Research of Statistical Recurrences of Candle Directions

Is it possible to predict the behavior of the market for a short upcoming interval of time, based on the recurring tendencies of candle directions, at specific times throughout the day? That is, If such an occurrence is found in the first place. This question has probably arisen in the mind of every trader. The purpose of this article is to attempt to predict the behavior of the market, based on the statistical recurrences of candle directions during specific intervals of time.

Developing a trading Expert Advisor from scratch (Part 19): New order system (II)

In this article, we will develop a graphical order system of the "look what happens" type. Please note that we are not starting from scratch this time, but we will modify the existing system by adding more objects and events on the chart of the asset we are trading.

How to Integrate Smart Money Concepts (BOS) Coupled with the RSI Indicator into an EA

Smart Money Concept (Break Of Structure) coupled with the RSI Indicator to make informed automated trading decisions based on the market structure.

Graphical Interfaces I: Testing Library in Programs of Different Types and in the MetaTrader 4 Terminal (Chapter 5)

In the previous chapter of the first part of the series about graphical interfaces, the form class was enriched by methods which allowed managing the form by pressing its controls. In this article, we will test our work in different types of MQL program such as indicators and scripts. As the library was designed to be cross-platform so it could be used in all MetaTrader platforms, we will also test it in MetaTrader 4.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 2): Indicator Signals: Multi Timeframe Parabolic SAR Indicator

The Multi-Currency Expert Advisor in this article is Expert Advisor or trading robot that can trade (open orders, close orders and manage orders for example: Trailing Stop Loss and Trailing Profit) for more than 1 symbol pair only from one symbol chart. This time we will use only 1 indicator, namely Parabolic SAR or iSAR in multi-timeframes starting from PERIOD_M15 to PERIOD_D1.

Graphical Interfaces X: Word wrapping algorithm in the Multiline Text box (build 12)

We continue to develop the Multiline Text box control. This time our task is to implement an automatic word wrapping in case a text box width overflow occurs, or a reverse word wrapping of the text to the previous line if the opportunity arises.

Developing an Expert Advisor (EA) based on the Consolidation Range Breakout strategy in MQL5

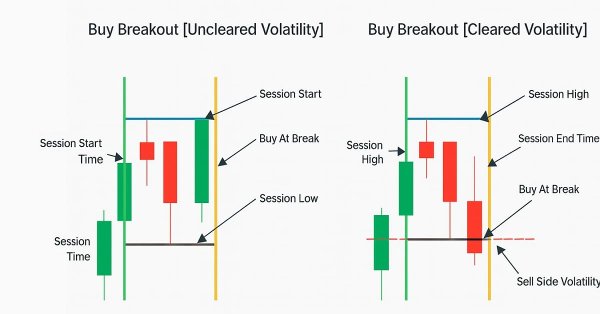

This article outlines the steps to create an Expert Advisor (EA) that capitalizes on price breakouts after consolidation periods. By identifying consolidation ranges and setting breakout levels, traders can automate their trading decisions based on this strategy. The Expert Advisor aims to provide clear entry and exit points while avoiding false breakouts

Graphical Interfaces IX: The Color Picker Control (Chapter 1)

With this article we begin chapter nine of series of articles dedicated to creating graphical interfaces in MetaTrader trading terminals. It consists of two chapters where new elements of controls and interface, such as color picker, color button, progress bar and line chart are presented.

Graphical Interfaces X: Sorting, rebuilding the table and controls in the cells (build 11)

We continue to add new features to the rendered table: data sorting, managing the number of columns and rows, setting the table cell types to place controls into them.

Automating Trading Strategies in MQL5 (Part 10): Developing the Trend Flat Momentum Strategy

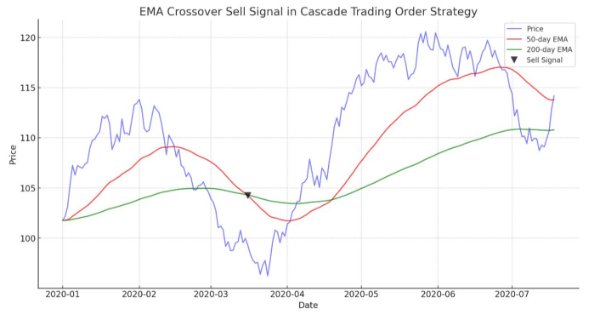

In this article, we develop an Expert Advisor in MQL5 for the Trend Flat Momentum Strategy. We combine a two moving averages crossover with RSI and CCI momentum filters to generate trade signals. We also cover backtesting and potential enhancements for real-world performance.

MQL5 Cookbook: Analyzing Position Properties in the MetaTrader 5 Strategy Tester

We will present a modified version of the Expert Advisor from the previous article "MQL5 Cookbook: Position Properties on the Custom Info Panel". Some of the issues we will address include getting data from bars, checking for new bar events on the current symbol, including a trade class of the Standard Library to a file, creating a function to search for trading signals and a function for executing trading operations, as well as determining trade events in the OnTrade() function.

Contest of Expert Advisors inside an Expert Advisor

Using virtual trading, you can create an adaptive Expert Advisor, which will turn on and off trades at the real market. Combine several strategies in a single Expert Advisor! Your multisystem Expert Advisor will automatically choose a trade strategy, which is the best to trade with at the real market, on the basis of profitability of virtual trades. This kind of approach allows decreasing drawdown and increasing profitability of your work at the market. Experiment and share your results with others! I think many people will be interested to know about your portfolio of strategies.

Graphical Interfaces XI: Integrating the Standard Graphics Library (build 16)

A new version of the graphics library for creating scientific charts (the CGraphic class) has been presented recently. This update of the developed library for creating graphical interfaces will introduce a version with a new control for creating charts. Now it is even easier to visualize data of different types.

Build Self Optimizing Expert Advisors in MQL5 (Part 4): Dynamic Position Sizing

Successfully employing algorithmic trading requires continuous, interdisciplinary learning. However, the infinite range of possibilities can consume years of effort without yielding tangible results. To address this, we propose a framework that gradually introduces complexity, allowing traders to refine their strategies iteratively rather than committing indefinite time to uncertain outcomes.

Automating Trading Strategies in MQL5 (Part 1): The Profitunity System (Trading Chaos by Bill Williams)

In this article, we examine the Profitunity System by Bill Williams, breaking down its core components and unique approach to trading within market chaos. We guide readers through implementing the system in MQL5, focusing on automating key indicators and entry/exit signals. Finally, we test and optimize the strategy, providing insights into its performance across various market scenarios.

Automating Trading Strategies in MQL5 (Part 16): Midnight Range Breakout with Break of Structure (BoS) Price Action

In this article, we automate the Midnight Range Breakout with Break of Structure strategy in MQL5, detailing code for breakout detection and trade execution. We define precise risk parameters for entries, stops, and profits. Backtesting and optimization are included for practical trading.

Automating Trading Strategies in MQL5 (Part 44): Change of Character (CHoCH) Detection with Swing High/Low Breaks

In this article, we develop a Change of Character (CHoCH) detection system in MQL5 that identifies swing highs and lows over a user-defined bar length, labels them as HH/LH for highs or LL/HL for lows to determine trend direction, and triggers trades on breaks of these swing points, indicating a potential reversal, and trades the breaks when the structure changes.

Graphical Interfaces V: The List View Element (Chapter 2)

In the previous chapter, we wrote classes for creating vertical and horizontal scrollbars. In this chapter, we will implement them. We will write a class for creating the list view element, a compound part of which will be a vertical scrollbar.

Movement continuation model - searching on the chart and execution statistics

This article provides programmatic definition of one of the movement continuation models. The main idea is defining two waves — the main and the correction one. For extreme points, I apply fractals as well as "potential" fractals - extreme points that have not yet formed as fractals.

Graphical Interfaces XI: Text edit boxes and Combo boxes in table cells (build 15)

In this update of the library, the Table control (the CTable class) will be supplemented with new options. The lineup of controls in the table cells is expanded, this time adding text edit boxes and combo boxes. As an addition, this update also introduces the ability to resize the window of an MQL application during its runtime.

Neural networks made easy (Part 29): Advantage Actor-Critic algorithm

In the previous articles of this series, we have seen two reinforced learning algorithms. Each of them has its own advantages and disadvantages. As often happens in such cases, next comes the idea to combine both methods into an algorithm, using the best of the two. This would compensate for the shortcomings of each of them. One of such methods will be discussed in this article.

Automating Trading Strategies in MQL5 (Part 3): The Zone Recovery RSI System for Dynamic Trade Management

In this article, we create a Zone Recovery RSI EA System in MQL5, using RSI signals to trigger trades and a recovery strategy to manage losses. We implement a "ZoneRecovery" class to automate trade entries, recovery logic, and position management. The article concludes with backtesting insights to optimize performance and enhance the EA’s effectiveness.

Automating Trading Strategies in MQL5 (Part 13): Building a Head and Shoulders Trading Algorithm

In this article, we automate the Head and Shoulders pattern in MQL5. We analyze its architecture, implement an EA to detect and trade it, and backtest the results. The process reveals a practical trading algorithm with room for refinement.

Neural networks made easy (Part 5): Multithreaded calculations in OpenCL

We have earlier discussed some types of neural network implementations. In the considered networks, the same operations are repeated for each neuron. A logical further step is to utilize multithreaded computing capabilities provided by modern technology in an effort to speed up the neural network learning process. One of the possible implementations is described in this article.

Neural Networks Made Easy (Part 96): Multi-Scale Feature Extraction (MSFformer)

Efficient extraction and integration of long-term dependencies and short-term features remain an important task in time series analysis. Their proper understanding and integration are necessary to create accurate and reliable predictive models.

Raise Your Linear Trading Systems to the Power

Today's article shows intermediate MQL5 programmers how they can get more profit from their linear trading systems (Fixed Lot) by easily implementing the so-called technique of exponentiation. This is because the resulting equity curve growth is then geometric, or exponential, taking the form of a parabola. Specifically, we will implement a practical MQL5 variant of the Fixed Fractional position sizing developed by Ralph Vince.

Developing a trading Expert Advisor from scratch (Part 21): New order system (IV)

Finally, the visual system will start working, although it will not yet be completed. Here we will finish making the main changes. There will be quite a few of them, but they are all necessary. Well, the whole work will be quite interesting.

Optimization. A Few Simple Ideas

The optimization process can require significant resources of your computer or even of the MQL5 Cloud Network test agents. This article comprises some simple ideas that I use for work facilitation and improvement of the MetaTrader 5 Strategy Tester. I got these ideas from the documentation, forum and articles.

Graphical Interfaces XI: Rendered controls (build 14.2)

In the new version of the library, all controls will be drawn on separate graphical objects of the OBJ_BITMAP_LABEL type. We will also continue to describe the optimization of code: changes in the core classes of the library will be discussed.

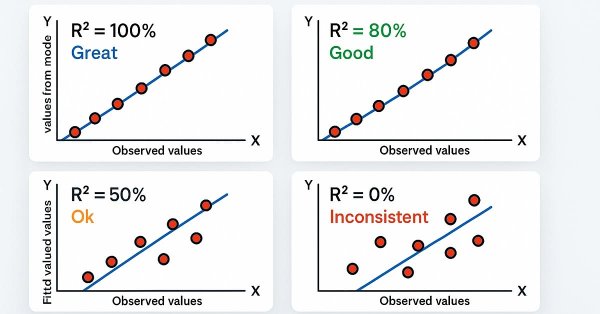

Optimal approach to the development and analysis of trading systems

In this article, I will show the criteria to be used when selecting a system or a signal for investing your funds, as well as describe the optimal approach to the development of trading systems and highlight the importance of this matter in Forex trading.

Developing a Volatility Based Breakout System

Volatility based breakout system identifies market ranges, then trades when price breaks above or below those levels, filtered by volatility measures such as ATR. This approach helps capture strong directional moves.

Cascade Order Trading Strategy Based on EMA Crossovers for MetaTrader 5

The article guides in demonstrating an automated algorithm based on EMA Crossovers for MetaTrader 5. Detailed information on all aspects of demonstrating an Expert Advisor in MQL5 and testing it in MetaTrader 5 - from analyzing price range behaviors to risk management.

MQL5 Cookbook - Multi-Currency Expert Advisor and Working with Pending Orders in MQL5

This time we are going to create a multi-currency Expert Advisor with a trading algorithm based on work with the pending orders Buy Stop and Sell Stop. This article considers the following matters: trading in a specified time range, placing/modifying/deleting pending orders, checking if the last position was closed at Take Profit or Stop Loss and control of the deals history for each symbol.

Graphical Interfaces II: Setting Up the Event Handlers of the Library (Chapter 3)

The previous articles contain the implementation of the classes for creating constituent parts of the main menu. Now, it is time to take a close look at the event handlers in the principle base classes and in the classes of the created controls. We will also pay special attention to managing the state of the chart depending on the location of the mouse cursor.

Neural networks made easy (Part 6): Experimenting with the neural network learning rate

We have previously considered various types of neural networks along with their implementations. In all cases, the neural networks were trained using the gradient decent method, for which we need to choose a learning rate. In this article, I want to show the importance of a correctly selected rate and its impact on the neural network training, using examples.

Automating Trading Strategies in MQL5 (Part 4): Building a Multi-Level Zone Recovery System

In this article, we develop a Multi-Level Zone Recovery System in MQL5 that utilizes RSI to generate trading signals. Each signal instance is dynamically added to an array structure, allowing the system to manage multiple signals simultaneously within the Zone Recovery logic. Through this approach, we demonstrate how to handle complex trade management scenarios effectively while maintaining a scalable and robust code design.

Building a Professional Trading System with Heikin Ashi (Part 2): Developing an EA

This article explains how to develop a professional Heikin Ashi-based Expert Advisor (EA) in MQL5. You will learn how to set up input parameters, enumerations, indicators, global variables, and implement the core trading logic. You will also be able to run a backtest on gold to validate your work.

Building a Social Technology Startup, Part I: Tweet Your MetaTrader 5 Signals

Today we will learn how to link an MetaTrader 5 terminal with Twitter so that you can tweet your EAs' trading signals. We are developing a Social Decision Support System in PHP based on a RESTful web service. This idea comes from a particular conception of automatic trading called computer-assisted trading. We want the cognitive abilities of human traders to filter those trading signals which otherwise would be automatically placed on the market by the Expert Advisors.

Automating Trading Strategies in MQL5 (Part 34): Trendline Breakout System with R-Squared Goodness of Fit

In this article, we develop a Trendline Breakout System in MQL5 that identifies support and resistance trendlines using swing points, validated by R-squared goodness of fit and angle constraints, to automate breakout trades. Our plan is to detect swing highs and lows within a specified lookback period, construct trendlines with a minimum number of touch points, and validate them using R-squared metrics and angle constraints to ensure reliability.

Programming EA's Modes Using Object-Oriented Approach

This article explains the idea of multi-mode trading robot programming in MQL5. Every mode is implemented with the object-oriented approach. Instances of both mode classes hierarchy and classes for testing are provided. Multi-mode programming of trading robots is supposed to take into account all peculiarities of every operational mode of an EA written in MQL5. Functions and enumeration are created for identifying the mode.