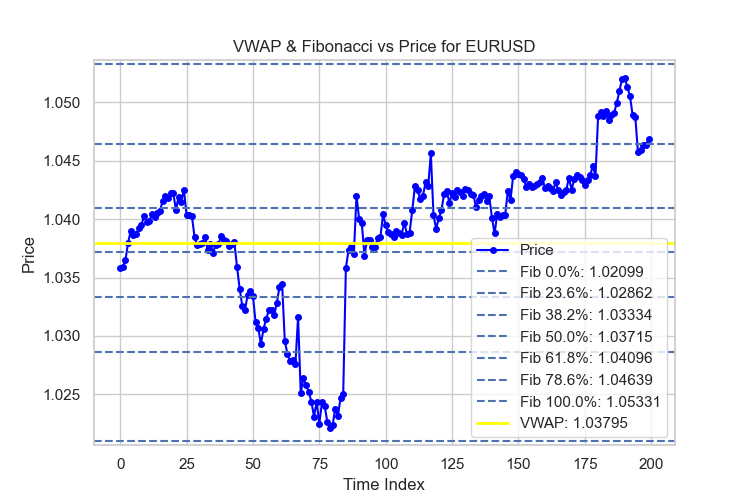

1. Plotting VWAP & Fibonacci vs Price

The plot_vwap_fib_vs_price() function visualizes the price movement, VWAP, and Fibonacci retracement levels. It is used to help understand the relationship between these three indicators. The function accepts the following parameters:

- symbol: The asset being analyzed

- vwap: The calculated Volume Weighted Average Price

- swingHigh and swingLow: The high and low points used to calculate Fibonacci retracement levels

- fibLevels: The Fibonacci retracement levels (default values include common retracements such as 0.236, 0.382, etc.)

- price_data: A pandas Series containing the price data over time

Function Breakdown:

- Plotting Price Data: The function starts by plotting the price data over time using sns.set for style and ax.plot for visualization

- Drawing Fibonacci Levels: For each Fibonacci level provided in the list, the function calculates the corresponding price and draws a horizontal line using ax.axhline

- Drawing VWAP: The VWAP is plotted as a yellow horizontal line

- Saving Plot: The plot is saved with a timestamp to avoid overwriting previous charts

The plot is saved as an image file, and this helps visualize how the price interacts with key Fibonacci retracement levels and the VWAP.

def plot_vwap_fib_vs_price(symbol: str, vwap: float, swingHigh: float, swingLow: float, fibLevels: list, price_data: pd.Series) -> str: sns.set(style="whitegrid") fig, ax = plt.subplots(figsize=(7.5, 5), dpi=100) ax.plot(price_data.index, price_data.values, label="Price", color='blue', marker='o', markersize=4) for level in fibLevels: level_price = swingLow + (swingHigh - swingLow) * level ax.axhline(y=level_price, linestyle='--', linewidth=1.5, label=f'Fib {level*100:.1f}%: {level_price:.5f}') ax.axhline(y=vwap, color='yellow', linestyle='-', linewidth=2, label=f'VWAP: {vwap:.5f}') ax.set_title(f'VWAP & Fibonacci vs Price for {symbol}') ax.set_xlabel('Time Index') ax.set_ylabel('Price') ax.legend() filename = f"vwap_fib_plot_{symbol}_{datetime.datetime.now().strftime('%Y%m%d_%H%M%S')}.png" plt.savefig(filename) plt.close(fig) return filename

2. Flask Route for Signal and Analysis

The get_signal() function is the core route that handles POST requests and is responsible for receiving market data, performing analysis, and returning trading signals. The data is sent to this route as a JSON payload from MQL5.

Function Breakdown:

- Receive Data: The function receives market data in raw format, decodes it, and parses it into a JSON object.

- Extract Data: Key data points like symbol, swingHigh, swingLow, vwap, fibLevels, and priceData are extracted from the incoming JSON.

- Plotting: It starts a new thread that calls the plotting function to generate the visual representation of the market conditions (VWAP and Fibonacci).

- Signal Generation: The buy/sell signal is generated by comparing the VWAP with the midpoint between the swing high and swing low. If the VWAP is lower than the midpoint, a "Buy" signal is generated; otherwise, a "Sell" signal is issued.

- Response: A response is returned with the generated signal ("Buy", "Sell", or "None") and an explanation.

The signal generation logic is simple but effective:

- Buy Signal: The VWAP is below the midpoint of the swing high and low, indicating potential upward momentum.

- Sell Signal: The VWAP is above the midpoint, suggesting a downtrend or bearish conditions.

@app.route('/getSignal', methods=['POST']) def get_signal(): try: # Get the raw data from the request raw_data = request.data.decode('utf-8').strip() logging.debug("Raw data received: " + raw_data) # Parse JSON decoder = json.JSONDecoder() data, idx = decoder.raw_decode(raw_data) if idx != len(raw_data): logging.error(f"Extra data found after valid JSON: index {idx} of {len(raw_data)}") logging.info("Data received from MQL5: " + json.dumps(data, indent=2)) except Exception as e: logging.error("Error parsing JSON: " + str(e)) return jsonify({"signal": "None", "error": str(e)}) try: # Extract parameters symbol = data.get('symbol', 'Unknown') swingHigh = float(data.get('swingHigh', 0)) swingLow = float(data.get('swingLow', 0)) vwap = float(data.get('vwap', 0)) fibLevels = data.get('fibLevels', [0.236, 0.382, 0.5, 0.618, 1.618]) # Default levels if not provided # Convert priceData list into a pandas Series price_data = pd.Series(data.get('priceData', [])) # Start thread for visualization threading.Thread(target=plot_vwap_fib_vs_price, args=(symbol, vwap, swingHigh, swingLow, fibLevels, price_data)).start() # Determine signal based on VWAP & Fibonacci mid_price = np.mean([swingHigh, swingLow]) if vwap < mid_price and price_data.iloc[-1] < swingLow + (swingHigh - swingLow) * 0.382: signal = "Buy" elif vwap > mid_price and price_data.iloc[-1] > swingLow + (swingHigh - swingLow) * 0.618: signal = "Sell" else: signal = "None" explanation = f"Signal: {signal} based on VWAP and Fibonacci analysis." except Exception as e: logging.error("Error processing data: " + str(e)) signal = "None" explanation = "Error processing the signal." # Build response response = { "signal": signal, "explanation": explanation, "received_data": data } logging.debug("Sending response to MQL5: " + json.dumps(response)) return jsonify(response)

In the code, the signal generation process takes both VWAP and Fibonacci into account, with the logic explicitly relying on both to determine whether to generate a Buy or Sell signal. The Buy or Sell signal is directly based on the alignment of the VWAP and Fibonacci levels. For example:

- Buy Signal: When the VWAP is below the midpoint and the price is approaching a support level (Fibonacci retracement), it's a strong indication for a Buy.

- Sell Signal: If the VWAP is above the midpoint and the price is at a resistance Fibonacci level, the Sell signal is stronger.

Other Functions

MQL5 EA

- Helper Functions

Let's start with the helper functions. These are like the small tools in our toolbox that simplify our work later on. For example, the function BoolToString converts a true/false value into a string ("true" or "false") so that when you log or display these values, they're easy to read. Then there's CharToStr, which takes a character code (an unsigned short) and converts it to a string—a handy function when you need to work with text data. Finally, MyStringToLower goes through a given string character by character, converting any uppercase letters to lowercase. This is especially useful when you want to compare strings without worrying about case differences. Here’s the exact code:

//+------------------------------------------------------------------+ //| Helper: Convert bool to string | //+------------------------------------------------------------------+ string BoolToString(bool val) { return(val ? "true" : "false"); } //+------------------------------------------------------------------+ //| Helper: Convert ushort (character code) to string | //+------------------------------------------------------------------+ string CharToStr(ushort ch) { return(StringFormat("%c", ch)); } //+------------------------------------------------------------------+ //| Helper: Convert a string to lower case | //| This custom function avoids the implicit conversion warning. | //+------------------------------------------------------------------+ string MyStringToLower(string s) { string res = ""; int len = StringLen(s); for(int i = 0; i < len; i++) { ushort ch = s[i]; // Check if character is uppercase A-Z. if(ch >= 'A' && ch <= 'Z') ch = ch + 32; res += CharToStr(ch); } return res; }

In essence, these functions help ensure our text and data handling is consistent throughout the EA.

- Initialization and Cleanup

Next, we have the initialization and cleanup routines. Think of these as setting the stage before the play begins and tidying up afterward. In the OnInit function, the EA starts by printing a welcome message. It then sets a timer using EventSetTimer (which is critical for periodic tasks) and calls InitializeFibonacciArray to preload our Fibonacci levels. Additionally, it records the current time for managing subsequent updates. If the timer fails, the EA stops immediately to prevent further issues. Conversely, the OnDeinit function is called when the EA is removed from the chart; it kills the timer with EventKillTimer and logs the reason. Here's what that looks like:

//+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { Print("FibVWAP No-Trade EA initializing..."); if(!EventSetTimer(InpTimerInterval)) { Print("Error: Unable to set timer."); return(INIT_FAILED); } InitializeFibonacciArray(); g_LastUpdateTime = TimeCurrent(); Print("FibVWAP No-Trade EA successfully initialized."); return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { EventKillTimer(); Print("FibVWAP No-Trade EA deinitialized, reason code: " + IntegerToString(reason)); } //+------------------------------------------------------------------+ //| Initialize Fibonacci levels array | //+------------------------------------------------------------------+ void InitializeFibonacciArray() { g_FibLevels[0] = 0.000; g_FibLevels[1] = 0.236; g_FibLevels[2] = 0.382; g_FibLevels[3] = 0.500; g_FibLevels[4] = 0.618; g_FibLevels[5] = 0.786; g_FibLevels[6] = 1.000; }

By carefully setting up and tearing down our environment, we ensure that our EA runs smoothly without leaving any loose ends.

- Periodic Execution and Event Handling

Now, let's look at how the EA manages its tasks during runtime. The OnTimer function is key here; it fires at intervals defined by the user (set by InpTimerInterval). Every time this timer goes off, the EA updates its indicators, builds a JSON payload, sends that payload to our Python endpoint, and processes any returned signal. If there's a new signal, the EA even draws an arrow on the chart. While OnTick gets called with every market update (or tick), we use it only to call MainProcessingLoop so that heavy processing doesn’t happen on every tick—only at controlled intervals. This design helps in keeping the EA efficient. Check out the code:

//+------------------------------------------------------------------+ //| Expert timer function: periodic update | //+------------------------------------------------------------------+ void OnTimer() { UpdateIndicators(); string payload = BuildJSONPayload(); Print("Payload sent to Python: " + payload); string signal = SendDataToPython(payload); if(signal != "") { if(signal != g_LastSignal) { g_LastSignal = signal; Print("New signal received: " + signal); Comment("ML Signal: " + signal); // Draw an arrow on the chart for the new signal. DrawSignalArrow(signal); } else { Print("Signal unchanged: " + signal); } } else { Print("Warning: No valid signal received."); } UpdateChartObjects(); } //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { MainProcessingLoop(); } //+------------------------------------------------------------------+ //| Main processing loop: can be called from OnTick | //+------------------------------------------------------------------+ void MainProcessingLoop() { datetime currentTime = TimeCurrent(); if(currentTime - g_LastUpdateTime >= InpTimerInterval) { UpdateChartObjects(); g_LastUpdateTime = currentTime; } }

This setup ensures that our EA performs its updates at the right pace without being overwhelmed by every tick.

- Chart Object Management

Visual feedback is significant in trading, and this is where our chart object management comes into play. The DrawChartObjects function is responsible for drawing visual elements on the chart, such as horizontal lines representing our Fibonacci levels and the VWAP. It first clears any previous objects to avoid clutter, then creates new objects with the appropriate colors, styles, and text labels. The helper function UpdateChartObjects simply calls DrawChartObjects to keep things modular, and ExtendedProcessing is available if we need to perform any extra updates or debugging actions. Here is the code:

//+------------------------------------------------------------------+ //| Draw objects on the chart for visual indicator levels | //+------------------------------------------------------------------+ void DrawChartObjects() { string objPrefix = "FibVWAP_"; // Remove previous objects with the given prefix. ObjectsDeleteAll(0, objPrefix); double range = g_SwingHigh - g_SwingLow; for(int i = 0; i < 7; i++) { double levelPrice = g_SwingLow + range * g_FibLevels[i]; string name = objPrefix + "FibLevel_" + IntegerToString(i); if(!ObjectCreate(0, name, OBJ_HLINE, 0, 0, levelPrice)) Print("Error creating object: " + name); else { ObjectSetInteger(0, name, OBJPROP_COLOR, clrDeepSkyBlue); ObjectSetInteger(0, name, OBJPROP_STYLE, STYLE_DOT); ObjectSetString(0, name, OBJPROP_TEXT, "Fib " + DoubleToString(g_FibLevels[i]*100, 0) + "%"); } } string vwapName = objPrefix + "VWAP"; if(!ObjectCreate(0, vwapName, OBJ_HLINE, 0, 0, g_VWAP)) Print("Error creating VWAP object."); else { ObjectSetInteger(0, vwapName, OBJPROP_COLOR, clrYellow); ObjectSetInteger(0, vwapName, OBJPROP_STYLE, STYLE_SOLID); ObjectSetString(0, vwapName, OBJPROP_TEXT, "VWAP"); } } //+------------------------------------------------------------------+ //| Periodically update chart objects | //+------------------------------------------------------------------+ void UpdateChartObjects() { DrawChartObjects(); } //+------------------------------------------------------------------+ //| Extended processing: additional updates and chart redraw | //+------------------------------------------------------------------+ void ExtendedProcessing() { Print("Extended processing executed."); UpdateChartObjects(); }

- Additional Utility Functions

//+------------------------------------------------------------------+ //| Convert char array to string | //+------------------------------------------------------------------+ string CharArrayToString(const char &arr[]) { string ret = ""; for(int i = 0; i < ArraySize(arr); i++) ret += CharToStr(arr[i]); return(ret); } //+------------------------------------------------------------------+ //| Custom logging function for detailed debug information | //+------------------------------------------------------------------+ void LogDebugInfo(string info) { string logMessage = TimeToString(TimeCurrent(), TIME_DATE|TIME_SECONDS) + " | " + info; Print(logMessage); } //+------------------------------------------------------------------+ //| Additional utility: Pause execution (for debugging) | //+------------------------------------------------------------------+ void PauseExecution(int seconds) { datetime endTime = TimeCurrent() + seconds; while(TimeCurrent() < endTime) { Sleep(100); } }

These functions might not be the star of the EA, but they make a big difference when it comes to troubleshooting and ensuring everything runs as expected.

Python Script

- Key Imports in Our Python Trading System

import datetime import json import logging import threading import numpy as np import pandas as pd import pandas_ta as ta import matplotlib.pyplot as plt import seaborn as sns from flask import Flask, request, jsonify

| Library | Purpose | How It’s Used in Our System |

|---|---|---|

| datetime | Time Management | Used to timestamp saved trading charts and log events. Every time we generate a chart, we attach a timestamp to keep track of different market conditions over time. |

| json | Data Exchange | Since our system communicates with MQL5, we send and receive data in JSON format. This module helps us encode and decode JSON messages between Python and MQL5. |

| logging | Debugging and monitoring | Keeps track of system events. We use it to log every step—when a signal is received, processed, or if an error occurs—making debugging easier. |

| threading | Running Tasks in Background | When we generate a VWAP-Fibonacci chart, we run it in a separate thread to ensure the server remains responsive and doesn’t delay sending signals back to MQL5. |

| numpy | Numerical Computation | We use NumPy to calculate the mid-price and perform other mathematical operations quickly and efficiently. Speed matters when processing real-time market data. |

| pandas | Data Handling | Since market data is structured in rows and columns (like a spreadsheet), pandas makes it easy to store, filter, and manipulate this data for analysis. |

| pandas_ta | Technical Indicators | Though not a core part of our current system, it allows for additional technical analysis tools if needed in the future. |

| matplotlib.pyplot | Charting & Visualization | The backbone of our visual analysis. We use it to plot price movements, VWAP levels, and Fibonacci retracement zones. |

| seanborn | Enhanced Chart Styling | Helps make our charts visually appealing, making it easier to spot trends and key levels. |

| flask | Communication Between MQL5 and Python | This is what makes real-time signal exchange possible. Flask creates an API that allows our MQL5 Expert Advisor to send price data and receive trading signals instantly. |

- Flask Server Initialization (if __name__ == '__main__')

How It Works:

- Binds the server to port 5110

- Runs in debug mode for real-time logging and troubleshooting

- Ensures the server doesn't auto-restart unnecessarily (use_reloader=False)

if __name__ == '__main__': port = 5110 logging.info(f"Starting Flask server on 127.0.0.1:{port} (debug mode ON)") app.run(host="127.0.0.1", port=port, debug=True, use_reloader=False)

Outcomes

To test the system, start by running the Python script to activate the port and server for connection. If you're unsure how to run the script, refer to the External Flow article for guidance. Once the server is active, run the MQL5 EA. Now, let's examine the results after successfully running the system.

Command Prompt Logs

2025-02-06 12:45:32,384 DEBUG: Sending response to MQL5: {"signal": "Sell", "explanation": "Signal: Sell based on VWAP and Fibonacci analysis.", "received_data": {"symbol": "EURUSD", "timeframe": "PERIOD_H1", "swingHigh": 1.05331, "swingLow": 1.02099, "vwap": 1.03795, "fibLevels": [0.0, 0.236, 0.382, 0.5, 0.618, 0.786, 1.0], "priceData": [1.03622, 1.03594, 1.03651, 1.03799, 1.03901, 1.03865, 1.03871, 1.0392, 1.03951, 1.04025, 1.03974, 1.03986, 1.04041, 1.04017, 1.04049, 1.04072, 1.04156, 1.04197, 1.04181, 1.04223, 1.04224, 1.04079, 1.04192, 1.04147, 1.04251, 1.04039, 1.04039, 1.04026, 1.0385, 1.03778, 1.03786, 1.03796, 1.03845, 1.03734, 1.03786, 1.03714, 1.0378, 1.03786, 1.03854, 1.03817, 1.03811, 1.03767, 1.03784, 1.03801, 1.03593, 1.03404, 1.03254, 1.03223, 1.0335, 1.03386, 1.03344, 1.03115, 1.03067, 1.02932, 1.0306, 1.03147, 1.0322, 1.03221, 1.03178, 1.03281, 1.0342, 1.03441, 1.02955, 1.02846, 1.02785, 1.02795, 1.02761, 1.03162, 1.0251, 1.0264, 1.02577, 1.02522, 1.02438, 1.0231, 1.02436, 1.02249, 1.02431, 1.02404, 1.02265, 1.02216, 1.02235, 1.02377, 1.02314, 1.0247, 1.02504, 1.03583, 1.03733, 1.03763, 1.03698, 1.042, 1.03998, 1.03964, 1.03687, 1.03822, 1.03825, 1.03759, 1.03765, 1.03836, 1.03845, 1.0404, 1.03946, 1.03888, 1.03875, 1.0385, 1.03897, 1.03884, 1.03867, 1.03969, 1.03873, 1.03885, 1.04076, 1.0428, 1.0425, 1.0417, 1.04197, 1.04314, 1.0428, 1.04562, 1.04033, 1.03918, 1.04007, 1.04076, 1.04217, 1.04239, 1.04139, 1.0422, 1.04191, 1.04253, 1.0423, 1.042, 1.04259, 1.04247, 1.04216, 1.04209, 1.04105, 1.04164, 1.042, 1.04213, 1.04157, 1.04194, 1.04013, 1.03878, 1.0404, 1.04016, 1.04037, 1.04038, 1.04244, 1.04161, 1.04372, 1.04403, 1.04386, 1.04374, 1.0434, 1.04272, 1.04304, 1.04272, 1.04286, 1.04301, 1.04315, 1.0435, 1.04264, 1.04279, 1.04262, 1.04241, 1.04314, 1.04249, 1.04203, 1.04234, 1.0425, 1.04352, 1.04252, 1.04342, 1.04376, 1.04364, 1.04336, 1.04291, 1.04336, 1.04378, 1.04453, 1.0437, 1.04886, 1.04916, 1.04881, 1.04926, 1.04849, 1.04888, 1.04908, 1.04992, 1.05094, 1.05199, 1.05212, 1.0513, 1.05054, 1.04888, 1.04875, 1.04571, 1.04591, 1.0463, 1.04633, 1.04686]}} 2025-02-06 12:39:32,397 INFO: 127.0.0.1 - - [06/Feb/2025 12:39:32] "POST /getSignal HTTP/1.1" 200 - 2025-02-06 12:39:32,805 DEBUG: VWAP & Fibonacci vs Price graph saved as vwap_fib_plot_EURUSD_20250206_123932.png

MQL5 Logs

2025.02.06 12:45:32.331 FIBVWAP (EURUSD,M5) Fib Level 0 (0%): 1.02099 2025.02.06 12:45:32.331 FIBVWAP (EURUSD,M5) Fib Level 1 (24%): 1.02862 2025.02.06 12:45:32.331 FIBVWAP (EURUSD,M5) Fib Level 2 (38%): 1.03334 2025.02.06 12:45:32.331 FIBVWAP (EURUSD,M5) Fib Level 3 (50%): 1.03715 2025.02.06 12:45:32.331 FIBVWAP (EURUSD,M5) Fib Level 4 (62%): 1.04096 2025.02.06 12:45:32.331 FIBVWAP (EURUSD,M5) Fib Level 5 (79%): 1.04639 2025.02.06 12:45:32.332 FIBVWAP (EURUSD,M5) Fib Level 6 (100%): 1.05331 2025.02.06 12:45:32.332 FIBVWAP (EURUSD,M5) Updated Indicators: SwingHigh=1.05331, SwingLow=1.02099, VWAP=1.03795 2025.02.06 12:45:32.332 FIBVWAP (EURUSD,M5) Payload sent to Python: {"symbol":"EURUSD","timeframe":"PERIOD_H1","swingHigh":1.05331,"swingLow":1.02099,"vwap":1.03795,"fibLevels":[0.000,0.236,0.382,0.500,0.618,0.786,1.000],"priceData":[1.03583,1.03594,1.03651,1.03799,1.03901,1.03865,1.03871,1.03920,1.03951,1.04025,1.03974,1.03986,1.04041,1.04017,1.04049,1.04072,1.04156,1.04197,1.04181,1.04223,1.04224,1.04079,1.04192,1.04147,1.04251,1.04039,1.04039,1.04026,1.03850,1.03778,1.03786,1.03796,1.03845,1.03734,1.03786,1.03714,1.03780,1.03786,1.03854,1.03817,1 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) HTTP Response: { 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) "explanation": "Signal: Sell based on VWAP and Fibonacci analysis.", 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) "received_data": { 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) "fibLevels": [ 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 0.0, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 0.236, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 0.382, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 0.5, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 0.618, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 0.786, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.0 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) ], 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) "priceData": [ 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03583, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03594, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03651, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03799, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03901, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03865, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03871, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.0392, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03951, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04025, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03974, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03986, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04041, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04017, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04049, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04072, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04156, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04197, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04181, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04223, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04224, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04079, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04192, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04147, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04251, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04039, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04039, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.04026, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.0385, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03778, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03786, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03796, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03845, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03734, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03786, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03714, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.0378, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03786, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03854, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03817, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03811, 2025.02.06 12:45:32.441 FIBVWAP (EURUSD,M5) 1.03767, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03784, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03801, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03593, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03404, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03254, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03223, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0335, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03386, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03344, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03115, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03067, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02932, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0306, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03147, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0322, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03221, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03178, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03281, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0342, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03441, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02955, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02846, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02785, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02795, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02761, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03162, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0251, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0264, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02577, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02522, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02438, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0231, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02436, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02249, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02431, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02404, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02265, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02216, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02235, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02377, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02314, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0247, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.02504, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03583, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03733, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03763, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03698, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.042, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03998, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03964, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03687, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03822, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03825, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03759, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03765, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03836, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03845, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0404, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03946, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03888, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03875, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0385, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03897, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03884, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03867, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03969, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03873, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03885, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04076, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0428, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0425, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0417, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04197, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04314, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0428, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04562, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04033, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03918, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04007, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04076, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04217, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04239, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04139, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0422, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04191, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04253, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0423, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.042, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04259, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04247, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04216, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04209, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04105, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04164, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.042, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04213, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04157, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04194, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04013, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.03878, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0404, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04016, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04037, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04038, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04244, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04161, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04372, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04403, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04386, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04374, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0434, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04272, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04304, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04272, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04286, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04301, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04315, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0435, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04264, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04279, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04262, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04241, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04314, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04249, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04203, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04234, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0425, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04352, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04252, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04342, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04376, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04364, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04336, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04291, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04336, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04378, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04453, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0437, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04886, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04916, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04881, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04926, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04849, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04888, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04908, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04992, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.05094, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.05199, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.05212, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0513, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.05054, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04888, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04875, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04571, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04591, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.0463, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04633, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) 1.04686 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) ], 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) "swingHigh": 1.05331, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) "swingLow": 1.02099, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) "symbol": "EURUSD", 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) "timeframe": "PERIOD_H1", 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) "vwap": 1.03795 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) }, 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) "signal": "Sell" 2025.02.06 12:45:32.442 FIBVWAP (EURUSD,M5) }

The VWAP-Fibonacci vs. Price graph was also plotted and saved in the same directory as the Python script. This plot helps visualize how price interacts with VWAP and Fibonacci levels.

Fig 3. Matplotlib Plot

In the diagram below, the MQL5 EA on the MetaTrader 5 chart logs and displays the response from the Python server. The chart shows two buy signals, indicated by arrows, which are also logged in the Experts tab. We can see that the market followed the direction of these signals, confirming their validity. I chose to view the M1 chart for a clearer analysis.

Fig 4. Test on Boom 300 Index

Conclusion

This system turns out to be highly useful for traders. Besides providing signals, it allows for a clear visualization of how price interacts with Fibonacci levels and VWAP during signal generation. The visualization is achieved in two ways: Python plots a graph using the Matplotlib library, while the MQL5 EA displays VWAP and Fibonacci lines directly on the chart for better analysis. This enhanced visual representation can assist traders in making informed decisions.

| Date | Tool Name | Description | Version | Updates | Notes |

|---|---|---|---|---|---|

| 01/10/24 | Chart Projector | Script to overlay the previous day's price action with ghost effect. | 1.0 | Initial Release | First tool in Lynnchris Tool Chest |

| 18/11/24 | Analytical Comment | It provides previous day's information in a tabular format, as well as anticipates the future direction of the market. | 1.0 | Initial Release | Second tool in the Lynnchris Tool Chest |

| 27/11/24 | Analytics Master | Regular Update of market metrics after every two hours | 1.01 | Second Release | Third tool in the Lynnchris Tool Chest |

| 02/12/24 | Analytics Forecaster | Regular Update of market metrics after every two hours with telegram integration | 1.1 | Third Edition | Tool number 4 |

| 09/12/24 | Volatility Navigator | The EA analyzes market conditions using the Bollinger Bands, RSI and ATR indicators | 1.0 | Initial Release | Tool Number 5 |

| 19/12/24 | Mean Reversion Signal Reaper | Analyzes market using mean reversion strategy and provides signal | 1.0 | Initial Release | Tool number 6 |

| 9/01/25 | Signal Pulse | Multiple timeframe analyzer | 1.0 | Initial Release | Tool number 7 |

| 17/01/25 | Metrics Board | Panel with button for analysis | 1.0 | Initial Release | Tool number 8 |

| 21/01/25 | External Flow | Analytics through external libraries | 1.0 | Initial Release | Tool number 9 |

| 27/01/25 | VWAP | Volume Weighted Average Price | 1.3 | Initial Release | Tool number 10 |

| 02/02/25 | Heikin Ashi | Trend Smoothening and reversal signal identification | 1.0 | Initial Release | Tool number 11 |

| 04/02/25 | FibVWAP | Signal generation through python analysis | 1.0 | Initial Release | Tool number 12 |

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Neural Networks in Trading: Lightweight Models for Time Series Forecasting

Neural Networks in Trading: Lightweight Models for Time Series Forecasting

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (I)

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (I)

Automating Trading Strategies in MQL5 (Part 6): Mastering Order Block Detection for Smart Money Trading

Automating Trading Strategies in MQL5 (Part 6): Mastering Order Block Detection for Smart Money Trading

Introduction to MQL5 (Part 12): A Beginner's Guide to Building Custom Indicators

Introduction to MQL5 (Part 12): A Beginner's Guide to Building Custom Indicators

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

1 update the scripts to use your address or local host 127.0.0.1

2 in tools options web request url add the address you are using

4 make sure all of the Python parts are installed

install matplotlib

pip install pandas

pip install Flask seaborn and Numpty if necessary

3 start the flask app on that address by running the python file with the address you are using

Thank You Chris for all your ideas and publications, definitely helpful stuff. For this article. to get it to work I need to make some setting appropriate to my environment after rechecking Price Action Analysis Toolkit Development (Part 9): External Flow - MQL5 Articles Which Maybe are helpful to others

1 update the scripts to use your address or local host 127.0.0.1

2 in tools options web request url add the address you are using

4 make sure all of the Python parts are installed

install matplotlib

pip install pandas

pip install Flask seaborn and Numpty if necessary

3 start the flask app on that address by running the python file with the address you are using