Nasdaq American Session Strategy

- Experts

- Manuel De Huerta De La Cruz

- Version: 1.2

- Updated: 25 August 2025

- Activations: 10

Type: Expert Advisor (MT5) | Instrument: NDX (Nasdaq) | Timeframe: M5 | Session: US Session

Overview

EA specialized in breakout with pullback trading during the US session on Nasdaq. It combines opening range breakout, trend confirmations, and dynamic risk management based on ATR. Designed for traders seeking robustness and consistency with clear rules and configurable parameters.

Trading Strategy

- Opening Range Breakout: detects the initial session range and waits for a valid breakout.

- Smart Pullback: confirms entries after retracement to avoid false breakouts.

- Confluence filters: moving averages + RSI validation (configurable).

- Exit management: SL and TP based on ATR multiples (R:R ≥ 2:1; optional up to 3:1 or more).

Results (Backtest & Validation)

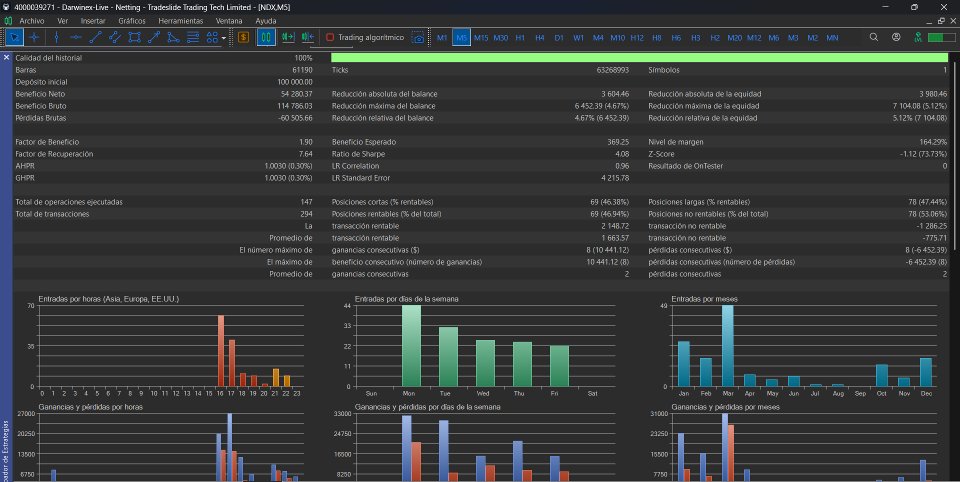

Tested period: 2023-01-01 to 2025-08-22 · Model: “Every tick based on real ticks” · Broker: Darwinex/MT5 (build 5200)

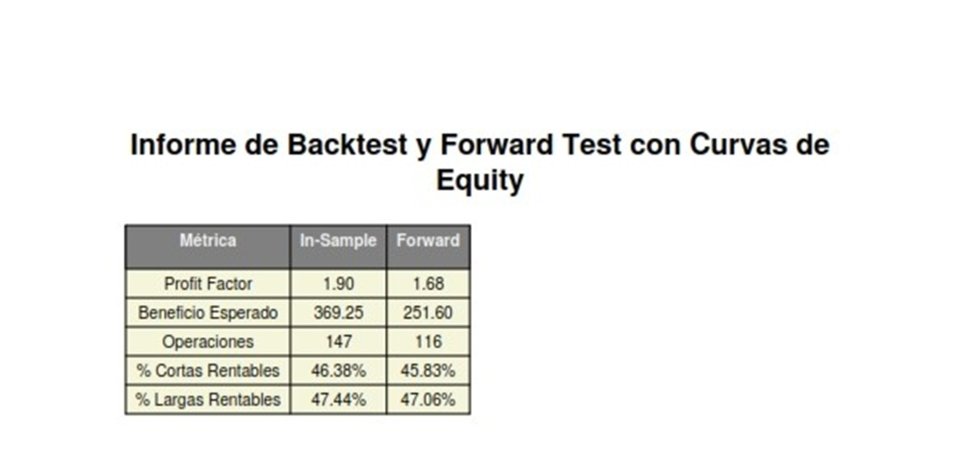

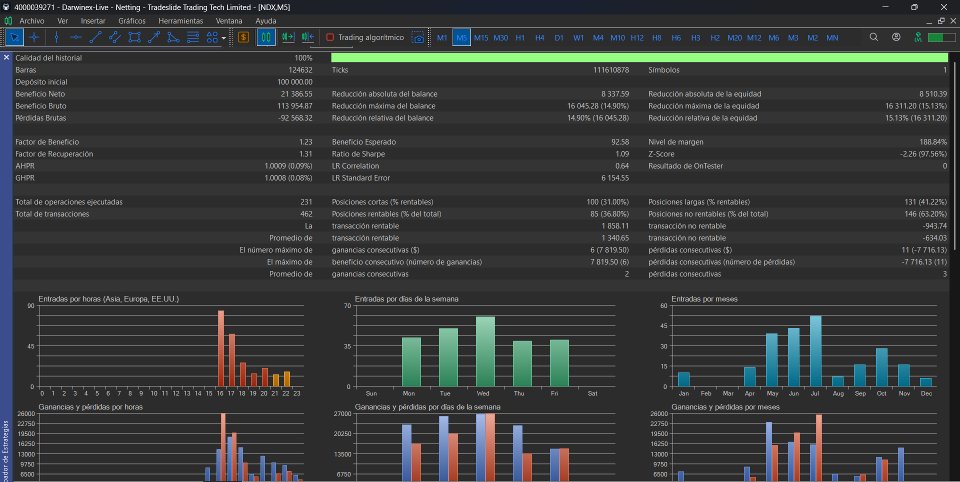

| Metric | Optimized Parameters (Current) | Previous Parameters |

|---|---|---|

| Profit Factor | 1.90 | 1.23 |

| Expected Payoff | 369.25 | 92.58 |

| Total Trades | 147 | 231 |

| Winning Trades (approx.) | 47% (longs & shorts) | 31–41% |

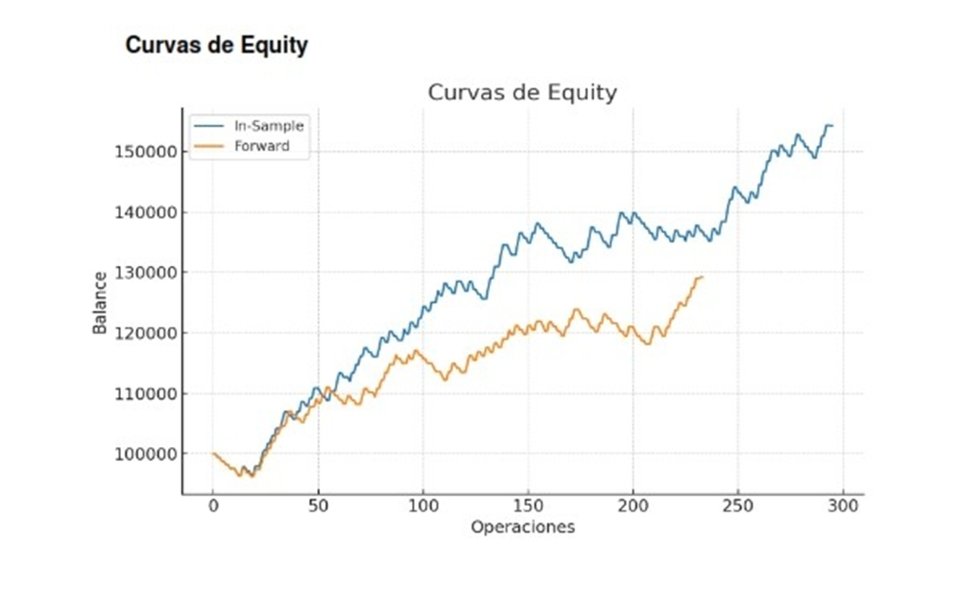

| Equity Curve | Stable, controlled DD | More drawdowns and stagnation |

Forward Validation: the strategy maintained solid results on out-of-sample data, confirming robustness and low risk of overfitting.

Risk Management

- Automatic Stop Loss based on ATR(14).

- Take Profit by risk multiples (≥2:1, recommended 3:1).

- Configurable fixed risk (% of balance per trade).

- Daily trade limit to control exposure.

Pros & Cons

| ✅ Advantages | ⚠️ Limitations |

|---|---|

| Stable equity curve, controlled drawdown. | Not recommended for scalping on 1M timeframe. |

| Optimized for US session (high volatility). | Requires broker with tight spread and good execution. |

| Validated with Backtest + Forward Test. | Results may vary depending on market conditions. |

| Flexible and configurable parameters. | Needs demo testing before going live. |

FAQ (Frequently Asked Questions)

- Which asset does it work best on?

NDX (Nasdaq) on M5, during the US session. - Can it be used on other assets?

Yes, but individual optimization is required. - What risk setting do you recommend?

≤1% per trade for safety, suitable for funded accounts. - Do I need a VPS?

Recommended to maintain stable execution during the session. - Are there live signals?

Yes, you can add your monitoring link on MQL5 Signals or Myfxbook.

Support

- Assistance with parameter setup and optimization.

- Guide to replicate results on your broker (spread, commissions, data).

Disclaimer

Trading involves risk of partial or total capital loss. This product is offered for educational and operational purposes; the user is responsible for its configuration and risk assumed. Past performance does not guarantee future results.