Learn how to design a trading system by CCI

In this new article from our series for learning how to design trading systems, I will present the Commodities Channel Index (CCI), explain its specifics, and share with you how to create a trading system based on this indicator.

Using WinInet in MQL5. Part 2: POST Requests and Files

In this article, we continue studying the principles of working with Internet using HTTP requests and exchange of information with server. It describes new functions of the CMqlNet class, methods of sending information from forms and sending of files using POST requests as well as authorization on websites under your login using Cookies.

Developing Advanced ICT Trading Systems: Implementing Order Blocks in an Indicator

In this article, we will learn how to create an indicator that detects, draws, and alerts on the mitigation of order blocks. We will also take a detailed look at how to identify these blocks on the chart, set accurate alerts, and visualize their position using rectangles to better understand the price action. This indicator will serve as a key tool for traders who follow the Smart Money Concepts and the Inner Circle Trader methodology.

Price Action Analysis Toolkit Development (Part 33): Candle Range Theory Tool

Upgrade your market reading with the Candle-Range Theory suite for MetaTrader 5, a fully MQL5-native solution that converts raw price bars into real-time volatility intelligence. The lightweight CRangePattern library benchmarks each candle’s true range against an adaptive ATR and classifies it the instant it closes; the CRT Indicator then projects those classifications on your chart as crisp, color-coded rectangles and arrows that reveal tightening consolidations, explosive breakouts, and full-range engulfment the moment they occur.

Using OpenCL to test candlestick patterns

The article describes the algorithm for implementing the OpenCL candlestick patterns tester in the "1 minute OHLC" mode. We will also compare its speed with the built-in strategy tester launched in the fast and slow optimization modes.

Learn how to design a trading system by Stochastic

In this article, we continue our learning series — this time we will learn how to design a trading system using one of the most popular and useful indicators, which is the Stochastic Oscillator indicator, to build a new block in our knowledge of basics.

OpenAI's ChatGPT features within the framework of MQL4 and MQL5 development

In this article, we will fiddle around ChatGPT from OpenAI in order to understand its capabilities in terms of reducing the time and labor intensity of developing Expert Advisors, indicators and scripts. I will quickly navigate you through this technology and try to show you how to use it correctly for programming in MQL4 and MQL5.

MQL5 Cookbook: Indicator Subwindow Controls - Buttons

In this article, we will consider an example of developing a user interface with button controls. To convey the idea of interactivity to the user, buttons will change their colors when the cursor hovers over them. With the cursor being over a button, the button color will be slightly darkened, getting significantly darker when the button is clicked. Furthermore, we will add tooltips to each button, thus creating an intuitive interface.

Introduction to MQL5 (Part 23): Automating Opening Range Breakout Strategy

This article explores how to build an Opening Range Breakout (ORB) Expert Advisor in MQL5. It explains how the EA identifies breakouts from the market’s initial range and opens trades accordingly. You’ll also learn how to control the number of positions opened and set a specific cutoff time to stop trading automatically.

Deep Neural Networks (Part VI). Ensemble of neural network classifiers: bagging

The article discusses the methods for building and training ensembles of neural networks with bagging structure. It also determines the peculiarities of hyperparameter optimization for individual neural network classifiers that make up the ensemble. The quality of the optimized neural network obtained in the previous article of the series is compared with the quality of the created ensemble of neural networks. Possibilities of further improving the quality of the ensemble's classification are considered.

Quick Manual Trading Toolkit: Working with open positions and pending orders

In this article, we will expand the capabilities of the toolkit: we will add the ability to close trade positions upon specific conditions and will create tables for controlling market and pending orders, with the ability to edit these orders.

Graphical Interfaces I: Animating the Graphical Interface (Chapter 3)

In the previous article, we started developing a form class for controls. In this article, we are going to continue doing that by filling this class with methods for moving a form over the chart area. We will then integrate this interface component into the core of the library. Also, we will ensure that the color of a form control changes when the mouse cursor is hovering over it.

How to use ONNX models in MQL5

ONNX (Open Neural Network Exchange) is an open format built to represent machine learning models. In this article, we will consider how to create a CNN-LSTM model to forecast financial timeseries. We will also show how to use the created ONNX model in an MQL5 Expert Advisor.

LifeHack for trader: "Quiet" optimization or Plotting trade distributions

Analysis of the trade history and plotting distribution charts of trading results in HTML depending on position entry time. The charts are displayed in three sections - by hours, by days of the week and by months.

Practical evaluation of the adaptive market following method

The main difference of the trading system proposed in the article is the use of mathematical tools for analyzing stock quotes. The system applies digital filtering and spectral estimation of discrete time series. The theoretical aspects of the strategy are described and a test Expert Advisor is created.

Custom Indicators (Part 1): A Step-by-Step Introductory Guide to Developing Simple Custom Indicators in MQL5

Learn how to create custom indicators using MQL5. This introductory article will guide you through the fundamentals of building simple custom indicators and demonstrate a hands-on approach to coding different custom indicators for any MQL5 programmer new to this interesting topic.

MQL5 Wizard: How to Teach an EA to Open Pending Orders at Any Price

The article describes a method of modifying the code of a trading signal module for the implementation of the functionality allowing you to set pending orders at any distance from the current price: it may be the Close or Open price of the previous bar or the value of the moving average. There are plenty of options. Important is that you can set any opening price for a pending order. This article will be useful to traders who trade with pending orders.

Cross-Platform Expert Advisor: Order Manager

This article discusses the creation of an order manager for a cross-platform expert advisor. The order manager is responsible for the entry and exit of orders or positions entered by the expert, as well as for keeping an independent record of such trades that is usable for both versions.

Indicator for Kagi Charting

The article proposes Kagi chart indicator with various charting options and additional functions. Also, indicator charting principle and its MQL5 implementation features are considered. The most popular cases of its implementation in trading are displayed - Yin/Yang exchange strategy, pushing away from the trend line and consistently increasing "shoulders"/decreasing "waists".

Applying network functions, or MySQL without DLL: Part II - Program for monitoring changes in signal properties

In the previous part, we considered the implementation of the MySQL connector. In this article, we will consider its application by implementing the service for collecting signal properties and the program for viewing their changes over time. The implemented example has practical sense if users need to observe changes in properties that are not displayed on the signal's web page.

Practical application of neural networks in trading. It's time to practice

The article provides a description and instructions for the practical use of neural network modules on the Matlab platform. It also covers the main aspects of creation of a trading system using the neural network module. In order to be able to introduce the complex within one article, I had to modify it so as to combine several neural network module functions in one program.

Studying candlestick analysis techniques (part IV): Updates and additions to Pattern Analyzer

The article presents a new version of the Pattern Analyzer application. This version provides bug fixes and new features, as well as the revised user interface. Comments and suggestions from previous article were taken into account when developing the new version. The resulting application is described in this article.

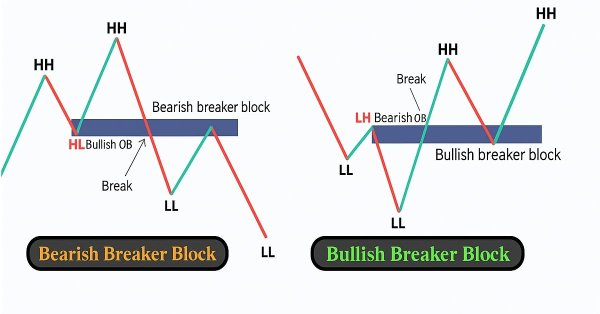

Automating Trading Strategies in MQL5 (Part 35): Creating a Breaker Block Trading System

In this article, we create a Breaker Block Trading System in MQL5 that identifies consolidation ranges, detects breakouts, and validates breaker blocks with swing points to trade retests with defined risk parameters. The system visualizes order and breaker blocks with dynamic labels and arrows, supporting automated trading and trailing stops.

An Example of a Trading Strategy Based on Timezone Differences on Different Continents

Surfing the Internet, it is easy to find many strategies, which will give you a number of various recommendations. Let’s take an insider’s approach and look into the process of strategy creation, based on the differences in timezones on different continents.

Automating Trading Strategies in MQL5 (Part 46): Liquidity Sweep on Break of Structure (BoS)

In this article, we build a Liquidity Sweep on Break of Structure (BoS) system in MQL5 that detects swing highs/lows over a user-defined length, labels them as HH/HL/LH/LL to identify BOS (HH in uptrend or LL in downtrend), and spots liquidity sweeps when price wicks beyond the swing but closes back inside on a bullish/bearish candle.

Cross-Platform Expert Advisor: Orders

MetaTrader 4 and MetaTrader 5 uses different conventions in processing trade requests. This article discusses the possibility of using a class object that can be used to represent the trades processed by the server, in order for a cross-platform expert advisor to further work on them, regardless of the version of the trading platform and mode being used.

A Universal Channel with the Graphical Interface

All channel indicators are displayed as three lines, including central, top and bottom lines. The drawing principle of the central line is similar to a moving average, while the moving average indicator is mostly used for drawing channels. The top and bottom lines are located at equal distances from the central line. This distance can be determined in points, as percent of price (the Envelopes indicator), using a standard deviation value (Bollinger Bands), or an ATR value (Keltner channel).

MQL5 Cookbook: Implementing an Associative Array or a Dictionary for Quick Data Access

This article describes a special algorithm allowing to gain access to elements by their unique keys. Any base data type can be used as a key. For example it may be represented as a string or an integer variable. Such data container is commonly referred to as a dictionary or an associative array. It provides easier and more efficient way of problem solving.

Library for easy and quick development of MetaTrader programs (part XXIII): Base trading class - verification of valid parameters

In the article, we continue the development of the trading class by implementing the control over incorrect trading order parameter values and voicing trading events.

Library for easy and quick development of MetaTrader programs (part XIX): Class of library messages

In this article, we will consider the class of displaying text messages. Currently, we have a sufficient number of different text messages. It is time to re-arrange the methods of their storage, display and translation of Russian or English messages to other languages. Besides, it would be good to introduce convenient ways of adding new languages to the library and quickly switching between them.

Adaptive Trading Systems and Their Use in the MetaTrader 5 Client Terminal

This article suggests a variant of an adaptive system that consists of many strategies, each of which performs its own "virtual" trade operations. Real trading is performed in accordance with the signals of a most profitable strategy at the moment. Thanks to using of the object-oriented approach, classes for working with data and trade classes of the Standard library, the architecture of the system appeared to be simple and scalable; now you can easily create and analyze the adaptive systems that include hundreds of trade strategies.

Library for easy and quick development of MetaTrader programs (part IV): Trading events

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. We already have collections of historical orders and deals, market orders and positions, as well as the class for convenient selection and sorting of orders. In this part, we will continue the development of the base object and teach the Engine Library to track trading events on the account.

Time Series Forecasting Using Exponential Smoothing (continued)

This article seeks to upgrade the indicator created earlier on and briefly deals with a method for estimating forecast confidence intervals using bootstrapping and quantiles. As a result, we will get the forecast indicator and scripts to be used for estimation of the forecast accuracy.

The Simple Example of Creating an Indicator Using Fuzzy Logic

The article is devoted to the practical application of the fuzzy logic concept for financial markets analysis. We propose the example of the indicator generating signals based on two fuzzy rules based on Envelopes indicator. The developed indicator uses several indicator buffers: 7 buffers for calculations, 5 buffers for the charts display and 2 color buffers.

Applying OLAP in trading (part 1): Online analysis of multidimensional data

The article describes how to create a framework for the online analysis of multidimensional data (OLAP), as well as how to implement this in MQL and to apply such analysis in the MetaTrader environment using the example of trading account history processing.

Visualizing optimization results using a selected criterion

In the article, we continue to develop the MQL application for working with optimization results. This time, we will show how to form the table of the best results after optimizing the parameters by specifying another criterion via the graphical interface.

Reversing: Reducing maximum drawdown and testing other markets

In this article, we continue to dwell on reversing techniques. We will try to reduce the maximum balance drawdown till an acceptable level for the instruments considered earlier. We will see if the measures will reduce the profit. We will also check how the reversing method performs on other markets, including stock, commodity, index, ETF and agricultural markets. Attention, the article contains a lot of images!

Timeseries in DoEasy library (part 40): Library-based indicators - updating data in real time

The article considers the development of a simple multi-period indicator based on the DoEasy library. Let's improve the timeseries classes to receive data from any timeframes to display it on the current chart period.

Creating a new trading strategy using a technology of resolving entries into indicators

The article suggests a technology helping everyone to create custom trading strategies by assembling an individual indicator set, as well as to develop custom market entry signals.

Applying the probability theory to trading gaps

In this article, we will apply the probability theory and mathematical statistics methods to creating and testing trading strategies. We will also look for optimal trading risk using the differences between the price and the random walk. It is proved that if prices behave like a zero-drift random walk (with no directional trend), then profitable trading is impossible.