Neural Networks Made Easy (Part 93): Adaptive Forecasting in Frequency and Time Domains (Final Part)

In this article, we continue the implementation of the approaches of the ATFNet model, which adaptively combines the results of 2 blocks (frequency and time) within time series forecasting.

Neural Networks in Trading: A Multi-Agent Self-Adaptive Model (Final Part)

In the previous article, we introduced the multi-agent self-adaptive framework MASA, which combines reinforcement learning approaches and self-adaptive strategies, providing a harmonious balance between profitability and risk in turbulent market conditions. We have built the functionality of individual agents within this framework. In this article, we will continue the work we started, bringing it to its logical conclusion.

Neural Networks in Trading: Transformer with Relative Encoding

Self-supervised learning can be an effective way to analyze large amounts of unlabeled data. The efficiency is provided by the adaptation of models to the specific features of financial markets, which helps improve the effectiveness of traditional methods. This article introduces an alternative attention mechanism that takes into account the relative dependencies and relationships between inputs.

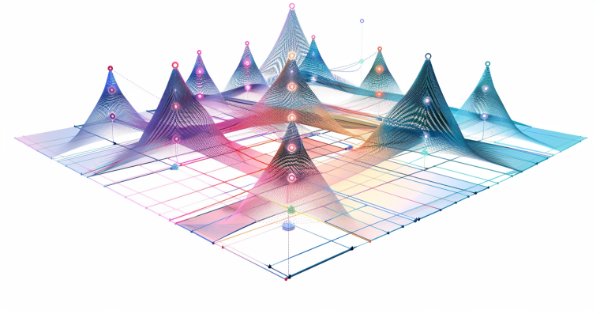

Neural Networks Made Easy (Part 92): Adaptive Forecasting in Frequency and Time Domains

The authors of the FreDF method experimentally confirmed the advantage of combined forecasting in the frequency and time domains. However, the use of the weight hyperparameter is not optimal for non-stationary time series. In this article, we will get acquainted with the method of adaptive combination of forecasts in frequency and time domains.

Neural Networks in Trading: Hybrid Graph Sequence Models (GSM++)

Hybrid graph sequence models (GSM++) combine the advantages of different architectures to provide high-fidelity data analysis and optimized computational costs. These models adapt effectively to dynamic market data, improving the presentation and processing of financial information.

Neural networks made easy (Part 34): Fully Parameterized Quantile Function

We continue studying distributed Q-learning algorithms. In previous articles, we have considered distributed and quantile Q-learning algorithms. In the first algorithm, we trained the probabilities of given ranges of values. In the second algorithm, we trained ranges with a given probability. In both of them, we used a priori knowledge of one distribution and trained another one. In this article, we will consider an algorithm which allows the model to train for both distributions.

Neural networks made easy (Part 80): Graph Transformer Generative Adversarial Model (GTGAN)

In this article, I will get acquainted with the GTGAN algorithm, which was introduced in January 2024 to solve complex problems of generation architectural layouts with graph constraints.

Reimagining Classic Strategies (Part III): Forecasting Higher Highs And Lower Lows

In this series article, we will empirically analyze classic trading strategies to see if we can improve them using AI. In today's discussion, we tried to predict higher highs and lower lows using the Linear Discriminant Analysis model.

Trading Insights Through Volume: Moving Beyond OHLC Charts

Algorithmic trading system that combines volume analysis with machine learning techniques, specifically LSTM neural networks. Unlike traditional trading approaches that primarily focus on price movements, this system emphasizes volume patterns and their derivatives to predict market movements. The methodology incorporates three main components: volume derivatives analysis (first and second derivatives), LSTM predictions for volume patterns, and traditional technical indicators.

Developing a multi-currency Expert Advisor (Part 5): Variable position sizes

In the previous parts, the Expert Advisor (EA) under development was able to use only a fixed position size for trading. This is acceptable for testing, but is not advisable when trading on a real account. Let's make it possible to trade using variable position sizes.

Creating a Trading Administrator Panel in MQL5 (Part VIII): Analytics Panel

Today, we delve into incorporating useful trading metrics within a specialized window integrated into the Admin Panel EA. This discussion focuses on the implementation of MQL5 to develop an Analytics Panel and highlights the value of the data it provides to trading administrators. The impact is largely educational, as valuable lessons are drawn from the development process, benefiting both upcoming and experienced developers. This feature demonstrates the limitless opportunities this development series offers in equipping trade managers with advanced software tools. Additionally, we'll explore the implementation of the PieChart and ChartCanvas classes as part of the continued expansion of the Trading Administrator panel’s capabilities.

Developing a multi-currency Expert Advisor (Part 14): Adaptive volume change in risk manager

The previously developed risk manager contained only basic functionality. Let's try to consider possible ways of its development, allowing us to improve trading results without interfering with the logic of trading strategies.

MQL5 Trading Tools (Part 7): Informational Dashboard for Multi-Symbol Position and Account Monitoring

In this article, we develop an informational dashboard in MQL5 for monitoring multi-symbol positions and account metrics like balance, equity, and free margin. We implement a sortable grid with real-time updates, CSV export, and a glowing header effect to enhance usability and visual appeal.

Portfolio optimization in Forex: Synthesis of VaR and Markowitz theory

How does portfolio trading work on Forex? How can Markowitz portfolio theory for portfolio proportion optimization and VaR model for portfolio risk optimization be synthesized? We create a code based on portfolio theory, where, on the one hand, we will get low risk, and on the other, acceptable long-term profitability.

Price Action Analysis Toolkit Development (Part 14): Parabolic Stop and Reverse Tool

Embracing technical indicators in price action analysis is a powerful approach. These indicators often highlight key levels of reversals and retracements, offering valuable insights into market dynamics. In this article, we demonstrate how we developed an automated tool that generates signals using the Parabolic SAR indicator.

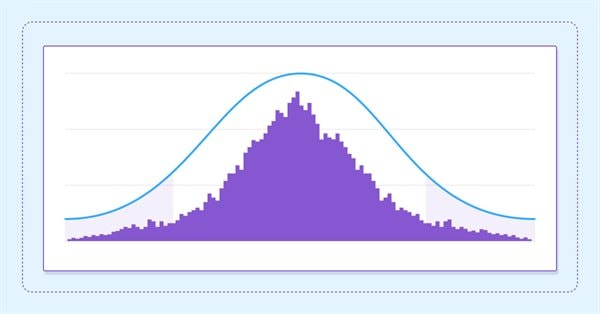

Estimate future performance with confidence intervals

In this article we delve into the application of boostrapping techniques as a means to estimate the future performance of an automated strategy.

News Trading Made Easy (Part 5): Performing Trades (II)

This article will expand on the trade management class to include buy-stop and sell-stop orders to trade news events and implement an expiration constraint on these orders to prevent any overnight trading. A slippage function will be embedded into the expert to try and prevent or minimize possible slippage that may occur when using stop orders in trading, especially during news events.

Neural networks made easy (Part 68): Offline Preference-guided Policy Optimization

Since the first articles devoted to reinforcement learning, we have in one way or another touched upon 2 problems: exploring the environment and determining the reward function. Recent articles have been devoted to the problem of exploration in offline learning. In this article, I would like to introduce you to an algorithm whose authors completely eliminated the reward function.

Neural Networks in Trading: Practical Results of the TEMPO Method

We continue our acquaintance with the TEMPO method. In this article we will evaluate the actual effectiveness of the proposed approaches on real historical data.

Neural networks made easy (Part 60): Online Decision Transformer (ODT)

The last two articles were devoted to the Decision Transformer method, which models action sequences in the context of an autoregressive model of desired rewards. In this article, we will look at another optimization algorithm for this method.

Chaos theory in trading (Part 1): Introduction, application in financial markets and Lyapunov exponent

Can chaos theory be applied to financial markets? In this article, we will consider how conventional Chaos theory and chaotic systems are different from the concept proposed by Bill Williams.

From Novice to Expert: Parameter Control Utility

Imagine transforming the traditional EA or indicator input properties into a real-time, on-chart control interface. This discussion builds upon our foundational work in the Market Periods Synchronizer indicator, marking a significant evolution in how we visualize and manage higher-timeframe (HTF) market structures. Here, we turn that concept into a fully interactive utility—a dashboard that brings dynamic control and enhanced multi-period price action visualization directly onto the chart. Join us as we explore how this innovation reshapes the way traders interact with their tools.

Neural Networks in Trading: State Space Models

A large number of the models we have reviewed so far are based on the Transformer architecture. However, they may be inefficient when dealing with long sequences. And in this article, we will get acquainted with an alternative direction of time series forecasting based on state space models.

Mastering Kagi Charts in MQL5 (Part I): Creating the Indicator

Learn how to build a complete Kagi Chart engine in MQL5—constructing price reversals, generating dynamic line segments, and updating Kagi structures in real time. This first part teaches you how to render Kagi charts directly on MetaTrader 5, giving traders a clear view of trend shifts and market strength while preparing for automated Kagi-based trading logic in Part 2.

Neural Networks Made Easy (Part 84): Reversible Normalization (RevIN)

We already know that pre-processing of the input data plays a major role in the stability of model training. To process "raw" input data online, we often use a batch normalization layer. But sometimes we need a reverse procedure. In this article, we discuss one of the possible approaches to solving this problem.

Building a Candlestick Trend Constraint Model (Part 10): Strategic Golden and Death Cross (EA)

Did you know that the Golden Cross and Death Cross strategies, based on moving average crossovers, are some of the most reliable indicators for identifying long-term market trends? A Golden Cross signals a bullish trend when a shorter moving average crosses above a longer one, while a Death Cross indicates a bearish trend when the shorter average moves below. Despite their simplicity and effectiveness, manually applying these strategies often leads to missed opportunities or delayed trades.

Creating a Trading Administrator Panel in MQL5 (Part V): Two-Factor Authentication (2FA)

Today, we will discuss enhancing security for the Trading Administrator Panel currently under development. We will explore how to implement MQL5 in a new security strategy, integrating the Telegram API for two-factor authentication (2FA). This discussion will provide valuable insights into the application of MQL5 in reinforcing security measures. Additionally, we will examine the MathRand function, focusing on its functionality and how it can be effectively utilized within our security framework. Continue reading to discover more!

Neural networks made easy (Part 39): Go-Explore, a different approach to exploration

We continue studying the environment in reinforcement learning models. And in this article we will look at another algorithm – Go-Explore, which allows you to effectively explore the environment at the model training stage.

Category Theory in MQL5 (Part 7): Multi, Relative and Indexed Domains

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

Reimagining Classic Strategies (Part VI): Multiple Time-Frame Analysis

In this series of articles, we revisit classic strategies to see if we can improve them using AI. In today's article, we will examine the popular strategy of multiple time-frame analysis to judge if the strategy would be enhanced with AI.

Neural Networks in Trading: Dual-Attention-Based Trend Prediction Model

We continue the discussion about the use of piecewise linear representation of time series, which was started in the previous article. Today we will see how to combine this method with other approaches to time series analysis to improve the price trend prediction quality.

Developing a multi-currency Expert Advisor (Part 3): Architecture revision

We have already made some progress in developing a multi-currency EA with several strategies working in parallel. Considering the accumulated experience, let's review the architecture of our solution and try to improve it before we go too far ahead.

Neural Networks in Trading: Multi-Task Learning Based on the ResNeXt Model

A multi-task learning framework based on ResNeXt optimizes the analysis of financial data, taking into account its high dimensionality, nonlinearity, and time dependencies. The use of group convolution and specialized heads allows the model to effectively extract key features from the input data.

Neural Networks in Trading: Unified Trajectory Generation Model (UniTraj)

Understanding agent behavior is important in many different areas, but most methods focus on just one of the tasks (understanding, noise removal, or prediction), which reduces their effectiveness in real-world scenarios. In this article, we will get acquainted with a model that can adapt to solving various problems.

Trading with the MQL5 Economic Calendar (Part 5): Enhancing the Dashboard with Responsive Controls and Filter Buttons

In this article, we create buttons for currency pair filters, importance levels, time filters, and a cancel option to improve dashboard control. These buttons are programmed to respond dynamically to user actions, allowing seamless interaction. We also automate their behavior to reflect real-time changes on the dashboard. This enhances the overall functionality, mobility, and responsiveness of the panel.

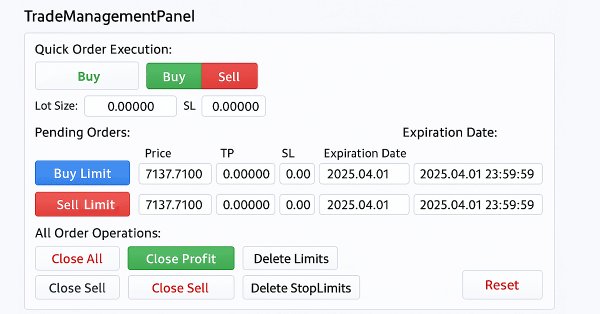

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (IV): Trade Management Panel class

This discussion covers the updated TradeManagementPanel in our New_Admin_Panel EA. The update enhances the panel by using built-in classes to offer a user-friendly trade management interface. It includes trading buttons for opening positions and controls for managing existing trades and pending orders. A key feature is the integrated risk management that allows setting stop loss and take profit values directly in the interface. This update improves code organization for large programs and simplifies access to order management tools, which are often complex in the terminal.

From Novice to Expert: Animated News Headline Using MQL5 (IX) — Multiple Symbol Management on a single chart for News Trading

News trading often requires managing multiple positions and symbols within a very short time due to heightened volatility. In today’s discussion, we address the challenges of multi-symbol trading by integrating this feature into our News Headline EA. Join us as we explore how algorithmic trading with MQL5 makes multi-symbol trading more efficient and powerful.

Trading with the MQL5 Economic Calendar (Part 4): Implementing Real-Time News Updates in the Dashboard

This article enhances our Economic Calendar dashboard by implementing real-time news updates to keep market information current and actionable. We integrate live data fetching techniques in MQL5 to update events on the dashboard continuously, improving the responsiveness of the interface. This update ensures that we can access the latest economic news directly from the dashboard, optimizing trading decisions based on the freshest data.

Neural networks made easy (Part 46): Goal-conditioned reinforcement learning (GCRL)

In this article, we will have a look at yet another reinforcement learning approach. It is called goal-conditioned reinforcement learning (GCRL). In this approach, an agent is trained to achieve different goals in specific scenarios.

Neural networks made easy (Part 78): Decoder-free Object Detector with Transformer (DFFT)

In this article, I propose to look at the issue of building a trading strategy from a different angle. We will not predict future price movements, but will try to build a trading system based on the analysis of historical data.