Neural Networks Made Easy (Part 94): Optimizing the Input Sequence

When working with time series, we always use the source data in their historical sequence. But is this the best option? There is an opinion that changing the sequence of the input data will improve the efficiency of the trained models. In this article I invite you to get acquainted with one of the methods for optimizing the input sequence.

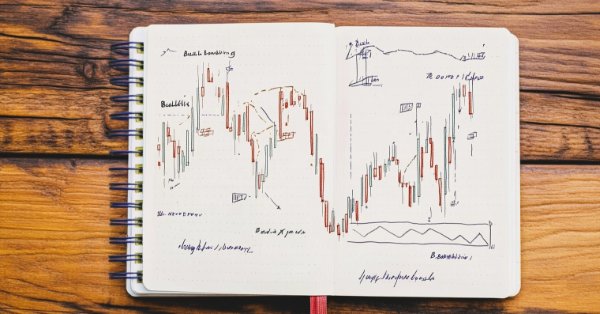

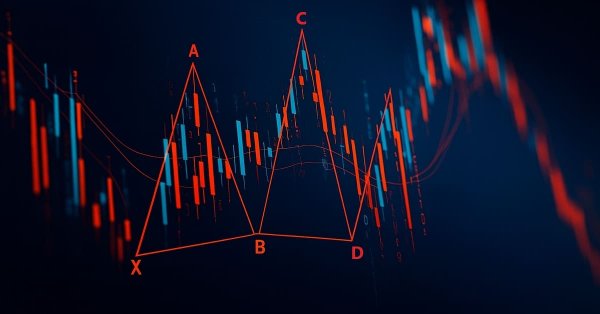

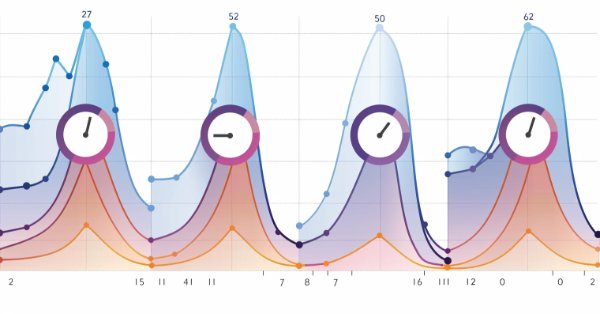

Introduction to MQL5 (Part 20): Introduction to Harmonic Patterns

In this article, we explore the fundamentals of harmonic patterns, their structures, and how they are applied in trading. You’ll learn about Fibonacci retracements, extensions, and how to implement harmonic pattern detection in MQL5, setting the foundation for building advanced trading tools and Expert Advisors.

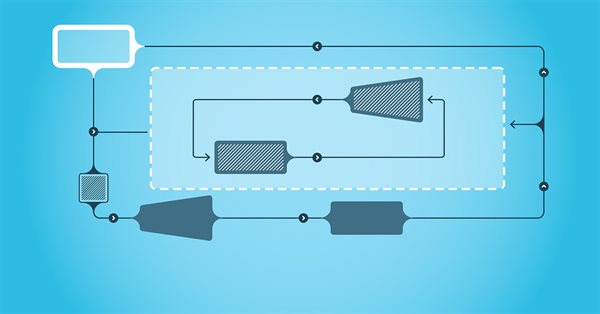

Developing a multi-currency Expert Advisor (Part 2): Transition to virtual positions of trading strategies

Let's continue developing a multi-currency EA with several strategies working in parallel. Let's try to move all the work associated with opening market positions from the strategy level to the level of the EA managing the strategies. The strategies themselves will trade only virtually, without opening market positions.

Larry Williams Market Secrets (Part 6): Measuring Volatility Breakouts Using Market Swings

This article demonstrates how to design and implement a Larry Williams volatility breakout Expert Advisor in MQL5, covering swing-range measurement, entry-level projection, risk-based position sizing, and backtesting on real market data.

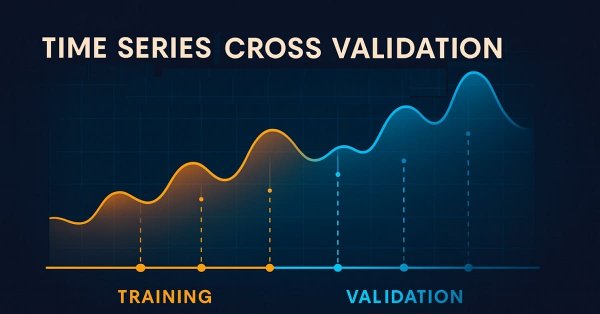

Overcoming The Limitation of Machine Learning (Part 5): A Quick Recap of Time Series Cross Validation

In this series of articles, we look at the challenges faced by algorithmic traders when deploying machine-learning-powered trading strategies. Some challenges within our community remain unseen because they demand deeper technical understanding. Today’s discussion acts as a springboard toward examining the blind spots of cross-validation in machine learning. Although often treated as routine, this step can easily produce misleading or suboptimal results if handled carelessly. This article briefly revisits the essentials of time series cross-validation to prepare us for more in-depth insight into its hidden blind spots.

Building a Smart Trade Manager in MQL5: Automate Break-Even, Trailing Stop, and Partial Close

Learn how to build a Smart Trade Manager Expert Advisor in MQL5 that automates trade management with break-even, trailing stop, and partial close features. A practical, step-by-step guide for traders who want to save time and improve consistency through automation.

Neural networks made easy (Part 35): Intrinsic Curiosity Module

We continue to study reinforcement learning algorithms. All the algorithms we have considered so far required the creation of a reward policy to enable the agent to evaluate each of its actions at each transition from one system state to another. However, this approach is rather artificial. In practice, there is some time lag between an action and a reward. In this article, we will get acquainted with a model training algorithm which can work with various time delays from the action to the reward.

Deconstructing examples of trading strategies in the client terminal

The article uses block diagrams to examine the logic of the candlestick-based training EAs located in the Experts\Free Robots folder of the terminal.

MQL5 Trading Tools (Part 2): Enhancing the Interactive Trade Assistant with Dynamic Visual Feedback

In this article, we upgrade our Trade Assistant Tool by adding drag-and-drop panel functionality and hover effects to make the interface more intuitive and responsive. We refine the tool to validate real-time order setups, ensuring accurate trade configurations relative to market prices. We also backtest these enhancements to confirm their reliability.

News Trading Made Easy (Part 3): Performing Trades

In this article, our news trading expert will begin opening trades based on the economic calendar stored in our database. In addition, we will improve the expert's graphics to display more relevant information about upcoming economic calendar events.

Neural Networks Made Easy (Part 87): Time Series Patching

Forecasting plays an important role in time series analysis. In the new article, we will talk about the benefits of time series patching.

Neural networks made easy (Part 44): Learning skills with dynamics in mind

In the previous article, we introduced the DIAYN method, which offers the algorithm for learning a variety of skills. The acquired skills can be used for various tasks. But such skills can be quite unpredictable, which can make them difficult to use. In this article, we will look at an algorithm for learning predictable skills.

Using PSAR, Heiken Ashi, and Deep Learning Together for Trading

This project explores the fusion of deep learning and technical analysis to test trading strategies in forex. A Python script is used for rapid experimentation, employing an ONNX model alongside traditional indicators like PSAR, SMA, and RSI to predict EUR/USD movements. A MetaTrader 5 script then brings this strategy into a live environment, using historical data and technical analysis to make informed trading decisions. The backtesting results indicate a cautious yet consistent approach, with a focus on risk management and steady growth rather than aggressive profit-seeking.

Creating a market making algorithm in MQL5

How do market makers work? Let's consider this issue and create a primitive market-making algorithm.

Neural networks made easy (Part 38): Self-Supervised Exploration via Disagreement

One of the key problems within reinforcement learning is environmental exploration. Previously, we have already seen the research method based on Intrinsic Curiosity. Today I propose to look at another algorithm: Exploration via Disagreement.

Neural networks made easy (Part 50): Soft Actor-Critic (model optimization)

In the previous article, we implemented the Soft Actor-Critic algorithm, but were unable to train a profitable model. Here we will optimize the previously created model to obtain the desired results.

Neural Networks in Trading: Hierarchical Vector Transformer (HiVT)

We invite you to get acquainted with the Hierarchical Vector Transformer (HiVT) method, which was developed for fast and accurate forecasting of multimodal time series.

Neural networks made easy (Part 43): Mastering skills without the reward function

The problem of reinforcement learning lies in the need to define a reward function. It can be complex or difficult to formalize. To address this problem, activity-based and environment-based approaches are being explored to learn skills without an explicit reward function.

Neural networks made easy (Part 48): Methods for reducing overestimation of Q-function values

In the previous article, we introduced the DDPG method, which allows training models in a continuous action space. However, like other Q-learning methods, DDPG is prone to overestimating Q-function values. This problem often results in training an agent with a suboptimal strategy. In this article, we will look at some approaches to overcome the mentioned issue.

Price Action Analysis Toolkit Development (Part 15): Introducing Quarters Theory (I) — Quarters Drawer Script

Points of support and resistance are critical levels that signal potential trend reversals and continuations. Although identifying these levels can be challenging, once you pinpoint them, you’re well-prepared to navigate the market. For further assistance, check out the Quarters Drawer tool featured in this article, it will help you identify both primary and minor support and resistance levels.

News Trading Made Easy (Part 6): Performing Trades (III)

In this article news filtration for individual news events based on their IDs will be implemented. In addition, previous SQL queries will be improved to provide additional information or reduce the query's runtime. Furthermore, the code built in the previous articles will be made functional.

Timeseries in DoEasy library (part 57): Indicator buffer data object

In the article, develop an object which will contain all data of one buffer for one indicator. Such objects will be necessary for storing serial data of indicator buffers. With their help, it will be possible to sort and compare buffer data of any indicators, as well as other similar data with each other.

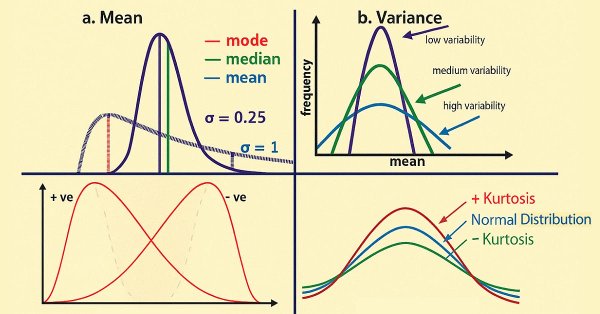

Automating Trading Strategies in MQL5 (Part 39): Statistical Mean Reversion with Confidence Intervals and Dashboard

In this article, we develop an MQL5 Expert Advisor for statistical mean reversion trading, calculating moments like mean, variance, skewness, kurtosis, and Jarque-Bera statistics over a specified period to identify non-normal distributions and generate buy/sell signals based on confidence intervals with adaptive thresholds

MQL5 Trading Toolkit (Part 8): How to Implement and Use the History Manager EX5 Library in Your Codebase

Discover how to effortlessly import and utilize the History Manager EX5 library in your MQL5 source code to process trade histories in your MetaTrader 5 account in this series' final article. With simple one-line function calls in MQL5, you can efficiently manage and analyze your trading data. Additionally, you will learn how to create different trade history analytics scripts and develop a price-based Expert Advisor as practical use-case examples. The example EA leverages price data and the History Manager EX5 library to make informed trading decisions, adjust trade volumes, and implement recovery strategies based on previously closed trades.

Mastering File Operations in MQL5: From Basic I/O to Building a Custom CSV Reader

This article focuses on essential MQL5 file-handling techniques, spanning trade logs, CSV processing, and external data integration. It offers both conceptual understanding and hands-on coding guidance. Readers will learn to build a custom CSV importer class step-by-step, gaining practical skills for real-world applications.

Neural Networks in Trading: Hyperbolic Latent Diffusion Model (Final Part)

The use of anisotropic diffusion processes for encoding the initial data in a hyperbolic latent space, as proposed in the HypDIff framework, assists in preserving the topological features of the current market situation and improves the quality of its analysis. In the previous article, we started implementing the proposed approaches using MQL5. Today we will continue the work we started and will bring it to its logical conclusion.

Reimagining Classic Strategies (Part II): Bollinger Bands Breakouts

This article explores a trading strategy that integrates Linear Discriminant Analysis (LDA) with Bollinger Bands, leveraging categorical zone predictions for strategic market entry signals.

Neural networks made easy (Part 47): Continuous action space

In this article, we expand the range of tasks of our agent. The training process will include some aspects of money and risk management, which are an integral part of any trading strategy.

Neural Networks in Trading: Enhancing Transformer Efficiency by Reducing Sharpness (Final Part)

SAMformer offers a solution to the key drawbacks of Transformer models in long-term time series forecasting, such as training complexity and poor generalization on small datasets. Its shallow architecture and sharpness-aware optimization help avoid suboptimal local minima. In this article, we will continue to implement approaches using MQL5 and evaluate their practical value.

From Novice to Expert: Collaborative Debugging in MQL5

Problem-solving can establish a concise routine for mastering complex skills, such as programming in MQL5. This approach allows you to concentrate on solving problems while simultaneously developing your skills. The more problems you tackle, the more advanced expertise is transferred to your brain. Personally, I believe that debugging is the most effective way to master programming. Today, we will walk through the code-cleaning process and discuss the best techniques for transforming a messy program into a clean, functional one. Read through this article and uncover valuable insights.

MQL5 Wizard Techniques you should know (Part 17): Multicurrency Trading

Trading across multiple currencies is not available by default when an expert advisor is assembled via the wizard. We examine 2 possible hacks traders can make when looking to test their ideas off more than one symbol at a time.

Automating Black-Scholes Greeks: Advanced Scalping and Microstructure Trading

Gamma and Delta were originally developed as risk-management tools for hedging options exposure, but over time they evolved into powerful instruments for advanced scalping, order-flow modeling, and microstructure trading. Today, they serve as real-time indicators of price sensitivity and liquidity behavior, enabling traders to anticipate short-term volatility with remarkable precision.

Neural Networks in Trading: Using Language Models for Time Series Forecasting

We continue to study time series forecasting models. In this article, we get acquainted with a complex algorithm built on the use of a pre-trained language model.

Introduction to MQL5 (Part 21): Automating Harmonic Pattern Detection

Learn how to detect and display the Gartley harmonic pattern in MetaTrader 5 using MQL5. This article explains each step of the process, from identifying swing points to applying Fibonacci ratios and plotting the full pattern on the chart for clear visual confirmation.

Neural Networks in Trading: An Agent with Layered Memory (Final Part)

We continue our work on creating the FinMem framework, which uses layered memory approaches that mimic human cognitive processes. This allows the model not only to effectively process complex financial data but also to adapt to new signals, significantly improving the accuracy and effectiveness of investment decisions in dynamically changing markets.

Seasonality Filtering and time period for Deep Learning ONNX models with python for EA

Can we benefit from seasonality when creating models for Deep Learning with Python? Does filtering data for the ONNX models help to get better results? What time period should we use? We will cover all of this over this article.

Automating Trading Strategies in MQL5 (Part 32): Creating a Price Action 5 Drives Harmonic Pattern System

In this article, we develop a 5 Drives pattern system in MQL5 that identifies bullish and bearish 5 Drives harmonic patterns using pivot points and Fibonacci ratios, executing trades with customizable entry, stop loss, and take-profit levels based on user-selected options. We enhance trader insight with visual feedback through chart objects like triangles, trendlines, and labels to clearly display the A-B-C-D-E-F pattern structure.

Developing a multi-currency Expert Advisor (Part 4): Pending virtual orders and saving status

Having started developing a multi-currency EA, we have already achieved some results and managed to carry out several code improvement iterations. However, our EA was unable to work with pending orders and resume operation after the terminal restart. Let's add these features.

From Novice to Expert: Automating Trade Discipline with an MQL5 Risk Enforcement EA

For many traders, the gap between knowing a risk rule and following it consistently is where accounts go to die. Emotional overrides, revenge trading, and simple oversight can dismantle even the best strategy. Today, we will transform the MetaTrader 5 platform into an unwavering enforcer of your trading rules by developing a Risk Enforcement Expert Advisor. Join this discussion to find out more.

Practicing the development of trading strategies

In this article, we will make an attempt to develop our own trading strategy. Any trading strategy must be based on some kind of statistical advantage. Moreover, this advantage should exist for a long time.