MQL5 Trading Tools (Part 4): Improving the Multi-Timeframe Scanner Dashboard with Dynamic Positioning and Toggle Features

In this article, we upgrade the MQL5 Multi-Timeframe Scanner Dashboard with movable and toggle features. We enable dragging the dashboard and a minimize/maximize option for better screen use. We implement and test these enhancements for improved trading flexibility.

Self Optimizing Expert Advisors in MQL5 (Part 10): Matrix Factorization

Factorization is a mathematical process used to gain insights into the attributes of data. When we apply factorization to large sets of market data — organized in rows and columns — we can uncover patterns and characteristics of the market. Factorization is a powerful tool, and this article will show how you can use it within the MetaTrader 5 terminal, through the MQL5 API, to gain more profound insights into your market data.

Combine Fundamental And Technical Analysis Strategies in MQL5 For Beginners

In this article, we will discuss how to integrate trend following and fundamental principles seamlessly into one Expert Advisors to build a strategy that is more robust. This article will demonstrate how easy it is for anyone to get up and running building customized trading algorithms using MQL5.

Formulating Dynamic Multi-Pair EA (Part 2): Portfolio Diversification and Optimization

Portfolio Diversification and Optimization strategically spreads investments across multiple assets to minimize risk while selecting the ideal asset mix to maximize returns based on risk-adjusted performance metrics.

Reimagining Classic Strategies (Part V): Multiple Symbol Analysis on USDZAR

In this series of articles, we revisit classical strategies to see if we can improve the strategy using AI. In today's article, we will examine a popular strategy of multiple symbol analysis using a basket of correlated securities, we will focus on the exotic USDZAR currency pair.

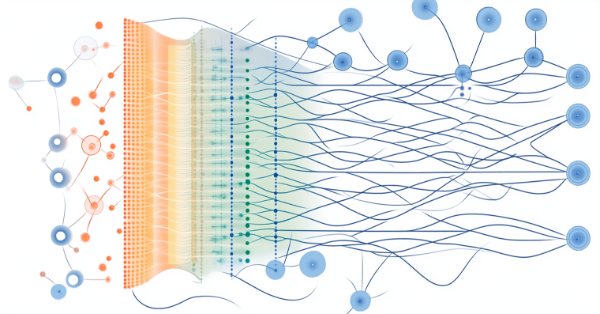

Neural Networks in Trading: Memory Augmented Context-Aware Learning (MacroHFT) for Cryptocurrency Markets

I invite you to explore the MacroHFT framework, which applies context-aware reinforcement learning and memory to improve high-frequency cryptocurrency trading decisions using macroeconomic data and adaptive agents.

Neural networks made easy (Part 45): Training state exploration skills

Training useful skills without an explicit reward function is one of the main challenges in hierarchical reinforcement learning. Previously, we already got acquainted with two algorithms for solving this problem. But the question of the completeness of environmental research remains open. This article demonstrates a different approach to skill training, the use of which directly depends on the current state of the system.

Neural networks made easy (Part 51): Behavior-Guided Actor-Critic (BAC)

The last two articles considered the Soft Actor-Critic algorithm, which incorporates entropy regularization into the reward function. This approach balances environmental exploration and model exploitation, but it is only applicable to stochastic models. The current article proposes an alternative approach that is applicable to both stochastic and deterministic models.

MQL5 Wizard Techniques you should know (Part 16): Principal Component Analysis with Eigen Vectors

Principal Component Analysis, a dimensionality reducing technique in data analysis, is looked at in this article, with how it could be implemented with Eigen values and vectors. As always, we aim to develop a prototype expert-signal-class usable in the MQL5 wizard.

Neural Networks in Trading: Lightweight Models for Time Series Forecasting

Lightweight time series forecasting models achieve high performance using a minimum number of parameters. This, in turn, reduces the consumption of computing resources and speeds up decision-making. Despite being lightweight, such models achieve forecast quality comparable to more complex ones.

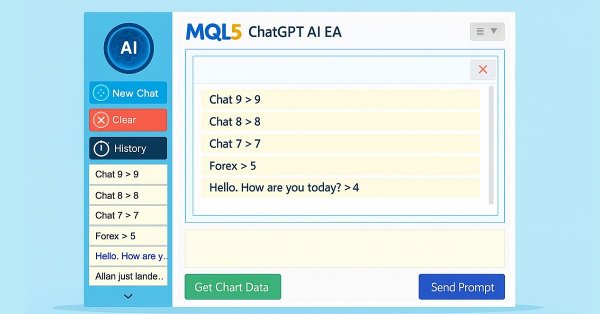

Building AI-Powered Trading Systems in MQL5 (Part 5): Adding a Collapsible Sidebar with Chat Popups

In Part 5 of our MQL5 AI trading system series, we enhance the ChatGPT-integrated Expert Advisor by introducing a collapsible sidebar, improving navigation with small and large history popups for seamless chat selection, while maintaining multiline input handling, persistent encrypted chat storage, and AI-driven trade signal generation from chart data.

Neural Networks in Trading: Two-Dimensional Connection Space Models (Final Part)

We continue to explore the innovative Chimera framework – a two-dimensional state-space model that uses neural network technologies to analyze multidimensional time series. This method provides high forecasting accuracy with low computational cost.

Neural Networks in Trading: Contrastive Pattern Transformer

The Contrastive Transformer is designed to analyze markets both at the level of individual candlesticks and based on entire patterns. This helps improve the quality of market trend modeling. Moreover, the use of contrastive learning to align representations of candlesticks and patterns fosters self-regulation and improves the accuracy of forecasts.

Neural Networks in Trading: Controlled Segmentation (Final Part)

We continue the work started in the previous article on building the RefMask3D framework using MQL5. This framework is designed to comprehensively study multimodal interaction and feature analysis in a point cloud, followed by target object identification based on a description provided in natural language.

Building A Candlestick Trend Constraint Model (Part 4): Customizing Display Style For Each Trend Wave

In this article, we will explore the capabilities of the powerful MQL5 language in drawing various indicator styles on Meta Trader 5. We will also look at scripts and how they can be used in our model.

Neural Networks Made Easy (Part 86): U-Shaped Transformer

We continue to study timeseries forecasting algorithms. In this article, we will discuss another method: the U-shaped Transformer.

Neural Networks Made Easy (Part 85): Multivariate Time Series Forecasting

In this article, I would like to introduce you to a new complex timeseries forecasting method, which harmoniously combines the advantages of linear models and transformers.

Creating a Trading Administrator Panel in MQL5 (Part VI):Trade Management Panel (II)

In this article, we enhance the Trade Management Panel of our multi-functional Admin Panel. We introduce a powerful helper function that simplifies the code, improving readability, maintainability, and efficiency. We will also demonstrate how to seamlessly integrate additional buttons and enhance the interface to handle a wider range of trading tasks. Whether managing positions, adjusting orders, or simplifying user interactions, this guide will help you develop a robust, user-friendly Trade Management Panel.

Polynomial models in trading

This article is about orthogonal polynomials. Their use can become the basis for a more accurate and effective analysis of market information allowing traders to make more informed decisions.

Neural networks made easy (Part 74): Trajectory prediction with adaptation

This article introduces a fairly effective method of multi-agent trajectory forecasting, which is able to adapt to various environmental conditions.

The MQL5 Standard Library Explorer (Part 5): Multiple Signal Expert

In this session, we will build a sophisticated, multi-signal Expert Advisor using the MQL5 Standard Library. This approach allows us to seamlessly blend built-in signals with our own custom logic, demonstrating how to construct a powerful and flexible trading algorithm. For more, click to read further.

From Novice to Expert: Animated News Headline Using MQL5 (III) — Indicator Insights

In this article, we’ll advance the News Headline EA by introducing a dedicated indicator insights lane—a compact, on-chart display of key technical signals generated from popular indicators such as RSI, MACD, Stochastic, and CCI. This approach eliminates the need for multiple indicator subwindows on the MetaTrader 5 terminal, keeping your workspace clean and efficient. By leveraging the MQL5 API to access indicator data in the background, we can process and visualize market insights in real-time using custom logic. Join us as we explore how to manipulate indicator data in MQL5 to create an intelligent and space-saving scrolling insights system, all within a single horizontal lane on your trading chart.

Neural Networks in Trading: Node-Adaptive Graph Representation with NAFS

We invite you to get acquainted with the NAFS (Node-Adaptive Feature Smoothing) method, which is a non-parametric approach to creating node representations that does not require parameter training. NAFS extracts features of each node given its neighbors and then adaptively combines these features to form a final representation.

Fortified Profit Architecture: Multi-Layered Account Protection

In this discussion, we introduce a structured, multi-layered defense system designed to pursue aggressive profit targets while minimizing exposure to catastrophic loss. The focus is on blending offensive trading logic with protective safeguards at every level of the trading pipeline. The idea is to engineer an EA that behaves like a “risk-aware predator”—capable of capturing high-value opportunities, but always with layers of insulation that prevent blindness to sudden market stress.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 7): Command Analysis for Indicator Automation on Charts

In this article, we explore how to integrate Telegram commands with MQL5 to automate the addition of indicators on trading charts. We cover the process of parsing user commands, executing them in MQL5, and testing the system to ensure smooth indicator-based trading

Neural networks made easy (Part 71): Goal-Conditioned Predictive Coding (GCPC)

In previous articles, we discussed the Decision Transformer method and several algorithms derived from it. We experimented with different goal setting methods. During the experiments, we worked with various ways of setting goals. However, the model's study of the earlier passed trajectory always remained outside our attention. In this article. I want to introduce you to a method that fills this gap.

Neural Networks Made Easy (Part 83): The "Conformer" Spatio-Temporal Continuous Attention Transformer Algorithm

This article introduces the Conformer algorithm originally developed for the purpose of weather forecasting, which in terms of variability and capriciousness can be compared to financial markets. Conformer is a complex method. It combines the advantages of attention models and ordinary differential equations.

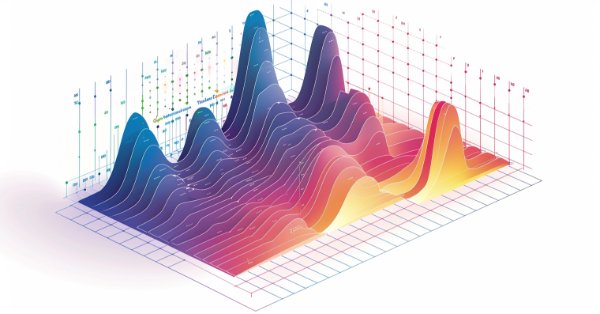

Self Optimizing Expert Advisors in MQL5 (Part 13): A Gentle Introduction To Control Theory Using Matrix Factorization

Financial markets are unpredictable, and trading strategies that look profitable in the past often collapse in real market conditions. This happens because most strategies are fixed once deployed and cannot adapt or learn from their mistakes. By borrowing ideas from control theory, we can use feedback controllers to observe how our strategies interact with markets and adjust their behavior toward profitability. Our results show that adding a feedback controller to a simple moving average strategy improved profits, reduced risk, and increased efficiency, proving that this approach has strong potential for trading applications.

Alternative risk return metrics in MQL5

In this article we present the implementation of several risk return metrics billed as alternatives to the Sharpe ratio and examine hypothetical equity curves to analyze their characteristics.

MQL5 Trading Tools (Part 5): Creating a Rolling Ticker Tape for Real-Time Symbol Monitoring

In this article, we develop a rolling ticker tape in MQL5 for real-time monitoring of multiple symbols, displaying bid prices, spreads, and daily percentage changes with scrolling effects. We implement customizable fonts, colors, and scroll speeds to highlight price movements and trends effectively.

Neural networks made easy (Part 42): Model procrastination, reasons and solutions

In the context of reinforcement learning, model procrastination can be caused by several reasons. The article considers some of the possible causes of model procrastination and methods for overcoming them.

Neural Networks Made Easy (Part 95): Reducing Memory Consumption in Transformer Models

Transformer architecture-based models demonstrate high efficiency, but their use is complicated by high resource costs both at the training stage and during operation. In this article, I propose to get acquainted with algorithms that allow to reduce memory usage of such models.

Websockets for MetaTrader 5: Asynchronous client connections with the Windows API

This article details the development of a custom dynamically linked library designed to facilitate asynchronous websocket client connections for MetaTrader programs.

Neural networks made easy (Part 40): Using Go-Explore on large amounts of data

This article discusses the use of the Go-Explore algorithm over a long training period, since the random action selection strategy may not lead to a profitable pass as training time increases.

Reimagining Classic Strategies (Part X): Can AI Power The MACD?

Join us as we empirically analyzed the MACD indicator, to test if applying AI to a strategy, including the indicator, would yield any improvements in our accuracy on forecasting the EURUSD. We simultaneously assessed if the indicator itself is easier to predict than price, as well as if the indicator's value is predictive of future price levels. We will furnish you with the information you need to decide whether you should consider investing your time into integrating the MACD in your AI trading strategies.

Neural networks made easy (Part 57): Stochastic Marginal Actor-Critic (SMAC)

Here I will consider the fairly new Stochastic Marginal Actor-Critic (SMAC) algorithm, which allows building latent variable policies within the framework of entropy maximization.

Quantitative approach to risk management: Applying VaR model to optimize multi-currency portfolio using Python and MetaTrader 5

This article explores the potential of the Value at Risk (VaR) model for multi-currency portfolio optimization. Using the power of Python and the functionality of MetaTrader 5, we demonstrate how to implement VaR analysis for efficient capital allocation and position management. From theoretical foundations to practical implementation, the article covers all aspects of applying one of the most robust risk calculation systems – VaR – in algorithmic trading.

Trading with the MQL5 Economic Calendar (Part 10): Draggable Dashboard and Interactive Hover Effects for Seamless News Navigation

In this article, we enhance the MQL5 Economic Calendar by introducing a draggable dashboard that allows us to reposition the interface for better chart visibility. We implement hover effects for buttons to improve interactivity and ensure seamless navigation with a dynamically positioned scrollbar.

Neural Networks in Trading: A Complex Trajectory Prediction Method (Traj-LLM)

In this article, I would like to introduce you to an interesting trajectory prediction method developed to solve problems in the field of autonomous vehicle movements. The authors of the method combined the best elements of various architectural solutions.

Example of CNA (Causality Network Analysis), SMOC (Stochastic Model Optimal Control) and Nash Game Theory with Deep Learning

We will add Deep Learning to those three examples that were published in previous articles and compare results with previous. The aim is to learn how to add DL to other EA.