Neural Networks in Trading: Reducing Memory Consumption with Adam-mini Optimization

One of the directions for increasing the efficiency of the model training and convergence process is the improvement of optimization methods. Adam-mini is an adaptive optimization method designed to improve on the basic Adam algorithm.

Neural Networks in Trading: Hierarchical Dual-Tower Transformer (Final Part)

We continue to build the Hidformer hierarchical dual-tower transformer model designed for analyzing and forecasting complex multivariate time series. In this article, we will bring the work we started earlier to its logical conclusion — we will test the model on real historical data.

Category Theory in MQL5 (Part 11): Graphs

This article is a continuation in a series that look at Category Theory implementation in MQL5. In here we examine how Graph-Theory could be integrated with monoids and other data structures when developing a close-out strategy to a trading system.

Neural Networks in Trading: Memory Augmented Context-Aware Learning for Cryptocurrency Markets (Final Part)

The MacroHFT framework for high-frequency cryptocurrency trading uses context-aware reinforcement learning and memory to adapt to dynamic market conditions. At the end of this article, we will test the implemented approaches on real historical data to assess their effectiveness.

Larry Williams Market Secrets (Part 9): Patterns to Profit

An empirical study of Larry Williams' short-term trading patterns, showing how classic setups can be automated in MQL5, tested on real market data, and evaluated for consistency, profitability, and practical trading value.

Neural networks made easy (Part 63): Unsupervised Pretraining for Decision Transformer (PDT)

We continue to discuss the family of Decision Transformer methods. From previous article, we have already noticed that training the transformer underlying the architecture of these methods is a rather complex task and requires a large labeled dataset for training. In this article we will look at an algorithm for using unlabeled trajectories for preliminary model training.

Creating a Trading Administrator Panel in MQL5 (Part VII): Trusted User, Recovery and Cryptography

Security prompts, such as those triggered every time you refresh the chart, add a new pair to the chat with the Admin Panel EA, or restart the terminal, can become tedious. In this discussion, we will explore and implement a feature that tracks the number of login attempts to identify a trusted user. After a set number of failed attempts, the application will transition to an advanced login procedure, which also facilitates passcode recovery for users who may have forgotten it. Additionally, we will cover how cryptography can be effectively integrated into the Admin Panel to enhance security.

News Trading Made Easy (Part 4): Performance Enhancement

This article will dive into methods to improve the expert's runtime in the strategy tester, the code will be written to divide news event times into hourly categories. These news event times will be accessed within their specified hour. This ensures that the EA can efficiently manage event-driven trades in both high and low-volatility environments.

Example of Causality Network Analysis (CNA) and Vector Auto-Regression Model for Market Event Prediction

This article presents a comprehensive guide to implementing a sophisticated trading system using Causality Network Analysis (CNA) and Vector Autoregression (VAR) in MQL5. It covers the theoretical background of these methods, provides detailed explanations of key functions in the trading algorithm, and includes example code for implementation.

Neural networks made easy (Part 77): Cross-Covariance Transformer (XCiT)

In our models, we often use various attention algorithms. And, probably, most often we use Transformers. Their main disadvantage is the resource requirement. In this article, we will consider a new algorithm that can help reduce computing costs without losing quality.

Neural networks made easy (Part 70): Closed-Form Policy Improvement Operators (CFPI)

In this article, we will get acquainted with an algorithm that uses closed-form policy improvement operators to optimize Agent actions in offline mode.

Neural Networks in Trading: Multi-Task Learning Based on the ResNeXt Model (Final Part)

We continue exploring a multi-task learning framework based on ResNeXt, which is characterized by modularity, high computational efficiency, and the ability to identify stable patterns in data. Using a single encoder and specialized "heads" reduces the risk of model overfitting and improves the quality of forecasts.

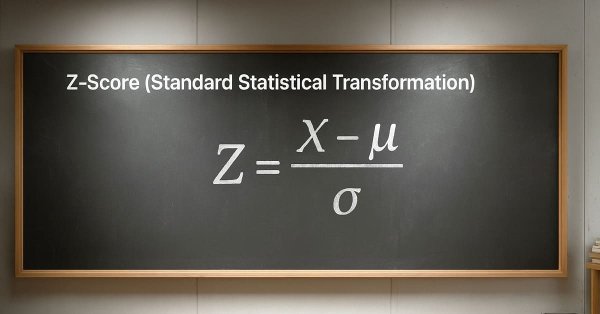

Self Optimizing Expert Advisors in MQL5 (Part 14): Viewing Data Transformations as Tuning Parameters of Our Feedback Controller

Preprocessing is a powerful yet quickly overlooked tuning parameter. It lives in the shadows of its bigger brothers: optimizers and shiny model architectures. Small percentage improvements here can have disproportionately large, compounding effects on profitability and risk. Too often, this largely unexplored science is boiled down to a simple routine, seen only as a means to an end, when in reality it is where signal can be directly amplified, or just as easily destroyed.

Neural networks made easy (Part 69): Density-based support constraint for the behavioral policy (SPOT)

In offline learning, we use a fixed dataset, which limits the coverage of environmental diversity. During the learning process, our Agent can generate actions beyond this dataset. If there is no feedback from the environment, how can we be sure that the assessments of such actions are correct? Maintaining the Agent's policy within the training dataset becomes an important aspect to ensure the reliability of training. This is what we will talk about in this article.

Neural Networks in Trading: Hyperbolic Latent Diffusion Model (HypDiff)

The article considers methods of encoding initial data in hyperbolic latent space through anisotropic diffusion processes. This helps to more accurately preserve the topological characteristics of the current market situation and improves the quality of its analysis.

Formulating Dynamic Multi-Pair EA (Part 6): Adaptive Spread Sensitivity for High-Frequency Symbol Switching

In this part, we will focus on designing an intelligent execution layer that continuously monitors and evaluates real-time spread conditions across multiple symbols. The EA dynamically adapts its symbol selection by enabling or disabling trading based on spread efficiency rather than fixed rules. This approach allows high-frequency multi-pair systems to prioritize cost-effective symbols.

From Novice to Expert: Animated News Headline Using MQL5 (V)—Event Reminder System

In this discussion, we’ll explore additional advancements as we integrate refined event‑alerting logic for the economic calendar events displayed by the News Headline EA. This enhancement is critical—it ensures users receive timely notifications a short time before key upcoming events. Join this discussion to discover more.

From Novice to Expert: Developing a Liquidity Strategy

Liquidity zones are commonly traded by waiting for the price to return and retest the zone of interest, often through the placement of pending orders within these areas. In this article, we leverage MQL5 to bring this concept to life, demonstrating how such zones can be identified programmatically and how risk management can be systematically applied. Join the discussion as we explore both the logic behind liquidity-based trading and its practical implementation.

Neural Networks in Trading: Two-Dimensional Connection Space Models (Chimera)

In this article, we will explore the innovative Chimera framework: a two-dimensional state-space model that uses neural networks to analyze multivariate time series. This method offers high accuracy with low computational cost, outperforming traditional approaches and Transformer architectures.

MQL5 Trading Tools (Part 14): Pixel-Perfect Scrollable Text Canvas with Antialiasing and Rounded Scrollbar

In this article, we enhance the canvas-based price dashboard in MQL5 by adding a pixel-perfect scrollable text panel for usage guides, overcoming native scrolling limitations through custom antialiasing and a rounded scrollbar design with hover-expand functionality. The text panel supports themed backgrounds with opacity, dynamic line wrapping for content like instructions and contacts, and interactive navigation via up/down buttons, slider dragging, and mouse wheel scrolling within the body area.

Visualizing Strategies in MQL5: Laying Out Optimization Results Across Criterion Charts

In this article, we write an example of visualizing the optimization process and display the top three passes for the four optimization criteria. We will also provide an opportunity to select one of the three best passes for displaying its data in tables and on a chart.

Introduction to MQL5 (Part 36): Mastering API and WebRequest Function in MQL5 (X)

This article introduces the basic concepts behind HMAC-SHA256 and API signatures in MQL5, explaining how messages and secret keys are combined to securely authenticate requests. It lays the foundation for signing API calls without exposing sensitive data.

Larry Williams Market Secrets (Part 8): Combining Volatility, Structure and Time Filters

An in-depth walkthrough of building a Larry Williams inspired volatility breakout Expert Advisor in MQL5, combining swing structure, volatility-based entries, trade day of the week filtering, time filters, and flexible risk management, with a complete implementation and reproducible test setup.

From Novice to Expert: Developing a Liquidity Strategy

Liquidity zones are commonly traded by waiting for the price to return and retest the zone of interest, often through the placement of pending orders within these areas. In this article, we leverage MQL5 to bring this concept to life, demonstrating how such zones can be identified programmatically and how risk management can be systematically applied. Join the discussion as we explore both the logic behind liquidity-based trading and its practical implementation.

Larry Williams Market Secrets (Part 7): An Empirical Study of the Trade Day of the Week Concept

An empirical study of Larry Williams’ Trade Day of the Week concept, showing how time-based market bias can be measured, tested, and applied using MQL5. This article presents a practical framework for analyzing win rates and performance across trading days to improve short-term trading systems.

Swap Arbitrage in Forex: Building a Synthetic Portfolio and Generating a Consistent Swap Flow

Do you want to know how to benefit from the difference in interest rates? This article considers how to use swap arbitrage in Forex to earn stable profit every night, creating a portfolio that is resistant to market fluctuations.

Introduction to MQL5 (Part 37): Mastering API and WebRequest Function in MQL5 (XI)

In this article, we show how to send authenticated requests to the Binance API using MQL5 to retrieve your account balance for all assets. Learn how to use your API key, server time, and signature to securely access account data, and how to save the response to a file for future use.

Price Action Analysis Toolkit Development (Part 58): Range Contraction Analysis and Maturity Classification Module

Building on the previous article that introduced the market state classification module, this installment focuses on implementing the core logic for identifying and evaluating compression zones. It presents a range contraction detection and maturity grading system in MQL5 that analyzes market congestion using price action alone.

The MQL5 Standard Library Explorer (Part 6): Optimizing a generated Expert Advisor

In this discussion, we follow up on the previously developed multi-signal Expert Advisor with the objective of exploring and applying available optimization methods. The aim is to determine whether the trading performance of the EA can be meaningfully improved through systematic optimization based on historical data.

Price Action Analysis Toolkit Development (Part 58): Range Contraction Analysis and Maturity Classification Module

Building on the previous article that introduced the market state classification module, this installment focuses on implementing the core logic for identifying and evaluating compression zones. It presents a range contraction detection and maturity grading system in MQL5 that analyzes market congestion using price action alone.

Integrating External Applications with MQL5 Community OAuth

Learn how to add “Sign in with MQL5” to your Android app using the OAuth 2.0 authorization code flow. The guide covers app registration, endpoints, redirect URI, Custom Tabs, deep-link handling, and a PHP backend that exchanges the code for an access token over HTTPS. You will authenticate real MQL5 users and access profile data such as rank and reputation.

MQL5 Trading Tools (Part 15): Canvas Blur Effects, Shadow Rendering, and Smooth Mouse Wheel Scrolling

In this article, we enhance the MQL5 canvas dashboard with advanced visual effects, including blur gradients for fog overlays, shadow rendering for headers, and antialiased drawing for smoother lines and curves. We add smooth mouse wheel scrolling to the text panel that does not interfere with the chart zoom scale, technically an upgrade.

Employing Game Theory Approaches in Trading Algorithms

We are creating an adaptive self-learning trading expert advisor based on DQN machine learning, with multidimensional causal inference. The EA will successfully trade simultaneously on 7 currency pairs. And agents of different pairs will exchange information with each other.

Integrating External Applications with MQL5 Community OAuth

Learn how to add “Sign in with MQL5” to your Android app using the OAuth 2.0 authorization code flow. The guide covers app registration, endpoints, redirect URI, Custom Tabs, deep-link handling, and a PHP backend that exchanges the code for an access token over HTTPS. You will authenticate real MQL5 users and access profile data such as rank and reputation.

Using Deep Reinforcement Learning to Enhance Ilan Expert Advisor

We revisit the Ilan grid Expert Advisor and integrate Q-learning in MQL5 to build an adaptive version for MetaTrader 5. The article shows how to define state features, discretize them for a Q-table, select actions with ε-greedy, and shape rewards for averaging and exits. You will implement saving/loading the Q-table, tune learning parameters, and test on EURUSD/AUDUSD in the Strategy Tester to evaluate stability and drawdown risks.