Adaptive Smart Money Architecture (ASMA): Merging SMC Logic With Market Sentiment for Dynamic Strategy Switching

This topic explores how to build an Adaptive Smart Money Architecture (ASMA)—an intelligent Expert Advisor that merges Smart Money Concepts (Order Blocks, Break of Structure, Fair Value Gaps) with real-time market sentiment to automatically choose the best trading strategy depending on current market conditions.

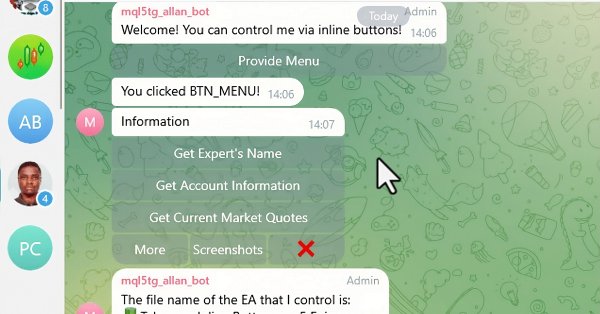

Creating an MQL5-Telegram Integrated Expert Advisor (Part 6): Adding Responsive Inline Buttons

In this article, we integrate interactive inline buttons into an MQL5 Expert Advisor, allowing real-time control via Telegram. Each button press triggers specific actions and sends responses back to the user. We also modularize functions for handling Telegram messages and callback queries efficiently.

Creating a Trading Administrator Panel in MQL5 (Part III): Enhancing the GUI with Visual Styling (I)

In this article, we will focus on visually styling the graphical user interface (GUI) of our Trading Administrator Panel using MQL5. We’ll explore various techniques and features available in MQL5 that allow for customization and optimization of the interface, ensuring it meets the needs of traders while maintaining an attractive aesthetic.

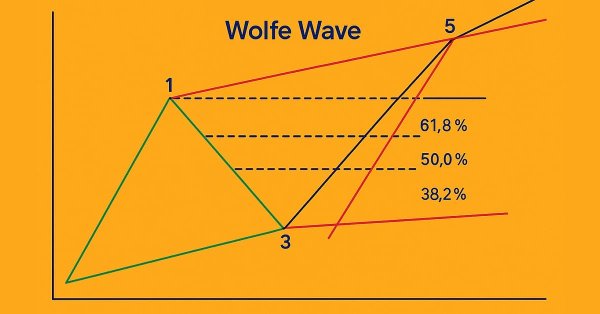

Introduction to MQL5 (Part 18): Introduction to Wolfe Wave Pattern

This article explains the Wolfe Wave pattern in detail, covering both the bearish and bullish variations. It also breaks down the step-by-step logic used to identify valid buy and sell setups based on this advanced chart pattern.

Dynamic Swing Architecture: Market Structure Recognition from Swings to Automated Execution

This article introduces a fully automated MQL5 system designed to identify and trade market swings with precision. Unlike traditional fixed-bar swing indicators, this system adapts dynamically to evolving price structure—detecting swing highs and swing lows in real time to capture directional opportunities as they form.

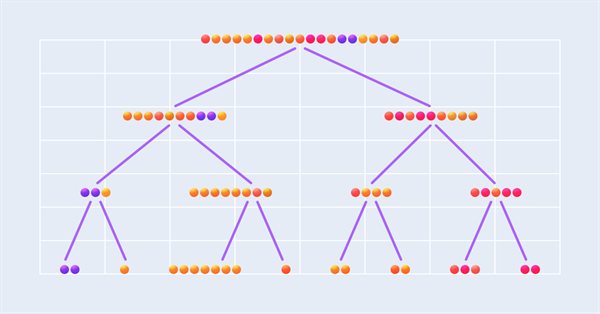

Neural networks made easy (Part 58): Decision Transformer (DT)

We continue to explore reinforcement learning methods. In this article, I will focus on a slightly different algorithm that considers the Agent’s policy in the paradigm of constructing a sequence of actions.

Neural networks made easy (Part 23): Building a tool for Transfer Learning

In this series of articles, we have already mentioned Transfer Learning more than once. However, this was only mentioning. in this article, I suggest filling this gap and taking a closer look at Transfer Learning.

Neural networks made easy (Part 73): AutoBots for predicting price movements

We continue to discuss algorithms for training trajectory prediction models. In this article, we will get acquainted with a method called "AutoBots".

MQL5 Trading Toolkit (Part 3): Developing a Pending Orders Management EX5 Library

Learn how to develop and implement a comprehensive pending orders EX5 library in your MQL5 code or projects. This article will show you how to create an extensive pending orders management EX5 library and guide you through importing and implementing it by building a trading panel or graphical user interface (GUI). The expert advisor orders panel will allow users to open, monitor, and delete pending orders associated with a specified magic number directly from the graphical interface on the chart window.

Introduction to MQL5 (Part 13): A Beginner's Guide to Building Custom Indicators (II)

This article guides you through building a custom Heikin Ashi indicator from scratch and demonstrates how to integrate custom indicators into an EA. It covers indicator calculations, trade execution logic, and risk management techniques to enhance automated trading strategies.

Wrapping ONNX models in classes

Object-oriented programming enables creation of a more compact code that is easy to read and modify. Here we will have a look at the example for three ONNX models.

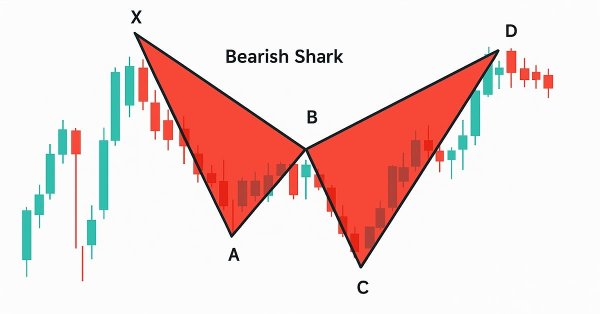

Automating Trading Strategies in MQL5 (Part 33): Creating a Price Action Shark Harmonic Pattern System

In this article, we develop a Shark pattern system in MQL5 that identifies bullish and bearish Shark harmonic patterns using pivot points and Fibonacci ratios, executing trades with customizable entry, stop-loss, and take-profit levels based on user-selected options. We enhance trader insight with visual feedback through chart objects like triangles, trendlines, and labels to clearly display the X-A-B-C-D pattern structure

Build Self Optimizing Expert Advisors With MQL5 And Python (Part II): Tuning Deep Neural Networks

Machine learning models come with various adjustable parameters. In this series of articles, we will explore how to customize your AI models to fit your specific market using the SciPy library.

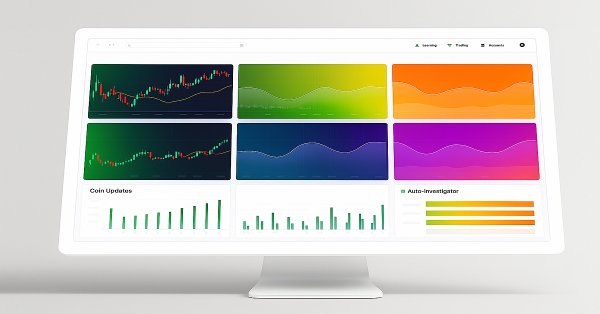

MQL5 Trading Tools (Part 10): Building a Strategy Tracker System with Visual Levels and Success Metrics

In this article, we develop an MQL5 strategy tracker system that detects moving average crossover signals filtered by a long-term MA, simulates or executes trades with configurable TP levels and SL in points, and monitors outcomes like TP/SL hits for performance analysis.

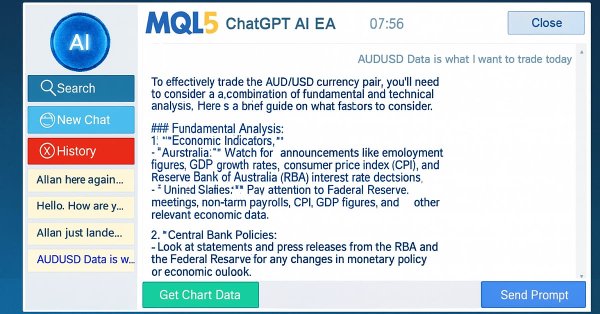

Building AI-Powered Trading Systems in MQL5 (Part 6): Introducing Chat Deletion and Search Functionality

In Part 6 of our MQL5 AI trading system series, we advance the ChatGPT-integrated Expert Advisor by introducing chat deletion functionality through interactive delete buttons in the sidebar, small/large history popups, and a new search popup, allowing traders to manage and organize persistent conversations efficiently while maintaining encrypted storage and AI-driven signals from chart data.

Example of Auto Optimized Take Profits and Indicator Parameters with SMA and EMA

This article presents a sophisticated Expert Advisor for forex trading, combining machine learning with technical analysis. It focuses on trading Apple stock, featuring adaptive optimization, risk management, and multiple strategies. Backtesting shows promising results with high profitability but also significant drawdowns, indicating potential for further refinement.

Neural networks made easy (Part 20): Autoencoders

We continue to study unsupervised learning algorithms. Some readers might have questions regarding the relevance of recent publications to the topic of neural networks. In this new article, we get back to studying neural networks.

Mastering Kagi Charts in MQL5 (Part 2): Implementing Automated Kagi-Based Trading

Learn how to build a complete Kagi-based trading Expert Advisor in MQL5, from signal construction to order execution, visual markers, and a three-stage trailing stop. Includes full code, testing results, and a downloadable set file.

Neural networks made easy (Part 53): Reward decomposition

We have already talked more than once about the importance of correctly selecting the reward function, which we use to stimulate the desired behavior of the Agent by adding rewards or penalties for individual actions. But the question remains open about the decryption of our signals by the Agent. In this article, we will talk about reward decomposition in terms of transmitting individual signals to the trained Agent.

Price Action Analysis Toolkit Development (Part 5): Volatility Navigator EA

Determining market direction can be straightforward, but knowing when to enter can be challenging. As part of the series titled "Price Action Analysis Toolkit Development", I am excited to introduce another tool that provides entry points, take profit levels, and stop loss placements. To achieve this, we have utilized the MQL5 programming language. Let’s delve into each step in this article.

Graphical Interfaces X: Updates for the Rendered table and code optimization (build 10)

We continue to complement the Rendered table (CCanvasTable) with new features. The table will now have: highlighting of the rows when hovered; ability to add an array of icons for each cell and a method for switching them; ability to set or modify the cell text during the runtime, and more.

Price Action Analysis Toolkit Development Part (4): Analytics Forecaster EA

We are moving beyond simply viewing analyzed metrics on charts to a broader perspective that includes Telegram integration. This enhancement allows important results to be delivered directly to your mobile device via the Telegram app. Join us as we explore this journey together in this article.

Neural Networks Made Easy (Part 88): Time-Series Dense Encoder (TiDE)

In an attempt to obtain the most accurate forecasts, researchers often complicate forecasting models. Which in turn leads to increased model training and maintenance costs. Is such an increase always justified? This article introduces an algorithm that uses the simplicity and speed of linear models and demonstrates results on par with the best models with a more complex architecture.

Quantitative analysis in MQL5: Implementing a promising algorithm

We will analyze the question of what quantitative analysis is and how it is used by major players. We will create one of the quantitative analysis algorithms in the MQL5 language.

Integrating ML models with the Strategy Tester (Conclusion): Implementing a regression model for price prediction

This article describes the implementation of a regression model based on a decision tree. The model should predict prices of financial assets. We have already prepared the data, trained and evaluated the model, as well as adjusted and optimized it. However, it is important to note that this model is intended for study purposes only and should not be used in real trading.

Neural Networks in Trading: An Ensemble of Agents with Attention Mechanisms (Final Part)

In the previous article, we introduced the multi-agent adaptive framework MASAAT, which uses an ensemble of agents to perform cross-analysis of multimodal time series at different data scales. Today we will continue implementing the approaches of this framework in MQL5 and bring this work to a logical conclusion.

Neural networks made easy (Part 66): Exploration problems in offline learning

Models are trained offline using data from a prepared training dataset. While providing certain advantages, its negative side is that information about the environment is greatly compressed to the size of the training dataset. Which, in turn, limits the possibilities of exploration. In this article, we will consider a method that enables the filling of a training dataset with the most diverse data possible.

Neural Networks in Trading: Optimizing the Transformer for Time Series Forecasting (LSEAttention)

The LSEAttention framework offers improvements to the Transformer architecture. It was designed specifically for long-term multivariate time series forecasting. The approaches proposed by the authors of the method can be applied to solve problems of entropy collapse and learning instability, which are often encountered with vanilla Transformer.

Raw Code Optimization and Tweaking for Improving Back-Test Results

Enhance your MQL5 code by optimizing logic, refining calculations, and reducing execution time to improve back-test accuracy. Fine-tune parameters, optimize loops, and eliminate inefficiencies for better performance.

Developing Trading Strategies with the Parafrac and Parafrac V2 Oscillators: Single Entry Performance Insights

This article introduces the ParaFrac Oscillator and its V2 model as trading tools. It outlines three trading strategies developed using these indicators. Each strategy was tested and optimized to identify their strengths and weaknesses. Comparative analysis highlighted the performance differences between the original and V2 models.

Introduction to MQL5 (Part 11): A Beginner's Guide to Working with Built-in Indicators in MQL5 (II)

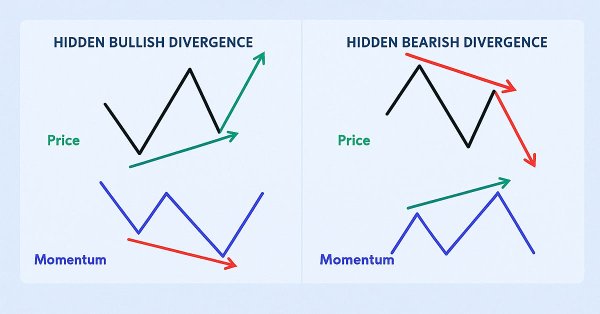

Discover how to develop an Expert Advisor (EA) in MQL5 using multiple indicators like RSI, MA, and Stochastic Oscillator to detect hidden bullish and bearish divergences. Learn to implement effective risk management and automate trades with detailed examples and fully commented source code for educational purposes!

Neural Networks in Trading: Scene-Aware Object Detection (HyperDet3D)

We invite you to get acquainted with a new approach to detecting objects using hypernetworks. A hypernetwork generates weights for the main model, which allows taking into account the specifics of the current market situation. This approach allows us to improve forecasting accuracy by adapting the model to different trading conditions.

MQL5 Trading Tools (Part 8): Enhanced Informational Dashboard with Draggable and Minimizable Features

In this article, we develop an enhanced informational dashboard that upgrades the previous part by adding draggable and minimizable features for improved user interaction, while maintaining real-time monitoring of multi-symbol positions and account metrics.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 4): Modularizing Code Functions for Enhanced Reusability

In this article, we refactor the existing code used for sending messages and screenshots from MQL5 to Telegram by organizing it into reusable, modular functions. This will streamline the process, allowing for more efficient execution and easier code management across multiple instances.

Automating Trading Strategies in MQL5 (Part 38): Hidden RSI Divergence Trading with Slope Angle Filters

In this article, we build an MQL5 EA that detects hidden RSI divergences via swing points with strength, bar ranges, tolerance, and slope angle filters for price and RSI lines. It executes buy/sell trades on validated signals with fixed lots, SL/TP in pips, and optional trailing stops for risk control.

Experiments with neural networks (Part 4): Templates

In this article, I will use experimentation and non-standard approaches to develop a profitable trading system and check whether neural networks can be of any help for traders. MetaTrader 5 as a self-sufficient tool for using neural networks in trading. Simple explanation.

From Novice to Expert: Animated News Headline Using MQL5 (II)

Today, we take another step forward by integrating an external news API as the source of headlines for our News Headline EA. In this phase, we’ll explore various news sources—both established and emerging—and learn how to access their APIs effectively. We'll also cover methods for parsing the retrieved data into a format optimized for display within our Expert Advisor. Join the discussion as we explore the benefits of accessing news headlines and the economic calendar directly on the chart, all within a compact, non-intrusive interface.

Price Action Analysis Toolkit Development (Part 2): Analytical Comment Script

Aligned with our vision of simplifying price action, we are pleased to introduce another tool that can significantly enhance your market analysis and help you make well-informed decisions. This tool displays key technical indicators such as previous day's prices, significant support and resistance levels, and trading volume, while automatically generating visual cues on the chart.

Self Optimizing Expert Advisors in MQL5 (Part 15): Linear System Identification

Trading strategies may be challenging to improve because we often don’t fully understand what the strategy is doing wrong. In this discussion, we introduce linear system identification, a branch of control theory. Linear feedback systems can learn from data to identify a system’s errors and guide its behavior toward intended outcomes. While these methods may not provide fully interpretable explanations, they are far more valuable than having no control system at all. Let’s explore linear system identification and observe how it may help us as algorithmic traders to maintain control over our trading applications.

Neural Networks in Trading: A Multimodal, Tool-Augmented Agent for Financial Markets (Final Part)

We continue to develop the algorithms for FinAgent, a multimodal financial trading agent designed to analyze multimodal market dynamics data and historical trading patterns.