Adaptive Swings EA

- Experts

- Joshua Eloho Edafemuno

- Version: 1.0

- Activations: 13

Swing • Levels • Risk Managed

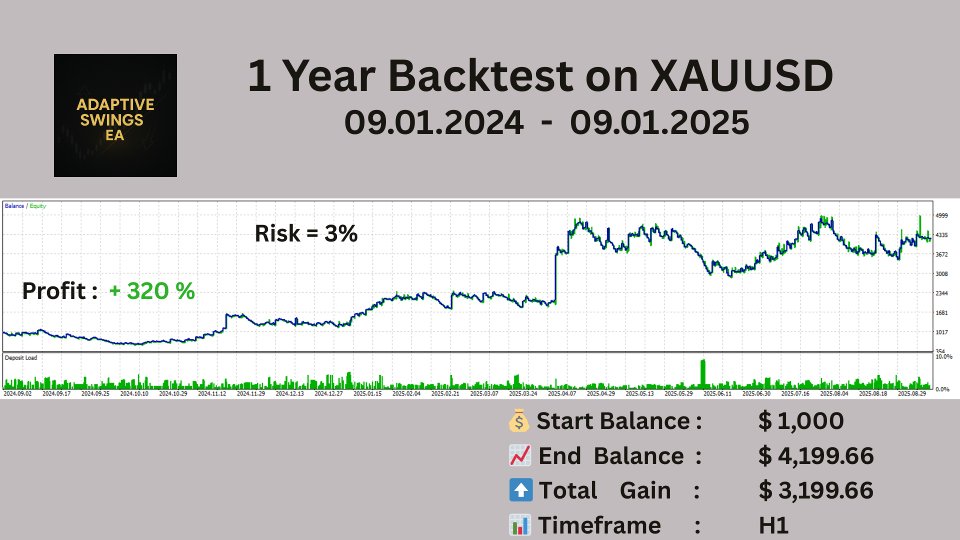

Backtested H1 • Excellent results on XAUUSD, GBPUSD, USDJPY, EURUSD

Adaptive Swings EA is a level-based swing trading Expert Advisor that intelligently identifies market swings, aligns entries to high-probability psychological levels, and manages risk automatically. Designed to be flexible — it works beautifully for intraday trading as well as for riding multi-bar swings. No fixed profit targets — exits rely on trailing stops and time-based rules chosen by you.

Key Advantages

- Adaptive level detection: Finds reliable swing levels and selects the most likely psychological price levels for entries.

- Built-in money management: Automatic position sizing by risk percent; optional enforcement cap to protect small accounts.

- Flexible exit methods: Time-based closes (end of day/week/month) or trailing stops — keep winning runs without fixed T/Ps.

- Works on any symbol & timeframe: Optimized and backtested on H1; performs especially well on Gold (XAUUSD) and major FX pairs.

- Simple, clear inputs: Intuitive parameter set so you can start with defaults and tweak to your style.

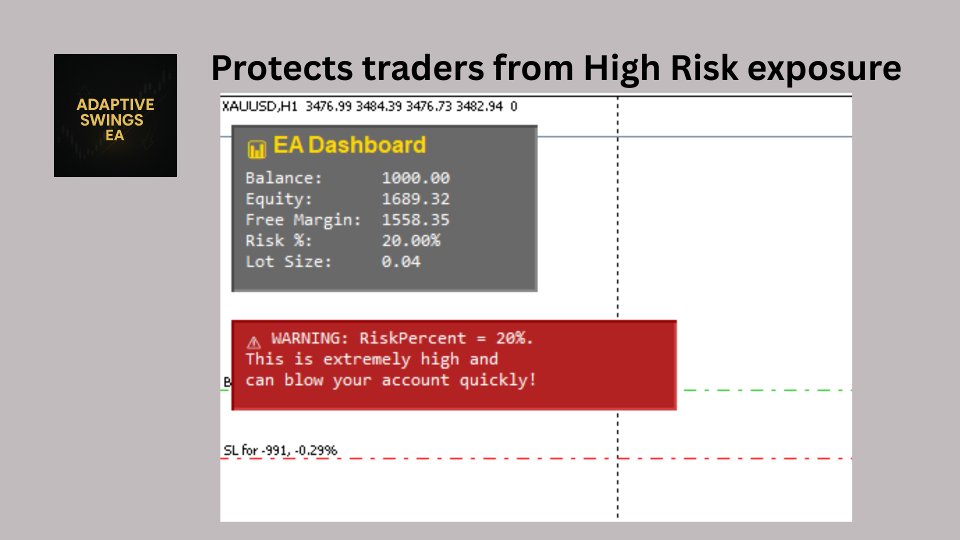

- On-chart dashboard & warnings: Real-time account stats and safety warnings so you always know the EA’s state.

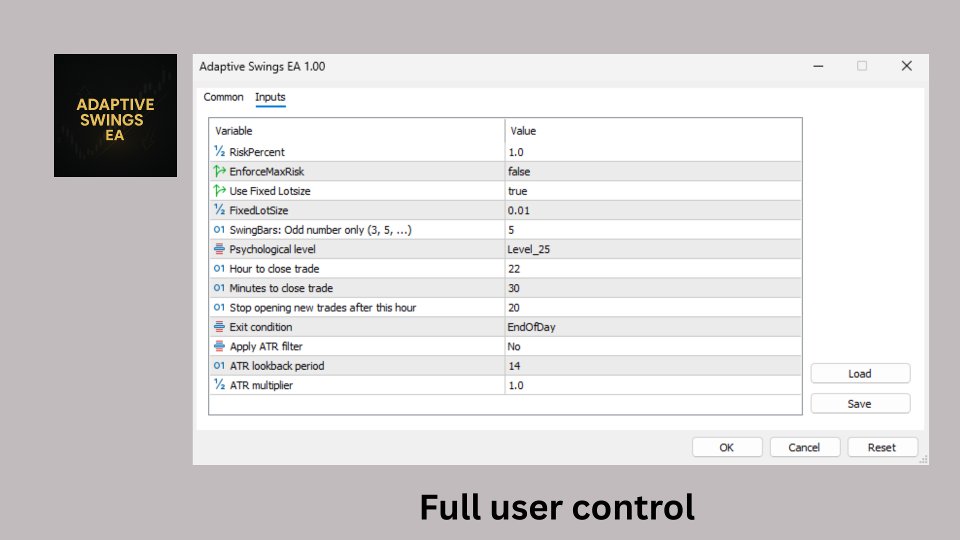

Inputs (what each parameter does)

| Input | Meaning / Effect |

|---|---|

| RiskPercent | How much of the account balance the EA will risk on a single trade (expressed as a percentage). The EA calculates lot size automatically from this value. |

| EnforceMaxRisk | If enabled, the EA caps RiskPercent at a safe upper limit. This protects the account from overly-large risk values entered by accident. |

| Use Fixed Lot | True/False option to toggle between fixed lot size or dynamic risk-based lot sizing. |

| FixedLot | The fixed trade volume (lot size) to use. Must be filled if Use Fixed Lot is enabled. |

| SwingBars | Odd numbers only (3, 5, 7 ...). Controls the number of bars used to define swing highs/lows — larger values make swing levels smoother; smaller values make them more sensitive. |

| Psychological level (Pick_Level) | A dropdown of typical psychological levels (10, 20, 25, 50, 100). The EA uses this selection when confirming which round-number levels are most reliable for entries. |

| HourToClose | If using a time-based exit (e.g. End of Day), this is the hour (server time) when the EA will close open trades. |

| MinutesToClose | The minute of the hour (with HourToClose) where the EA closes positions for time-based exits. |

| DontTradeAfter | Stop opening new trades after this hour — useful to avoid low-volume/late-session trading. |

| Exit Condition | Choose how the EA exits existing trades: End of Day, End of Week, End of Month or TrailStopsTillHit (trailing stops). |

| Apply ATR filter | Enable a daily ATR-based volatility filter. When enabled, trade decisions consider current volatility before placing positions. |

| ATR lookback period | Number of bars (ATR period) used to compute the ATR (daily ATR). Required if Apply ATR is selected. |

| ATR multiplier | Integer multiplier for ATR. Used to scale ATR-derived thresholds for stops and filter sensitivity. |

How Adaptive Swings EA works (brief)

The EA continuously scans price action and detects swing highs/lows based on your SwingBars setting. It then evaluates surrounding round-number (psychological) price levels and ranks setups by reliability. When a high-probability level is confirmed, the EA sizes positions automatically using RiskPercent, places the trade, and manages the position with trailing stops or a time-based exit according to your chosen rule.

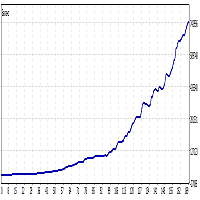

Performance & instruments

Adaptive Swings EA has been backtested and forward-tested on multiple instruments. It performs especially well on: XAUUSD (Gold), GBPUSD, USDJPY, EURUSD. The primary backtest shown in the product screenshots is an H1 test covering the one-year period. You are encouraged to run your own backtests — the EA is versatile and settings can be tuned per instrument and timeframe.

- Start Balance: $1,000

- End Balance (1 year): $4,199.66

- Risk per trade (example): 3%

Recommended setup

- Initial deposit: $1,000 (recommended starting test size).

- Recommended timeframe: H1 (primary backtests performed on H1).

- Test first: Always run forward tests with your broker spread/slippage settings and preferred pair.

- Symbols to try first: XAUUSD (Gold), EURUSD, GBPUSD, USDJPY.

What you get

- Adaptive Swings EA (.ex5) file and a short user guide to install and configure.

- On-chart dashboard showing Balance, Equity, Free Margin, current Lot Size and Risk percentage.

- Safety warnings and automatic lot adjustment if margin is insufficient.

- Optional: optimized settings can be provided after purchase (contact author).

Usage tips

- Start on a demo account to verify behavior with your broker and server time.

- If you prefer conservative trading, keep RiskPercent at 1–2%.

- Use EnforceMaxRisk if you want the EA to cap accidental large risk entries.

- Adjust SwingBars to control sensitivity (smaller=more trades, larger=fewer but stronger setups).

Support & notes

After purchase you will receive installation instructions and a short user guide. If you need help tuning the EA for a particular symbol or broker, contact the author — support and recommended settings are available. Optimized settings for specific pairs may be shared after purchase.

Important disclaimer

Trading financial instruments involves significant risk. Past performance and backtest results do not guarantee future performance. Use the EA on a demo account first and make sure you understand how risk and margin work with your broker. Never risk more than you can afford to lose. By using this product you accept full responsibility for any trading decisions you make.

Version: 1.00 | Platform: MetaTrader 5 | Author: JamedFx