MQL5 Wizard: Placing Orders, Stop-Losses and Take Profits on Calculated Prices. Standard Library Extension

This article describes the MQL5 Standard Library extension, which allows to create Expert Advisors, place orders, Stop Losses and Take Profits using the MQL5 Wizard by the prices received from included modules. This approach does not apply any additional restrictions on the number of modules and does not cause conflicts in their joint work.

Creating an Expert Advisor, which Trades on a Number of Instruments

The concept of diversification of assets on financial markets is quiet old, and has always attracted beginner traders. In this article, the author proposes a maximally simple approach to a construction of a multi-currency Expert Advisor, for an initial introduction to this direction of trading strategies.

Master MQL5 from beginner to pro (Part I): Getting started with programming

This article is an introduction to a series of articles about programming. It is assumed here that the reader has never dealt with programming before. So, this series starts from the very basics. Programming knowledge level: Absolute Beginner.

Automating Trading Strategies in MQL5 (Part 47): Nick Rypock Trailing Reverse (NRTR) with Hedging Features

In this article, we develop a Nick Rypock Trailing Reverse (NRTR) trading system in MQL5 that uses channel indicators for reversal signals, enabling trend-following entries with hedging support for buys and sells. We incorporate risk management features like auto lot sizing based on equity or balance, fixed or dynamic stop-loss and take-profit levels using ATR multipliers, and position limits.

Trading DiNapoli levels

The article considers one of the variants for Expert Advisor practical realization to trade DiNapoli levels using MQL5 standard tools. Its performance is tested and conclusions are made.

Universal Expert Advisor: Custom Strategies and Auxiliary Trade Classes (Part 3)

In this article, we will continue analyzing the algorithms of the CStrategy trading engine. The third part of the series contains the detailed analysis of examples of how to develop specific trading strategies using this approach. Special attention is paid to auxiliary algorithms — Expert Advisor logging system and data access using a conventional indexer (Close[1], Open[0] etc.)

Optimization management (Part I): Creating a GUI

This article describes the process of creating an extension for the MetaTrader terminal. The solution discussed helps to automate the optimization process by running optimizations in other terminals. A few more articles will be written concerning this topic. The extension has been developed using the C# language and design patterns, which additionally demonstrates the ability to expand the terminal capabilities by developing custom modules, as well as the ability to create custom graphical user interfaces using the functionality of a preferred programming language.

Graphical Interfaces IV: the Multi-Window Mode and System of Priorities (Chapter 2)

In this chapter, we will extend the library implementation to the possibility of creating multi-window interfaces for the MQL applications. We will also develop a system of priorities for left mouse clicking on graphical objects. This is required to avoid problems when elements do not respond to the user's actions.

Universal Expert Advisor: Accessing Symbol Properties (Part 8)

The eighth part of the article features the description of the CSymbol class, which is a special object that provides access to any trading instrument. When used inside an Expert Advisor, the class provides a wide set of symbol properties, while allowing to simplify Expert Advisor programming and to expand its functionality.

Regular expressions for traders

A regular expression is a special language for handling texts by applying a specified rule, also called a regex or regexp for short. In this article, we are going to show how to handle a trade report with the RegularExpressions library for MQL5, and will also demonstrate the optimization results after using it.

Enhancing the StrategyTester to Optimize Indicators Solely on the Example of Flat and Trend Markets

It is essential to detect whether a market is flat or not for many strategies. Using the well known ADX we demonstrate how we can use the Strategy Tester not only to optimize this indicator for our specific purpose, but as well we can decide whether this indicator will meet our needs and get to know the average range of the flat and trend markets which might be quite important to determine stops and targets of the markets.

Creating Expert Advisors Using Expert Advisor Visual Wizard

Expert Advisor Visual Wizard for MetaTrader 5 provides a highly intuitive graphical environment with a comprehensive set of predefined trading blocks that let you design Expert Advisors in minutes. The click, drag and drop approach of Expert Advisor Visual Wizard allows you to create visual representations of forex trading strategies and signals as you would with pencil and paper. These trading diagrams are analyzed automatically by Molanis’ MQL5 code generator that transforms them into ready to use Expert Advisors. The interactive graphical environment simplifies the design process and eliminates the need to write MQL5 code.

MQL5 Wizard: How to Create a Risk and Money Management Module

The generator of trading strategies of the MQL5 Wizard greatly simplifies testing of trading ideas. The article describes how to develop a custom risk and money management module and enable it in the MQL5 Wizard. As an example we've considered a money management algorithm, in which the size of the trade volume is determined by the results of the previous deal. The structure and format of description of the created class for the MQL5 Wizard are also discussed in the article.

Useful and exotic techniques for automated trading

In this article I will demonstrate some very interesting and useful techniques for automated trading. Some of them may be familiar to you. I will try to cover the most interesting methods and will explain why they are worth using. Furthermore, I will show what these techniques are apt to in practice. We will create Expert Advisors and test all the described techniques using historic quotes.

Universal Expert Advisor: Pending Orders and Hedging Support (Part 5)

This article provides further description of the CStrategy trading engine. By popular demand of users, we have added pending order support functions to the trading engine. Also, the latest version of the MetaTrader 5 now supports accounts with the hedging option. The same support has been added to CStrategy. The article provides a detailed description of algorithms for the use of pending orders, as well as of CStrategy operation principles on accounts with the hedging option enabled.

MQL5 Cookbook: Using Indicators to Set Trading Conditions in Expert Advisors

In this article, we will continue to modify the Expert Advisor we have been working on throughout the preceding articles of the MQL5 Cookbook series. This time, the Expert Advisor will be enhanced with indicators whose values will be used to check position opening conditions. To spice it up, we will create a drop-down list in the external parameters to be able to select one out of three trading indicators.

Deep Neural Networks (Part VI). Ensemble of neural network classifiers: bagging

The article discusses the methods for building and training ensembles of neural networks with bagging structure. It also determines the peculiarities of hyperparameter optimization for individual neural network classifiers that make up the ensemble. The quality of the optimized neural network obtained in the previous article of the series is compared with the quality of the created ensemble of neural networks. Possibilities of further improving the quality of the ensemble's classification are considered.

Graphical Interfaces I: Animating the Graphical Interface (Chapter 3)

In the previous article, we started developing a form class for controls. In this article, we are going to continue doing that by filling this class with methods for moving a form over the chart area. We will then integrate this interface component into the core of the library. Also, we will ensure that the color of a form control changes when the mouse cursor is hovering over it.

Practical evaluation of the adaptive market following method

The main difference of the trading system proposed in the article is the use of mathematical tools for analyzing stock quotes. The system applies digital filtering and spectral estimation of discrete time series. The theoretical aspects of the strategy are described and a test Expert Advisor is created.

MQL5 Wizard: How to Teach an EA to Open Pending Orders at Any Price

The article describes a method of modifying the code of a trading signal module for the implementation of the functionality allowing you to set pending orders at any distance from the current price: it may be the Close or Open price of the previous bar or the value of the moving average. There are plenty of options. Important is that you can set any opening price for a pending order. This article will be useful to traders who trade with pending orders.

Introduction to MQL5 (Part 23): Automating Opening Range Breakout Strategy

This article explores how to build an Opening Range Breakout (ORB) Expert Advisor in MQL5. It explains how the EA identifies breakouts from the market’s initial range and opens trades accordingly. You’ll also learn how to control the number of positions opened and set a specific cutoff time to stop trading automatically.

Visualizing optimization results using a selected criterion

In the article, we continue to develop the MQL application for working with optimization results. This time, we will show how to form the table of the best results after optimizing the parameters by specifying another criterion via the graphical interface.

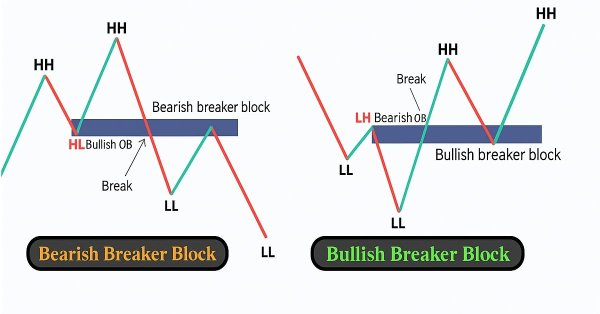

Automating Trading Strategies in MQL5 (Part 35): Creating a Breaker Block Trading System

In this article, we create a Breaker Block Trading System in MQL5 that identifies consolidation ranges, detects breakouts, and validates breaker blocks with swing points to trade retests with defined risk parameters. The system visualizes order and breaker blocks with dynamic labels and arrows, supporting automated trading and trailing stops.

Error 146 ("Trade context busy") and How to Deal with It

The article deals with conflict-free trading of several experts on one МТ 4 Client Terminal. It will be useful for those who have basic command of working with the terminal and programming in MQL 4.

Automating Trading Strategies in MQL5 (Part 46): Liquidity Sweep on Break of Structure (BoS)

In this article, we build a Liquidity Sweep on Break of Structure (BoS) system in MQL5 that detects swing highs/lows over a user-defined length, labels them as HH/HL/LH/LL to identify BOS (HH in uptrend or LL in downtrend), and spots liquidity sweeps when price wicks beyond the swing but closes back inside on a bullish/bearish candle.

Automating Trading Strategies in MQL5 (Part 12): Implementing the Mitigation Order Blocks (MOB) Strategy

In this article, we build an MQL5 trading system that automates order block detection for Smart Money trading. We outline the strategy’s rules, implement the logic in MQL5, and integrate risk management for effective trade execution. Finally, we backtest the system to assess its performance and refine it for optimal results.

Automating Trading Strategies in MQL5 (Part 40): Fibonacci Retracement Trading with Custom Levels

In this article, we build an MQL5 Expert Advisor for Fibonacci retracement trading, using either daily candle ranges or lookback arrays to calculate custom levels like 50% and 61.8% for entries, determining bullish or bearish setups based on close vs. open. The system triggers buys or sells on price crossings of levels with max trades per level, optional closure on new Fib calcs, points-based trailing stops after a min profit threshold, and SL/TP buffers as percentages of the range.

Graphical Interfaces I: Functions for the Form Buttons and Deleting Interface Elements (Chapter 4)

In this article, we are going to continue developing the CWindow class by adding methods, which will allow managing the form by clicking on its controls. We will enable the program to be closed by a form button as well as implement a minimizing and maximizing feature for the form.

Automating Trading Strategies in MQL5 (Part 11): Developing a Multi-Level Grid Trading System

In this article, we develop a multi-level grid trading system EA using MQL5, focusing on the architecture and algorithm design behind grid trading strategies. We explore the implementation of multi-layered grid logic and risk management techniques to handle varying market conditions. Finally, we provide detailed explanations and practical tips to guide you through building, testing, and refining the automated trading system.

Graphical Interfaces III: Groups of Simple and Multi-Functional Buttons (Chapter 2)

The first chapter of the series was about simple and multi-functional buttons. The second article will be dedicated to groups of interconnected buttons that will allow the creation of elements in an application when a user can select one of the option out of a set (group).

The Optimal Method for Calculation of Total Position Volume by Specified Magic Number

The problem of calculation of the total position volume of the specified symbol and magic number is considered in this article. The proposed method requests only the minimum necessary part of the history of deals, finds the closest time when the total position was equal to zero, and performs the calculations with the recent deals. Working with global variables of the client terminal is also considered.

Graphical Interfaces X: Updates for Easy And Fast Library (Build 2)

Since the publication of the previous article in the series, Easy And Fast library has received some new features. The library structure and code have been partially optimized slightly reducing CPU load. Some recurring methods in many control classes have been moved to the CElement base class.

Resolving entries into indicators

Different situations happen in trader’s life. Often, the history of successful trades allows us to restore a strategy, while looking at a loss history we try to develop and improve it. In both cases, we compare trades with known indicators. This article suggests methods of batch comparison of trades with a number of indicators.

Neural networks made easy (Part 7): Adaptive optimization methods

In previous articles, we used stochastic gradient descent to train a neural network using the same learning rate for all neurons within the network. In this article, I propose to look towards adaptive learning methods which enable changing of the learning rate for each neuron. We will also consider the pros and cons of this approach.

Creating a trading robot for Moscow Exchange. Where to start?

Many traders on Moscow Exchange would like to automate their trading algorithms, but they do not know where to start. The MQL5 language offers a huge range of trading functions, and it additionally provides ready classes that help users to make their first steps in algo trading.

MQL5 Cookbook - Programming moving channels

This article presents a method of programming the equidistant channel system. Certain details of building such channels are being considered here. Channel typification is provided, and a universal type of moving channels' method is suggested. Object-oriented programming (OOP) is used for code implementation.

Cross-Platform Expert Advisor: Custom Stops, Breakeven and Trailing

This article discusses how custom stop levels can be set up in a cross-platform expert advisor. It also discusses a closely-related method by which the evolution of a stop level over time can be defined.

Manual charting and trading toolkit (Part II). Chart graphics drawing tools

This is the next article within the series, in which I show how I created a convenient library for manual application of chart graphics by utilizing keyboard shortcuts. The tools used include straight lines and their combinations. In this part, we will view how the drawing tools are applied using the functions described in the first part. The library can be connected to any Expert Advisor or indicator which will greatly simplify the charting tasks. This solution DOES NOT use external dlls, while all the commands are implemented using built-in MQL tools.

Mastering Market Dynamics: Creating a Support and Resistance Strategy Expert Advisor (EA)

A comprehensive guide to developing an automated trading algorithm based on the Support and Resistance strategy. Detailed information on all aspects of creating an expert advisor in MQL5 and testing it in MetaTrader 5 – from analyzing price range behaviors to risk management.

Graphical Interfaces X: Text Edit box, Picture Slider and simple controls (build 5)

This article will consider new controls: Text Edit box, Picture Slider, as well as additional simple controls: Text label and Picture. The library continues to grow, and in addition to introduction of new controls, the previously created ones are also being improved.